Question

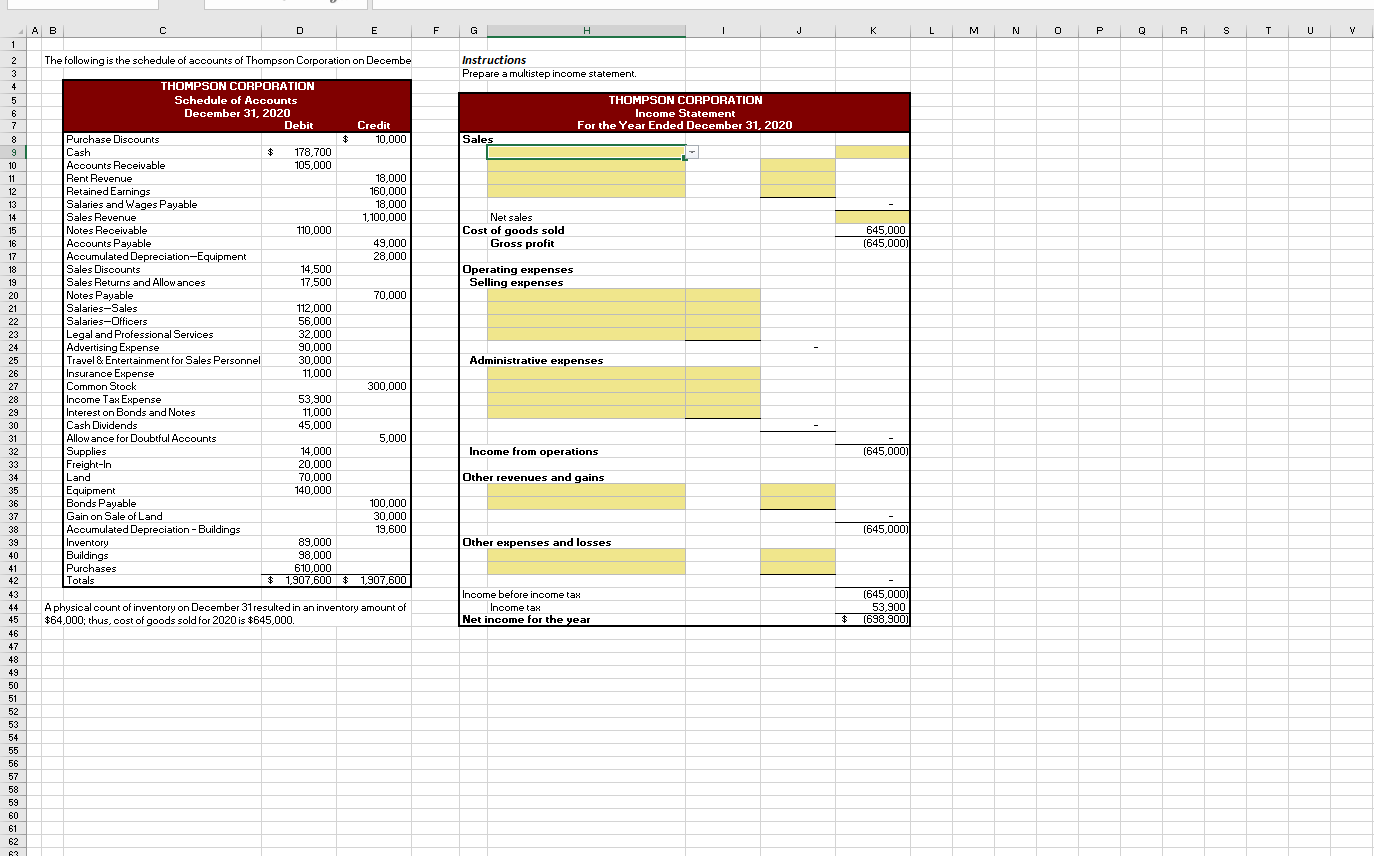

Intermediate accounting 1 Multistep Income Statement The schedule of accounts of Thompson Corporation at December 31, 2020, is given in the spreadsheet. A physical count

Intermediate accounting 1

Multistep Income Statement

The schedule of accounts of Thompson Corporation at December 31, 2020, is given in the spreadsheet. A physical count of inventory on December 31 resulted in an inventory amount of $64,000; thus, cost of goods sold for 2020 is $645,000. You are asked to prepare a multistep income statement.

Reference the appropriate cells in the schedule of accounts whenever possible in the income statement.

Complete the Sales section of the income statement.

- Select the correct accounts using the drop-down lists in column H and enter the correct values in column J and K.

- Using a formula calculate the Net sales in cell K14.

Complete the Selling Expenses section of the income statement.

- Select the correct accounts using the drop-down lists in column H and enter the correct values in column I.

- Notice that the total expenses for this section are already calculated in cell J24.

Complete the Administrative Expenses section of the income statement.

- Select the correct accounts using the drop-down lists in column H and enter the correct values in column I.

- Notice that the total expenses for this section are already calculated in cell J30.

Complete the Other revenues and gains section of the income statement.

- Select the correct accounts using the drop-down lists in column H and enter the correct values in column J.

- Notice that the total expenses for this section are already calculated in cell K37.

Complete the Other expenses and losses section of the income statement.

- Select the correct accounts using the drop-down lists in column H and enter the correct values in column J.

- Notice that the total expenses for this section are already calculated in cell K42.

Drop down menu:

Accounts payable

Accounts receivable

Accumulated depreciation-buildings

Accumulated depreciation-equipment

Advertising expense

Allowance of doubtful accounts

Bonds payable

Buildings

Cash

Cash dividends

Common stock

Equipment

Freight-in

Gain of sale of land

Income tax expense

Insurance expense

Interest on bonds and notes

Inventory

Land

Legal and professional services

Notes payable

Notes receivable

Purchase discounts

Purchases

Rent revenue

Retained earnings

Salaries-officers

Salaries-sales

Salaries and wages payable

Sales discounts

Sales returns and allowances

Sales revenue

Supplies

Travel and entertainment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started