Answered step by step

Verified Expert Solution

Question

1 Approved Answer

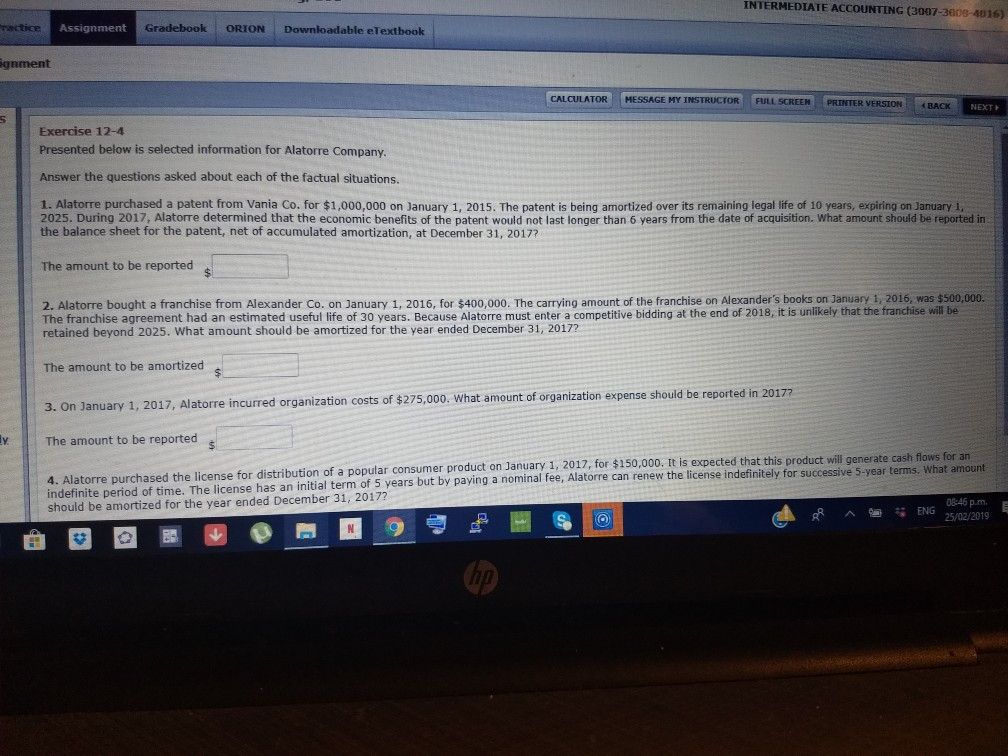

INTERMEDIATE ACCOUNTING (3007-3608-4016) ractice Assignment Gradebook ORION Downloadable eTextbook gnment | CALCULATOR I MESSAGE MY INSTRUCTOR RILL SCREEN-PRINTER VERSION BACK NEXT Exercise 12-4 Presented below

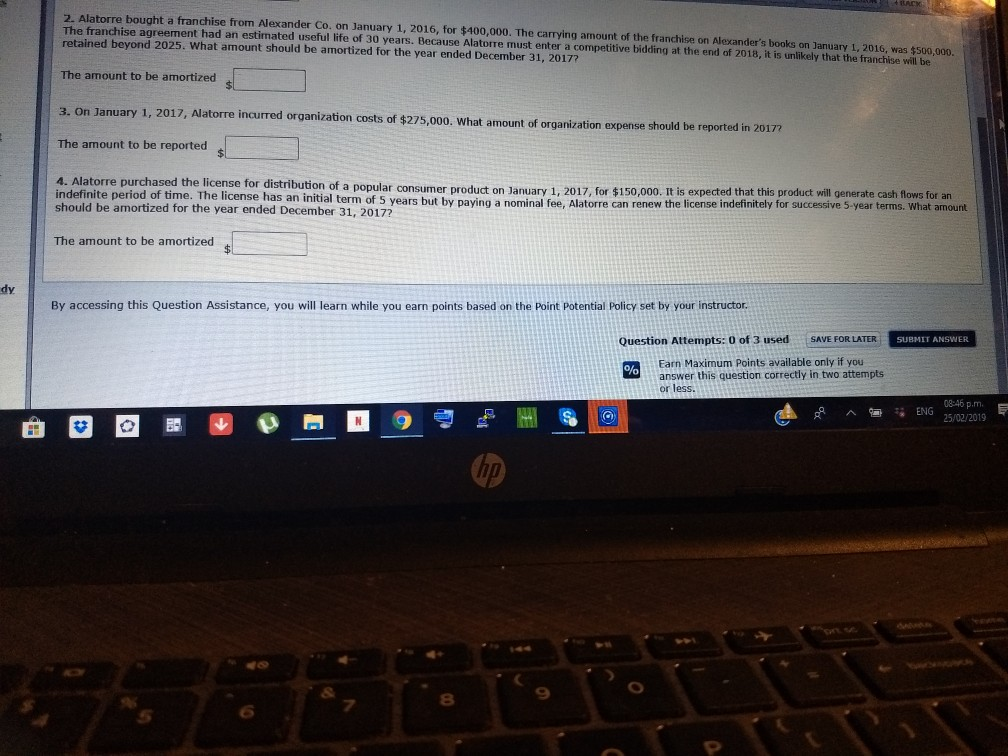

INTERMEDIATE ACCOUNTING (3007-3608-4016) ractice Assignment Gradebook ORION Downloadable eTextbook gnment | CALCULATOR I MESSAGE MY INSTRUCTOR RILL SCREEN-PRINTER VERSION BACK NEXT Exercise 12-4 Presented below is selected information for Alatorre Company Answer the questions asked about each of the factual situations. 1. Alatorre purchased a patent from Vania Co. for $1,000,000 on January 1, 2015. The patent is being amortized over its remaining legal life of 10 years, expiring on January i, 2025. During 2017, Alatorre determined that the economic benefits of the patent would not last longer than 6 years from the date of acquisition. What amount should be reported in the balance sheet for the patent, net of accumulated amortization, at December 31, 2017? The amount to be reported 2. Alatorre bought a franchise from Alexander Co. on January 1, 2016, for $400,000. The carrying amount of the franchise on Alexander's books on January 1. 2016 was $500,000 The franchise agreement had an estimated useful life of 30 years. Because Alatorre must enter a competitive bidding at the end of 2018, it is unlikely that the franchise will be The amount to be amortized mount of organization expense should be reported in 20177 3. On January 1, 2017, Alatorre incurred organization costs of $275,000. what a The amount to be reported 4. Alatorre purchased the license for distribution of a popular consumer product on January 1, 2017, for indefinite period of time. The license has an initial term of 5 years but by paying a nominal fee, Alatorre can renew the lic should be amortized for the year ended December 31, 2017? $150,000. It is expected that this product will generate cash flows for an ense indefinitely for successive 5-year terms. What amount 08-46 p.m. 25/02/2019 2. Alatorre bought a franchise from Alexander Co. on January 1, 2016, for $400,000. The carrying amount of the franchise on Alexander's books on January 1, 2016, was $500,00o. The franchise agreement had an estirmated useful ife of 30 years. Because Alatorre must enter a competitive bidding at the end of 2018, it is unlikely that the franchise will be The amount to be amortized 3. on January 1, 2017, Alatorre incurred organization costs of $275,000. What amount of organization expense should be reported in 2017 The amount to be reported 4. Alatorre purchased the license for distribution popular cons houldbe e iehas an initial term of 5 years but by paying a nominal fee, Alatorre can renew the license indefinitely for successive 5-year terms. What at tion of a popular consumer product on January 1, 2017, for $150,000. It is expected that this product will generate cash flows for an amortized for the year ended December 31, 2017? The amount to be amortized dy By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. Question Attempts: 0 of 3 used SAVE FOR LATER SUBMIT ANSWER Earn Maximum Points available only if you answer this question correctly in two attempts or less. 08 46 p.m. E : ENG 25/02/2019 7 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started