Intermidiate Accounting II

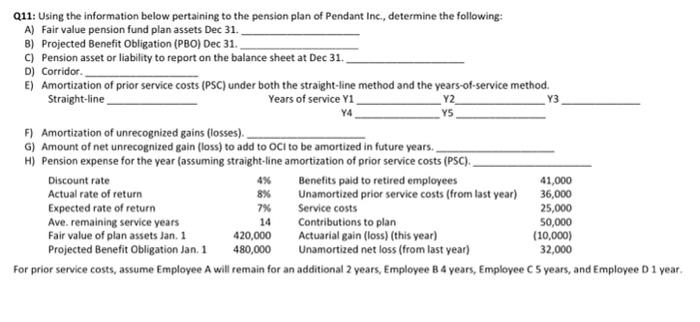

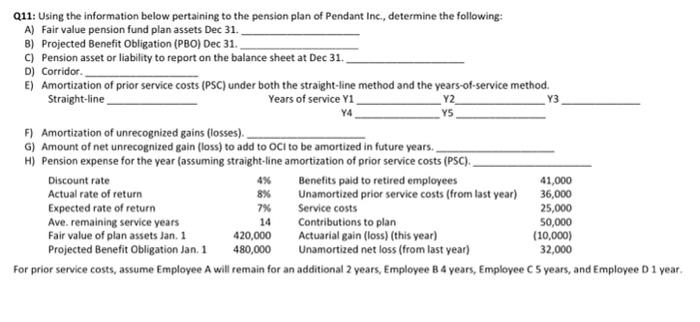

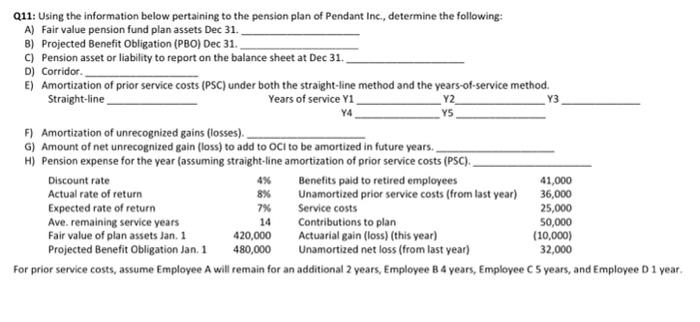

Y2 Y5 Q11: Using the information below pertaining to the pension plan of Pendant Inc., determine the following: A) Fair value pension fund plan assets Dec 31. B) Projected Benefit Obligation (PBO) Dec 31. C) Pension asset or liability to report on the balance sheet at Dec 31. D) Corridor. E) Amortization of prior service costs (PSC) under both the straight-line method and the years-of-service method. Straight-line Years of service Y1 Y3 Y4 F) Amortization of unrecognized gains (losses). G) Amount of net unrecognized gain (loss) to add to Oci to be amortized in future years. H) Pension expense for the year (assuming straight-line amortization of prior service costs (PSC). Discount rate 4% Benefits paid to retired employees 41,000 Actual rate of return 8% Unamortized prior service costs (from last year) 36,000 Expected rate of return 7% Service costs 25,000 Ave, remaining service years 14 Contributions to plan 50,000 Fair value of plan assets Jan. 1 420,000 Actuarial gain (loss) (this year) (10,000) Projected Benefit Obligation Jan. 1 480,000 Unamortized net loss (from last year) 32,000 For prior service costs, assume Employee A will remain for an additional 2 years, Employee B 4 years, Employee C 5 years, and Employee D 1 year Y2 Y5 Q11: Using the information below pertaining to the pension plan of Pendant Inc., determine the following: A) Fair value pension fund plan assets Dec 31. B) Projected Benefit Obligation (PBO) Dec 31. C) Pension asset or liability to report on the balance sheet at Dec 31. D) Corridor. E) Amortization of prior service costs (PSC) under both the straight-line method and the years-of-service method. Straight-line Years of service Y1 Y3 Y4 F) Amortization of unrecognized gains (losses). G) Amount of net unrecognized gain (loss) to add to Oci to be amortized in future years. H) Pension expense for the year (assuming straight-line amortization of prior service costs (PSC). Discount rate 4% Benefits paid to retired employees 41,000 Actual rate of return 8% Unamortized prior service costs (from last year) 36,000 Expected rate of return 7% Service costs 25,000 Ave, remaining service years 14 Contributions to plan 50,000 Fair value of plan assets Jan. 1 420,000 Actuarial gain (loss) (this year) (10,000) Projected Benefit Obligation Jan. 1 480,000 Unamortized net loss (from last year) 32,000 For prior service costs, assume Employee A will remain for an additional 2 years, Employee B 4 years, Employee C 5 years, and Employee D 1 year