Intermediate accounting 2

Intangible Assets

Assist Burr Oak, Inc to correctly value it's intangible assets. Pertinent information can be found on the worksheet.

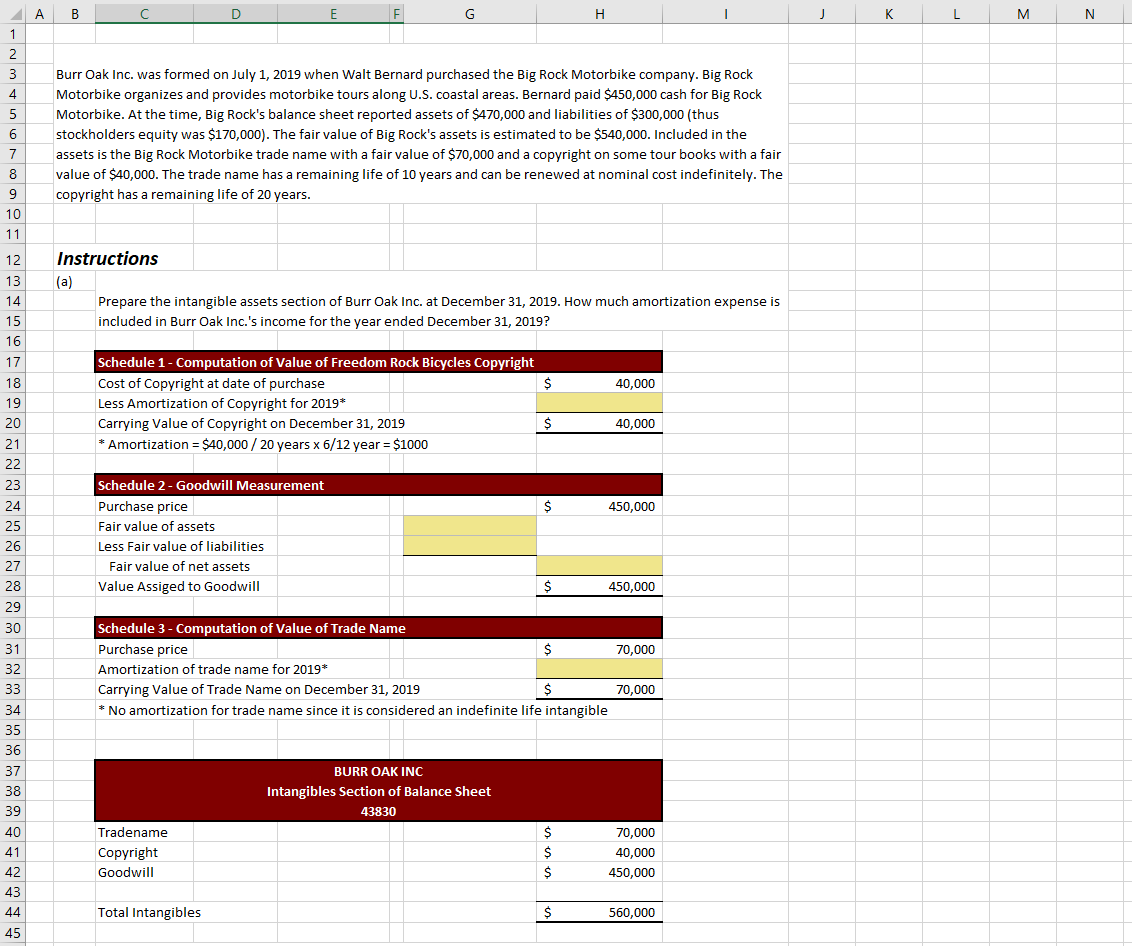

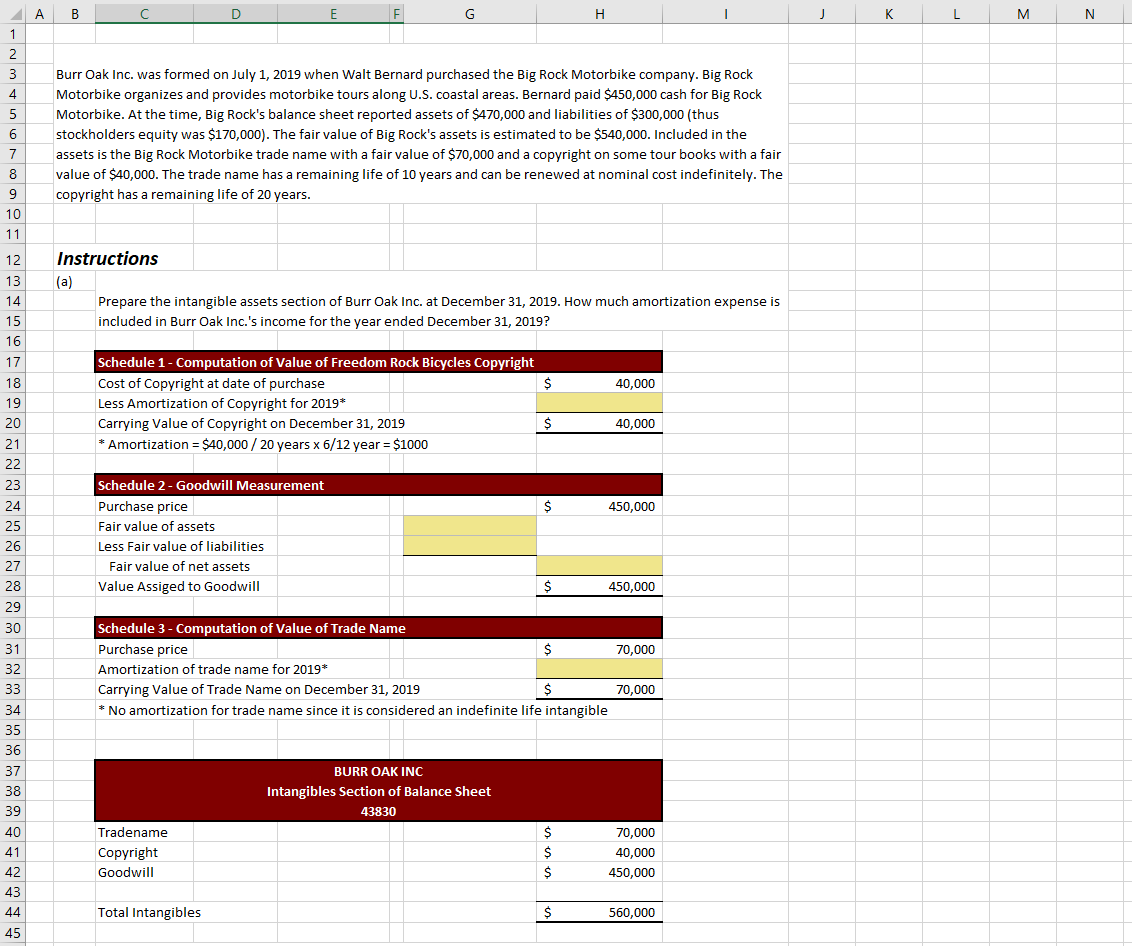

In cell H19, calculate 2019 amortization, if any, on the Big Rock Motorbike Copyright.

In the table G25:H27 complete the steps to calculate the value assigned to goodwill.

- Enter appropriate amounts in cells G25 and G26. If none, enter 0 (zero) for the value.

- Calculate the fair value of net assets in cell H27.

In cell H32, calculate 2019 amortization, if any, on the Big Rock Motorbike Trade Name. If none, enter 0 (zero) for the value.

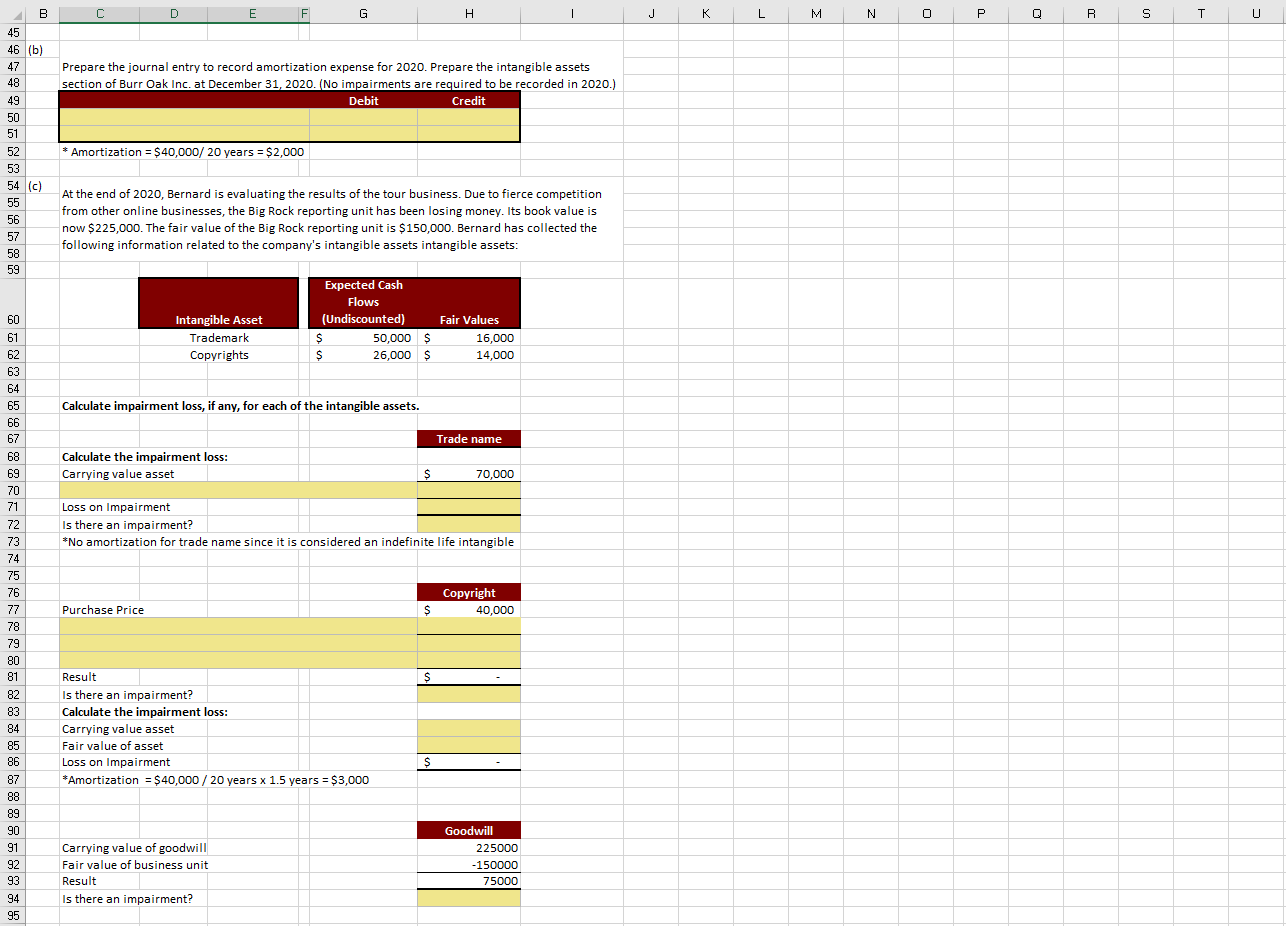

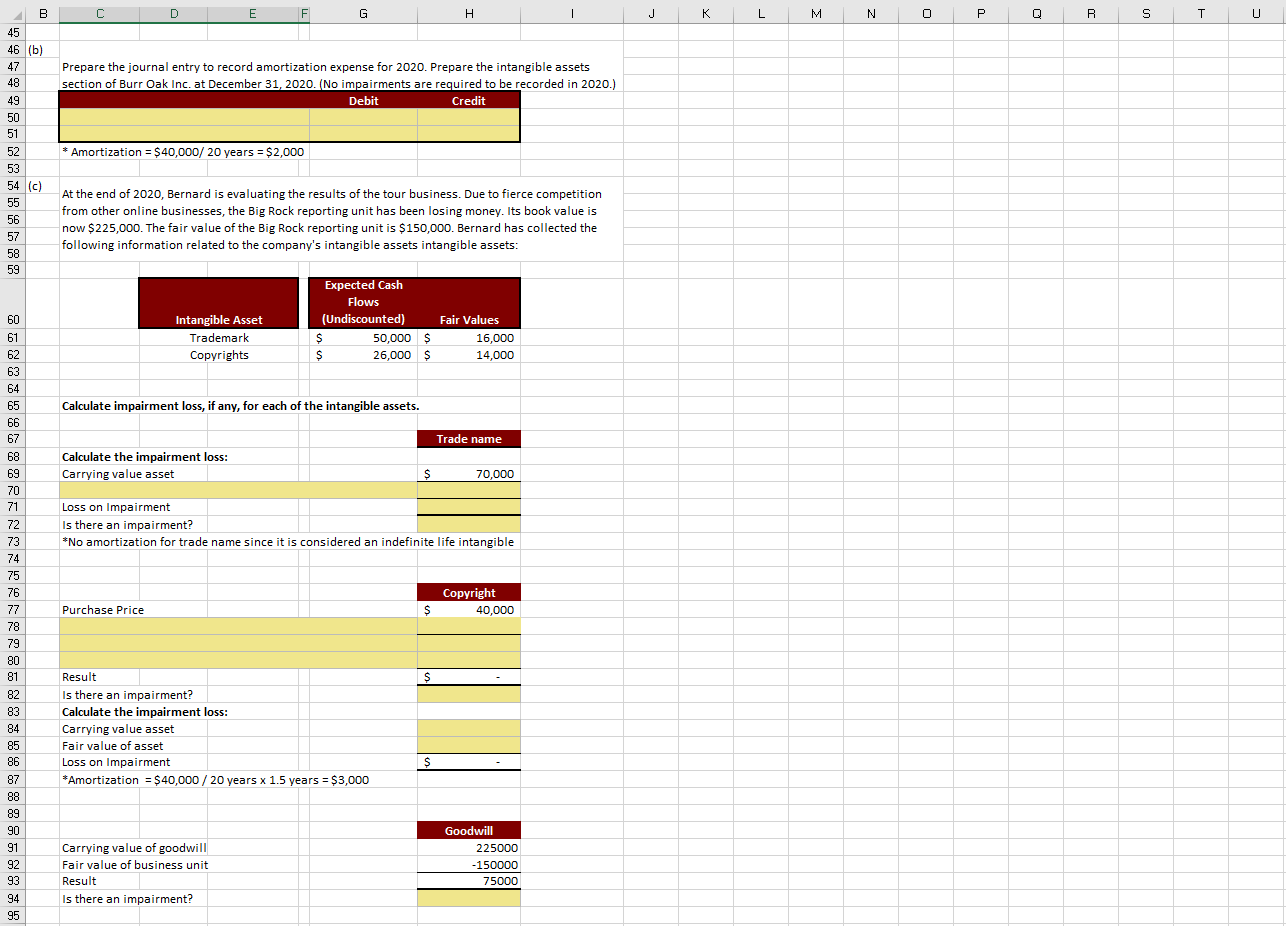

In the table C50:H51, prepare the journal entry to record the 2020 Amortization.

- Choose appropriate account titles using the drop-down lists in column C.

- In columns G and H enter appropriate debit/credit amounts for the items in the journal entry.

Calculate impairment loss in cell C70:H71.

- In the cells C70 and H70, choose the appropriate item in column C and then in column H, enter the appropriate amount.

- In cell H71, calculate the impairment loss with regards to the Trade Name.

In cell H72, answer Yes or No to the question: "Is there an impairment?" with regards to the Trade Name.

In the table C78:H80 determine if an impairment to the copyright exists.

- Choose the appropriate item in column C.

- In column H, enter the appropriate amount or formula to calculate the result to determine if an impairment exists with regards to the Copyright.

In cell H82, answer Yes or No to the question: "Is there an impairment?" with regards to the Copyright.

- In cells H84:H85 enter the appropriate amount. If the answer in cell H82 is No, enter 0 (zero) in cells H84:H85.

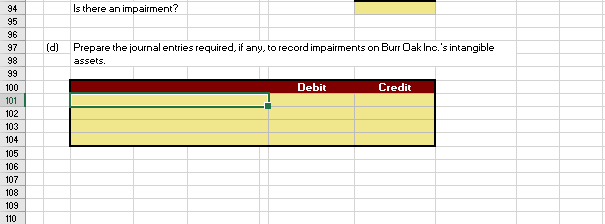

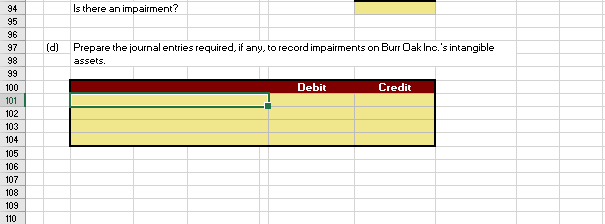

In cell H94, answer Yes or No to the question: "Is there an impairment?" with regards to Goodwill. n the table C101:H104, prepare the journal entry to record the 2020 Loss on Impairment.

- Choose appropriate account titles in column C.

- In columns G and H reference appropriate debit/credit amounts for the items in the journal entry.

Drop down menu:

Accumulated amortization- copyright

Accumulated amortization- trade name

Amortization expense*

Amortization of copyright 2019*

Amortization of trade name 2019*

Carrying value-copyright

Copyright

Fair value of assets

Fair value of net assets

Goodwill

Less accumulated amortization

Less expected cash flows

Les fair value of liabilities

Less fair value of trade name

Loss on impairment

Trade names

A B D E F G H K L M N 1 2 3 4 5 6 Burr Oak Inc. was formed on July 1, 2019 when Walt Bernard purchased the Big Rock Motorbike company. Big Rock Motorbike organizes and provides motorbike tours along U.S. coastal areas. Bernard paid $450,000 cash for Big Rock Motorbike. At the time, Big Rock's balance sheet reported assets of $470,000 and liabilities of $300,000 (thus stockholders equity was $170,000). The fair value of Big Rock's assets is estimated to be $540,000. Included in the assets is the Big Rock Motorbike trade name with a fair value of $70,000 and a copyright on some tour books with a fair value of $40,000. The trade name has a remaining life of 10 years and can be renewed at nominal cost indefinitely. The copyright has a remaining life of 20 years. 7 8 9 10 11 12 13 14 15 16 Instructions (a) Prepare the intangible assets section of Burr Oak Inc. at December 31, 2019. How much amortization expense is included in Burr Oak Inc.'s income for the year ended December 31, 2019? 17 18 $ 40,000 19 20 Schedule 1 - Computation of Value of Freedom Rock Bicycles Copyright Cost of Copyright at date of purchase Less Amortization of Copyright for 2019* Carrying Value of Copyright on December 31, 2019 * Amortization = $40,000 / 20 years x 6/12 year = $1000 $ 40,000 $ 450,000 21 22 23 24 25 26 27 28 Schedule 2 - Goodwill Measurement Purchase price Fair value of assets Less Fair value of liabilities Fair value of net assets Value Assiged to Goodwill $ 450,000 29 30 31 32 33 70,000 Schedule 3 - Computation of Value of Trade Name Purchase price $ Amortization of trade name for 2019* Carrying Value of Trade Name on December 31, 2019 $ * No amortization for trade name since it is considered an indefinite life intangible 70,000 34 35 36 37 38 39 BURR OAK INC Intangibles Section of Balance Sheet 43830 40 41 Tradename Copyright Goodwill $ $ $ 70,000 40,000 450,000 42 43 44 45 Total Intangibles $ 560,000 C D E F G . J K L M N O P Q R S U Prepare the journal entry to record amortization expense for 2020. Prepare the intangible assets section of Burr Oak Inc. at December 31, 2020. (No impairments are required to be recorded in 2020.) Debit Credit 45 46 (b) 47 48 49 50 51 52 53 54 (c) 55 56 57 58 59 * Amortization = $40,000/ 20 years = $2,000 At the end of 2020, Bernard is evaluating the results of the tour business. Due to fierce competition from other online businesses, the Big Rock reporting unit has been losing money. Its book value is now $225,000. The fair value of the Big Rock reporting unit is $150,000. Bernard has collected the following information related to the company's intangible assets intangible assets: Intangible Asset Trademark Copyrights Expected Cash Flows (Undiscounted) $ 50,000 $ $ 26,000 $ Fair Values 16,000 14,000 Calculate impairment loss, if any, for each of the intangible assets. Trade name Calculate the impairment loss: Carrying value asset $ 70,000 Loss on Impairment Is there an impairment? *No amortization for trade name since it is considered an indefinite life intangible Copyright 40,000 Purchase Price $ 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 $ Result Is there an impairment? Calculate the impairment loss: Carrying value asset Fair value of asset Loss on Impairment *Amortization = $40,000 / 20 years x 1.5 years = $3,000 $ Goodwill 225000 Carrying value of goodwill Fair value of business unit Result Is there an impairment? - 150000 75000 Is there an impairment? (d) Prepare the journal entries required, if any, to record impairments on Burr Oak Inc.'s intangible assets. Debit Credit 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 A B D E F G H K L M N 1 2 3 4 5 6 Burr Oak Inc. was formed on July 1, 2019 when Walt Bernard purchased the Big Rock Motorbike company. Big Rock Motorbike organizes and provides motorbike tours along U.S. coastal areas. Bernard paid $450,000 cash for Big Rock Motorbike. At the time, Big Rock's balance sheet reported assets of $470,000 and liabilities of $300,000 (thus stockholders equity was $170,000). The fair value of Big Rock's assets is estimated to be $540,000. Included in the assets is the Big Rock Motorbike trade name with a fair value of $70,000 and a copyright on some tour books with a fair value of $40,000. The trade name has a remaining life of 10 years and can be renewed at nominal cost indefinitely. The copyright has a remaining life of 20 years. 7 8 9 10 11 12 13 14 15 16 Instructions (a) Prepare the intangible assets section of Burr Oak Inc. at December 31, 2019. How much amortization expense is included in Burr Oak Inc.'s income for the year ended December 31, 2019? 17 18 $ 40,000 19 20 Schedule 1 - Computation of Value of Freedom Rock Bicycles Copyright Cost of Copyright at date of purchase Less Amortization of Copyright for 2019* Carrying Value of Copyright on December 31, 2019 * Amortization = $40,000 / 20 years x 6/12 year = $1000 $ 40,000 $ 450,000 21 22 23 24 25 26 27 28 Schedule 2 - Goodwill Measurement Purchase price Fair value of assets Less Fair value of liabilities Fair value of net assets Value Assiged to Goodwill $ 450,000 29 30 31 32 33 70,000 Schedule 3 - Computation of Value of Trade Name Purchase price $ Amortization of trade name for 2019* Carrying Value of Trade Name on December 31, 2019 $ * No amortization for trade name since it is considered an indefinite life intangible 70,000 34 35 36 37 38 39 BURR OAK INC Intangibles Section of Balance Sheet 43830 40 41 Tradename Copyright Goodwill $ $ $ 70,000 40,000 450,000 42 43 44 45 Total Intangibles $ 560,000 C D E F G . J K L M N O P Q R S U Prepare the journal entry to record amortization expense for 2020. Prepare the intangible assets section of Burr Oak Inc. at December 31, 2020. (No impairments are required to be recorded in 2020.) Debit Credit 45 46 (b) 47 48 49 50 51 52 53 54 (c) 55 56 57 58 59 * Amortization = $40,000/ 20 years = $2,000 At the end of 2020, Bernard is evaluating the results of the tour business. Due to fierce competition from other online businesses, the Big Rock reporting unit has been losing money. Its book value is now $225,000. The fair value of the Big Rock reporting unit is $150,000. Bernard has collected the following information related to the company's intangible assets intangible assets: Intangible Asset Trademark Copyrights Expected Cash Flows (Undiscounted) $ 50,000 $ $ 26,000 $ Fair Values 16,000 14,000 Calculate impairment loss, if any, for each of the intangible assets. Trade name Calculate the impairment loss: Carrying value asset $ 70,000 Loss on Impairment Is there an impairment? *No amortization for trade name since it is considered an indefinite life intangible Copyright 40,000 Purchase Price $ 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 $ Result Is there an impairment? Calculate the impairment loss: Carrying value asset Fair value of asset Loss on Impairment *Amortization = $40,000 / 20 years x 1.5 years = $3,000 $ Goodwill 225000 Carrying value of goodwill Fair value of business unit Result Is there an impairment? - 150000 75000 Is there an impairment? (d) Prepare the journal entries required, if any, to record impairments on Burr Oak Inc.'s intangible assets. Debit Credit 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110