Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Internal Controls [Provide suggestions for a simple system of internal controls to assist the owners in protecting assets and ensuring accuracy in financial data.

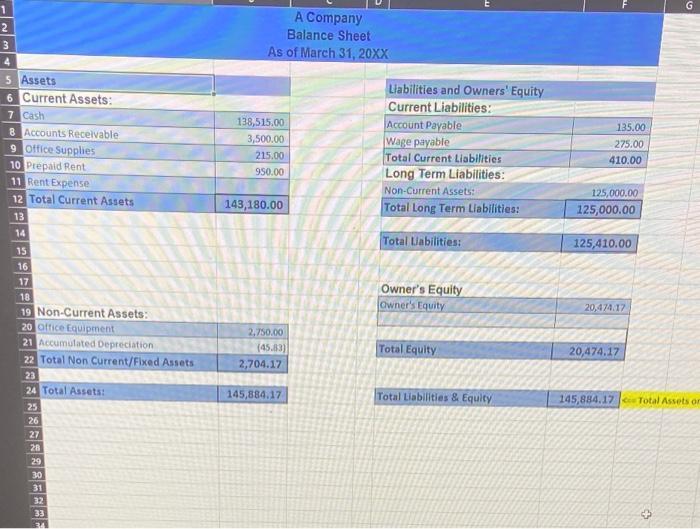

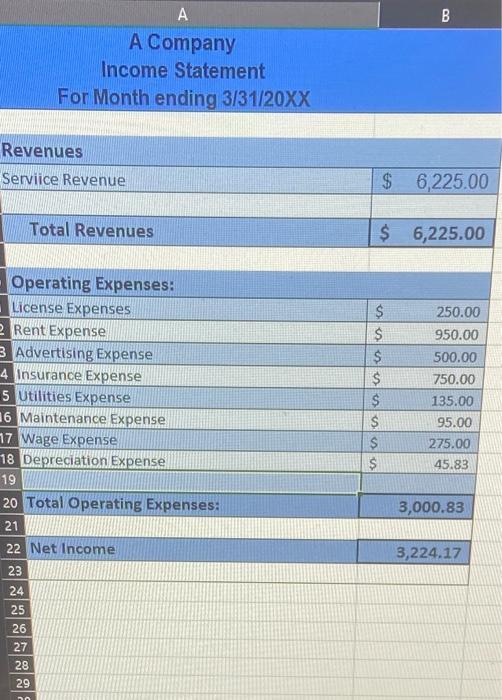

Internal Controls [Provide suggestions for a simple system of internal controls to assist the owners in protecting assets and ensuring accuracy in financial data. Consider additional controls that will support the potential for adding merchandise and additional assets with business growth/expansion] Looking to the Future [In response to the owner's request for additional information and support for future growth, discuss accounting considerations associated with the acquisition of additional long term/fixed assets, and the addition of merchandise inventory. How will the company account for the costs of long-term assets? How will the method of depreciation be determined? (Expand on 2 different methods of depreciation to demonstrate ideal application). How does accounting change with the addition of merchandise inventory? How will it be determined which inventory costing method to apply? (Discuss how the FIFO, LIFO, and Average methods differ and provide examples of the types of merchandising scenarios that would be ideally applicable in each case)]] Process [In this section you will discuss the process you used to generate accurate financial statement results for the business owner from the list of business transactions provided. Explain what is being communicated through each of the financial statements you prepared (income statement, statement of equity and balance sheet) and how this information will be used in business decision making and planning (This report provides a summary of the company's performance, including purchasing, sales, profit, and stockholder earnings 2 3 4 5 Assets 6 Current Assets: Cash 7 8 Accounts Receivable 9 Office Supplies 10 Prepaid Rent 11 Rent Expense 12 Total Current Assets 13 14 15 16 17 18 19 Non-Current Assets: 20 Office Equipment 21 Accumulated Depreciation 22 Total Non Current/Fixed Assets 23 24 Total Assets: 25 26 27 28 AREBBE A Company Balance Sheet As of March 31, 20XX 138,515.00 3,500.00 215.00 950.00 143,180.00 2,750.00 (45.83) 2,704.17 145,884.17 Liabilities and Owners' Equity Current Liabilities: Account Payable Wage payable Total Current Liabilities Long Term Liabilities: Non-Current Assets: Total Long Term Liabilities: Total Liabilities: Owner's Equity Owner's Equity Total Equity Total Liabilities & Equity 135.00 275.00 410.00 125,000.00 125,000.00 125,410.00 20,474.17 20,474.17 G 145,884.17 Total Assets on 33 Revenues Serviice Revenue A A Company Income Statement For Month ending 3/31/20XX Total Revenues Operating Expenses: License Expenses 2 Rent Expense 3 Advertising Expense 4 Insurance Expense 5 Utilities Expense 6 Maintenance Expense 17 Wage Expense 18 Depreciation Expense 19 20 Total Operating Expenses: 21 22 Net Income 23 24 25 26 27 28 29 50 SSS es $ $ 6,225.00 $ 6,225.00 $ SSS $ $ $ $ B 250.00 950.00 500.00 750.00 135.00 95.00 275.00 45.83 3,000.83 3,224.17

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started