Answered step by step

Verified Expert Solution

Question

1 Approved Answer

International Finance Economics Consider a small open economy. Let t=1,2,,. The representative household has preferences t=1t11Ct1 where Ct is consumption in period t,(0,1) is the

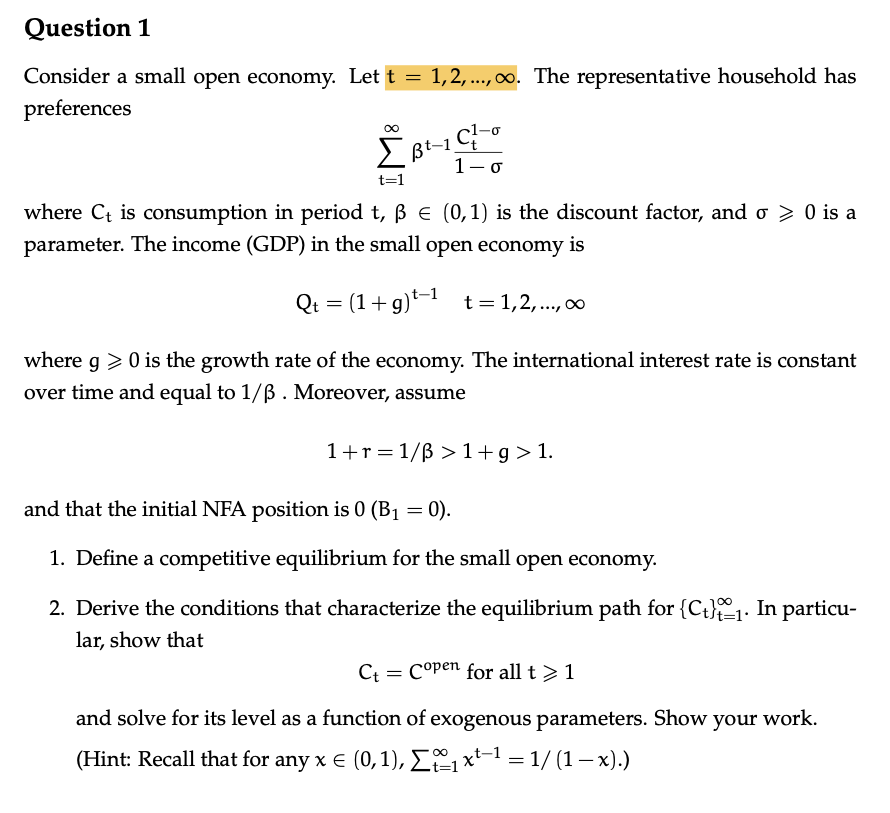

International Finance Economics

Consider a small open economy. Let t=1,2,,. The representative household has preferences t=1t11Ct1 where Ct is consumption in period t,(0,1) is the discount factor, and 0 is a parameter. The income (GDP) in the small open economy is Qt=(1+g)t1t=1,2,, where g0 is the growth rate of the economy. The international interest rate is constant over time and equal to 1/. Moreover, assume 1+r=1/>1+g>1. and that the initial NFA position is 0(B1=0). 1. Define a competitive equilibrium for the small open economy. 2. Derive the conditions that characterize the equilibrium path for {Ct}t=1. In particular, show that Ct=Copenforallt1 and solve for its level as a function of exogenous parameters. Show your work. (Hint: Recall that for any x(0,1),t=1xt1=1/(1x).) Consider a small open economy. Let t=1,2,,. The representative household has preferences t=1t11Ct1 where Ct is consumption in period t,(0,1) is the discount factor, and 0 is a parameter. The income (GDP) in the small open economy is Qt=(1+g)t1t=1,2,, where g0 is the growth rate of the economy. The international interest rate is constant over time and equal to 1/. Moreover, assume 1+r=1/>1+g>1. and that the initial NFA position is 0(B1=0). 1. Define a competitive equilibrium for the small open economy. 2. Derive the conditions that characterize the equilibrium path for {Ct}t=1. In particular, show that Ct=Copenforallt1 and solve for its level as a function of exogenous parameters. Show your work. (Hint: Recall that for any x(0,1),t=1xt1=1/(1x).)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started