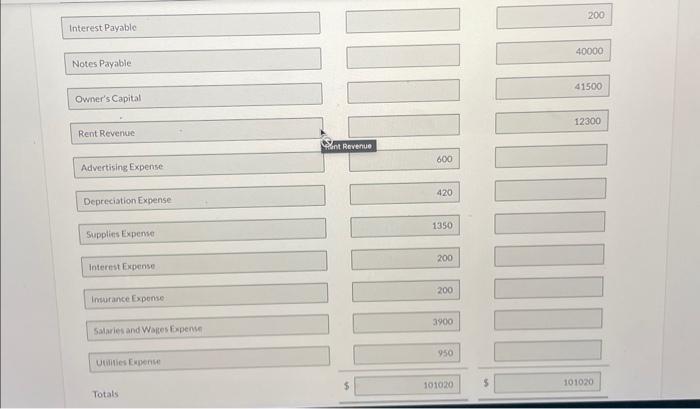

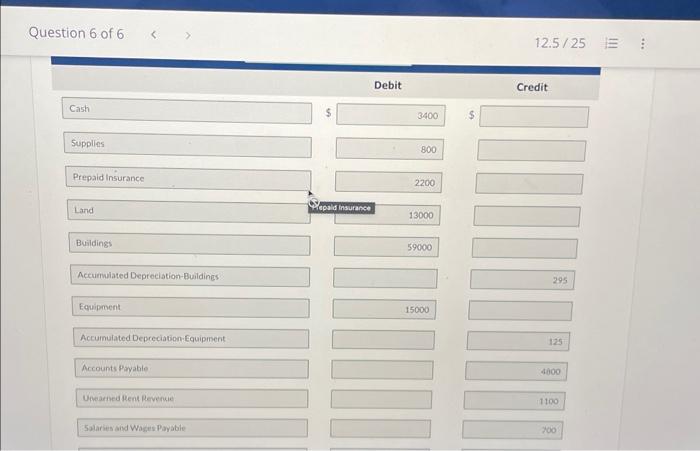

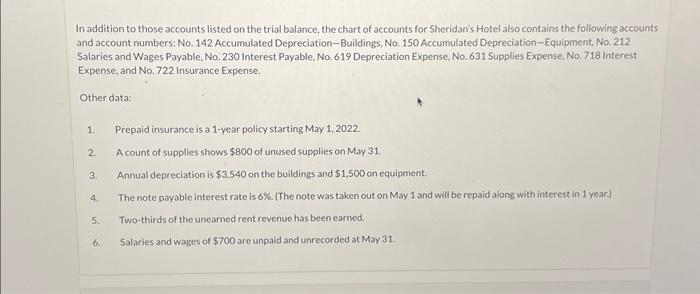

Interest Payable Notes Payable Owner's Capital Rent Revenue Advertising Expense 600 200 Depreciation Expense 420 40000 Supplies Experse 1350 Interest Expense \begin{tabular}{|r|} \hline 41500 \\ \hline 12300 \\ \hline \end{tabular} Insurance Expense Salaries and Wages fopense Utilies Expence Totals 1350 40000 \begin{tabular}{|r|} \hline 41500 \\ \hline 12300 \\ \hline \end{tabular} 200 200 Question 6 of 6 12.5/25 In addition to those accounts listed on the trial balance, the chart of accounts for Sheridan's Hotel also contains the following accounts and account numbers: No. 142 Accumulated Depreciation-Buildings, No. 150 Accumulated Depreciation-Equipment, No. 212 Salaries and Wages Payable, No. 230 Interest Payable, No. 619 Depreciation Expense, No. 631 Supplies Expense, No. 718 Interest Expense, and No, 722 Insurance Expense. Other data: 1. Prepaid insurance is a 1-year policy starting May 1, 2022. 2. A count of supplies shows $800 of unused supplies on May 31 . 3. Annual depreciation is $3,540 on the buildings and $1,500 on equipment. 4. The note payable interest rate is 6%. (The note was taken out on May 1 and will be repaid along with interest in 1 year.) 5. Two-thirds of the unearned rent revenuc has been earned. 6. Salaries and wages of $700 are unpaid and unrecorded at May 31 Interest Payable Notes Payable Owner's Capital Rent Revenue Advertising Expense 600 200 Depreciation Expense 420 40000 Supplies Experse 1350 Interest Expense \begin{tabular}{|r|} \hline 41500 \\ \hline 12300 \\ \hline \end{tabular} Insurance Expense Salaries and Wages fopense Utilies Expence Totals 1350 40000 \begin{tabular}{|r|} \hline 41500 \\ \hline 12300 \\ \hline \end{tabular} 200 200 Question 6 of 6 12.5/25 In addition to those accounts listed on the trial balance, the chart of accounts for Sheridan's Hotel also contains the following accounts and account numbers: No. 142 Accumulated Depreciation-Buildings, No. 150 Accumulated Depreciation-Equipment, No. 212 Salaries and Wages Payable, No. 230 Interest Payable, No. 619 Depreciation Expense, No. 631 Supplies Expense, No. 718 Interest Expense, and No, 722 Insurance Expense. Other data: 1. Prepaid insurance is a 1-year policy starting May 1, 2022. 2. A count of supplies shows $800 of unused supplies on May 31 . 3. Annual depreciation is $3,540 on the buildings and $1,500 on equipment. 4. The note payable interest rate is 6%. (The note was taken out on May 1 and will be repaid along with interest in 1 year.) 5. Two-thirds of the unearned rent revenuc has been earned. 6. Salaries and wages of $700 are unpaid and unrecorded at May 31