Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Intermediate Research Assignment #3 Roger and Nicole Beasley divorced in 2017. Under the divorce decree, Roger is required to pay alimony of $3,000 per month

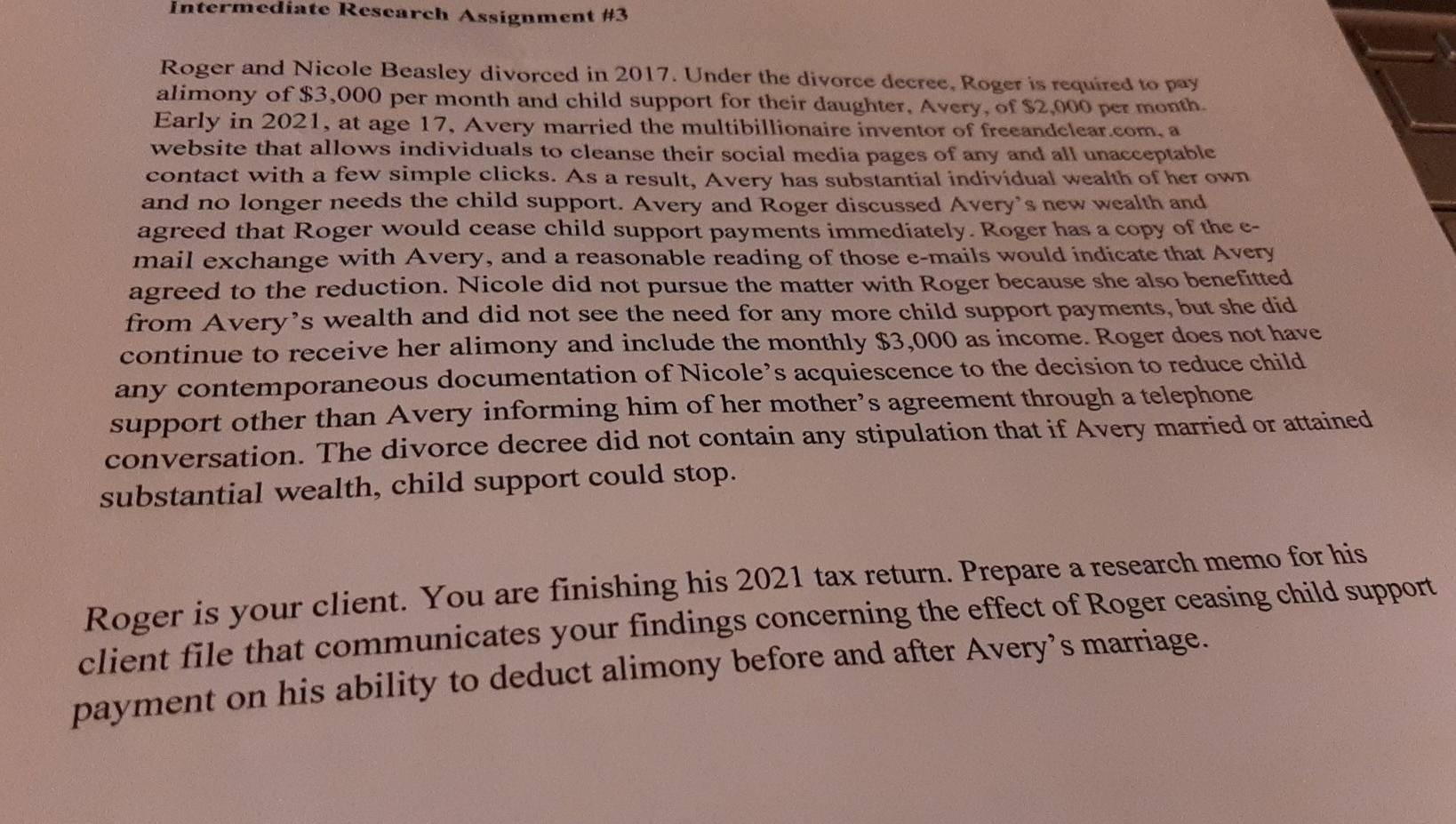

Intermediate Research Assignment #3 Roger and Nicole Beasley divorced in 2017. Under the divorce decree, Roger is required to pay alimony of $3,000 per month and child support for their daughter, Avery, of $2,000 per month Early in 2021, at age 17, Avery married the multibillionaire inventor of freeandclear.com, a website that allows individuals to cleanse their social media pages of any and all unacceptable contact with a few simple clicks. As a result, Avery has substantial individual wealth of her own and no longer needs the child support. Avery and Roger discussed Avery's new wealth and agreed that Roger would cease child support payments immediately. Roger has a copy of the e- mail exchange with Avery, and a reasonable reading of those e-mails would indicate that Avery agreed to the reduction. Nicole did not pursue the matter with Roger because she also benefitted from Avery's wealth and did not see the need for any more child support payments, but she did continue to receive her alimony and include the monthly $3,000 as income. Roger does not have any contemporaneous documentation of Nicole's acquiescence to the decision to reduce child support other than Avery informing him of her mother's agreement through a telephone conversation. The divorce decree did not contain any stipulation that if Avery married or attained substantial wealth, child support could stop. Roger is your client. You are finishing his 2021 tax return. Prepare a research memo for his client file that communicates your findings concerning the effect of Roger ceasing child support payment on his ability to deduct alimony before and after Avery's marriage. Intermediate Research Assignment #3 Roger and Nicole Beasley divorced in 2017. Under the divorce decree, Roger is required to pay alimony of $3,000 per month and child support for their daughter, Avery, of $2,000 per month Early in 2021, at age 17, Avery married the multibillionaire inventor of freeandclear.com, a website that allows individuals to cleanse their social media pages of any and all unacceptable contact with a few simple clicks. As a result, Avery has substantial individual wealth of her own and no longer needs the child support. Avery and Roger discussed Avery's new wealth and agreed that Roger would cease child support payments immediately. Roger has a copy of the e- mail exchange with Avery, and a reasonable reading of those e-mails would indicate that Avery agreed to the reduction. Nicole did not pursue the matter with Roger because she also benefitted from Avery's wealth and did not see the need for any more child support payments, but she did continue to receive her alimony and include the monthly $3,000 as income. Roger does not have any contemporaneous documentation of Nicole's acquiescence to the decision to reduce child support other than Avery informing him of her mother's agreement through a telephone conversation. The divorce decree did not contain any stipulation that if Avery married or attained substantial wealth, child support could stop. Roger is your client. You are finishing his 2021 tax return. Prepare a research memo for his client file that communicates your findings concerning the effect of Roger ceasing child support payment on his ability to deduct alimony before and after Avery's marriage

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started