Answered step by step

Verified Expert Solution

Question

1 Approved Answer

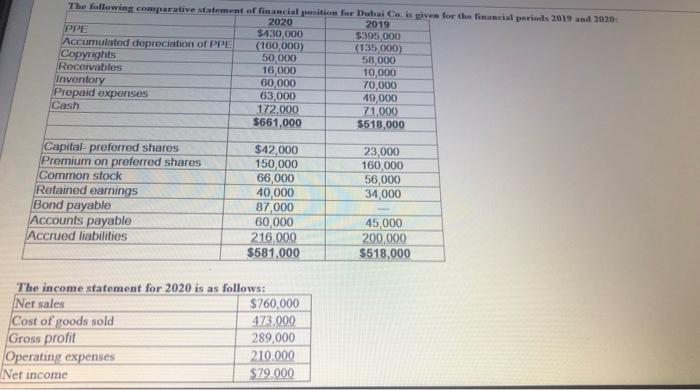

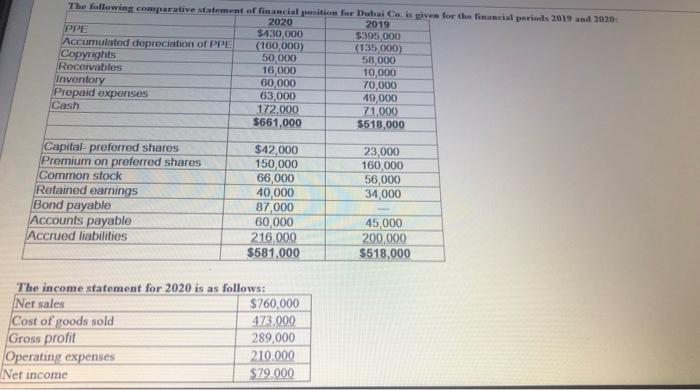

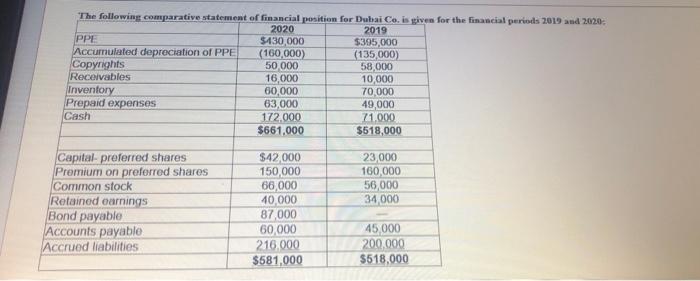

intermediate please fast The following comparative statement of financial position for Dubai Co. is given for the financial periods 2019 and 2020 2020 2019 PPE

intermediate please fast

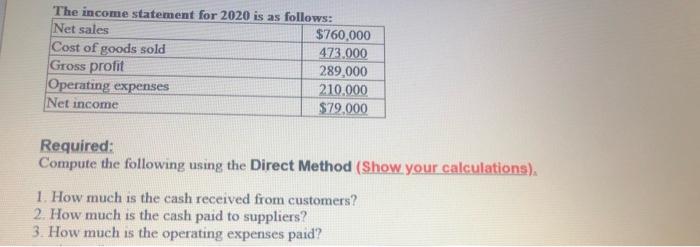

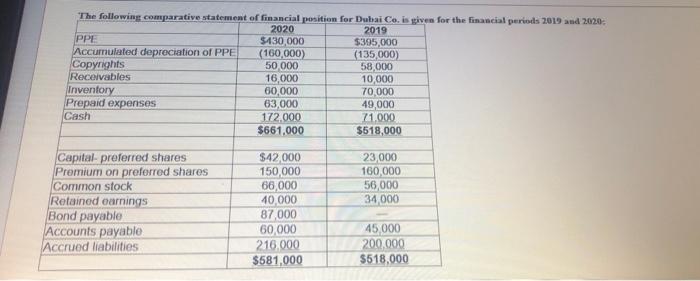

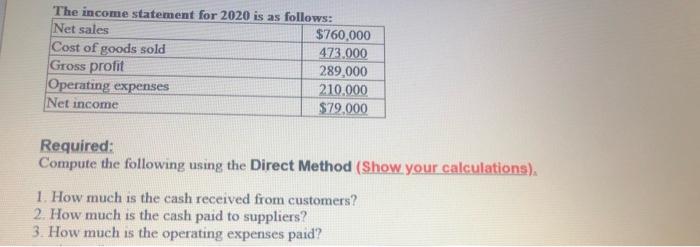

The following comparative statement of financial position for Dubai Co. is given for the financial periods 2019 and 2020 2020 2019 PPE $430,000 $395,000 Accumulated depreciation of PPE (100,000) (135,000) Copyrights 50 000 58 000 Receivables 16,000 10,000 Inventory 60,000 70,000 Prepaid expenses 63,000 19,000 Cash 172.000 71,000 $661,000 $518,000 Capital preferred shares Premium on preferred shares Common stock Retained earnings Bond payable Accounts payable Accrued liabilities $42,000 150,000 66,000 40,000 87,000 60,000 216,000 $681,000 23,000 160,000 56,000 34,000 45,000 200,000 $518,000 The income statement for 2020 is as follows: Net sales $760,000 Cost of goods sold 473.000 Gross profit 289.000 Operating expenses 210.000 Net income $79.000 The income statement for 2020 is as follows: Net sales $760,000 Cost of goods sold 473.000 Gross profit 289,000 Operating expenses 210.000 Net income $79.000 Required: Compute the following using the Direct Method (Show your calculations), 1. How much is the cash received from customers? 2. How much is the cash paid to suppliers? 3. How much is the operating expenses paid? The following comparative statement of financial position for Dubai Co. is given for the financial periods 2019 and 2020 2020 2019 PPE $130,000 $395,000 Accumulated depreciation of PPE (160,000) (135,000) Copyrights 50 000 58,000 Receivables 16,000 10,000 Inventory 60,000 70,000 Prepaid expenses 63,000 49,000 Cash 172.000 71.000 $661.000 $518,000 Capital preferred shares Premium on preferred shares Common stock Retained earnings Bond payable Accounts payable Accrued liabilities 23,000 160,000 56,000 34000 $42.000 150,000 66,000 40.000 87 000 60.000 216.000 $681,000 45,000 200,000 $518,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started