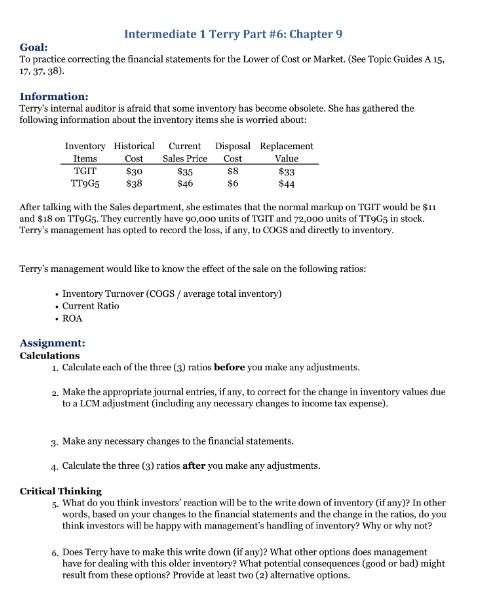

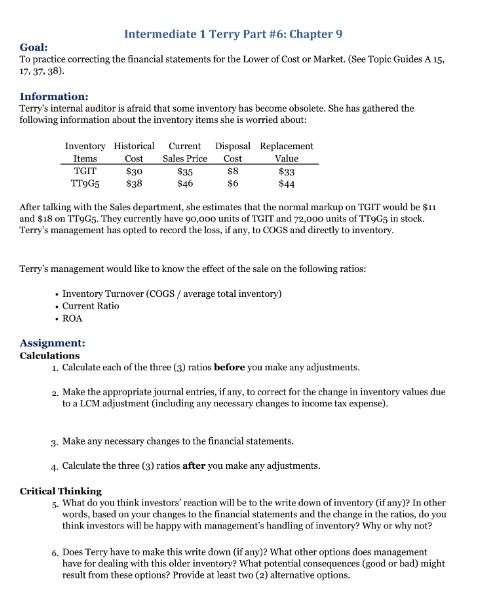

Intermediate 1 Terry Part #6: Chapter 9 Goal: To practice correcting the financial statements for the Lower of Cost or Market. (See Topic Guides A 15 17,37.38). Information: Terry's internal auditor is afraid that some inventory has become obsolete. She has gathered the following information about the inventory items she is worried about: Inventory Historia Curr Disposal Replacement Cost Sales Price Cost $35 $46 Value $33 TGIT $30 TI9G5 $38 S8 $6 After talking with the Sales department, she estimates that the normal markup on TGIT would be $I1 and $18 on TT9G5. They currently have go,oo0 units of TGIT and 72,000 units of TT9Gs in stock. Terry's management has opted to record the loss, if any, to COGS and directly to inventory Terry's management would like to know the effect of the sale on the following ratios: Inventory Turnover (COGS Current Ratio ROA average total inventory) Assignment: Calculations 1. Calculate each of the three (3) ratios before you make any adjustments 2. Make the appropriate journal entries, if any, to correct for the change in inventory values due to a LCM adjustment (inclu ding any necessary changes to income tax expense) 3. Make any necessary changes to the financial statements 4. Calculate the three (3) ratios after you make any adjustments. Critical Thinking 5. What do you think investors' reaction will be to the write down of inventory (if any)? In other words, based on your changes to the financial statements and the change in the ratios, do you think investors will be happy with management's handling of inventory? Why or why not? 6. Does Terry have to make this write down (if any)? What other options does management have for dealing with this older inventory? What potential consequences (good or bad) might result from these options? Provide at least two (2) alternative options Intermediate 1 Terry Part #6: Chapter 9 Goal: To practice correcting the financial statements for the Lower of Cost or Market. (See Topic Guides A 15 17,37.38). Information: Terry's internal auditor is afraid that some inventory has become obsolete. She has gathered the following information about the inventory items she is worried about: Inventory Historia Curr Disposal Replacement Cost Sales Price Cost $35 $46 Value $33 TGIT $30 TI9G5 $38 S8 $6 After talking with the Sales department, she estimates that the normal markup on TGIT would be $I1 and $18 on TT9G5. They currently have go,oo0 units of TGIT and 72,000 units of TT9Gs in stock. Terry's management has opted to record the loss, if any, to COGS and directly to inventory Terry's management would like to know the effect of the sale on the following ratios: Inventory Turnover (COGS Current Ratio ROA average total inventory) Assignment: Calculations 1. Calculate each of the three (3) ratios before you make any adjustments 2. Make the appropriate journal entries, if any, to correct for the change in inventory values due to a LCM adjustment (inclu ding any necessary changes to income tax expense) 3. Make any necessary changes to the financial statements 4. Calculate the three (3) ratios after you make any adjustments. Critical Thinking 5. What do you think investors' reaction will be to the write down of inventory (if any)? In other words, based on your changes to the financial statements and the change in the ratios, do you think investors will be happy with management's handling of inventory? Why or why not? 6. Does Terry have to make this write down (if any)? What other options does management have for dealing with this older inventory? What potential consequences (good or bad) might result from these options? Provide at least two (2) alternative options