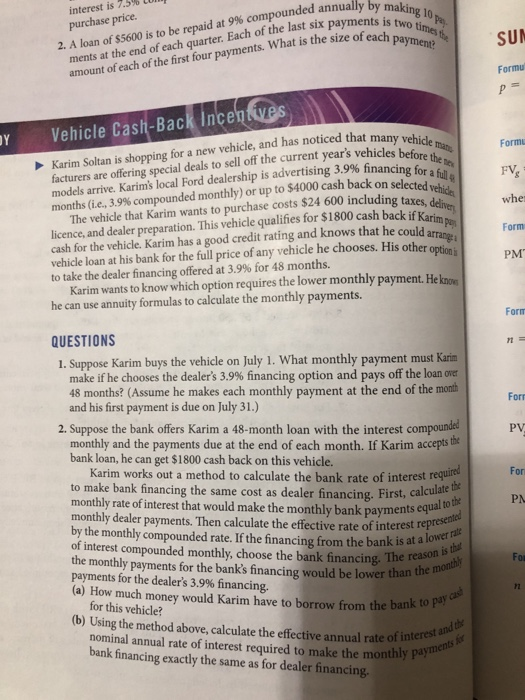

interest is 7.5% tor purchase price. by making 10 six payments is two ti 2. A loan of $5600 is to be repaid at 9% compounded annually size of each paymene SU ments at the end of each quarter. Each of the last six payments making amount of each of the first four payments. What is the si Formu y Vehicle Cast-Back Incen Karim Soltan is shopping for a new vehicle, and has noticed that r facturers are offering special deals to sell off the current year's vehicles bet demu models arrive, Karim's local Ford dealership is advertising 3.9% financi months (ie, 3.9% compounded monthly) or up to $4000 cash back on s vehicle man ma before the ne Formu FVg whe Form PM for a full selected vehicdes licence, and dealer preparation. This vehicle qualifies for $1800 cash back if Karin cash for the vehicle. Karim has a good credit rating and knows that he could arra vehicle loan at his bank for the full price of any vehicle he chooses. His other opt to take the dealer financing offered at 3.9% for 48 months The vehicle that Karim wants to purchase costs $24 600 including taxes d r nihoeiesr monthlypment in he can use annuity formulas to calculate the monthly payments. QUESTIONS 1. Suppose Karim buys the vehicle on July 1. What monthly payment must Karim Form rt make if he chooses the dealer's 3.9% financing option and pays off the loan oner 48 months? (Assume he makes each monthly payment at the end of the month and his first payment is due on July 31.) Forr 2. Suppose the bank offers Karim a 48-month loan with the interest compoundel PV monthly and the payments due at the end of each month. If Karim accepts tbo bank loan, he can get $1800 cash back on this vehicle. Karim works out a method to calculate the bank rate of interest required For to make bank financing the same cost as dealer financing. First, calc monthly rate of interest that would make the monthly bank payments equ monthly dealer payments. Then calculate the effective rate of interest rep by the monthly compounded rate. If the financing from the bank is at a of interest compounded monthly, choose the bank financing. The reasol the monthly payments for the bank's financing would be lower than the payments for the dealer's 3.9% financing. (a) How much money would Karim have to borrow from the ban lower rate reason is thet for this vehicle? (b) Using the method above, calculate the effective annual rate of inte nominal annual rate of interest required to make the m bank financing exactly the same as for dealer financing. SUMMARY OF FORMULAS 461 3. Suppose Karim decides to explore the costs of financing a more expensive vehicle. The more expensive vehicle costs $34 900 in total and qualifies for the 3.9% dealer financing for 48 months or $2500 cash back. What is the highest efective annual rate of interest at which Karim should borrow from the bank instead of using the dealer's 3.9% financing? FORMULAS Finding the equivalent rate of interest per payment period ptor a nominal annual rate of interest compounded & times per payment interva fture value of an ordinary general annuity using the nayment period