Question

Intermediate accounting 2 Cost of Land and Building Alliah Company purchases land with an existing building. The plan is to demolish the existing building and

Intermediate accounting 2

Cost of Land and Building

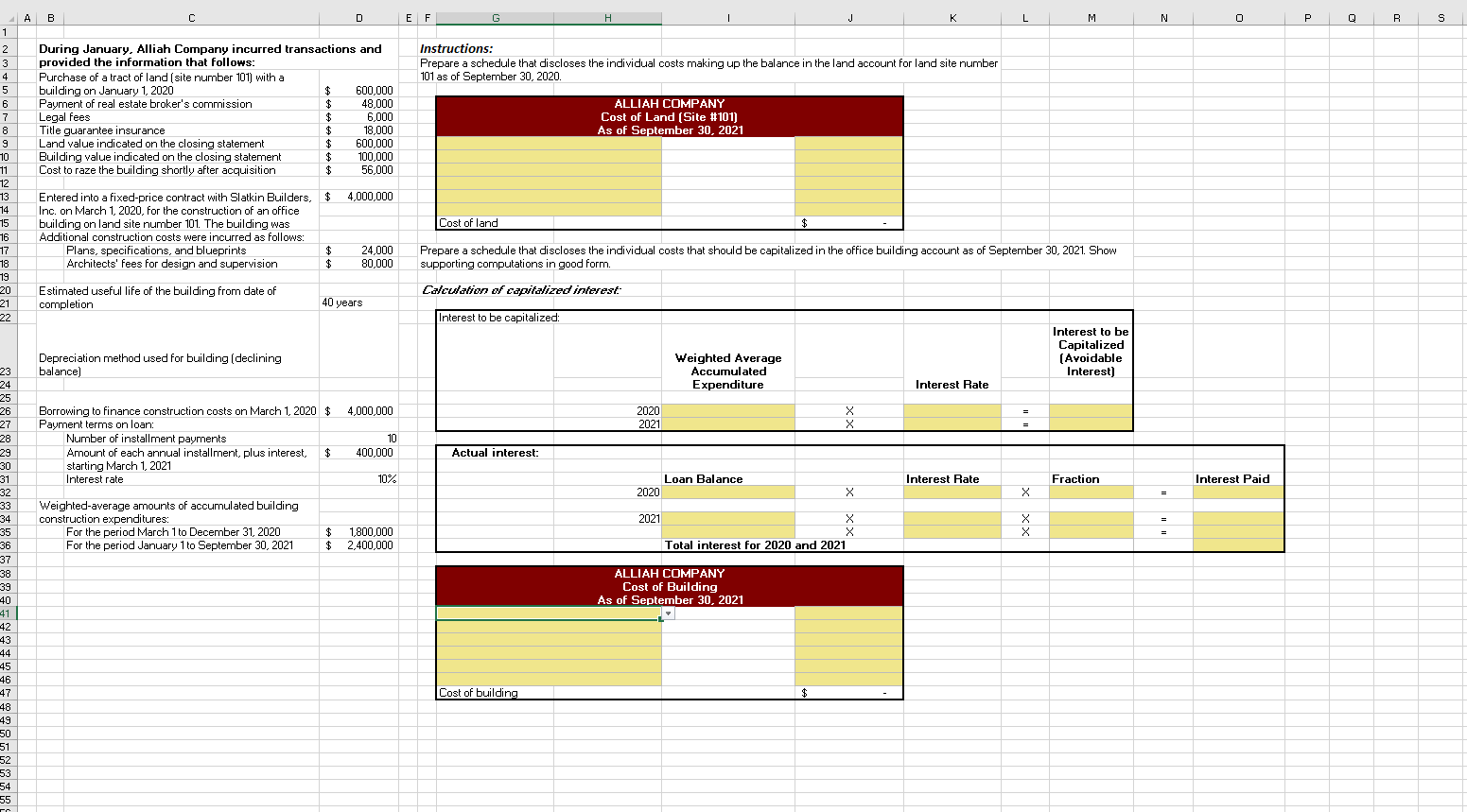

Alliah Company purchases land with an existing building. The plan is to demolish the existing building and construct a new building for Alliah's use. The CFO has asked Dylan to calculate several amounts related to the transactions. The details of the transaction are provided in the worksheet.

In the table G9:J14, calculate the cost of Land (Site #101) as of September 30, 2021.

- Choose appropriate expense titles in column G.

- In column J, reference the appropriate expense amount for the item from given information.

- If any rows are not necessary, leave them blank.

In the table H26:M27, calculate the interest to be capitalized (avoidable interest).

- In column I, indicate the weighted-average appropriate accumulated expenditure amounts.

- In column K, indicate the appropriate interest rate.

- In column M, calculate the interest to be capitalized (avoidable interest).

- Hint: The weighted-average accumulated expenditures is already given.

Using the table H32:O36, calculate the amount of actual interest to be paid.

- In Column I, select (if necessary, calculate) the appropriate debt balance.

- In column K, select the appropriate interest rate.

- In column M, determine the appropriate fraction of a year to which the debt balance applies. Hint: Utilize an Excel formula to create a decimal number that can be used in a calculation; using a fraction will result in an autocorrected date format.

- In column M, calculate the amount of actual interest to be paid in 2020 and 2021.

Using the table G41:J47, calculate the cost of Alliah Company's new building as of September 30, 2021.

- Choose appropriate expense titles in column G.

- In column J, reference the appropriate expense amount for the item from given information.

- If any rows are not necessary, leave them blank.

Drop down menu:

Architects fees

Building value

Cost of land and old building

Fixed construction contact price

Interest capitalized during 2020

Interest capitalized during 2021

Land value

Legal fees

Plans specifications and blueprints

Real estate brokers commission

Removal of old building

Title insurance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started