Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Intermediate Accounting Question Five (7 marks) A. XYZ, Inc. is negotiating with the local government to build a new bridge after demolishing the existing bridge

Intermediate Accounting

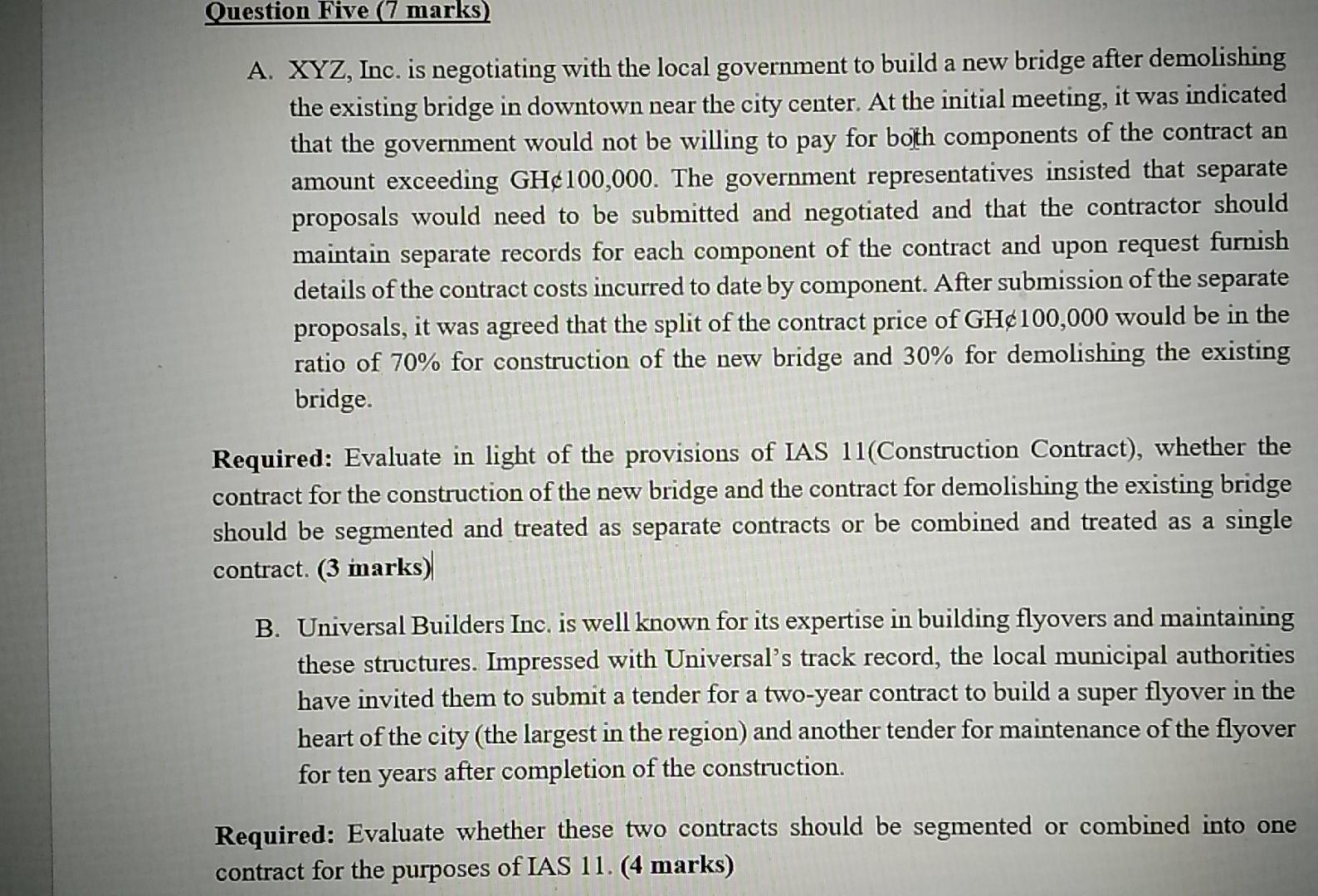

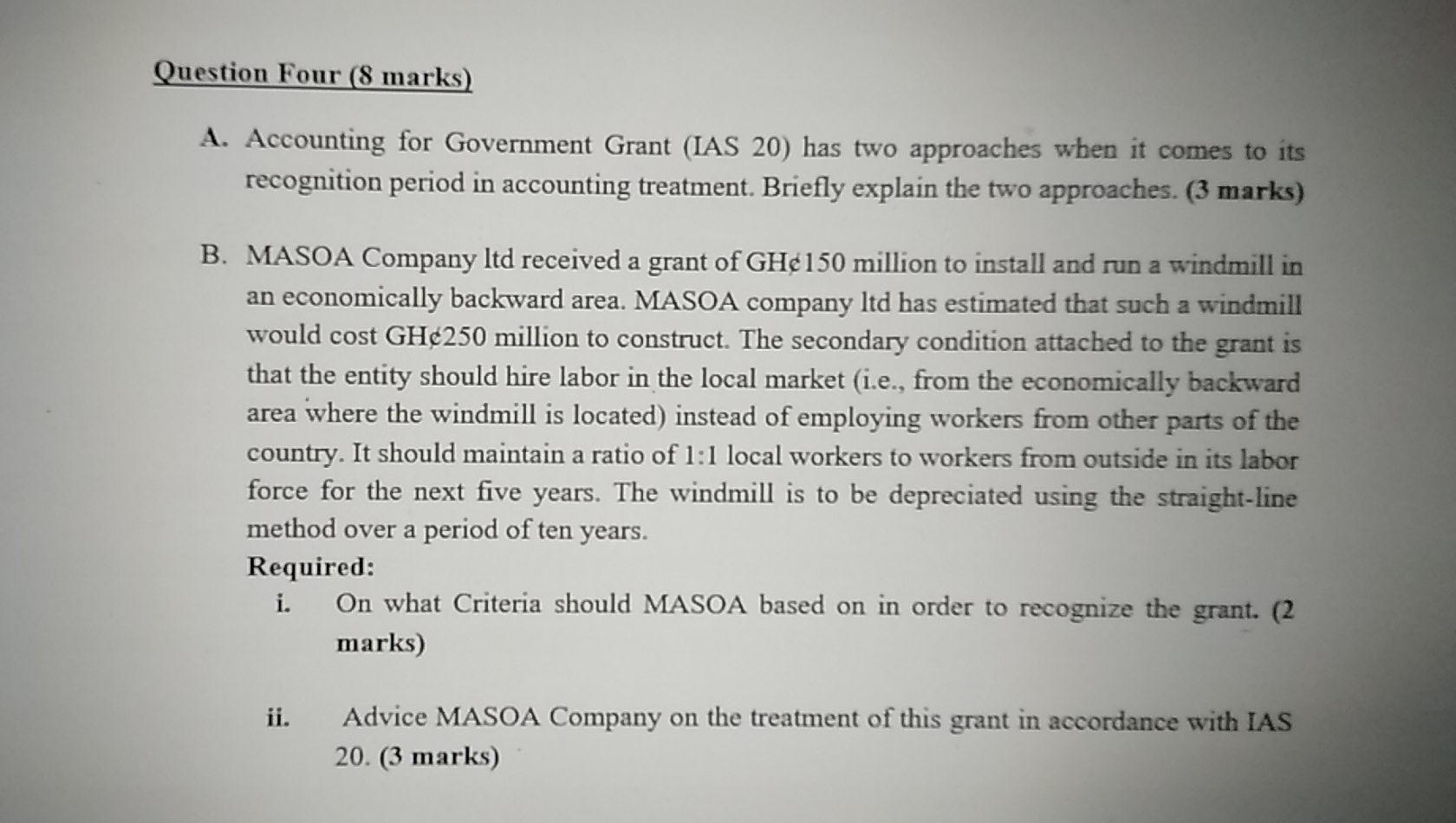

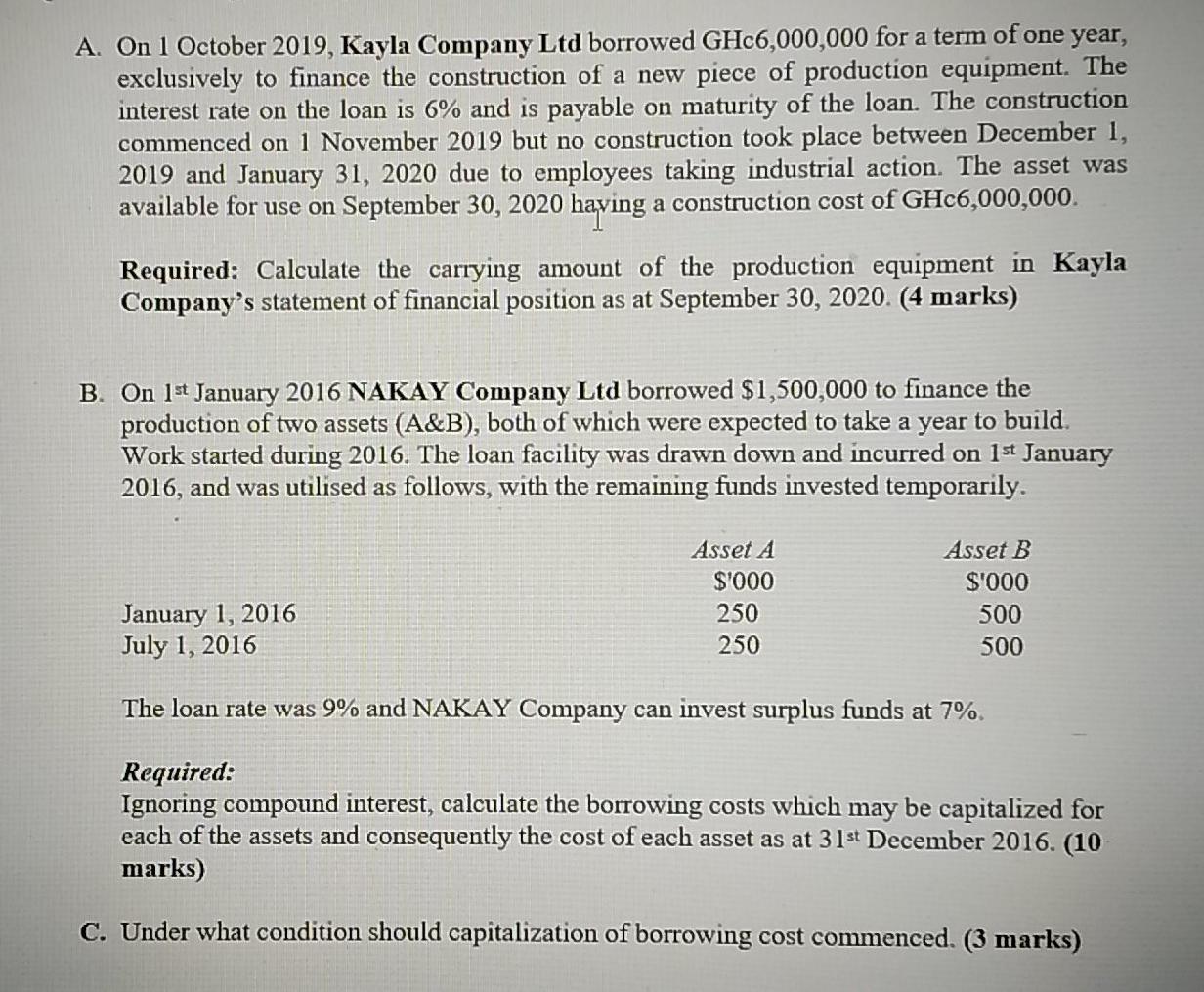

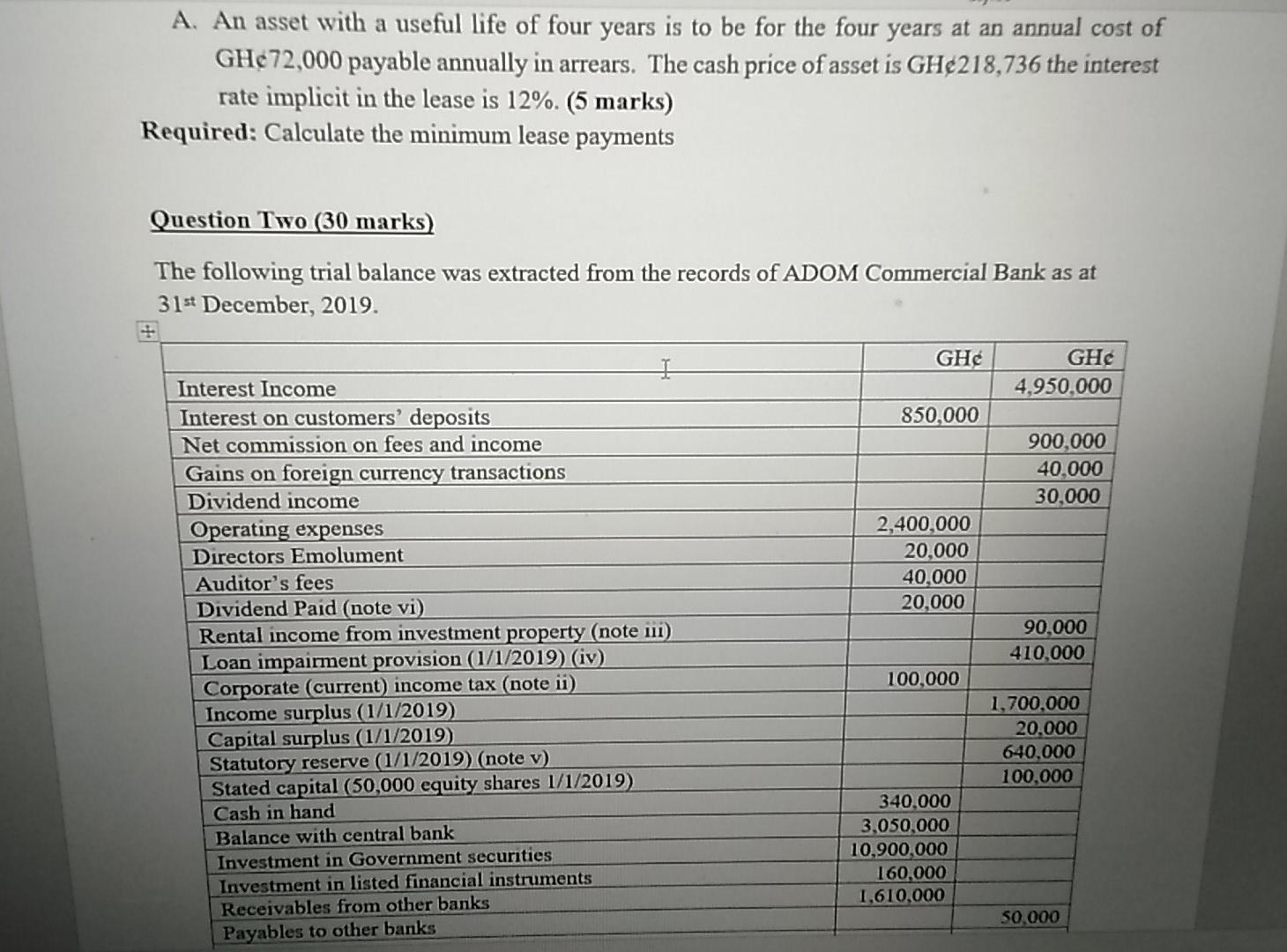

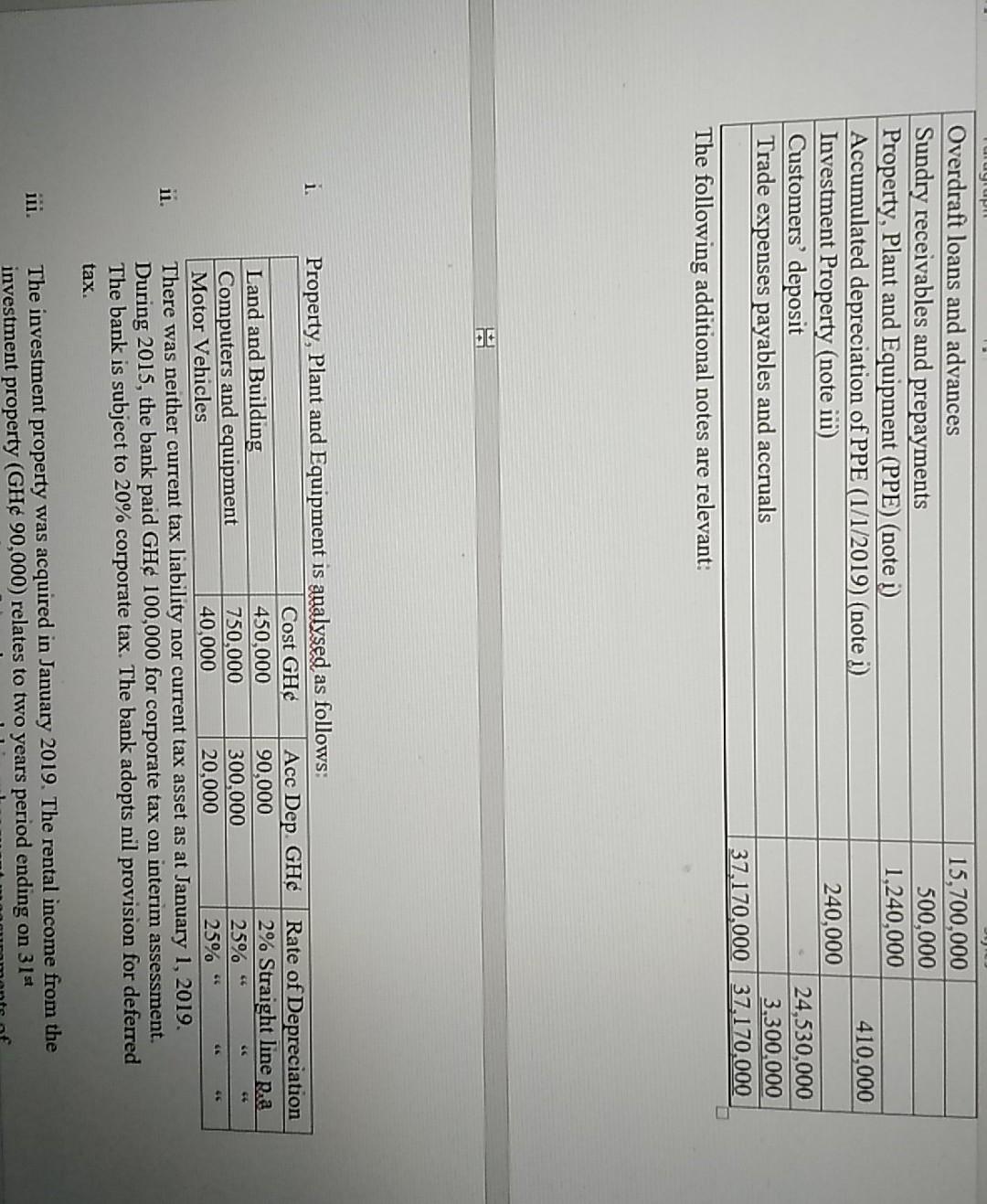

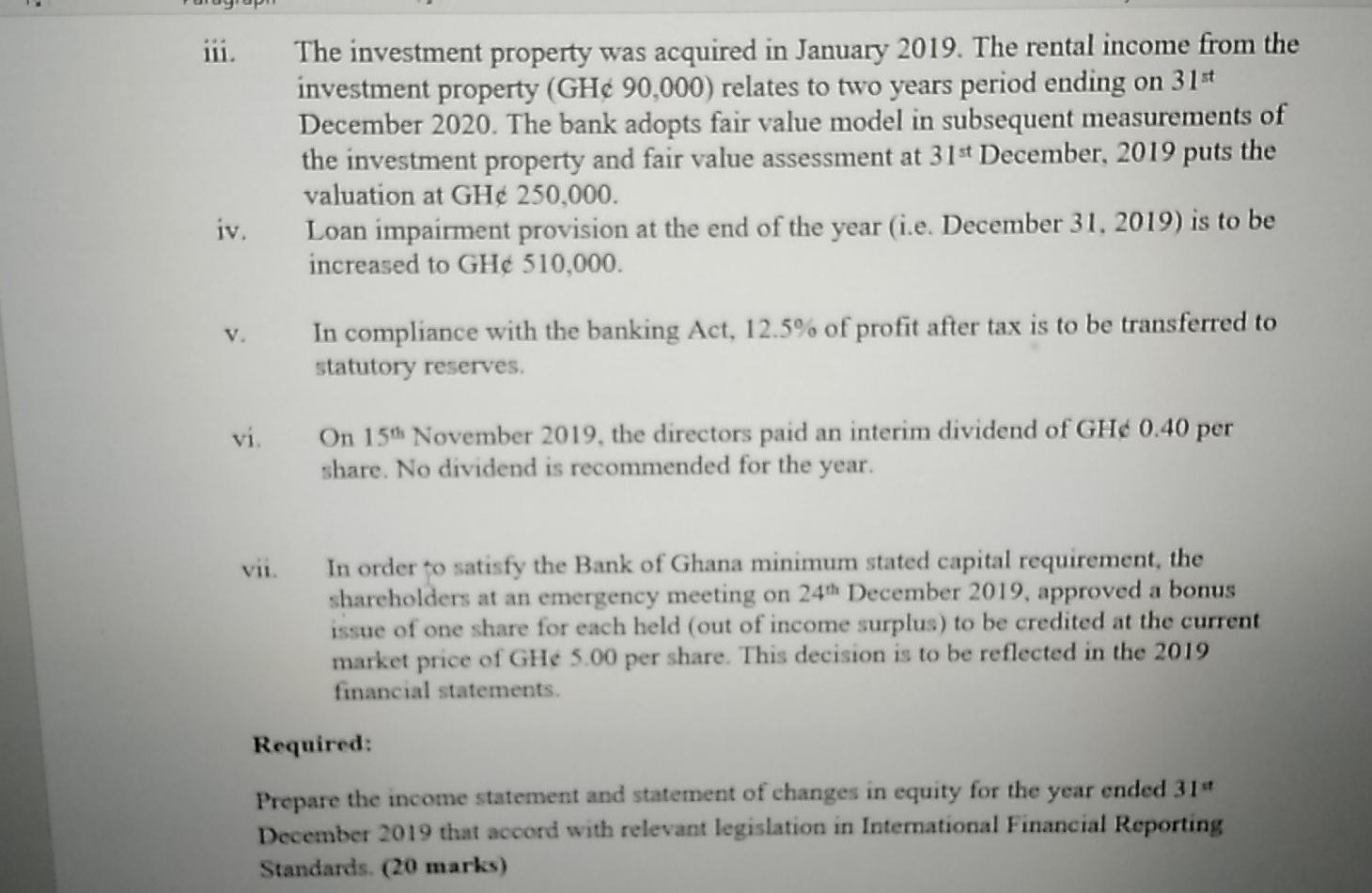

Question Five (7 marks) A. XYZ, Inc. is negotiating with the local government to build a new bridge after demolishing the existing bridge in downtown near the city center. At the initial meeting, it was indicated that the government would not be willing to pay for both components of the contract an amount exceeding GH100,000. The government representatives insisted that separate proposals would need to be submitted and negotiated and that the contractor should maintain separate records for each component of the contract and upon request furnish details of the contract costs incurred to date by component. After submission of the separate proposals, it was agreed that the split of the contract price of GH100,000 would be in the ratio of 70% for construction of the new bridge and 30% for demolishing the existing bridge. Required: Evaluate in light of the provisions of IAS 11(Construction Contract), whether the contract for the construction of the new bridge and the contract for demolishing the existing bridge should be segmented and treated as separate contracts or be combined and treated as a single contract. (3 marks) B. Universal Builders Inc. is well known for its expertise in building flyovers and maintaining these structures. Impressed with Universal's track record, the local municipal authorities have invited them to submit a tender for a two-year contract to build a super flyover in the heart of the city (the largest in the region) and another tender for maintenance of the flyover for ten years after completion of the construction. Required: Evaluate whether these two contracts should be segmented or combined into one contract for the purposes of IAS 11. (4 marks) Question Four (8 marks) A. Accounting for Government Grant (IAS 20) has two approaches when it comes to its recognition period in accounting treatment. Briefly explain the two approaches. (3 marks) B. MASOA Company ltd received a grant of GH 150 million to install and run a windmill in an economically backward area. MASOA company ltd has estimated that such a windmill would cost GH250 million to construct. The secondary condition attached to the grant is that the entity should hire labor in the local market (i.e., from the economically backward area where the windmill is located) instead of employing workers from other parts of the country. It should maintain a ratio of 1:1 local workers to workers from outside in its labor force for the next five years. The windmill is to be depreciated using the straight-line method over a period of ten years. Required: i. On what Criteria should MASOA based on in order to recognize the grant. (2 marks) Advice MASOA Company on the treatment of this grant in accordance with IAS 20. (3 marks) A. On 1 October 2019, Kayla Company Ltd borrowed GHC6,000,000 for a term of one year, exclusively to finance the construction of a new piece of production equipment. The interest rate on the loan is 6% and is payable on maturity of the loan. The construction commenced on 1 November 2019 but no construction took place between December 1, 2019 and January 31, 2020 due to employees taking industrial action. The asset was available for use on September 30, 2020 having a construction cost of GHc6,000,000. Required: Calculate the carrying amount of the production equipment in Kayla Company's statement of financial position as at September 30, 2020. (4 marks) B. On 1st January 2016 NAKAY Company Ltd borrowed $1,500,000 to finance the production of two assets (A&B), both of which were expected to take a year to build Work started during 2016. The loan facility was drawn down and in irred on 1st January 2016, and was utilised as follows, with the remaining funds invested temporarily. Asset A $'000 250 250 Asset B $'000 500 500 January 1, 2016 July 1, 2016 The loan rate was 9% and NAKAY Company can invest surplus funds at 7% Required: Ignoring compound interest, calculate the borrowing costs which may be capitalized for each of the assets and consequently the cost of each asset as at 31st December 2016. (10 marks) c. Under what condition should capitalization of borrowing cost commenced. (3 marks) A. An asset with a useful life of four years is to be for the four years at an annual cost of GH72,000 payable annually in arrears. The cash price of asset is GH218,736 the interest rate implicit in the lease is 12%. (5 marks) Required: Calculate the minimum lease payments Question Two (30 marks) The following trial balance was extracted from the records of ADOM Commercial Bank as at 31st December, 2019. GH GHC 4,950.000 850,000 900,000 40.000 30,000 2,400,000 20,000 40,000 20,000 Interest Income Interest on customers' deposits Net commission on fees and income Gains on foreign currency transactions Dividend income Operating expenses Directors Emolument Auditor's fees Dividend Paid (note vi Rental income from investment property (note ill) Loan impairment provision (1/1/2019) (iv) Corporate (current) income tax (note ii) Income surplus (1/1/2019) Capital surplus (1/1/2019) Statutory reserve (1/1/2019 (note v) Stated capital (50,000 equity shares 1/1/2019) Cash in hand Balance with central bank Investment in Government securities Investment in listed financial instruments Receivables from other banks Payables to other banks 90.000 410,000 100,000 1,700,000 20.000 640,000 100,000 340.000 3,050,000 10,900,000 160,000 1,610,000 50.000 yap Overdraft loans and advances Sundry receivables and prepayments Property, Plant and Equipment (PPE) (note :) Accumulated depreciation of PPE (1/1/2019) (note i) Investment Property (note iii) Customers' deposit Trade expenses payables and accruals 15,700,000 500,000 1,240,000 410,000 240,000 24,530,000 3.300.000 37,170.000 37,170.000 The following additional notes are relevant: i 66 66 66 Property, Plant and Equipment is analysed as follows: Cost GHC Acc Dep. GH Rate of Depreciation Land and Building 450,000 90,000 2% Straight line pa Computers and equipment 750,000 300,000 25% Motor Vehicles 40,000 20,000 25% There was neither current tax liability nor current tax asset as at January 1, 2019. During 2015, the bank paid GH 100,000 for corporate tax on interim assessment. The bank is subject to 20% corporate tax. The bank adopts nil provision for deferred tax. 11 111. The investment property was acquired in January 2019. The rental income from the investment property (GH 90,000) relates to two years period ending on 31st The investment property was acquired in January 2019. The rental income from the investment property (GH 90,000) relates to two years period ending on 31st December 2020. The bank adopts fair value model in subsequent measurements of the investment property and fair value assessment at 31 December, 2019 puts the valuation at GH 250,000. Loan impairment provision at the end of the year (i.e. December 31, 2019) is to be increased to GH 510,000. iv. V. In compliance with the banking Act, 12.5% of profit after tax is to be transferred to statutory reserves vi On 15 November 2019, the directors paid an interim dividend of GH 0.40 per share. No dividend is recommended for the year. In order to satisfy the Bank of Ghana minimum stated capital requirement, the shareholders at an emergency meeting on 24th December 2019, approved a bonus issue of one share for each held (out of income surplus) to be credited at the current market price of GHe 5.00 per share. This decision is to be reflected in the 2019 financial statements Required: Prepare the income statement and statement of changes in equity for the year ended 31* December 2019 that accord with relevant legislation in International Financial Reporting Standards. (20 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started