Answered step by step

Verified Expert Solution

Question

1 Approved Answer

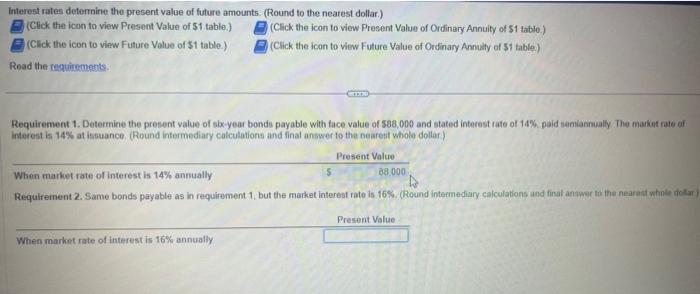

Interest rates determine the present value of future amounts (Round to the nearest dollar.) (Click the icon to view Present Value of $1 table.)

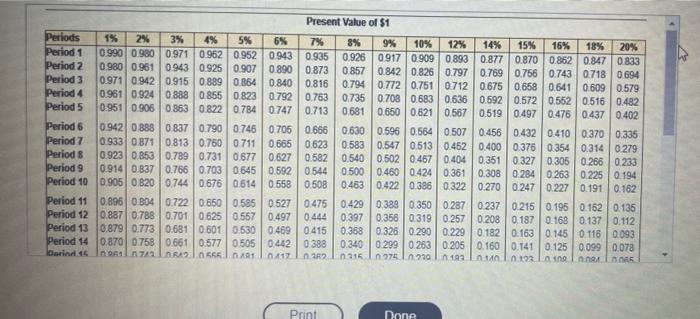

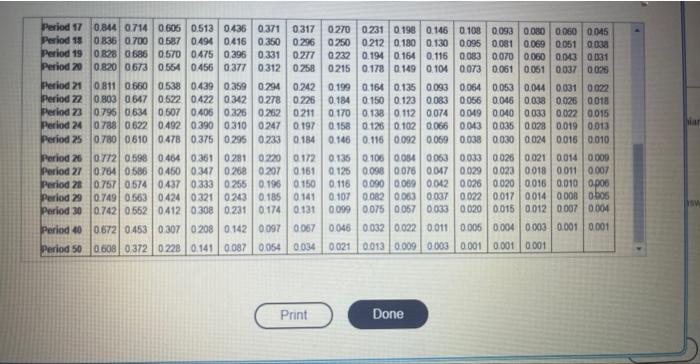

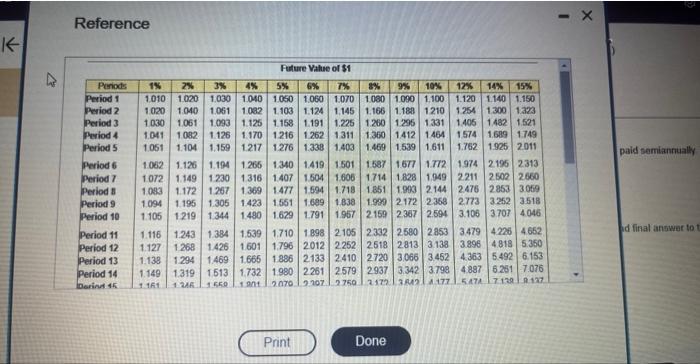

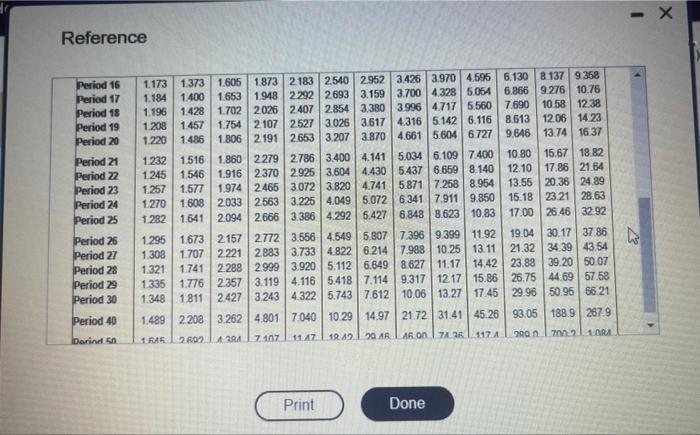

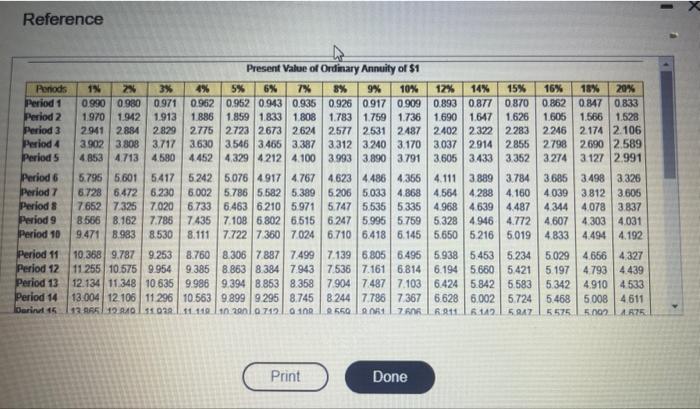

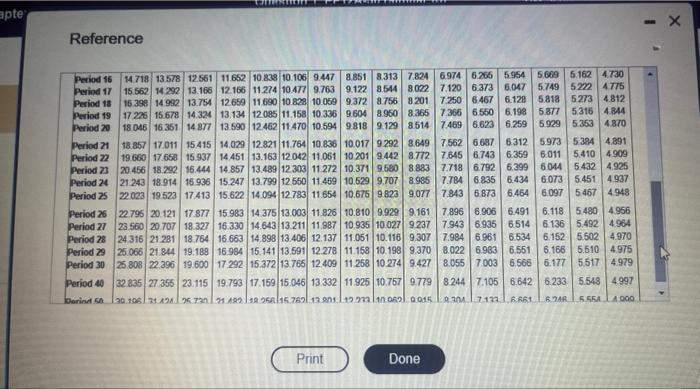

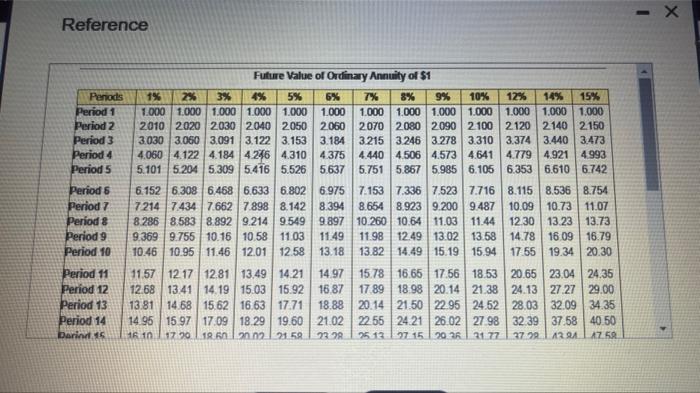

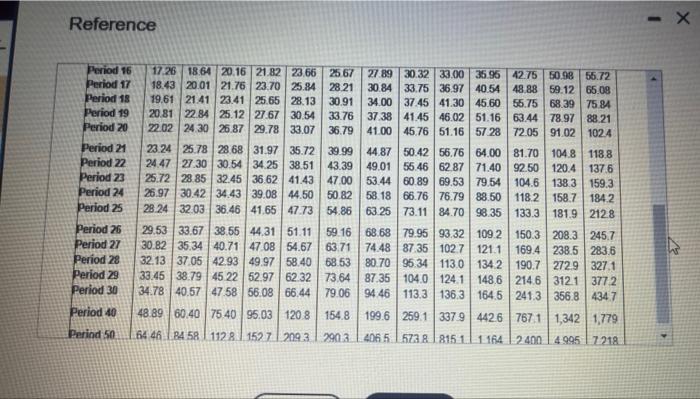

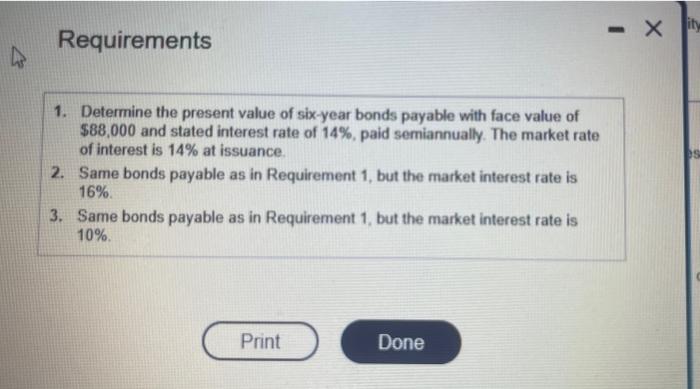

Interest rates determine the present value of future amounts (Round to the nearest dollar.) (Click the icon to view Present Value of $1 table.) (Click the icon to view Future Value of $1 table.) Read the requirements. (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of Ordinary Annuity of 51 table) GOOD Requirement 1. Determine the present value of six-year bonds payable with face value of 588,000 and stated interest rate of 14%, paid semiannually. The market rate of interest is 14 % at issuance (Round intermediary calculations and final answer to the nearest whole dollar) Present Value 88.000 When market rate of interest is 16% annually When market rate of interest is 14% annually Requirement 2. Same bonds payable as in requirement 1, but the market interest rate is 16%. (Round intermediary calculations and final answer to the nearest whole dollar) Present Value Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Present Value of $1 4% 5% 14% 15% 16% 18% 20% 0.877 0.870 0.862 0.847 0.833 0.769 0.766 0.743 0.718 0.694 6% 7% 8% 9% 10% 12% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.980 0.961 0943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.797 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.712 0.675 0.658 0.641 0.609 0.579 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.636 0.592 0.572 0.552 0.516 0.482 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.567 0.519 0.497 0.476 0.437 0.402 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.507 0.456 0.432 0.410 0.370 0.335 0.933 0.871 0.813 0.750 0.711 0.665 0.623 0.583 0.547 0.513 0.452 0.400 0.376 0.354 0.314 0.279 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.404 0.351 0.327 0.305 0.266 0.233 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.361 0.308 0.284 0.263 0.225 0.194 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.322 0.270 0.247 0.227 0.191 0.162 0.429 0.388 0.350 0.287 0237 0.215 0.195 0.162 0.135 0.397 0.356 0.319 0257 0.208 0.187 0.168 0.137 0.112 0.368 0.326 0.290 0.229 0.182 0.163 0.145 0.116 0.093 0.340 0.299 0.263 0.205 0.160 0.141 0.125 0.099 0.078 0316 0.375 0.230 n.193. 01100.123 0102 0.02 0.045 1% 2% 3% K 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.879 0.773 0.681 0.601 0.530 0469 0.415 0.577 0.505 Period 11 Period 12 Period 13 Period 14 0.870 0.758 0.661 Darind 15 0961 07423 0642 0555 91 0.442 0.388 0417 0262 Print Done Period 17 Period 18 Period 19 Period 20 Period 21 Period 22 Period 23 Period 24 Period 25 Period 26 Period 27 Period 28 Period 29 Period 30 Period 40 Period 50 0.844 0.714 0.605 0.513 0.436 0.371 0317 0.836 0.700 0.587 0494 0416 0.350 0.296 0828 0686 0.570 0475 0.396 0.331 0.277 0.820 0673 0.554 0456 0.377 0.312 0.258 0.811 0.660 0.538 0.439 0.359 0.294 0.242 0.199 0.164 0.135 0.093 0.064 0.803 0.647 0.522 0422 0.342 0.278 0226 0.184 0.150 0.123 0.083 0.056 0.262 0211 0.170 0.138 0,112 0.074 0.049 0.040 0.033 0.022 0.015 0.390 0310 0.247 0.197 0.158 0.126 0.102 0.066 0.043 0.035 0.028 0.019 0.013 0.295 0.233 0.184 0.146 0.116 0.092 0.069 0.038 0.030 0.024 0.016 0.010 0.053 0.044 0.031 0.022 0.046 0.038 0.026 0018 0.507 0406 0.326 0.492 0.478 0.375 0.795 0.634 0788 0 622 0.780 0.610 0270 0231 0.198 0.146 0.108 0.093 0.080 0060 0.045 0.250 0.212 0.180 0.130 0.095 0.081 0.069 0.051 0.038 0.232 0.194 0.164 0.116 0.083 0.070 0.060 0.043 0.031 0215 0.178 0149 0.104 0073 0.061 0.051 0037 0026 0772 0.598 0.361 0.464 0281 0220 0172 0.135 0.106 0.084 0.063 0.033 0026 0.021 0.014 0.009 0.764 0586 0.450 0347 0.268 0207 0.161 0.125 0.098 0076 0.047 0.029 0023 0.018 0011 0007 0.757 0.574 0.437 0.333 0255 0.196 0.150 0.116 0.090 0.069 0.042 0.026 0.020 0.016 0010 0.006 0.749 0.563 0424 0.321 0243 0.185 0141 0.107 0.082 0.063 0.037 0.022 0.017 0014 0.008 0005 0.742 0.562 0412 0.308 0.231 0174 0.131 0.099 0.075 0.067 0.033 0.020 0.015 0.012 0.007 0.004 0.672 0.453 0307 0208 0.142 0097 0.067 0.046 0.032 0.022 0.011 0.005 0.004 0.003 0.001 0.001 0.608 0.372 0228 0.141 0.087 0.054 0.034 0021 0.013 0.009 0.003 0.001 0.001 0.001 Print Done biar w K Reference Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Darina 15 Future Value of $1 1,010 1.020 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 1.030 1.040 1.050 1.060 1.070 1080 1.090 1.100 1.120 1.140 1.150 1.020 1.040 1.061 1.082 1.103 1.124 1.145 1.166 1.188 1210 1.254 1.300 1.323 1.030 1.061 1.093 1.125 1.158 1.191 1.225 1.260 1.295 1.331 1.405 1482 1.521 1.041 1.082 1.126 1.170 1216 1.262 1.311 1.360 1412 1464 1.574 1.689 1.749 1.051 1.104 1.159 1.217 1.276 1.338 1403 1.469 1.539 1.611 1.762 1.925 2011 1.062 1.126 1.194 1.265 1.340 1419 1.501 1.587 1.677 1.772 1.974 2.196 2313 1.072 1.149 1.230 1.316 1.407 1.504 1.606 1.714 1.828 1.949 2.211 2502 2.660 2.476 2.8563 3.059 1.094 1.105 1.629 1.791 1.957 2159 2.367 2.594 1.083 1.172 1.267 1.369 1.477 1.594 1.718 1.851 1.993 2.144 1.195 1.305 1423 1.551 1.689 1.838 1.999 2172 2.358 1219 1.344 1.480 1.116 1.243 1.384 1.539 1.710 1.898 2.105 2.332 2.580 2853 1.127 1.268 1.426 1.601 1.796 2012 2.252 2518 2813 3138 1.138 1.294 1469 1.665 1.886 2133 2410 2720 3.066 3.452 4.363 5.492 6.153 1.149 1.319 1513 1.732 1.980 2261 2.579 2.937 3.342 3.798 4.887 6.251 7.076 1.161 1.246 1.560 1.901 2070 2207 2750 2172 3842 4.177 547A 3479 4.226 4652 3.896 4818 5.350 7.139 137 Print Done 2.773 3252 3518 3.106 3.707 4.046 paid semiannually ad final answer to t Reference Period 16 Period 17 Period 18 Period 19 Period 20 Period 21 Period 22 Period 23 Period 24 Period 25 Period 26 Period 27 Period 28 Period 29 Period 30 Period 40 Darind 50 1.173 1.373 1.605 1.873 2.183 2540 2.952 3.426 3.970 4.595 6.130 8.137 9.358 1.184 1.400 1.653 1.948 2292 2.693 3.159 3.700 4.328 5.054 6.866 9.276 10.76 1.196 1.428 1.702 2.026 2407 2.854 3.380 3.996 4.717 5.560 7.690 10.58 12.38 12.06 14.23 1.208 1.457 1.754 2.107 2.527 3.026 3.617 4.316 5.142 6.116 8.613 1.220 1.486 1.806 2191 2.653 3.207 3.870 4.661 5.604 6.727 9.646 13.74 16.37 4.141 5.034 6.109 7.400 10.80 15.67 18.82 12.10 17.86 21.64 4.430 5.437 6.659 8.140. 3.072 3.820 4.741 5.871 7.258 8.954 13.55 20.36 24.89 15.18 23.21 28.63 1.232 1.516 1.860 2.279 2786 3.400 1.245 1.546 1.916 2.370 2.925 3.604 1.257 1.577 1.974 2.465 1.270 1.608 2033 2.563 1.282 1.641 2.094 2.666 3.225 4.049 5.072 6.341 7.911 9.850 3.386 4.292 5427 6.848 8.623 10.83 17.00 26.46 32.92 1.295 1.308 9.399 11.92 10.25 13.11 11.17 14.42 1.673 2157 2772 3.556 4.549 5.807 7.396 1.707 2.221 2883 3.733 4.822 6.214 7.988 2288 2.999 3.920 5.112 6.649 8.627 2.357 3.119 4.116 5.418 7.114 9.317 12.17 15.86 2.427 3.243 4.322 5.743 7.612 7.040 10.29 10.06 13.27 17.45 14.97 21.72 31.41 45.26 12 12 20 A6 AR 00 74 36 117 A 1.321 1.741 1.335 1.776 1.348 1.811 1.489 2.208 3.262 4.801 1.645 2.602 4 204 7 107 11.47. Print Done 19.04 30.17 37.86 21.32 34.39 43.54 23.88 39.20 50.07 26.75 44.69 57.58 29.96 50.95 66.21 93.05 188.9 267.9 200 n 700.21 1.0RA - X K Reference Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period S Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Darint 15 2% 3% 4% 1% 0.990 0.980 0.971 0.962 1.970 1.942 1.913 1.886 2.941 2884 2.829 2.775 3.902 3.808 3.717 3.630 4.853 4.713 4.580 4.452 Present Value of Ordinary Annuity of $1 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 0.862 0.847 0.833 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.626 1.605 1.566 1.528 2.723 2673 2.624 2.577 2531 2487 2402 2.322 2283 2.246 2.174 2.106 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.855 2.798 2.690 2.589 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.352 3.274 3.127 2.991 5.076 4.917 4.767 4.623 4.486 4.355 4.111 3.889 3.784 3.685 3.498 3.326 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.160 4.039 3.812 3.605 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.487 4.344 4.078 3.837 7.108 6.802 6.515 6.247 5.995 5.759 5.328 4.946 4.772 4.607 4.303 4.031 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 5.019 4.833 4.494 4.192 5.795 5.601 5417 5.242 6.728 6472 6.230 6.002 7.652 7.325 7.020 6.733 8.566 8.162 7.785 7.435 9.471 8.983 8.530 8.111 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.938 5.453 5.234 5.029 4.656 4.327 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.194 5.660 5.421 5.197 4.793 4.439 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.424 5.842 5.583 5.342 4.910 4.533 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.724 5.468 5008 4611 11.119 10 290l a 712 0100 2.550 2051 7606 6.211. 6.142 5947 5.575 5.000 1.675 10.368 9.787 9.253 11 255 10.575 9.954 12.134 11.348 10 635 13.004 12 106 11 296 11.029 13 865 12.9.40 Print Done apte Reference Period 16 Period 17 Period 18 Period 19 Period 20 Period 21 Period 22 Period 23 Period 24 Period 25 Period 26 Period 27 Period 28 Period 29 Period 30 Period 40 Darind 50 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 6.974 6.266 5.954 15.562 14.292 13.166 12.166 11274 10.477 9.763 9.122 8.544 8.022 7.120 6.373 6047 5.818 5.273 4.812 16.398 14 992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8201 7.250 6.467 6.128 17 226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 6.198 5.877 5.316 4.844 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.469 6.623 6.259 5.929 5.353 4.870 14.029 12.821 11.764 10.836 10.017 9.292 8.649 7.562 6.687 6312 5.973 5.384 4.891 14.451 13.163 12.042 11.061 10.201 9.442 8.772 7.645 6.743 6.359 6.011 5410 4.909 14.857 13.489 12.303 11.272 10.371 9.580 8.883 7.718 6.792 6.399 6044 5432 4.925 15.247 13.799 12.550 11.459 10.529 9.707 8.985 7.784 6.835 6.434 6.073 5451 4.937 15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.843 6.873 6.464 6.097 5467 4.948 6.906 6.491 7.943 6.935 6514 7.984 6.961 6.534 10.810 9.929 9.161 7.896 10.935 10.027 9.237 11.051 10.116 9.307 6.118 5.480 4.956 6.136 5.492 4.964 6.152 5.502 4.970 8.022 6.983 6.551 6.166 5.510 4.975 8.055 7.003 6.566 6.177 5.517 4.979 6.233 5.548 4.997 6.246 5.554 4000 18.857 17.011 15.415 19.660 17.658 15.937 20 456 18.292 16.444 21 243 18.914 16.936 22.023 19.523 17.413 22.795 20 121 23.560 20.707 17.877 15.983 14.375 13.003 11.826 18.327 16.330 14.643 13.211 11.987 18.764 16.663 14.898 13.406 12.137 25.066 21.844 19.188 16.984 15.141 13.591 12.278 11.158 10.198 9.370 25.808 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 24.316 21 281 32 835 27.356 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.244 7.105 6.642 30.106 21.424 26.735 21 49218256/15.762 13.801 12.233110 0621 0015 01011972 nht Print 5.669 5.162 4.730 5.749 5222 4.775 Done X Reference Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period & Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Darind 15 Future Value of Ordinary Annuity of $1 1% 2% 3% 5% 6% 1.000 1.000 1.000 1.000 1.000 1.000 2010 2020 2030 2040 2050 2060 3.030 3.060 3.091 3.122 3.153 3.184 4.060 4.122 4.184 4.246 4.310 4.375 5.101 5.204 5.309 5.416 5.526 5.637 6.152 6.308 6.468 6.633 6.802 6.975 7214 7.434 7.662 7.898 8.142 8.394 8.286 8.583 8.892 9.214 9.549 9.897 9.369 9.755 10.16 10.58 11.03 11.49 10.46 10.95 11.46 12.01 12.58 13.18 11.57 12 17 12.81 13.49 14.21 14.97 15.03 15.92 16.87 12.68 13.41 13.81 14.68 14.19 15.62 16.63 17.71 18.88 14.95 15.97 17.09 18.29 19.60 21.02 16.10. 17 20 18 60 20.02 21.58 23.28 7% 8% 9% 10% 12% 14% 15% 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2070 2080 2090 2100 2120 2140 2150 3.215 3.246 3.278 3.310 3.374 3.440 3.473 4.440 4.506 4.573 4.641 4.779 4.921 4.993 5.751 5.867 5.985 6.105 6.353 6.610 6.742 7.153 7.336 7.523 7.716 8.115 8.536 8.754 8.654 8.923 9.200 9.487 10.09 10.73 11.07 10.260 10.64 11.03 11.44 12.30 13.23 13.73 11.98 12.49 13.02 13.58 13.82 15.78 16.65 17.56 18.53 17.89 18.98 20.14 21.38 24.13 27.27 29.00 20.14 21.50 22.95 24.52 28.03 32.09 34.35 22.55 24.21 26.02 27.98 32.39 37.58 40.50 25 13 27 15 20 36 14.78 16.09 16.79 14.49 15.19 15.94 17.55 19.34 20.30 20.65 23.04 24.35 31 77 37 22 13.21 AZ.50 X Reference Period 16 Period 17 Period 18 Period 19 Period 20 Period 21 Period 22 Period 23 Period 24 Period 25 Period 26 Period 27 Period 28 Period 29 Period 30 Period 40 Period 50 19.61 21.41 23.41 17.26 18.64 20.16 21.82 23.66 25.67 27.89 30.32 33.00 35.96 42.75 50.98 55.72 18.43 20.01 21.76 23.70 25.84 28.21 30.84 33.75 36.97 40.54 48.88 59.12 65.08 25.65 30.91 34.00 37.45 41.30 45.60 55.75 68.39 75.84 33.76 37.38 41.45 46.02 51.16 63.44 78.97 88.21 41.00 45.76 51.16 57.28 72.05 91.02 102.4 20.81 22.84 25.12 27.67 22.02 24.30 26.87 29.78 36.79 28.13 30.54 33.07 23 24 25.78 27 30 24.47 25.72 28.85 26.97 30.42 28.24 32.03 44.87 50.42 56.76 64.00 81.70 104.8 118.8 49.01 55.46 62.87 71.40 92.50 120.4 137.6 53.44 60.89 69.53 79.54 104.6 138.3 159.3 58.18 66.76 76.79 88.50 118.2 158.7 184.2 63.25 73.11 84.70 98.35 133.3 181.9 212.8 29.53 33.67 38.55 44.31 51.11 59.16 68.68 79.95 93.32 109.2 150.3 208.3 245.7 30.82 35.34 40.71 47.08 54.67 63.71 74.48 87.35 102.7 121.1 169.4 238.5 283.6 32.13 37.05 42.93 49.97 58.40 68.53 80.70 95.34 113.0 134.2 190.7 272.9 327.1 33.45 38.79 45 22 52.97 62.32 73.64 87.35 104.0 124.1 148.6 214.6 312.1 377.2 34.78 40.57 47.58 56.08 66.44 79.06 94 46 113.3 136.3 164.5 241.3 356.8 434.7 259.1 337.9 442.6 767.1 1,342 1,779 5738 815 1 1164 2400 4995 7218 48.89 60.40 75 40 95.03 120.8 154.8 199.6 64 46 84 58 1128 1527 2093 2903 406 5 31.97 35.72 39.99 28 68 30.54 32.45 36.62 34.25 38.51 43.39 41.43 47.00 44.50 50.82 34.43 39.08 36.46 41.65 47.73 54.86 - X Requirements 1. Determine the present value of six-year bonds payable with face value of $88,000 and stated interest rate of 14%, paid semiannually. The market rate of interest is 14% at issuance. 2. Same bonds payable as in Requirement 1, but the market interest rate is 16%. 3. Same bonds payable as in Requirement 1, but the market interest rate is 10%. Print Done -Xity

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Based on the requirements and the provided present value tables you are asked to determine the prese...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started