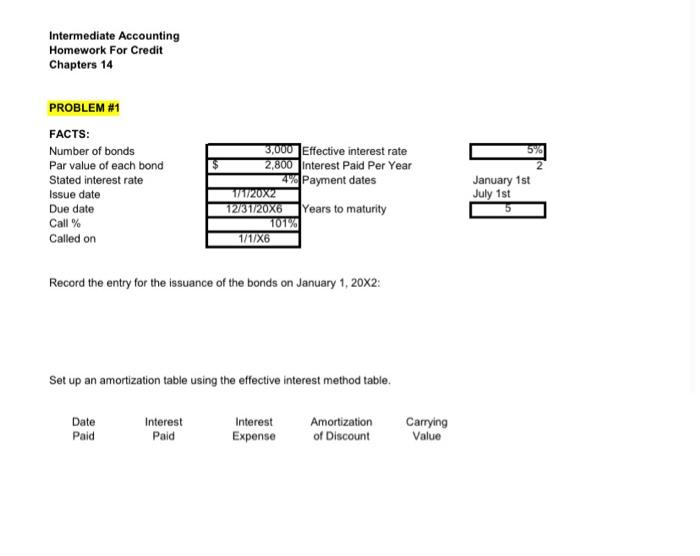

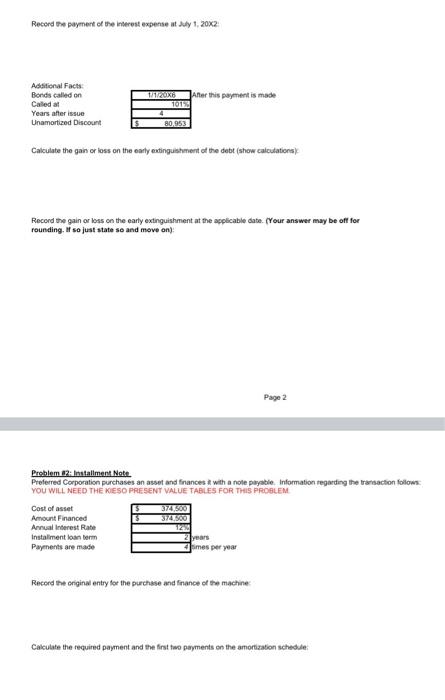

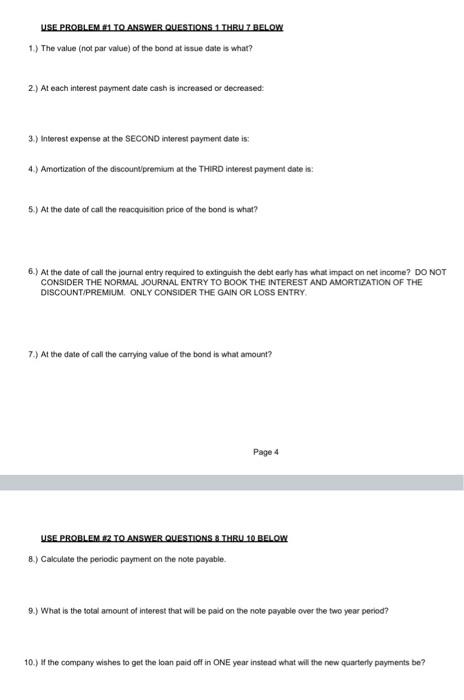

Intermediate Accounting Homework For Credit Chapters 14 PROBLEM \#1 Record the entry for the issuance of the bonds on January 1, 20X2: Set up an amortization table using the effective interest method table. Record the paymert of the inserest expense at ddy 1, 20x2: Calculate the gain or loss on the early ewtingushenent of the debt (show calculationsk Record the gain or loss on the early extinguishment at the applicable dabe. frour answer may be off for rounding. If so just state se and move onj: Page 2 Problem a 2i-instaliment Note. Preferred Corporation purchases an assef and finances fit with a nole payable. Information regording the trarsaction follows: YOU WILL NEED THE KIESO PFESENT WALUE TABLFS FOR THIS PROGLEM Record the original entry for the purchsse and finance of the machine Calculate the required payment and the first two payments en the amortiation schedsie: 1.) The value (not par value) of the bond at issue date is what? 2.) At each interest payment date cash is increased or decreased: 3.) Interest expense at the SECOND interest payment date is: 4.) Amortization of the discounvpremium at the THIRD interest payment date is: 5.) At the date of call the reacquisition price of the bond is what? 6.) At the date of call the journal entry required to extinguish the debt earfy has what impact on net income? DO NOT CONSIDER THE NORMAL. JOURNAL ENTRY TO BOOK THE INTEREST AND AMORTIZATION OF THE DISCOUNT.PREMIUM. ONLY CONSIOER THE GAIN OR LOSS ENTRY. 7.) At the dale of call the carrying value of the bond is what amount? Page 4 USE PROBLEM M2 TO ANSWER QUESTIONS S THRU 1Q BELOW 8.) Calculate the periodic payment on the note payable. 9.) Whet is the total amount of interest that will be paid on the note payable over the two year period? 10.) If the company wishes to get the loan paid off in ONE year instead what will the new quarterly payments be? Intermediate Accounting Homework For Credit Chapters 14 PROBLEM \#1 Record the entry for the issuance of the bonds on January 1, 20X2: Set up an amortization table using the effective interest method table. Record the paymert of the inserest expense at ddy 1, 20x2: Calculate the gain or loss on the early ewtingushenent of the debt (show calculationsk Record the gain or loss on the early extinguishment at the applicable dabe. frour answer may be off for rounding. If so just state se and move onj: Page 2 Problem a 2i-instaliment Note. Preferred Corporation purchases an assef and finances fit with a nole payable. Information regording the trarsaction follows: YOU WILL NEED THE KIESO PFESENT WALUE TABLFS FOR THIS PROGLEM Record the original entry for the purchsse and finance of the machine Calculate the required payment and the first two payments en the amortiation schedsie: 1.) The value (not par value) of the bond at issue date is what? 2.) At each interest payment date cash is increased or decreased: 3.) Interest expense at the SECOND interest payment date is: 4.) Amortization of the discounvpremium at the THIRD interest payment date is: 5.) At the date of call the reacquisition price of the bond is what? 6.) At the date of call the journal entry required to extinguish the debt earfy has what impact on net income? DO NOT CONSIDER THE NORMAL. JOURNAL ENTRY TO BOOK THE INTEREST AND AMORTIZATION OF THE DISCOUNT.PREMIUM. ONLY CONSIOER THE GAIN OR LOSS ENTRY. 7.) At the dale of call the carrying value of the bond is what amount? Page 4 USE PROBLEM M2 TO ANSWER QUESTIONS S THRU 1Q BELOW 8.) Calculate the periodic payment on the note payable. 9.) Whet is the total amount of interest that will be paid on the note payable over the two year period? 10.) If the company wishes to get the loan paid off in ONE year instead what will the new quarterly payments be