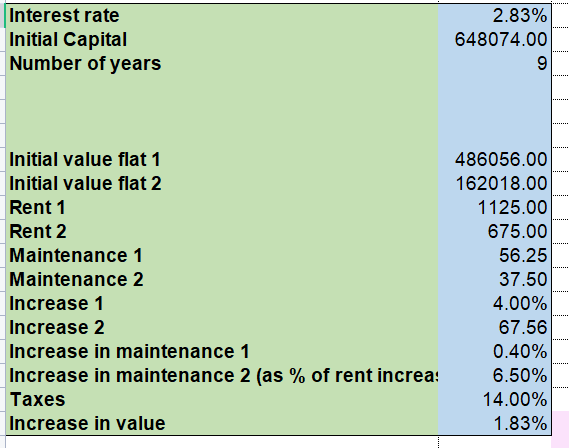

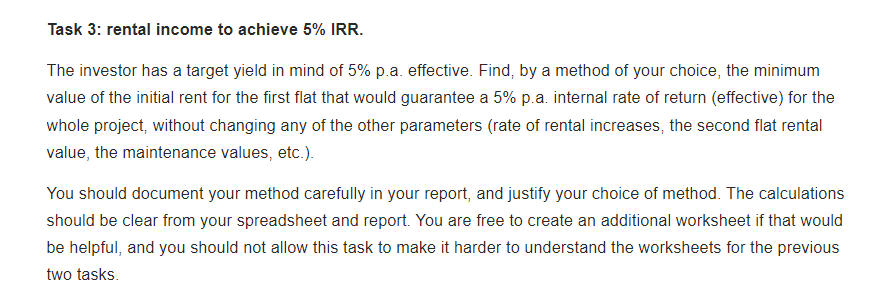

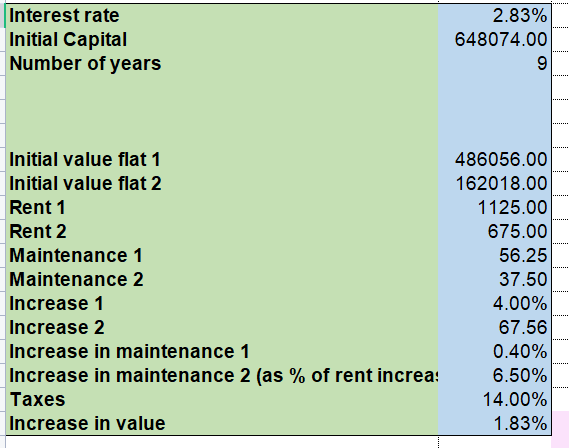

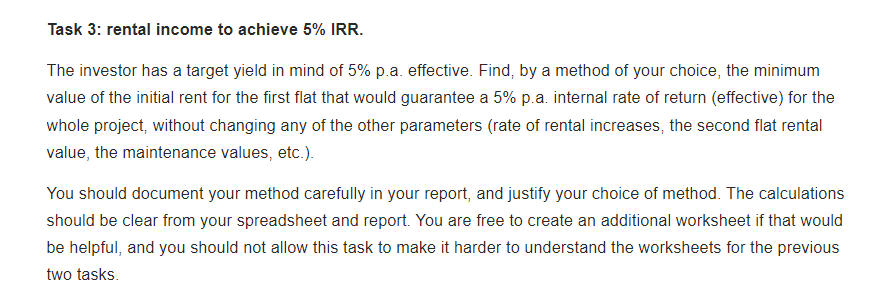

Interest rate Initial Capital Number of years 2.83% 648074.00 9 Initial value flat 1 Initial value flat 2 Rent 1 Rent 2 Maintenance 1 Maintenance 2 Increase 1 Increase 2 Increase in maintenance 1 Increase in maintenance 2 (as % of rent increa: Taxes Increase in value 486056.00 162018.00 1125.00 675.00 56.25 37.50 4.00% 67.56 0.40% 6.50% 14.00% 1.83% Task 3: rental income to achieve 5% IRR. The investor has a target yield in mind of 5% p.a. effective. Find, by a method of your choice, the minimum value of the initial rent for the first flat that would guarantee a 5% p.a. internal rate of return (effective) for the whole project, without changing any of the other parameters (rate of rental increases, the second flat rental value, the maintenance values, etc.). You should document your method carefully in your report, and justify your choice of method. The calculations should be clear from your spreadsheet and report. You are free to create an additional worksheet if that would be helpful, and you should not allow this task to make it harder to understand the worksheets for the previous two tasks. Interest rate Initial Capital Number of years 2.83% 648074.00 9 Initial value flat 1 Initial value flat 2 Rent 1 Rent 2 Maintenance 1 Maintenance 2 Increase 1 Increase 2 Increase in maintenance 1 Increase in maintenance 2 (as % of rent increa: Taxes Increase in value 486056.00 162018.00 1125.00 675.00 56.25 37.50 4.00% 67.56 0.40% 6.50% 14.00% 1.83% Task 3: rental income to achieve 5% IRR. The investor has a target yield in mind of 5% p.a. effective. Find, by a method of your choice, the minimum value of the initial rent for the first flat that would guarantee a 5% p.a. internal rate of return (effective) for the whole project, without changing any of the other parameters (rate of rental increases, the second flat rental value, the maintenance values, etc.). You should document your method carefully in your report, and justify your choice of method. The calculations should be clear from your spreadsheet and report. You are free to create an additional worksheet if that would be helpful, and you should not allow this task to make it harder to understand the worksheets for the previous two tasks