Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Interest rate by default is assume to be r and continuously compounded. Without considering the binomial tree model, find the replicating portfolio for a forward

Interest rate by default is assume to be r and continuously compounded.

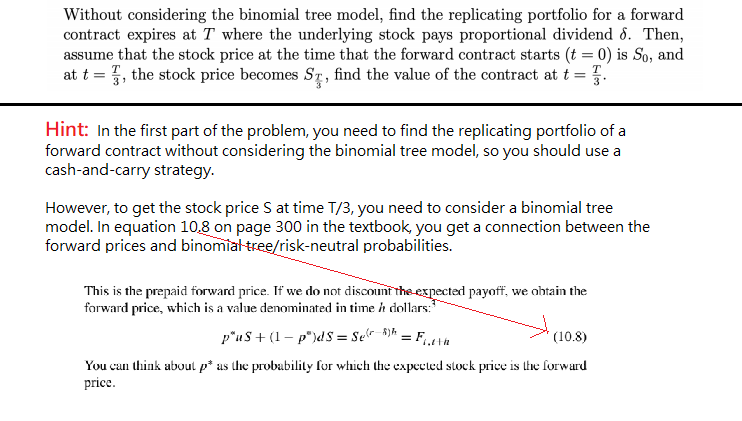

Without considering the binomial tree model, find the replicating portfolio for a forward contract expires at T where the underlying stock pays proportional dividend 8. Then, assume that the stock price at the time that the forward contract starts (t = 0) is So, and at t = J, the stock price becomes Sp, find the value of the contract at t = 1. Hint: In the first part of the problem, you need to find the replicating portfolio of a forward contract without considering the binomial tree model, so you should use a cash-and-carry strategy. However, to get the stock price S at time T/3, you need to consider a binomial tree model. In equation 10,8 on page 300 in the textbook, you get a connection between the forward prices and binomiat-tree/risk-neutral probabilities. This is the prepaid forward price. If we do not discount the expected payoff, we obtain the forward price, which is a value denominated in time h dollars: p'us + (1 - pdS = Sete_8)h = Forth (10.8) You can think about p* as the probability for which the expected stock price is the forward price. Without considering the binomial tree model, find the replicating portfolio for a forward contract expires at T where the underlying stock pays proportional dividend 8. Then, assume that the stock price at the time that the forward contract starts (t = 0) is So, and at t = J, the stock price becomes Sp, find the value of the contract at t = 1. Hint: In the first part of the problem, you need to find the replicating portfolio of a forward contract without considering the binomial tree model, so you should use a cash-and-carry strategy. However, to get the stock price S at time T/3, you need to consider a binomial tree model. In equation 10,8 on page 300 in the textbook, you get a connection between the forward prices and binomiat-tree/risk-neutral probabilities. This is the prepaid forward price. If we do not discount the expected payoff, we obtain the forward price, which is a value denominated in time h dollars: p'us + (1 - pdS = Sete_8)h = Forth (10.8) You can think about p* as the probability for which the expected stock price is the forward priceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started