Answered step by step

Verified Expert Solution

Question

1 Approved Answer

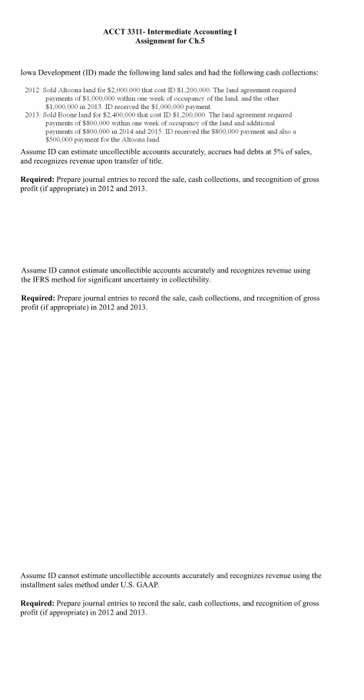

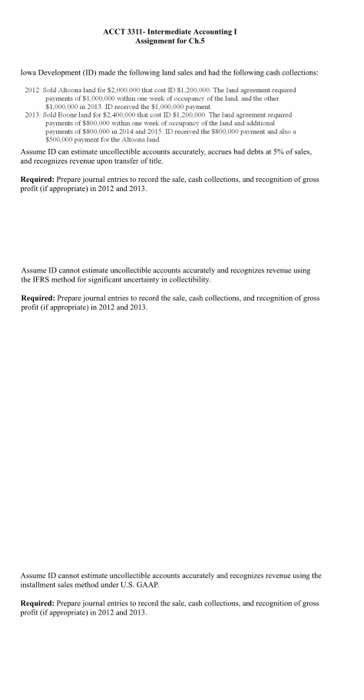

Intermediate accounting ACCT 3311- Intermediate Accounting I Assignmeat for Ch.5 lowa Develogement (LD) made the following land sales and had the fellowing cash collections: 012

Intermediate accounting

ACCT 3311- Intermediate Accounting I Assignmeat for Ch.5 lowa Develogement (LD) made the following land sales and had the fellowing cash collections: 012 Sold Altoona land for $2.000.000 that cost tD $1.200,000 The land agreement reqeined payments of $1.000,00 within one week of oeoupancy of the land and the other 1,000,000 in 2013 ID received the $1,000,000 paymen 2013 Sold Boone land So $2 400.000 thct ID $1.200,000 The lnd agreement required payments of $300,000 within one week of occupancy of the land and additioel payments of $800,000 in 2014 and 2015 ID reeivied the 5300,000 pasment and alsoa $500,000 pay ment foe the Atooea land Assume ID can estimate uncollectible accounts accurately, accrues bad debts at 5% of sales, and recognizes revenue upon transfer of title Required: Prepare journal entries to recoed the sale, cash collections, and recognition of gross profit (if appeopriate) in 2012 and 2013 Assume ID cannot estimate uncollectible accounts accurately and recognizes revenue using the IFRS method for significant uncertainty in collectibility. Required: Prepare journal entries to record the sale, cash collections, and recognition of gross profit (if appropriate) in 2012 and 2013 Assume ID cannot estimate uncollectible accounts accurately and recognizes revenue using the installment sales method under US. GAAP Required: Prepare journal entries to record the sale, cash collections, and recognition of gross profit (if appeopriate) in 2012 and 2013. ACCT 3311- Intermediate Accounting I Assignmeat for Ch.5 lowa Develogement (LD) made the following land sales and had the fellowing cash collections: 012 Sold Altoona land for $2.000.000 that cost tD $1.200,000 The land agreement reqeined payments of $1.000,00 within one week of oeoupancy of the land and the other 1,000,000 in 2013 ID received the $1,000,000 paymen 2013 Sold Boone land So $2 400.000 thct ID $1.200,000 The lnd agreement required payments of $300,000 within one week of occupancy of the land and additioel payments of $800,000 in 2014 and 2015 ID reeivied the 5300,000 pasment and alsoa $500,000 pay ment foe the Atooea land Assume ID can estimate uncollectible accounts accurately, accrues bad debts at 5% of sales, and recognizes revenue upon transfer of title Required: Prepare journal entries to recoed the sale, cash collections, and recognition of gross profit (if appeopriate) in 2012 and 2013 Assume ID cannot estimate uncollectible accounts accurately and recognizes revenue using the IFRS method for significant uncertainty in collectibility. Required: Prepare journal entries to record the sale, cash collections, and recognition of gross profit (if appropriate) in 2012 and 2013 Assume ID cannot estimate uncollectible accounts accurately and recognizes revenue using the installment sales method under US. GAAP Required: Prepare journal entries to record the sale, cash collections, and recognition of gross profit (if appeopriate) in 2012 and 2013

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started