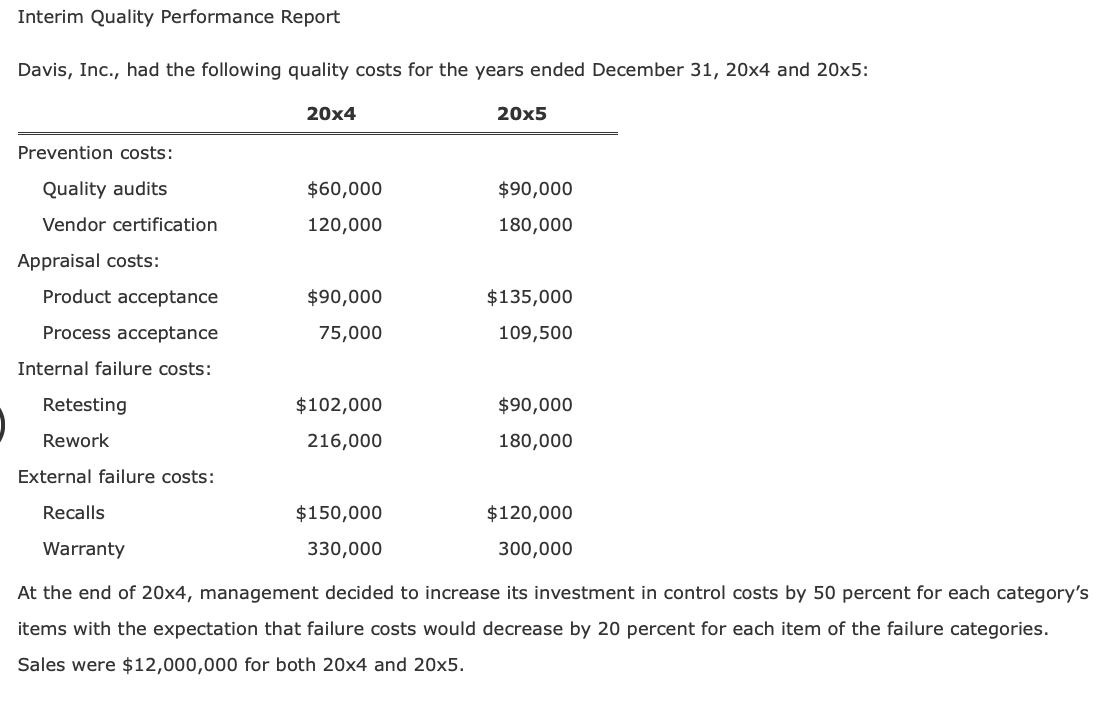

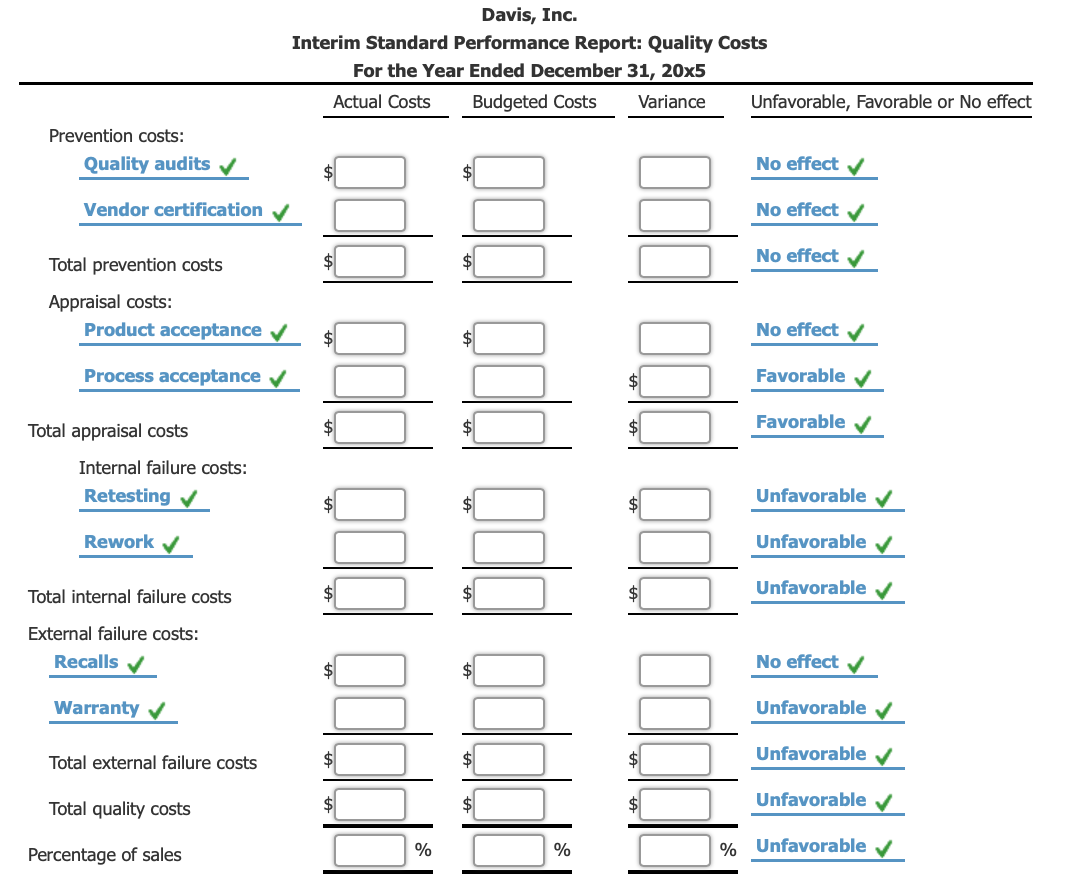

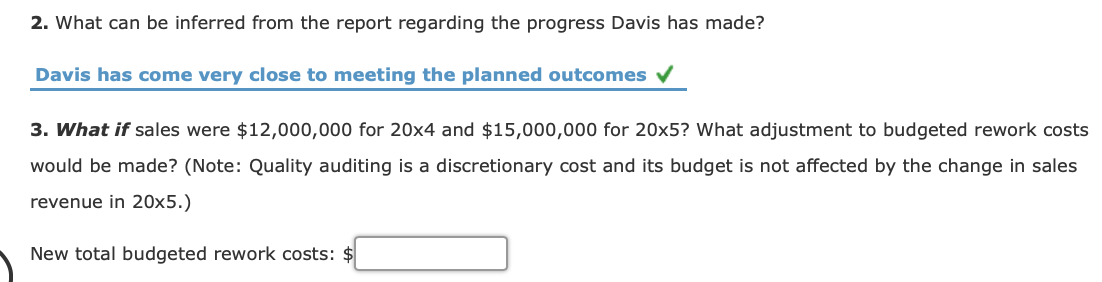

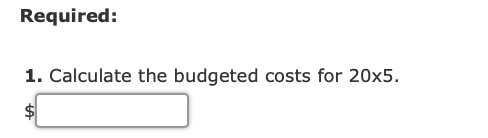

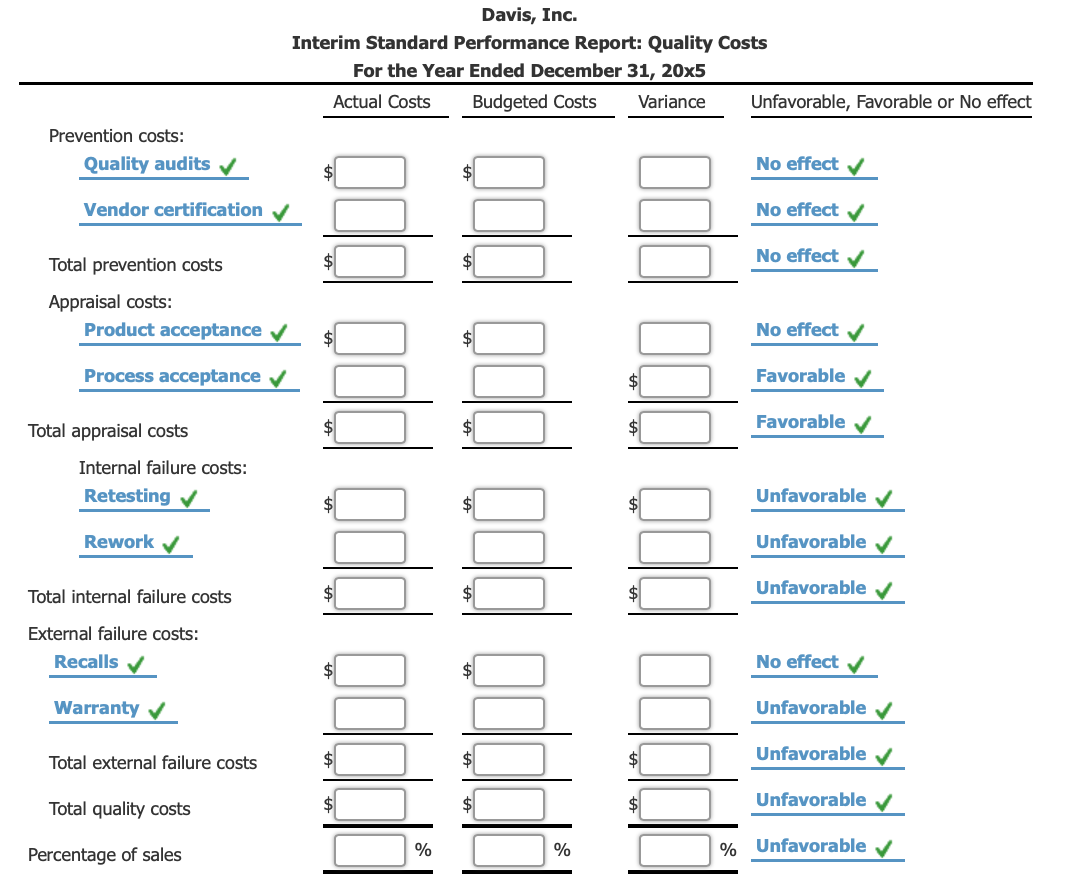

Interim Quality Performance Report Davis, Inc., had the following quality costs for the years ended December 31, 20x4 and 20x5: 20x4 20x5 Prevention costs: $60,000 120,000 $90,000 180,000 Quality audits Vendor certification Appraisal costs: Product acceptance Process acceptance Internal failure costs: $90,000 75,000 $135,000 109,500 $90,000 Retesting Rework $102,000 216,000 180,000 External failure costs: Recalls $150,000 330,000 $120,000 300,000 Warranty At the end of 20x4, management decided to increase its investment in control costs by 50 percent for each category's items with the expectation that failure costs would decrease by 20 percent for each item of the failure categories. Sales were $12,000,000 for both 20x4 and 20x5. Required: 1. Calculate the budgeted costs for 20x5. $ Prepare an interim quality performance report. Enter all answers as positive amounts, and if there is no variance enter "O" for your answer. If the budget variance amount is unfavorable select "Unfavorable" in the last column of the table, select "Favorable" if it is favorable or "No effect" if it is not applicable. Round percentage answers to two decimal places, when rounding is required. For example, 5.789% would be entered as "5.79". Davis, Inc. Interim Standard Performance Report: Quality Costs For the Year Ended December 31, 20x5 Actual Costs Budgeted Costs Variance Unfavorable, Favorable or No effect Prevention costs: Quality audits No effect Vendor certification No effect No effect Total prevention costs Appraisal costs: Product acceptance No effect Process acceptance Favorable Favorable Total appraisal costs Internal failure costs: Retesting Unfavorable odd odd odd oddi Rework Unfavorable Unfavorable Total internal failure costs External failure costs: Recalls No effect Warranty Unfavorable Total external failure costs Unfavorable Unfavorable Total quality costs Percentage of sales Unfavorable 2. What can be inferred from the report regarding the progress Davis has made? Davis has come very close to meeting the planned outcomes 3. What if sales were $12,000,000 for 20x4 and $15,000,000 for 20x5? What adjustment to budgeted rework costs would be made? (Note: Quality auditing is a discretionary cost and its budget is not affected by the change in sales revenue in 20x5.) New total budgeted rework costs: $