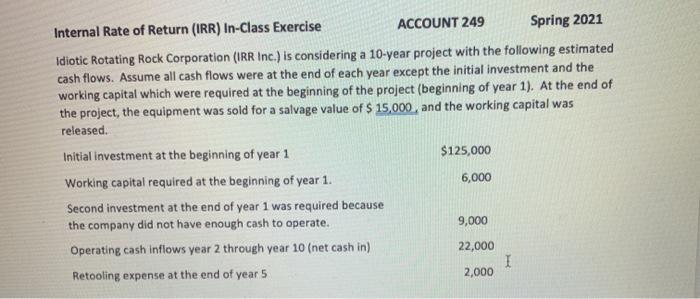

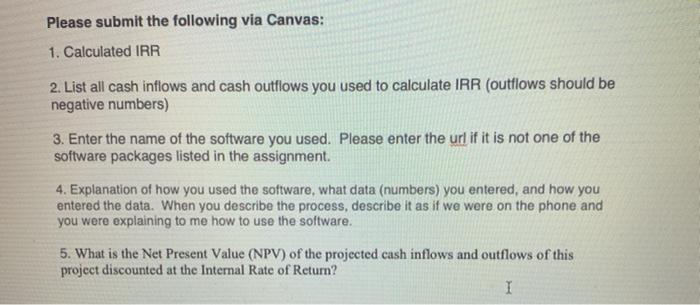

Internal Rate of Return (IRR) In-Class Exercise ACCOUNT 249 Spring 2021 Idiotic Rotating Rock Corporation (IRR Inc.) is considering a 10-year project with the following estimated cash flows. Assume all cash flows were at the end of each year except the initial investment and the working capital which were required at the beginning of the project (beginning of year 1). At the end of the project, the equipment was sold for a salvage value of $ 15,000, and the working capital was released Initial investment at the beginning of year 1 $125,000 Working capital required at the beginning of year 1. 6,000 Second investment at the end of year 1 was required because the company did not have enough cash to operate. 9,000 Operating cash inflows year 2 through year 10 (net cash in) 22,000 I Retooling expense at the end of year 5 2,000 Please submit the following via Canvas: 1. Calculated IRR 2. List all cash inflows and cash outflows you used to calculate IRR (outflows should be negative numbers) 3. Enter the name of the software you used. Please enter the url if it is not one of the software packages listed in the assignment. 4. Explanation of how you used the software, what data (numbers) you entered, and how you entered the data. When you describe the process, describe it as if we were on the phone and you were explaining to me how to use the software. 5. What is the Net Present Value (NPV) of the projected cash inflows and outflows of this project discounted at the Internal Rate of Return? I Internal Rate of Return (IRR) In-Class Exercise ACCOUNT 249 Spring 2021 Idiotic Rotating Rock Corporation (IRR Inc.) is considering a 10-year project with the following estimated cash flows. Assume all cash flows were at the end of each year except the initial investment and the working capital which were required at the beginning of the project (beginning of year 1). At the end of the project, the equipment was sold for a salvage value of $ 15,000, and the working capital was released Initial investment at the beginning of year 1 $125,000 Working capital required at the beginning of year 1. 6,000 Second investment at the end of year 1 was required because the company did not have enough cash to operate. 9,000 Operating cash inflows year 2 through year 10 (net cash in) 22,000 I Retooling expense at the end of year 5 2,000 Please submit the following via Canvas: 1. Calculated IRR 2. List all cash inflows and cash outflows you used to calculate IRR (outflows should be negative numbers) 3. Enter the name of the software you used. Please enter the url if it is not one of the software packages listed in the assignment. 4. Explanation of how you used the software, what data (numbers) you entered, and how you entered the data. When you describe the process, describe it as if we were on the phone and you were explaining to me how to use the software. 5. What is the Net Present Value (NPV) of the projected cash inflows and outflows of this project discounted at the Internal Rate of Return