Intermediate Accounting.

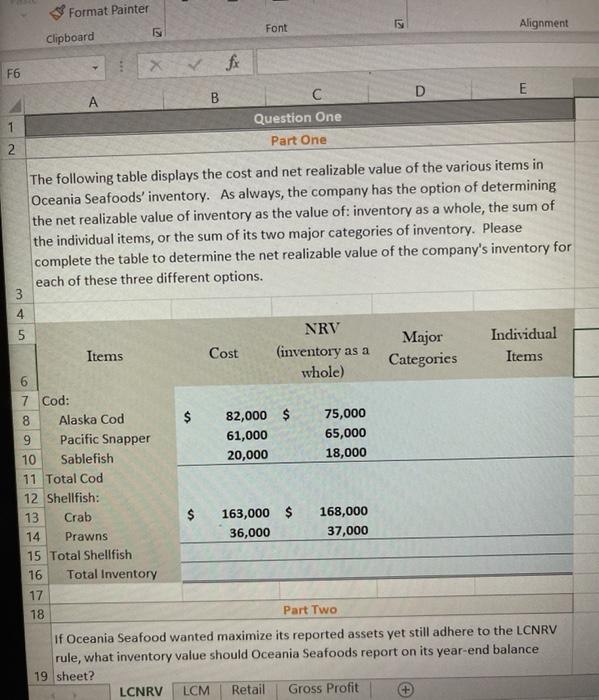

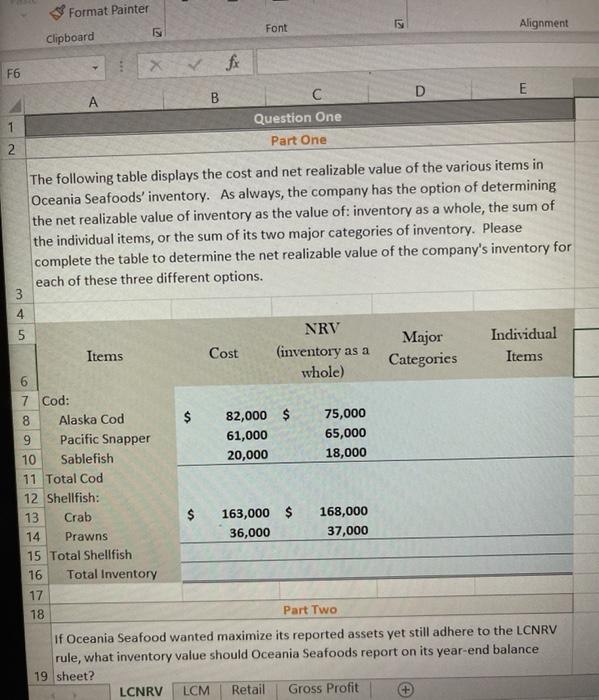

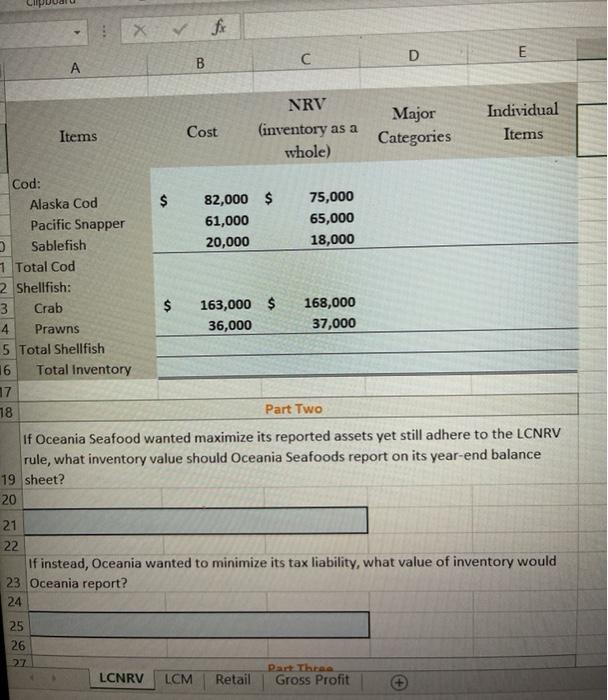

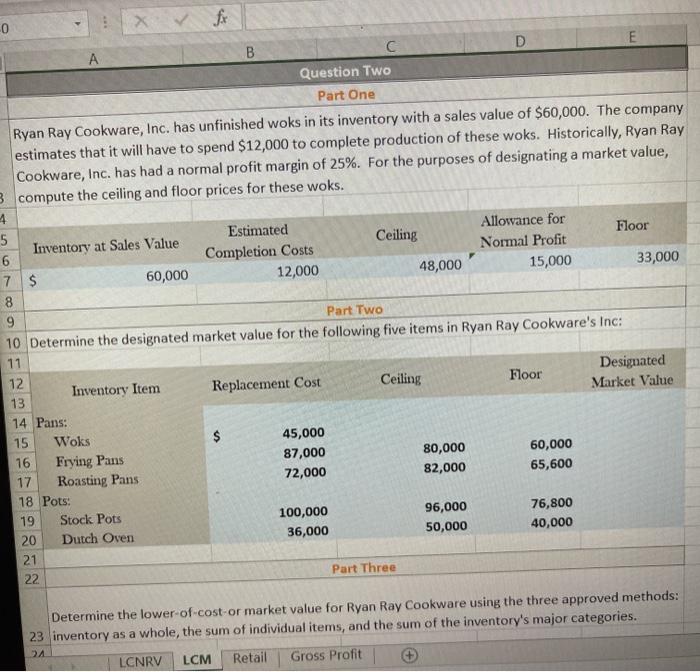

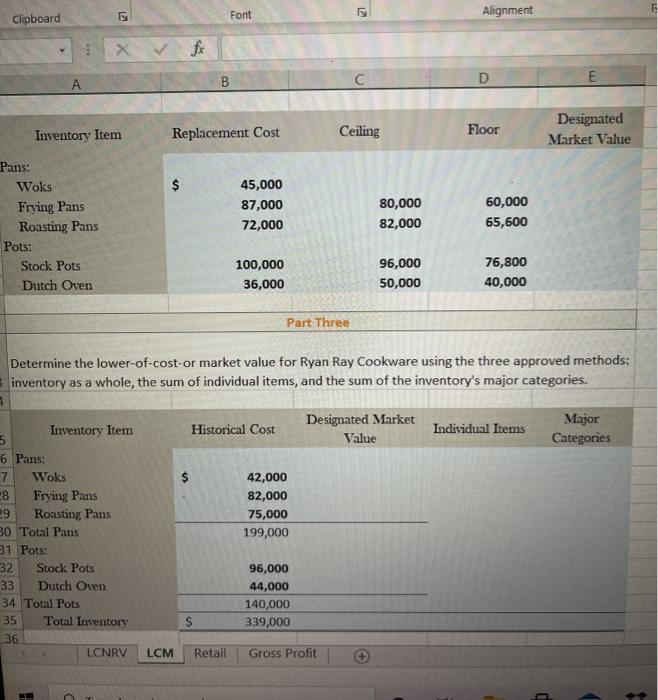

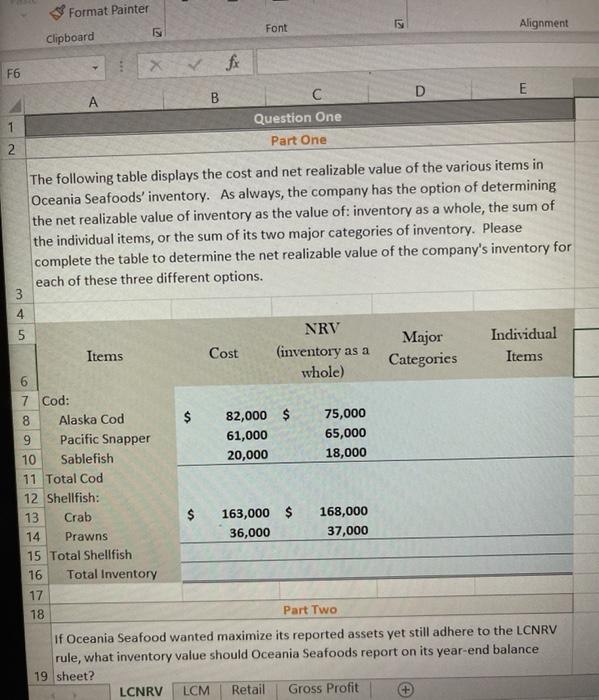

Format Painter Font Alignment Clipboard F6 D E B C Question One Part One 1 2 The following table displays the cost and net realizable value of the various items in Oceania Seafoods' inventory. As always, the company has the option of determining the net realizable value of inventory as the value of: inventory as a whole, the sum of the individual items, or the sum of its two major categories of inventory. Please complete the table to determine the net realizable value of the company's inventory for each of these three different options. 3 3 4 5 Items NRV (inventory as a whole) Individual Items Cost Major Categories 82,000 $ 61,000 20,000 75,000 65,000 18,000 6 7 Cod: 8 Alaska Cod Pacific Snapper 10 Sablefish 11 Total Cod 12 Shellfish: 13 Crab 14 Prawns 15 Total Shellfish 16 Total Inventory 17 $ 163,000 $ 36,000 168,000 37,000 18 Part Two If Oceania Seafood wanted maximize its reported assets yet still adhere to the LCNRV rule, what inventory value should Oceania Seafoods report on its year-end balance 19 sheet? LCNRV LCM Retail Gross Profit for D E C A B NRV (inventory as a whole) Major Categories Individual Items Items Cost Cod: Alaska Cod $ 82,000 $ 75,000 Pacific Snapper 61,000 65,000 Sablefish 20,000 18,000 1 Total Cod 2 Shellfish: 3 Crab $ 163,000 $ 168,000 4 Prawns 36,000 37,000 5 Total Shellfish 16 Total Inventory 17 18 Part Two If Oceania Seafood wanted maximize its reported assets yet still adhere to the LCNRV rule, what inventory value should Oceania Seafoods report on its year-end balance 19 sheet? 20 21 22 If instead, Oceania wanted to minimize its tax liability, what value of inventory would 23 Oceania report? 24 25 26 27 LCNRV LCM Retail Part Three Gross Profit -0 A B C D E Question Two Part One Ryan Ray Cookware, Inc. has unfinished woks in its inventory with a sales value of $60,000. The company estimates that it will have to spend $12,000 to complete production of these woks. Historically, Ryan Ray Cookware, Inc. has had a normal profit margin of 25%. For the purposes of designating a market value, 3. compute the ceiling and floor prices for these woks. 4 5 Estimated Allowance for Inventory at Sales Value Ceiling Floor 6 Completion Costs Normal Profit 7 $ 60,000 12,000 48,000 15,000 33,000 8 9 Part Two 10 Determine the designated market value for the following five items in Ryan Ray Cookware's Inc: 11 12 Designated Inventory Item Replacement Cost Ceiling Floor 13 Market Value 14 Pans: 15 Woks 45,000 16 Frying Pans 87,000 80,000 60,000 17 Roasting Pans 72,000 82,000 65,600 18 Pots: 19 Stock Pots 100,000 96,000 76,800 20 Dutch Oven 36,000 50,000 40,000 21 22 Part Three $ Determine the lower-of-cost or market value for Ryan Ray Cookware using the three approved methods: 23 inventory as a whole, the sum of individual items, and the sum of the inventory's major categories. LCNRV LCM Retail Gross Profit A LA Clipboard Font Alignment Z1 . B C D Inventory Item Replacement Cost Ceiling Floor Designated Market Value $ Pans: Woks Frying Pans Roasting Pans Pots: Stock Pots Dutch Oven 45,000 87,000 72,000 80,000 82,000 60,000 65,600 100,000 36,000 96,000 50,000 76,800 40,000 Part Three Determine the lower-of-cost-or market value for Ryan Ray Cookware using the three approved methods: inventory as a whole, the sum of individual items, and the sum of the inventory's major categories. 1 Historical Cost Designated Market Value Individual Items Major Categories Inventory Item 5 6 Pans: 7 Woks 28 Frying Pans 09 Roasting Pans 30 Total Pans 31 Pots: 32 Stock Pots 33 Dutch Oven 34 Total Pots 35 Total Inventory 36 LCNRV 42,000 82,000 75,000 199,000 96,000 44,000 140,000 339,000 $ LCM Retail Gross Profit