Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Internal and external corporate governance provisions and activities can take many forms, including a targeted share repurchase provision. Which of the following best describes this

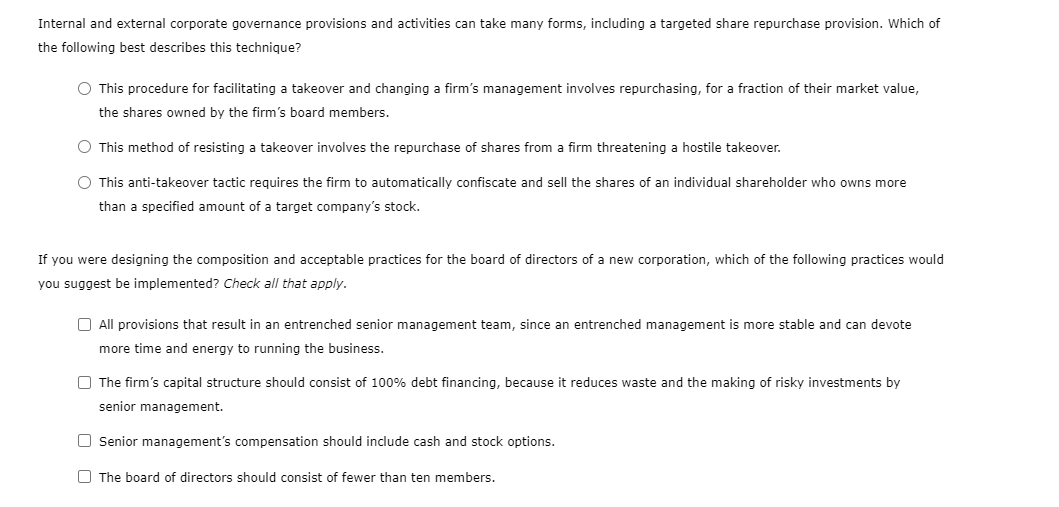

Internal and external corporate governance provisions and activities can take many forms, including a targeted share repurchase provision. Which of the following best describes this technique? This procedure for facilitating a takeover and changing a firm's management involves repurchasing, for a fraction of their market value, the shares owned by the firm's board members. This method of resisting a takeover involves the repurchase of shares from a firm threatening a hostile takeover. This anti-takeover tactic requires the firm to automatically confiscate and sell the shares of an individual shareholder who owns more than a specified amount of a target company's stock. If you were designing the composition and acceptable practices for the board of directors of a new corporation, which of the following practices would you suggest be implemented? Check al/ that apply. All provisions that result in an entrenched senior management team, since an entrenched management is more stable and can devote more time and energy to running the business. The firm's capital structure should consist of 100% debt financing, because it reduces waste and the making of risky investments by senior management. Senior management's compensation should include cash and stock options. The board of directors should consist of fewer than ten members

Internal and external corporate governance provisions and activities can take many forms, including a targeted share repurchase provision. Which of the following best describes this technique? This procedure for facilitating a takeover and changing a firm's management involves repurchasing, for a fraction of their market value, the shares owned by the firm's board members. This method of resisting a takeover involves the repurchase of shares from a firm threatening a hostile takeover. This anti-takeover tactic requires the firm to automatically confiscate and sell the shares of an individual shareholder who owns more than a specified amount of a target company's stock. If you were designing the composition and acceptable practices for the board of directors of a new corporation, which of the following practices would you suggest be implemented? Check al/ that apply. All provisions that result in an entrenched senior management team, since an entrenched management is more stable and can devote more time and energy to running the business. The firm's capital structure should consist of 100% debt financing, because it reduces waste and the making of risky investments by senior management. Senior management's compensation should include cash and stock options. The board of directors should consist of fewer than ten members Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started