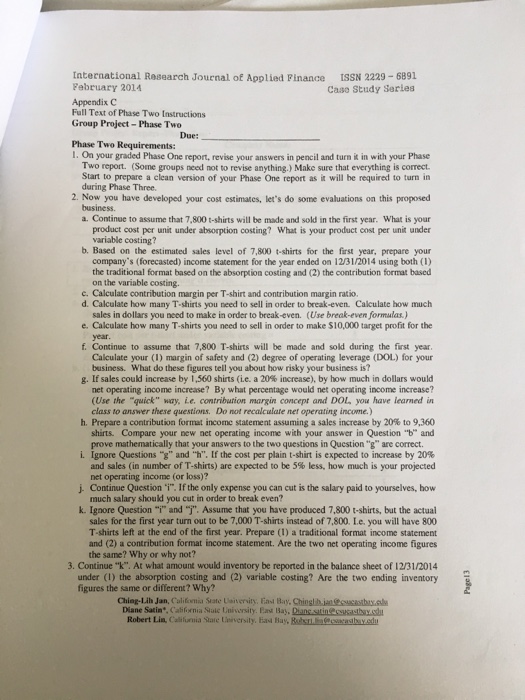

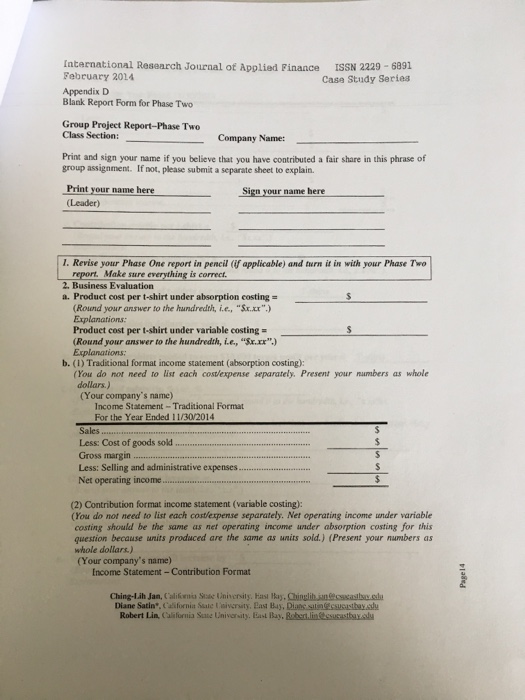

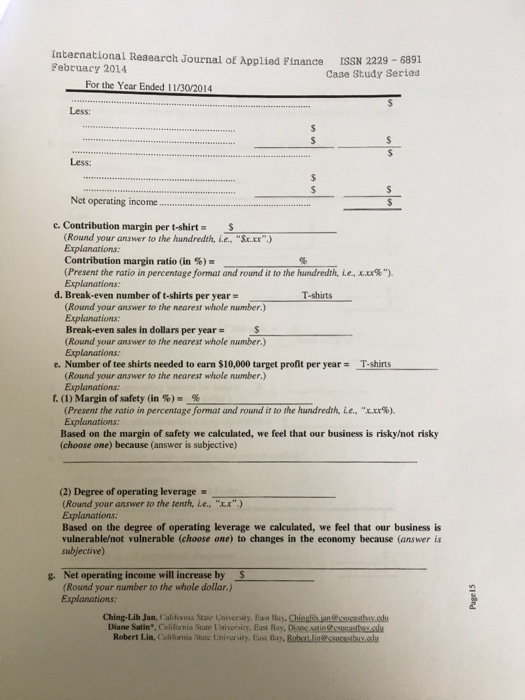

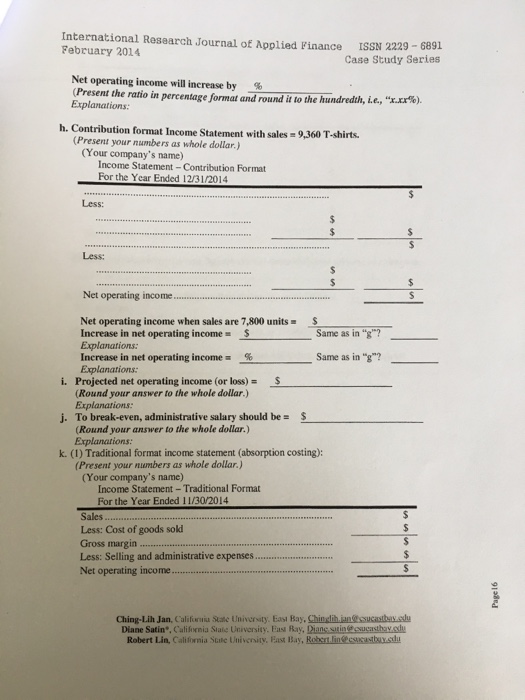

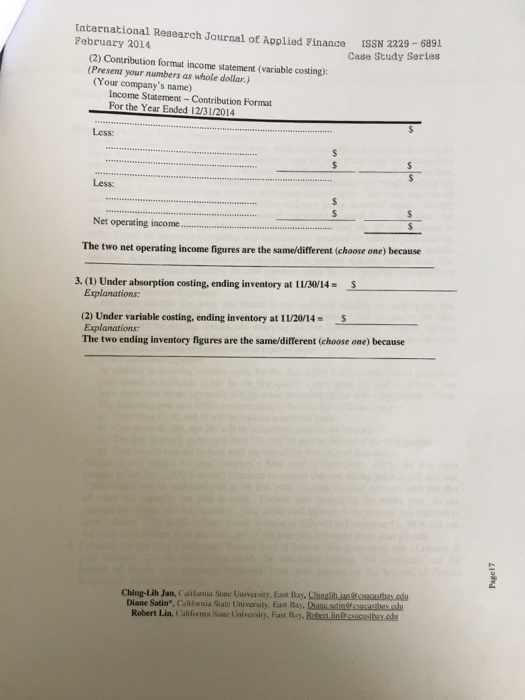

International Research Journal of Applied Finance ISSN 2229 6891 February 2014 Case Study Series Appendix C Full Text of Phase Two Instructions Group Project-Phase Two Due: Phase Two Req I. On your graded Phase One report, revise your answers in pencil and turn it in with your Phase Two report. (Some groups need not to revise anything.) Make sure that everything is comect. Start to prepare a clean version of your Phase One report as it will be required to turn in during Phase Three. 2. Now you have developed your cost estimates, let's do some evaluations on this a. Continue to assume that 7,800 t-shirts will be made and sold in the first year. What is your product cost per unit under absorption costing? What is your product cost per unit under b. Based on the estimated sales lewel of 7,800 t-shirts for the first year, prepare your company's (forecasted income statement for the year ended on 1231/2014 using both (I) the traditional format based on the absorption costing and (2) the contribution format based on the variable costing. c. Calculate contribution margin per T-shirt and contribution margin ratio. d. Calculate how many T-shirts you need to sell in order to break-even. Calculate how much sales in dollars you need to make in order to break-even. (Use break-even formulas) in order to make $10,000 target profit for the e. Calculate how many T-shirts you need to sel f Continue to assume that 7.800 T-shirts will be made and sold during the first year business. What do these figures tell you about how risky your business is? g. If sales could increase by 1,560 shirts (ie, a 20% increase), by how much in dollars would net operating income increase? By what percentage would net operating income increase? (Use the "quick" way, Le contribution margin concepr and DOL you have learned in class to answer these questions. Do not recalculate ner operating income.) h. Prepare a contribution format income statement assuming a sales increase by 20% to 9,360 shirts. Compare your new net operating income with your answer in Question "b" and prove mathematically that your answers to the two questions in Qu estion "g are correct. i. Ignore Questions "g" and "h", Lf the cost per pla in t-shirt is expected to increase by 20% and sales (in number of T-shirts) are expected to be 5% less, how much is your projected net operating income (or loss Continue Question "i". Ifthe only expense you can cut is the salary paid to yourselves, how much salary should you cut in order to break even? i" and "j". Assume that you have produced 7,800 t-shirts, but the actual k. Ignore sales for the first year turn out to be 7.000 T-shirts instead of 7,800, Le. you will have 800 T-shirts left at the end of the first year. Prepare a traditional format income statement and (2) a contribution format income statement. Are the two net operating income figures the same? Why or why not 3. Continue "k". At what amount would inventory be reported in the balance sheet of 1231/2014 under the absorpti ion costing and (2) variable costing? Are the two ending inventory figures the same or different? Why? Ching-Lih Jan, Califomia Siate Uaitervity, East Bay, Chin Diane Satin", California Sale University. Bat Robert Lin, Cali luniia Saare lativersily. Bay, International Research Journal of Applied Finance ISSN 2229 6891 February 2014 Case Study Series Appendix C Full Text of Phase Two Instructions Group Project-Phase Two Due: Phase Two Req I. On your graded Phase One report, revise your answers in pencil and turn it in with your Phase Two report. (Some groups need not to revise anything.) Make sure that everything is comect. Start to prepare a clean version of your Phase One report as it will be required to turn in during Phase Three. 2. Now you have developed your cost estimates, let's do some evaluations on this a. Continue to assume that 7,800 t-shirts will be made and sold in the first year. What is your product cost per unit under absorption costing? What is your product cost per unit under b. Based on the estimated sales lewel of 7,800 t-shirts for the first year, prepare your company's (forecasted income statement for the year ended on 1231/2014 using both (I) the traditional format based on the absorption costing and (2) the contribution format based on the variable costing. c. Calculate contribution margin per T-shirt and contribution margin ratio. d. Calculate how many T-shirts you need to sell in order to break-even. Calculate how much sales in dollars you need to make in order to break-even. (Use break-even formulas) in order to make $10,000 target profit for the e. Calculate how many T-shirts you need to sel f Continue to assume that 7.800 T-shirts will be made and sold during the first year business. What do these figures tell you about how risky your business is? g. If sales could increase by 1,560 shirts (ie, a 20% increase), by how much in dollars would net operating income increase? By what percentage would net operating income increase? (Use the "quick" way, Le contribution margin concepr and DOL you have learned in class to answer these questions. Do not recalculate ner operating income.) h. Prepare a contribution format income statement assuming a sales increase by 20% to 9,360 shirts. Compare your new net operating income with your answer in Question "b" and prove mathematically that your answers to the two questions in Qu estion "g are correct. i. Ignore Questions "g" and "h", Lf the cost per pla in t-shirt is expected to increase by 20% and sales (in number of T-shirts) are expected to be 5% less, how much is your projected net operating income (or loss Continue Question "i". Ifthe only expense you can cut is the salary paid to yourselves, how much salary should you cut in order to break even? i" and "j". Assume that you have produced 7,800 t-shirts, but the actual k. Ignore sales for the first year turn out to be 7.000 T-shirts instead of 7,800, Le. you will have 800 T-shirts left at the end of the first year. Prepare a traditional format income statement and (2) a contribution format income statement. Are the two net operating income figures the same? Why or why not 3. Continue "k". At what amount would inventory be reported in the balance sheet of 1231/2014 under the absorpti ion costing and (2) variable costing? Are the two ending inventory figures the same or different? Why? Ching-Lih Jan, Califomia Siate Uaitervity, East Bay, Chin Diane Satin", California Sale University. Bat Robert Lin, Cali luniia Saare lativersily. Bay