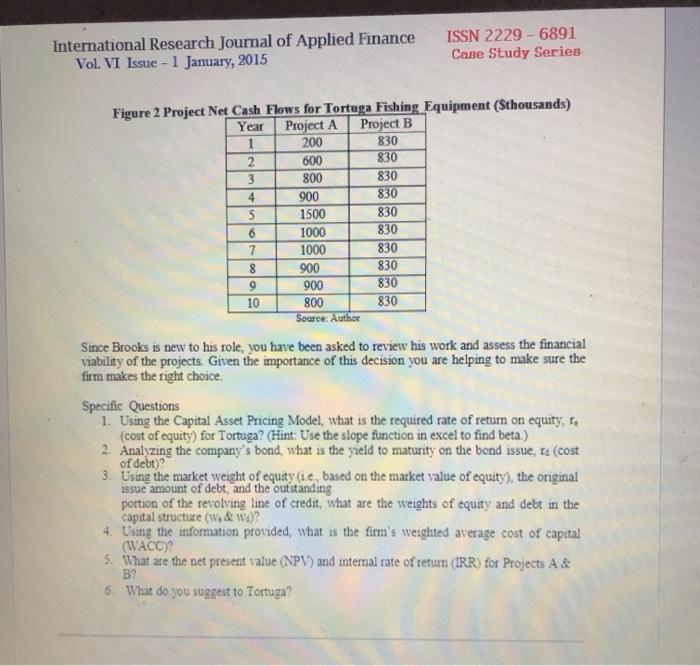

International Research Journal of Applied Finance Vol. VI Issue - 1 January, 2015 ISSN 2229-6891 Case Study Series 4 Figure 2 Project Net Cash Flows for Tortuga Fishing Equipment (Sthousands) Year Project A Project B 1 200 830 2 600 830 3 800 830 900 830 5 1500 830 6 1000 830 7 1000 830 8 900 830 9 900 830 10 800 830 Source: Author Since Brooks is new to his role, you have been asked to review his work and assess the financial viability of the projects. Given the importance of this decision you are helping to make sure the firm makes the right choice Specific Questions 1. Using the Capital Asset Pricing Model, what is the required rate of return on equity, Tz (cost of equity) for Tortuga? (Hint: Use the slope function in excel to find beta.) 2. Analyzing the company's bond, what is the yield to maturity on the bond issue, Ia (cost of debt)? 3. Using the market weight of equity (1.c, based on the market value of equity), the original issue amount of debt, and the outstanding portion of the revolving line of credit, what are the weights of equity and debt in the capital structure (w & w.)? 4. Using the information provided, what is the firm's weighted average cost of capital (WACC)? 5. What are the net present value (NPV) and internal rate of retum (IRR) for Projects A & B2 6. What do you suggest to Tortuga? International Research Journal of Applied Finance Vol. VI Issue - 1 January, 2015 ISSN 2229-6891 Case Study Series 4 Figure 2 Project Net Cash Flows for Tortuga Fishing Equipment (Sthousands) Year Project A Project B 1 200 830 2 600 830 3 800 830 900 830 5 1500 830 6 1000 830 7 1000 830 8 900 830 9 900 830 10 800 830 Source: Author Since Brooks is new to his role, you have been asked to review his work and assess the financial viability of the projects. Given the importance of this decision you are helping to make sure the firm makes the right choice Specific Questions 1. Using the Capital Asset Pricing Model, what is the required rate of return on equity, Tz (cost of equity) for Tortuga? (Hint: Use the slope function in excel to find beta.) 2. Analyzing the company's bond, what is the yield to maturity on the bond issue, Ia (cost of debt)? 3. Using the market weight of equity (1.c, based on the market value of equity), the original issue amount of debt, and the outstanding portion of the revolving line of credit, what are the weights of equity and debt in the capital structure (w & w.)? 4. Using the information provided, what is the firm's weighted average cost of capital (WACC)? 5. What are the net present value (NPV) and internal rate of retum (IRR) for Projects A & B2 6. What do you suggest to Tortuga