Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Interest Payment Date Cash Payment Amount Dec 31, 2021 $840,000 Decrease Interest in Expense Discount Discount $911,169 Dec 31, 2022 $840,000 $916,151 Book Value

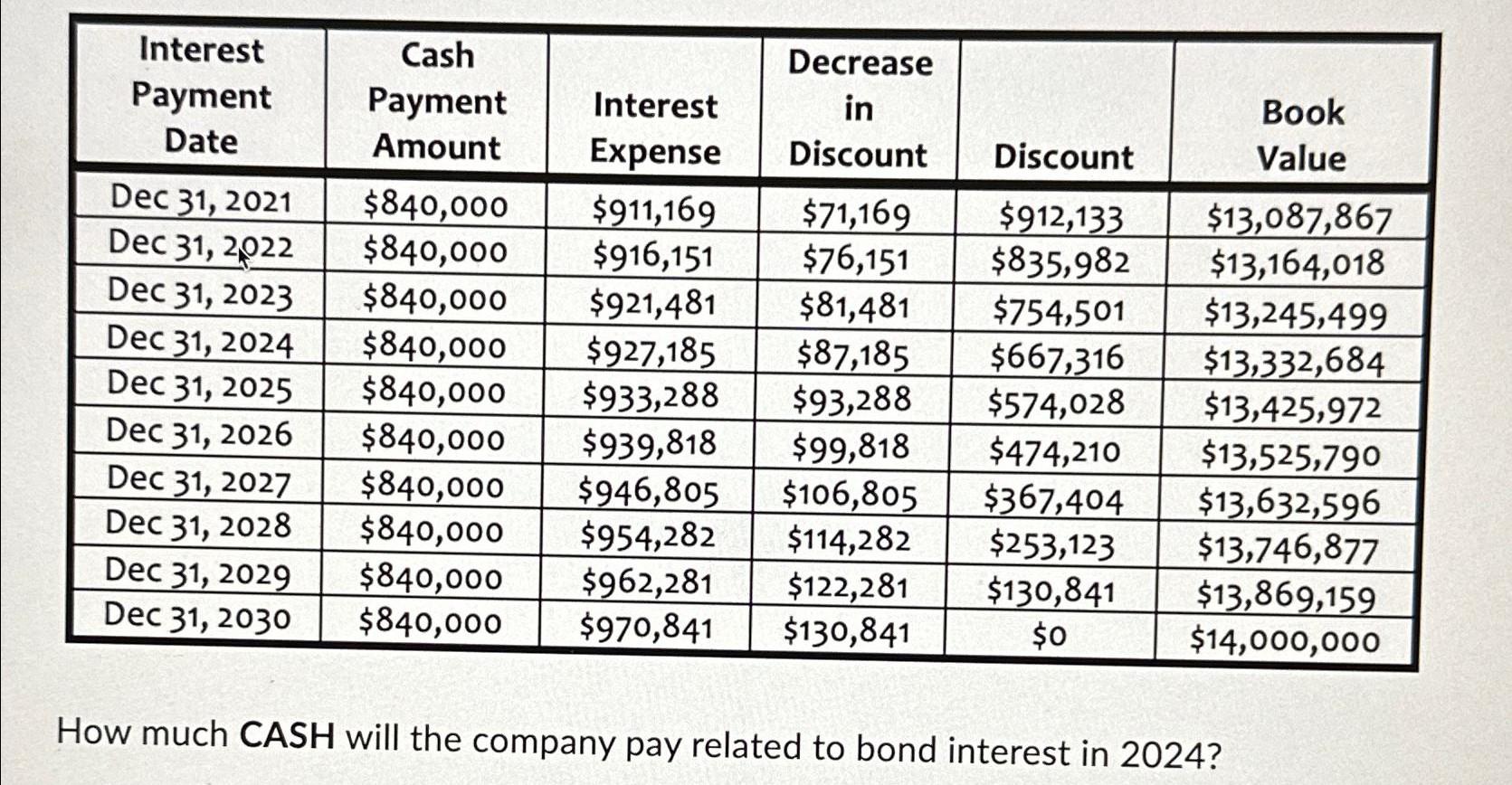

Interest Payment Date Cash Payment Amount Dec 31, 2021 $840,000 Decrease Interest in Expense Discount Discount $911,169 Dec 31, 2022 $840,000 $916,151 Book Value $71,169 $912,133 $13,087,867 $76,151 $835,982 $13,164,018 Dec 31, 2023 $840,000 $921,481 $81,481 $754,501 $13,245,499 Dec 31, 2024 $840,000 $927,185 $87,185 $667,316 $13,332,684 Dec 31, 2025 $840,000 $933,288 $93,288 $574,028 $13,425,972 Dec 31, 2026 $840,000 $939,818 $99,818 $474,210 $13,525,790 Dec 31, 2027 $840,000 $946,805 $106,805 $367,404 $13,632,596 Dec 31, 2028 $840,000 $954,282 $114,282 $253,123 $13,746,877 Dec 31, 2029 $840,000 $962,281 $122,281 $130,841 $13,869,159 Dec 31, 2030 $840,000 $970,841 $130,841 $0 $14,000,000 How much CASH will the company pay related to bond interest in 2024?

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the cash payment related to bond interest in 2024 we can u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started