intermediat accounting

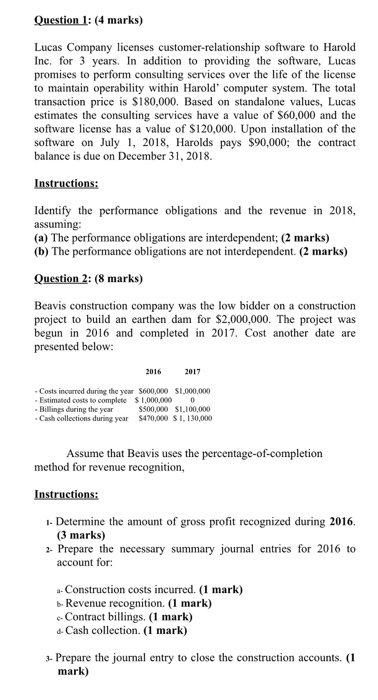

Question 1: (4 marks) Lucas Company licenses customer-relationship software to Harold Inc. for 3 years. In addition to providing the software, Lucas promises to perform consulting services over the life of the license to maintain operability within Harold' computer system. The total transaction price is $180,000. Based on standalone values, Lucas estimates the consulting services have a value of $60,000 and the software license has a value of $120,000. Upon installation of the software on July 1, 2018, Harolds pays $90,000; the contract balance is due on December 31, 2018. Instructions: Identify the performance obligations and the revenue in 2018, assuming: (a) The performance obligations are interdependent: (2 marks) (b) The performance obligations are not interdependent. (2 marks) Question 2: (8 marks) Beavis construction company was the low bidder on a construction project to build an earthen dam for $2,000,000. The project was begun in 2016 and completed in 2017. Cost another date are presented below: 2016 2017 - Costs incurred during the year $600,000 $1,000,000 Estimated costs to complete S 1,000,000 0 - Bilings during the year $500,000 $1.100.000 Cash collections during year $410,000 S 1.130,000 Assume that Beavis uses the percentage-of-completion method for revenue recognition, Instructions: 1. Determine the amount of gross profit recognized during 2016, (3 marks) 2. Prepare the necessary summary journal entries for 2016 to account for: - Construction costs incurred. (1 mark) - Revenue recognition. (1 mark) - Contract billings. (1 mark) d. Cash collection. (1 mark) 3. Prepare the journal entry to close the construction accounts. (1 mark) Question 3: (8 marks) The following information is for Hulk corporation for its first year of operations for the year 2015. Hulk's Pretax accounting income for 2015 was $ 62 million, which also included the following amounts: - Prepaid insurance is $12 paid in 2015, but for tax purpose, the deduction will be equally in the years 2015, 2016, 2017 and 2018; b. Installment recognized for financial reporting purposes in 2015 was $ 25 million, which will be equally collected over the 3 next years (2016 to 2018); c. Interest revenue of $ 2 from municipal bonds; d.Charitable donation of $ 500,000 recognized as expense, but not deductible for tax purposes. The enacted tax rate is 40% Instructions: 1- Compute income tax expense for 2015 Hulk's corporation. (5 marks) 2. Prepare the appropriate journal entry to record Hulk's 2015 income tax expense. (1 mark) 3. Prepare the income tax expense section of income statement for 2015, beginning with the line "Income before income taxes" (2 marks)