Answered step by step

Verified Expert Solution

Question

1 Approved Answer

International and local business is moving at a great rate toward business combination as a game plan for expansion and marketability. Multinational firms can be

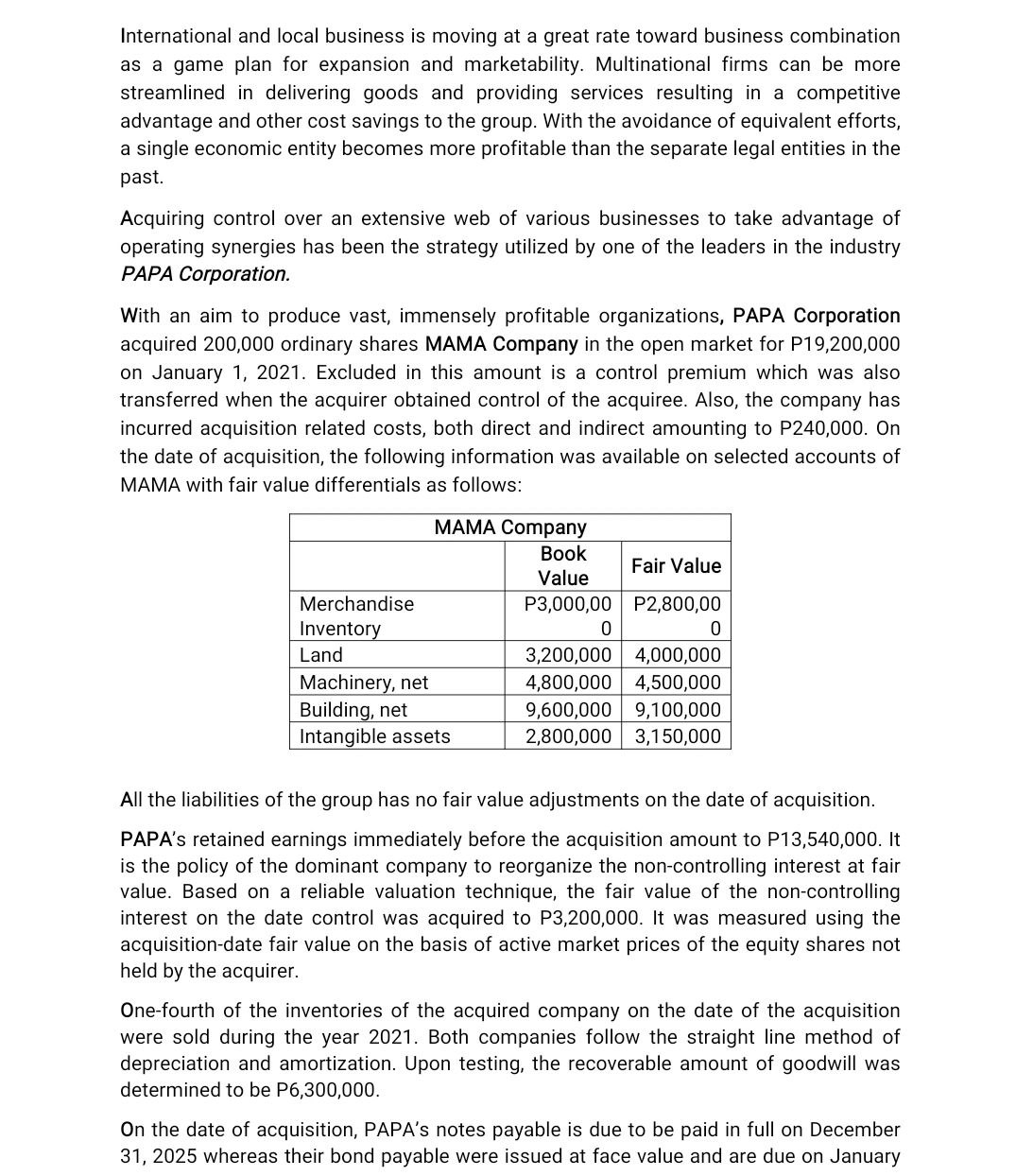

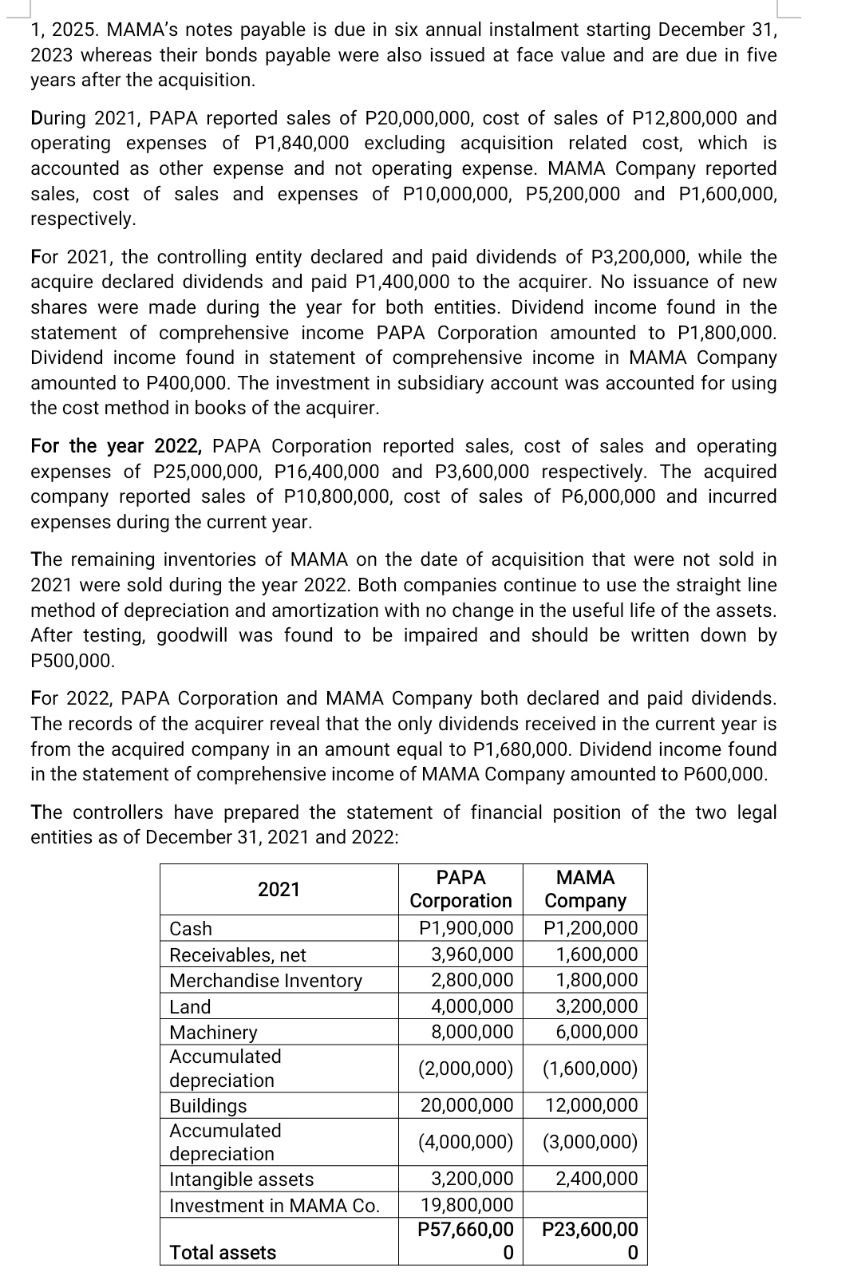

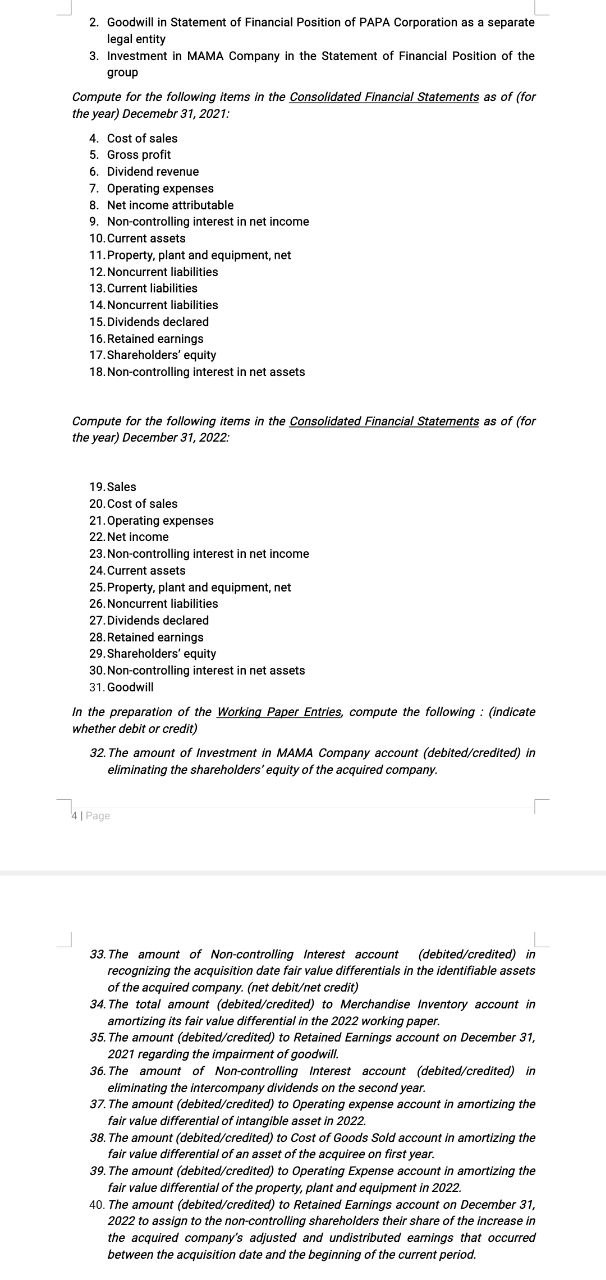

International and local business is moving at a great rate toward business combination as a game plan for expansion and marketability. Multinational firms can be more streamlined in delivering goods and providing services resulting in a competitive advantage and other cost savings to the group. With the avoidance of equivalent efforts, a single economic entity becomes more profitable than the separate legal entities in the past. Acquiring control over an extensive web of various businesses to take advantage of operating synergies has been the strategy utilized by one of the leaders in the industry PAPA Corporation. With an aim to produce vast, immensely profitable organizations, PAPA Corporation acquired 200,000 ordinary shares MAMA Company in the open market for P19,200,000 on January 1, 2021. Excluded in this amount is a control premium which was also transferred when the acquirer obtained control of the acquiree. Also, the company has incurred acquisition related costs, both direct and indirect amounting to P240,000. On the date of acquisition, the following information was available on selected accounts of MAMA with fair value differentials as follows: All the liabilities of the group has no fair value adjustments on the date of acquisition. PAPA's retained earnings immediately before the acquisition amount to P13,540,000. It is the policy of the dominant company to reorganize the non-controlling interest at fair value. Based on a reliable valuation technique, the fair value of the non-controlling interest on the date control was acquired to P3,200,000. It was measured using the acquisition-date fair value on the basis of active market prices of the equity shares not held by the acquirer. One-fourth of the inventories of the acquired company on the date of the acquisition were sold during the year 2021. Both companies follow the straight line method of depreciation and amortization. Upon testing, the recoverable amount of goodwill was determined to be P6,300,000. On the date of acquisition, PAPA's notes payable is due to be paid in full on December 31,2025 whereas their bond payable were issued at face value and are due on January 1, 2025. MAMA's notes payable is due in six annual instalment starting December 31 , 2023 whereas their bonds payable were also issued at face value and are due in five years after the acquisition. During 2021, PAPA reported sales of P20,000,000, cost of sales of P12,800,000 and operating expenses of P1,840,000 excluding acquisition related cost, which is accounted as other expense and not operating expense. MAMA Company reported sales, cost of sales and expenses of P10,000,000,P5,200,000 and P1,600,000, respectively. For 2021, the controlling entity declared and paid dividends of P3,200,000, while the acquire declared dividends and paid P1,400,000 to the acquirer. No issuance of new shares were made during the year for both entities. Dividend income found in the statement of comprehensive income PAPA Corporation amounted to P1,800,000. Dividend income found in statement of comprehensive income in MAMA Company amounted to P400,000. The investment in subsidiary account was accounted for using the cost method in books of the acquirer. For the year 2022, PAPA Corporation reported sales, cost of sales and operating expenses of P25,000,000,P16,400,000 and P3,600,000 respectively. The acquired company reported sales of P10,800,000, cost of sales of P6,000,000 and incurred expenses during the current year. The remaining inventories of MAMA on the date of acquisition that were not sold in 2021 were sold during the year 2022. Both companies continue to use the straight line method of depreciation and amortization with no change in the useful life of the assets. After testing, goodwill was found to be impaired and should be written down by P500,000. For 2022, PAPA Corporation and MAMA Company both declared and paid dividends. The records of the acquirer reveal that the only dividends received in the current year is from the acquired company in an amount equal to P1,680,000. Dividend income found in the statement of comprehensive income of MAMA Company amounted to P600,000. The controllers have prepared the statement of financial position of the two legal entities as of December 31, 2021 and 2022: 2. Goodwill in Statement of Financial Position of PAPA Corporation as a separate legal entity 3. Investment in MAMA Company in the Statement of Financial Position of the group Compute for the following items in the Consolidated Financial Statements as of (for the year) Decemebr 31, 2021: 4. Cost of sales 5. Gross profit 6. Dividend revenue 7. Operating expenses 8. Net income attributable 9. Non-controlling interest in net income 10. Current assets 11. Property, plant and equipment, net 12. Noncurrent liabilities 13. Current liabilities 14. Noncurrent liabilities 15. Dividends declared 16. Retained earnings 17. Shareholders' equity 18. Non-controlling interest in net assets Compute for the following items in the Consolidated Financial Statements as of (for the year) December 31, 2022: 19.Sales 20. Cost of sales 21. Operating expenses 22. Net income 23. Non-controlling interest in net income 24. Current assets 25. Property, plant and equipment, net 26. Noncurrent liabilities 27. Dividends declared 28. Retained earnings 29. Shareholders' equity 30 . Non-controlling interest in net assets 31. Goodwill In the preparation of the Working Paper Entries, compute the following: (indicate whether debit or credit) 32. The amount of Investment in MAMA Company account (debited/credited) in eliminating the shareholders' equity of the acquired company. 33.The amount of Non-controlling Interest account (debited/credited) in recognizing the acquisition date fair value differentials in the identifiable assets of the acquired company. (net debitet credit) 34. The total amount (debited/credited) to Merchandise Inventory account in amortizing its fair value differential in the 2022 working paper. 35. The amount (debited/credited) to Retained Earnings account on December 31, 2021 regarding the impairment of goodwill. 36. The amount of Non-controlling Interest account (debited/credited) in eliminating the intercompany dividends on the second year. 37. The amount (debited/credited) to Operating expense account in amortizing the fair value differential of intangible asset in 2022. 38. The amount (debited/credited) to cost of Goods Sold account in amortizing the fair value differential of an asset of the acquiree on first year. 39. The amount (debited/credited) to Operating Expense account in amortizing the fair value differential of the property, plant and equipment in 2022. 40. The amount (debited/credited) to Retained Earnings account on December 31, 2022 to assign to the non-controlling shareholders their share of the increase in the acquired company's adjusted and undistributed earnings that occurred between the acquisition date and the beginning of the current period

International and local business is moving at a great rate toward business combination as a game plan for expansion and marketability. Multinational firms can be more streamlined in delivering goods and providing services resulting in a competitive advantage and other cost savings to the group. With the avoidance of equivalent efforts, a single economic entity becomes more profitable than the separate legal entities in the past. Acquiring control over an extensive web of various businesses to take advantage of operating synergies has been the strategy utilized by one of the leaders in the industry PAPA Corporation. With an aim to produce vast, immensely profitable organizations, PAPA Corporation acquired 200,000 ordinary shares MAMA Company in the open market for P19,200,000 on January 1, 2021. Excluded in this amount is a control premium which was also transferred when the acquirer obtained control of the acquiree. Also, the company has incurred acquisition related costs, both direct and indirect amounting to P240,000. On the date of acquisition, the following information was available on selected accounts of MAMA with fair value differentials as follows: All the liabilities of the group has no fair value adjustments on the date of acquisition. PAPA's retained earnings immediately before the acquisition amount to P13,540,000. It is the policy of the dominant company to reorganize the non-controlling interest at fair value. Based on a reliable valuation technique, the fair value of the non-controlling interest on the date control was acquired to P3,200,000. It was measured using the acquisition-date fair value on the basis of active market prices of the equity shares not held by the acquirer. One-fourth of the inventories of the acquired company on the date of the acquisition were sold during the year 2021. Both companies follow the straight line method of depreciation and amortization. Upon testing, the recoverable amount of goodwill was determined to be P6,300,000. On the date of acquisition, PAPA's notes payable is due to be paid in full on December 31,2025 whereas their bond payable were issued at face value and are due on January 1, 2025. MAMA's notes payable is due in six annual instalment starting December 31 , 2023 whereas their bonds payable were also issued at face value and are due in five years after the acquisition. During 2021, PAPA reported sales of P20,000,000, cost of sales of P12,800,000 and operating expenses of P1,840,000 excluding acquisition related cost, which is accounted as other expense and not operating expense. MAMA Company reported sales, cost of sales and expenses of P10,000,000,P5,200,000 and P1,600,000, respectively. For 2021, the controlling entity declared and paid dividends of P3,200,000, while the acquire declared dividends and paid P1,400,000 to the acquirer. No issuance of new shares were made during the year for both entities. Dividend income found in the statement of comprehensive income PAPA Corporation amounted to P1,800,000. Dividend income found in statement of comprehensive income in MAMA Company amounted to P400,000. The investment in subsidiary account was accounted for using the cost method in books of the acquirer. For the year 2022, PAPA Corporation reported sales, cost of sales and operating expenses of P25,000,000,P16,400,000 and P3,600,000 respectively. The acquired company reported sales of P10,800,000, cost of sales of P6,000,000 and incurred expenses during the current year. The remaining inventories of MAMA on the date of acquisition that were not sold in 2021 were sold during the year 2022. Both companies continue to use the straight line method of depreciation and amortization with no change in the useful life of the assets. After testing, goodwill was found to be impaired and should be written down by P500,000. For 2022, PAPA Corporation and MAMA Company both declared and paid dividends. The records of the acquirer reveal that the only dividends received in the current year is from the acquired company in an amount equal to P1,680,000. Dividend income found in the statement of comprehensive income of MAMA Company amounted to P600,000. The controllers have prepared the statement of financial position of the two legal entities as of December 31, 2021 and 2022: 2. Goodwill in Statement of Financial Position of PAPA Corporation as a separate legal entity 3. Investment in MAMA Company in the Statement of Financial Position of the group Compute for the following items in the Consolidated Financial Statements as of (for the year) Decemebr 31, 2021: 4. Cost of sales 5. Gross profit 6. Dividend revenue 7. Operating expenses 8. Net income attributable 9. Non-controlling interest in net income 10. Current assets 11. Property, plant and equipment, net 12. Noncurrent liabilities 13. Current liabilities 14. Noncurrent liabilities 15. Dividends declared 16. Retained earnings 17. Shareholders' equity 18. Non-controlling interest in net assets Compute for the following items in the Consolidated Financial Statements as of (for the year) December 31, 2022: 19.Sales 20. Cost of sales 21. Operating expenses 22. Net income 23. Non-controlling interest in net income 24. Current assets 25. Property, plant and equipment, net 26. Noncurrent liabilities 27. Dividends declared 28. Retained earnings 29. Shareholders' equity 30 . Non-controlling interest in net assets 31. Goodwill In the preparation of the Working Paper Entries, compute the following: (indicate whether debit or credit) 32. The amount of Investment in MAMA Company account (debited/credited) in eliminating the shareholders' equity of the acquired company. 33.The amount of Non-controlling Interest account (debited/credited) in recognizing the acquisition date fair value differentials in the identifiable assets of the acquired company. (net debitet credit) 34. The total amount (debited/credited) to Merchandise Inventory account in amortizing its fair value differential in the 2022 working paper. 35. The amount (debited/credited) to Retained Earnings account on December 31, 2021 regarding the impairment of goodwill. 36. The amount of Non-controlling Interest account (debited/credited) in eliminating the intercompany dividends on the second year. 37. The amount (debited/credited) to Operating expense account in amortizing the fair value differential of intangible asset in 2022. 38. The amount (debited/credited) to cost of Goods Sold account in amortizing the fair value differential of an asset of the acquiree on first year. 39. The amount (debited/credited) to Operating Expense account in amortizing the fair value differential of the property, plant and equipment in 2022. 40. The amount (debited/credited) to Retained Earnings account on December 31, 2022 to assign to the non-controlling shareholders their share of the increase in the acquired company's adjusted and undistributed earnings that occurred between the acquisition date and the beginning of the current period Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started