Answered step by step

Verified Expert Solution

Question

1 Approved Answer

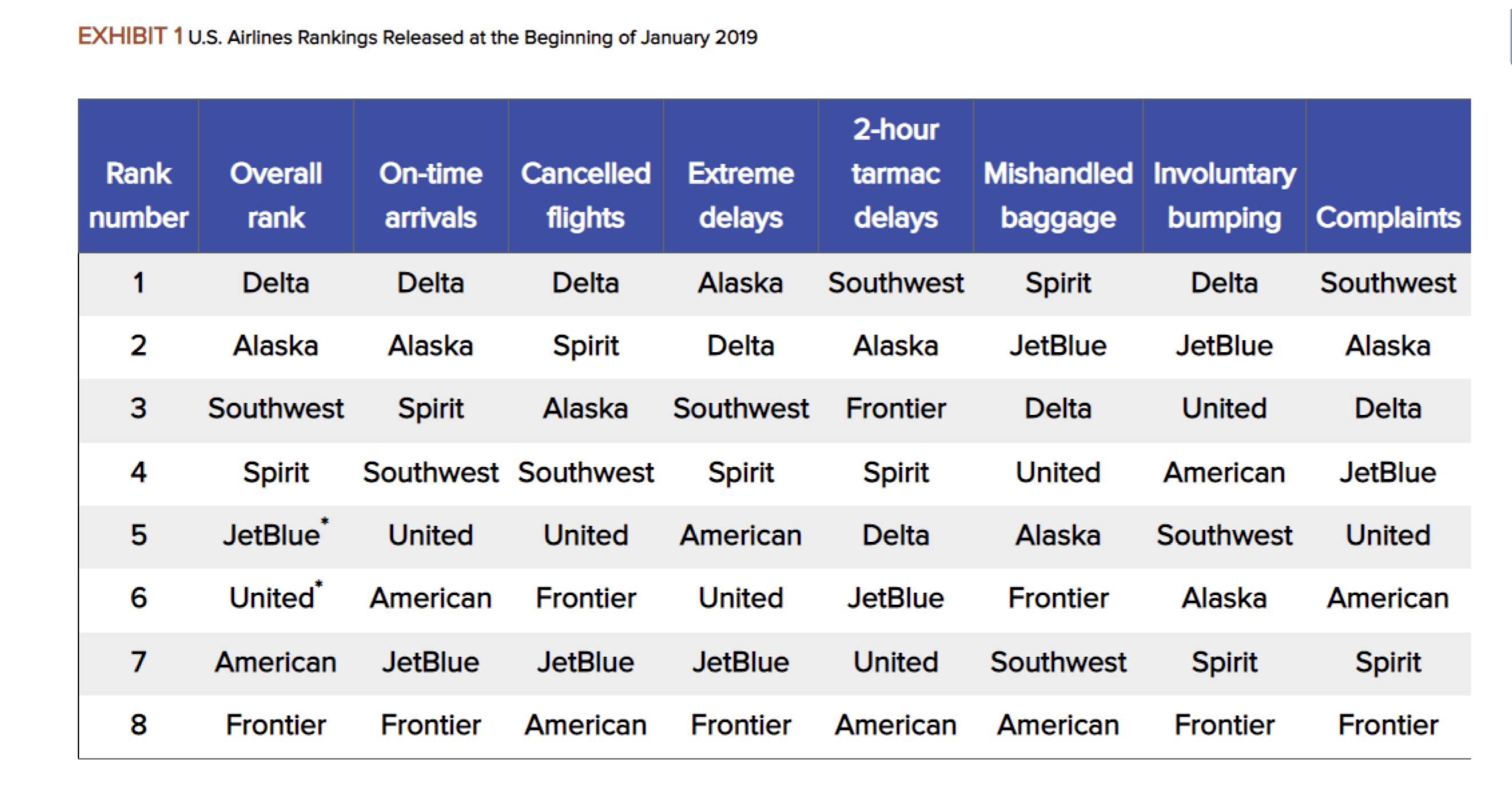

Internal and External Analysis for South West Airlines EXHIBIT 1 U.S. Airlines Rankings Released at the Beginning of January 2019 Emergence, Growth, and Transition 4

Internal and External Analysis for South West Airlines

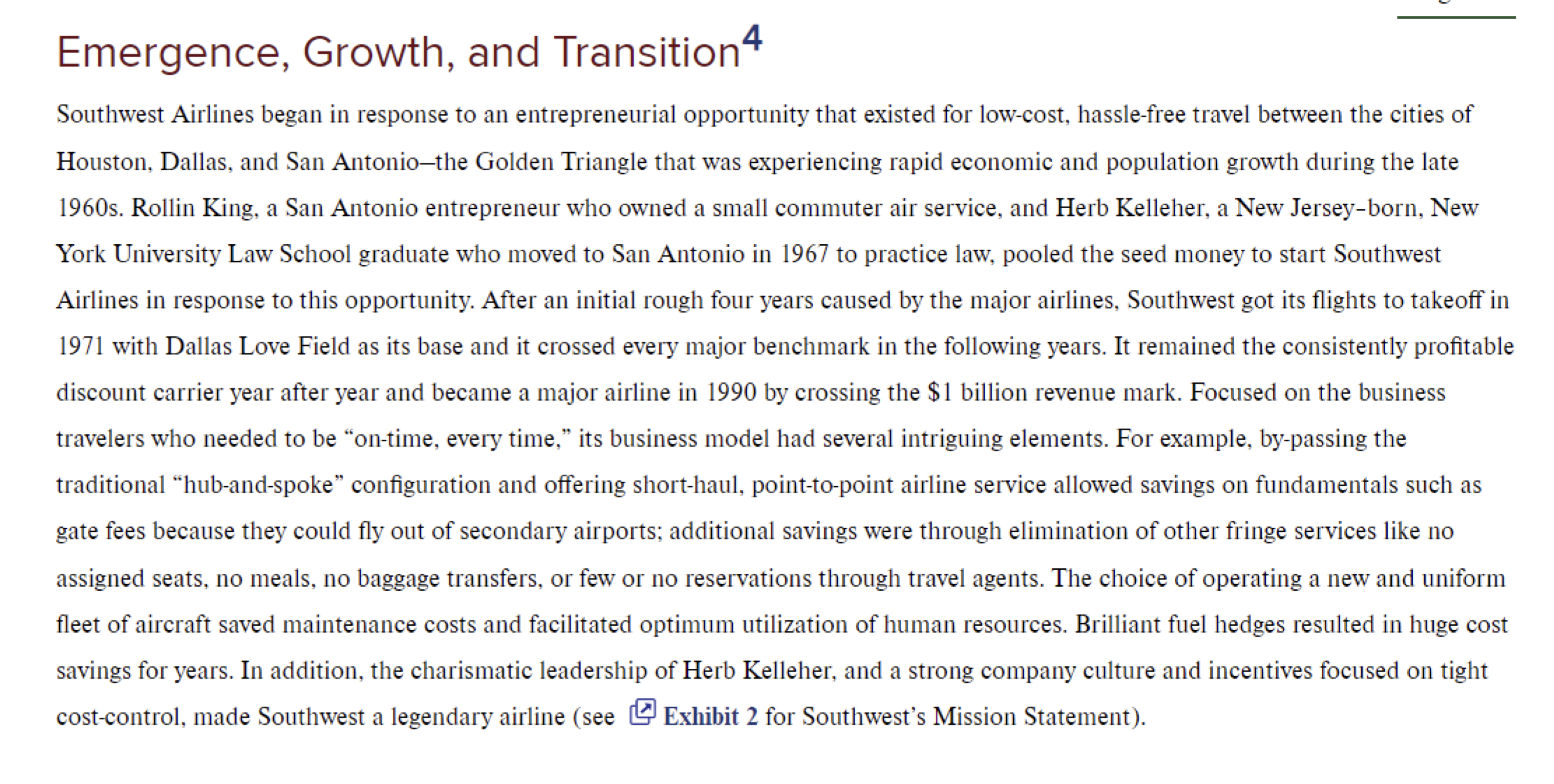

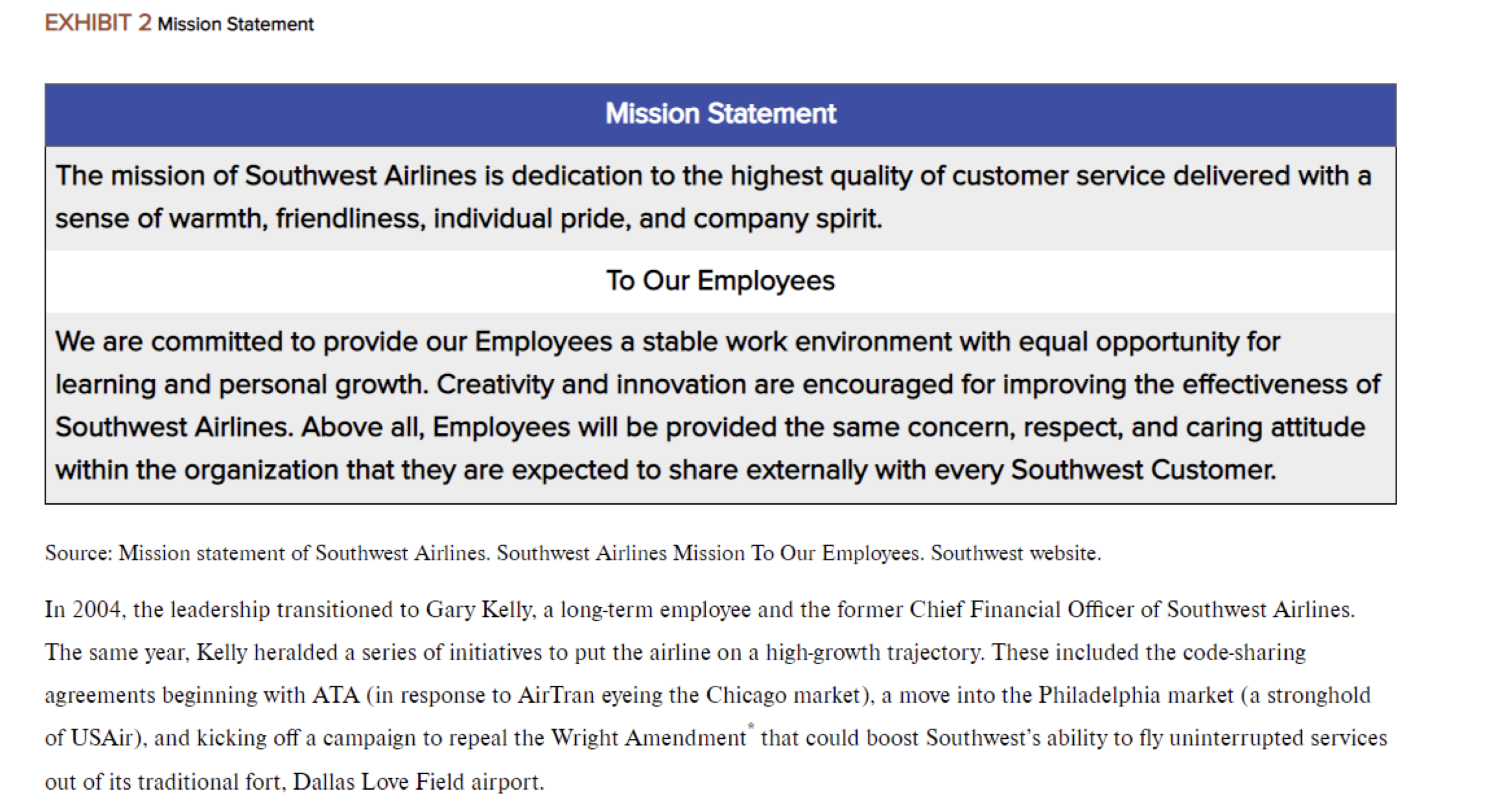

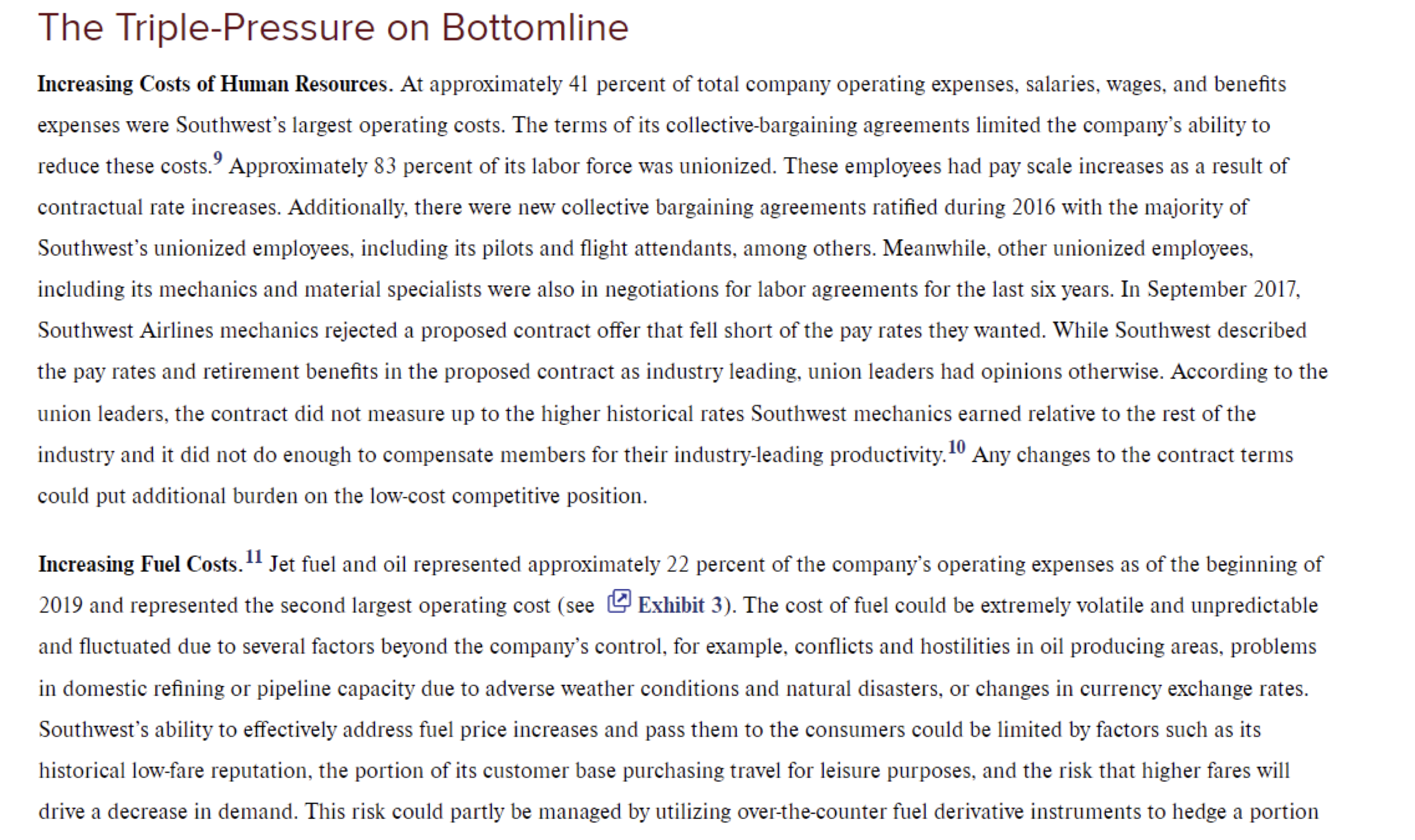

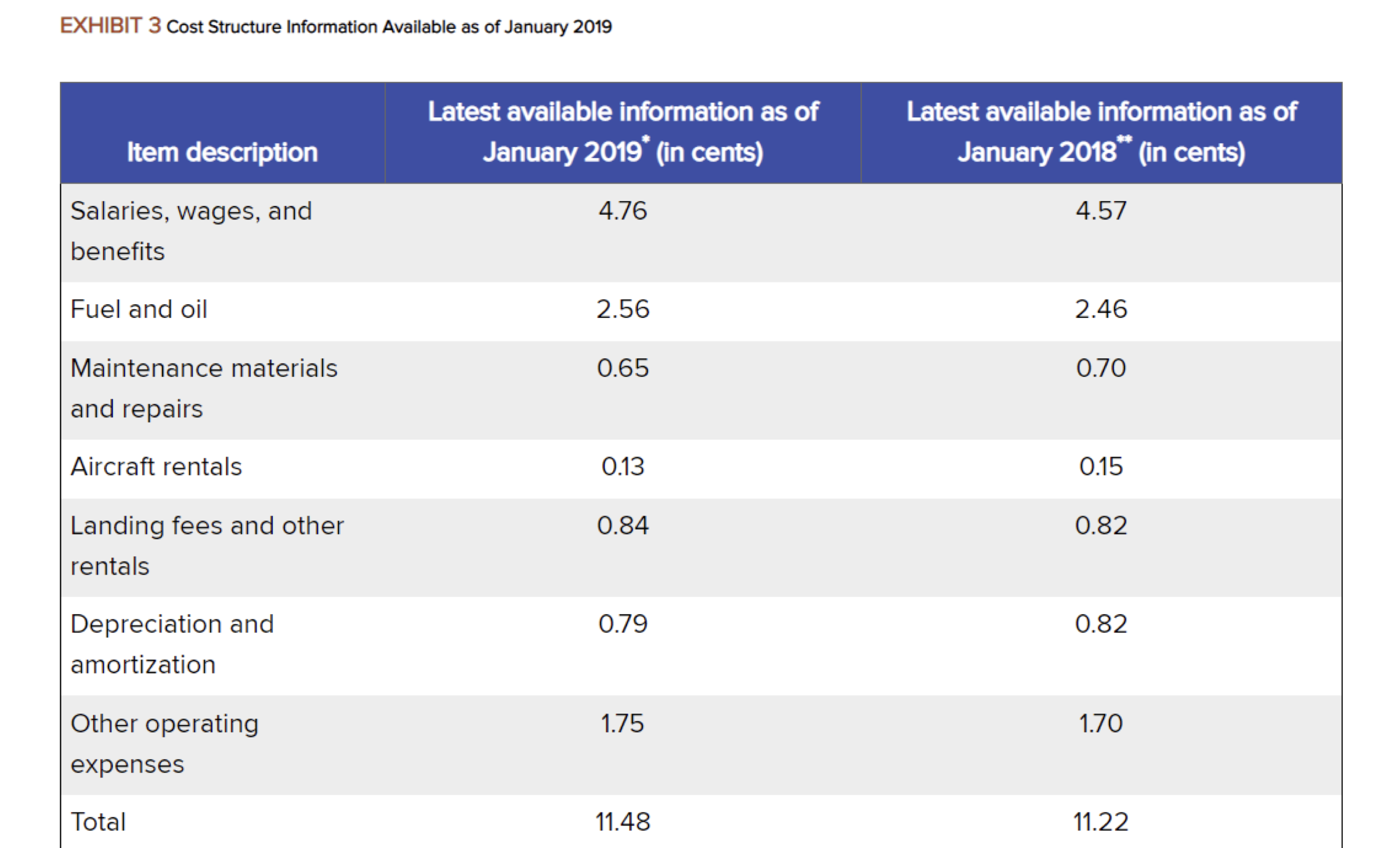

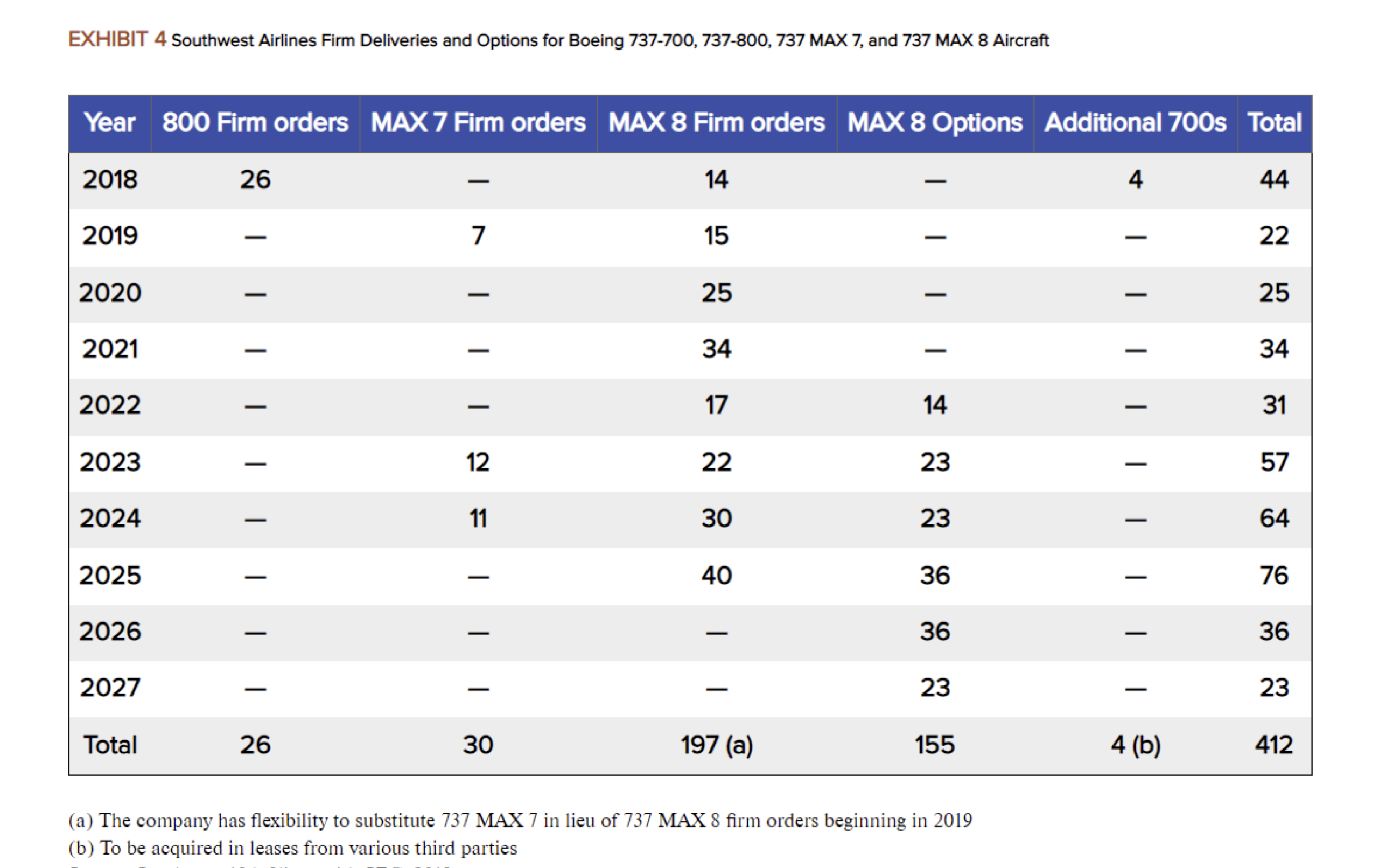

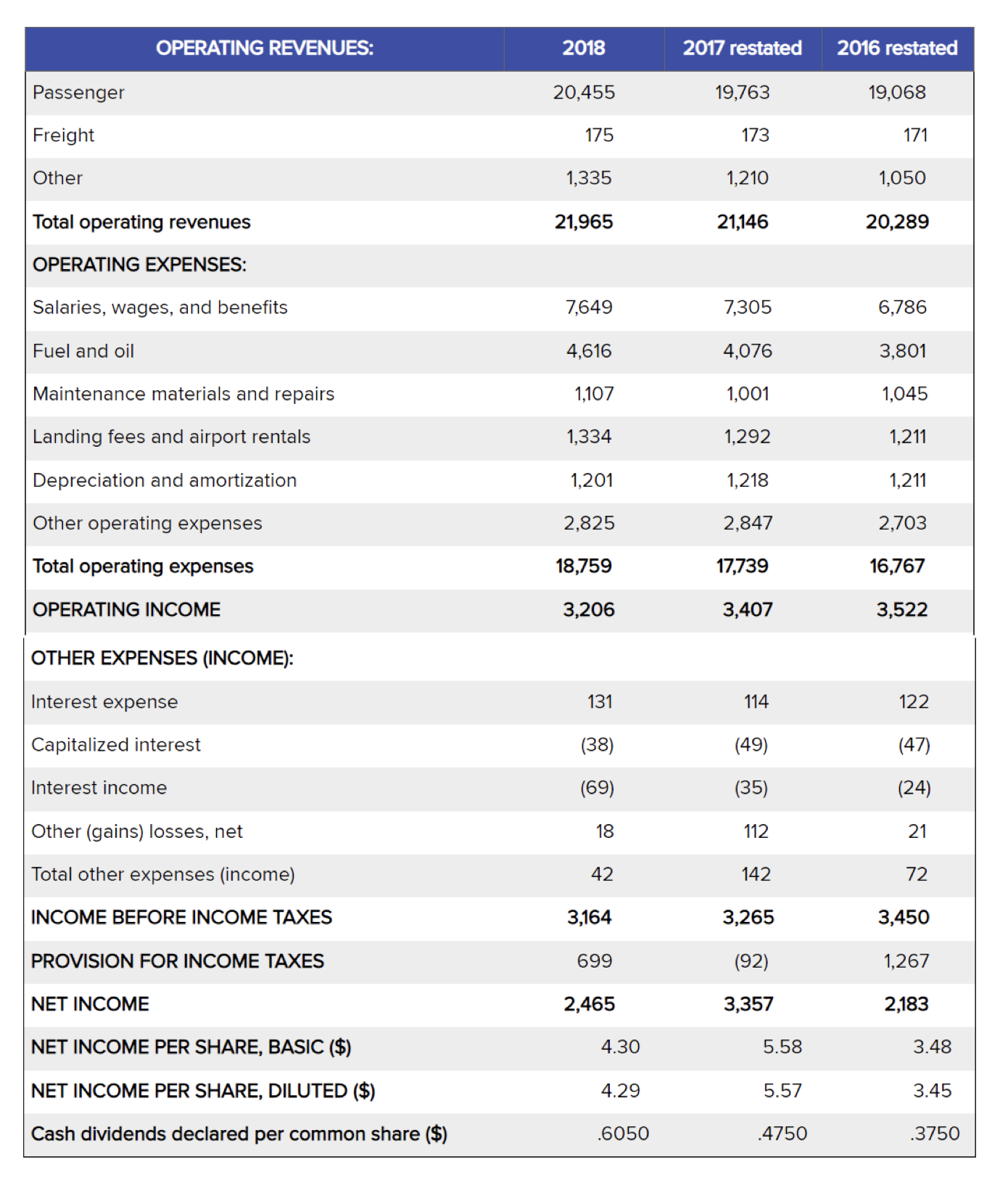

EXHIBIT 1 U.S. Airlines Rankings Released at the Beginning of January 2019 Emergence, Growth, and Transition 4 Southwest Airlines began in response to an entrepreneurial opportunity that existed for low-cost, hassle-free travel between the cities of Houston, Dallas, and San Antonio-the Golden Triangle that was experiencing rapid economic and population growth during the late 1960s. Rollin King, a San Antonio entrepreneur who owned a small commuter air service, and Herb Kelleher, a New Jersey-born, New York University Law School graduate who moved to San Antonio in 1967 to practice law, pooled the seed money to start Southwest Airlines in response to this opportunity. After an initial rough four years caused by the major airlines, Southwest got its flights to takeoff in 1971 with Dallas Love Field as its base and it crossed every major benchmark in the following years. It remained the consistently profitable discount carrier year after year and became a major airline in 1990 by crossing the $1 billion revenue mark. Focused on the business travelers who needed to be "on-time, every time," its business model had several intriguing elements. For example, by-passing the traditional "hub-and-spoke" configuration and offering short-haul, point-to-point airline service allowed savings on fundamentals such as gate fees because they could fly out of secondary airports; additional savings were through elimination of other fringe services like no assigned seats, no meals, no baggage transfers, or few or no reservations through travel agents. The choice of operating a new and uniform fleet of aircraft saved maintenance costs and facilitated optimum utilization of human resources. Brilliant fuel hedges resulted in huge cost savings for years. In addition, the charismatic leadership of Herb Kelleher, and a strong company culture and incentives focused on tight cost-control, made Southwest a legendary airline (see [ Exhibit 2 for Southwest's Mission Statement). EXHIBIT 2 Mission Statement The Iriple-Pressure on Bottomline Increasing Costs of Human Resources. At approximately 41 percent of total company operating expenses, salaries, wages, and benefits expenses were Southwest's largest operating costs. The terms of its collective-bargaining agreements limited the company's ability to reduce these costs. 9 Approximately 83 percent of its labor force was unionized. These employees had pay scale increases as a result of contractual rate increases. Additionally, there were new collective bargaining agreements ratified during 2016 with the majority of Southwest's unionized employees, including its pilots and flight attendants, among others. Meanwhile, other unionized employees, including its mechanics and material specialists were also in negotiations for labor agreements for the last six years. In September 2017 , Southwest Airlines mechanics rejected a proposed contract offer that fell short of the pay rates they wanted. While Southwest described the pay rates and retirement benefits in the proposed contract as industry leading, union leaders had opinions otherwise. According to the union leaders, the contract did not measure up to the higher historical rates Southwest mechanics earned relative to the rest of the industry and it did not do enough to compensate members for their industry-leading productivity. 10 Any changes to the contract terms could put additional burden on the low-cost competitive position. Increasing Fuel Costs. 11 Jet fuel and oil represented approximately 22 percent of the company's operating expenses as of the beginning of 2019 and represented the second largest operating cost (see Exhibit 3). The cost of fuel could be extremely volatile and unpredictable and fluctuated due to several factors beyond the company's control, for example, conflicts and hostilities in oil producing areas, problems in domestic refining or pipeline capacity due to adverse weather conditions and natural disasters, or changes in currency exchange rates. Southwest's ability to effectively address fuel price increases and pass them to the consumers could be limited by factors such as its historical low-fare reputation, the portion of its customer base purchasing travel for leisure purposes, and the risk that higher fares will drive a decrease in demand. This risk could partly be managed by utilizing over-the-counter fuel derivative instruments to hedge a portion EXHIBIT 3 Cost Structure Information Available as of January 2019 EXHIBIT 4 Southwest Airlines Firm Deliveries and Options for Boeing 737-700, 737-800, 737 MAX 7, and 737 MAX 8 Aircraft (a) The company has flexibility to substitute 737 MAX 7 in lieu of 737 MAX 8 firm orders beginning in 2019 (b) To be acquired in leases from various third parties The ULCCs represented a completely different approach to the traditional air travel model. While similar to the disruptive innovation like Southwest Airlines in its initial stages-when converting non-users to users of air travel-the ULCCs are yet significantly different in several ways. Allegiant Airlines perfected this model offering low-fare, high-value vacation packages from secondary airports to points in Florida and to Las Vegas. The revenue stream for a ULCC was not based on air tickets, the core revenue for low-cost airlines like Southwest, but on purchase of ancillary products such as hotel and tour packages. The model evolved to be even less dependent on vacation/leisure travel. A ULCC aimed to stimulate travel decisions by offering very low fares and providing a nonstop routing where there was none, even if only for a few times a week. By offering a high value-to-cost equation for the consumer, these airlines aimed to divert discretionary dollars into air travel. Unlike Southwest, the ULCCs were not in the business of connecting people and destinations. The stimulant of demand in Page C12 the ULCC model was fares and not the need to get to a destination. Typically, a ULCC entered markets that it thought had latent potential, offered several flights, and then monitored the results. If the expectations about traffic materialized, it offered more services at that airport. If expectations did not materialize or the traffic was less productive than at other points, the ULCC moved out quickly. With the exception of some operations by Frontier at Denver, these airlines did not have their own turf nor did they operate connecting hubs. In this model, airplanes were moved around the country when opportunities were spotted. ULCC flight schedules fitted their fleet availability and not necessarily in timings that were most preferred by customers. Alongside Allegiant, Frontier, Spirit, and Sun Country were the other prominent players in this genre. They represented about 7 percent of all U.S. airline departing seats by late 2018 and were expected to grow to over 12 percent by 2020 . Southwest in 2019 As of January 2019, Southwest Airlines offered services to over 100 destinations throughout the United States, Mexico, and the Caribbean. It operated more than 3,800 flights a day including more than 500 roundtrip markets. 13 Its international footprint expanded to over 14 destinations covered through 16 international gateway cities. The company remained profitable as of 2018 . It made significant technology investments and completed its single largest technology project in its history in the recent years to completely transition its reservation system to the Amadeus Alta Passenger Service System. The new reservation system was designed to improve flight scheduling and inventory management. It would enable operational enhancements to manage flight disruptions, such as those caused by extreme weather conditions. Additional international growth and other foundational and operational capabilities were expected to get a boost. 14 The company continued to invest in technology to optimize other aspects of its operations. The progressive modernization of its fleet was also expected to facilitate cost control. Nevertheless, the mid-seat rankings suggested Southwest faced stiff competition from both the traditional carriers and the Page C13 ULCCs. The company's stock was down by 20 percent in 2018. The concerns about its planes and people continued. Amidst increasing fuel cost concerns, the company was expected to slow its expansion plans and capacity. Is Southwest on the gliding path to history

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started