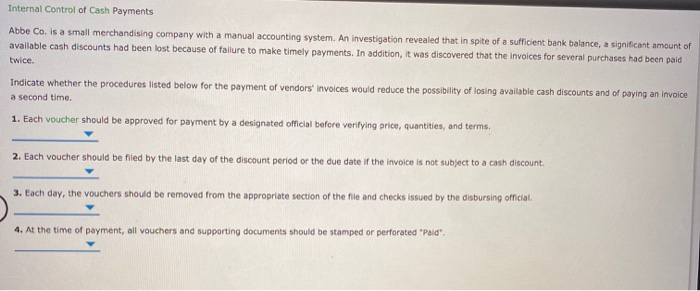

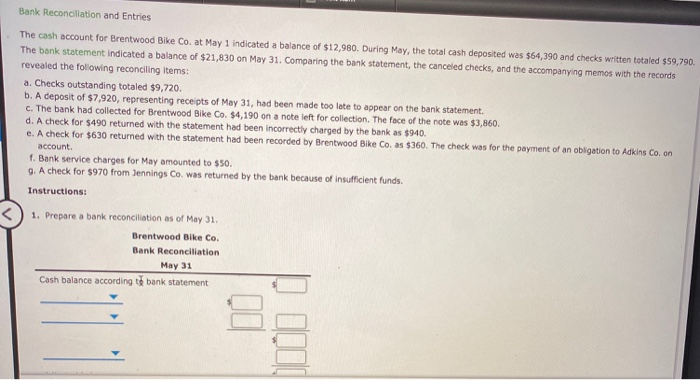

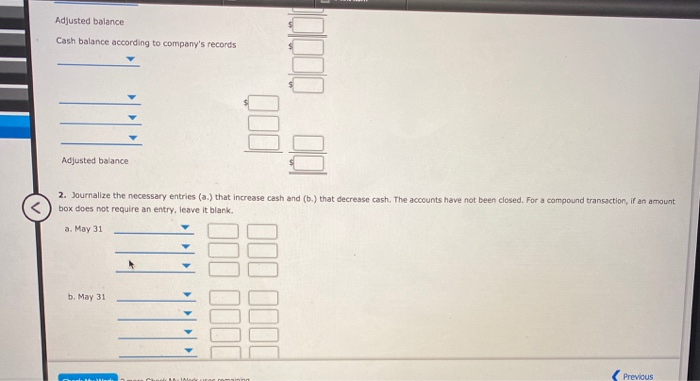

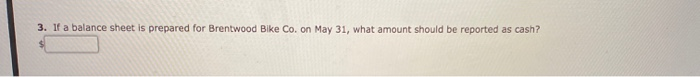

Internal Control of Cash Payments Abbe Co. is a small merchandising company with a manual accounting system. An investigation revealed that in spite of a sufficient bank balance, a significant amount of available cash discounts had been lost because of failure to make timely payments. In addition, it was discovered that the invoices for several purchases had been paid twice. Indicate whether the procedures listed below for the payment of vendors invoices would reduce the possibility of losing available cash discounts and of paying an invoice a second time. 1. Each voucher should be approved for payment by a designated official before verifying price, quantities, and terms, 2. Each voucher should be filed by the last day of the discount period or the due date if the invoice is not subject to a cash discount 3. Each day, the vouchers should be removed from the appropriate section of the file and checks issued by the disbursing official 4. At the time of payment, all vouchers and supporting documents should be stamped or perforated "Pald". Bank Reconciliation and Entries The cash account for Brentwood Bike Co. at May 1 indicated a balance of $12,980. During May, the total cash deposited was $64,390 and checks written totaled $59,790. The bank statement indicated a balance of $21,830 on May 31. Comparing the bank statement, the canceled checks, and the accompanying memos with the records revealed the following reconciling items: a. Checks outstanding totaled $9,720. b. A deposit of $7,920, representing receipts of May 31, had been made too late to appear on the bank statement. C. The bank had collected for Brentwood Bike Co. $4,190 on a note left for collection. The face of the note was $3,860. d. A check for $490 returned with the statement had been incorrectly charged by the bank as $940. e. A check for $630 returned with the statement had been recorded by Brentwood Bike Co. as $360. The check was for the payment of an obligation to Adkins Co. on account. f. Bank service charges for May amounted to $50. 9. A check for $970 from Jennings Co. was returned by the bank because of insufficient funds. Instructions: 1. Prepare a bank reconciliation as of May 31. Brentwood Bike Co. Bank Reconciliation May 31 Cash balance according to bank statement Adjusted balance Cash balance according to company's records Adjusted balance 2. Journalize the necessary entries (a.) that increase cash and (b.) that decrease cash. The accounts have not been closed. For a compound transaction, if an amount box does not require an entry, leave it blank. a. May 31 b. May 31 Previous 3. If a balance sheet is prepared for Brentwood Bike Co. on May 31, what amount should be reported as cash