Answered step by step

Verified Expert Solution

Question

1 Approved Answer

interning at the Nam entertainment Ltd Group (Nam entertainment Group). You were recently contacted by Tony Bander ('Tony') to provide accounting advice to the Group.

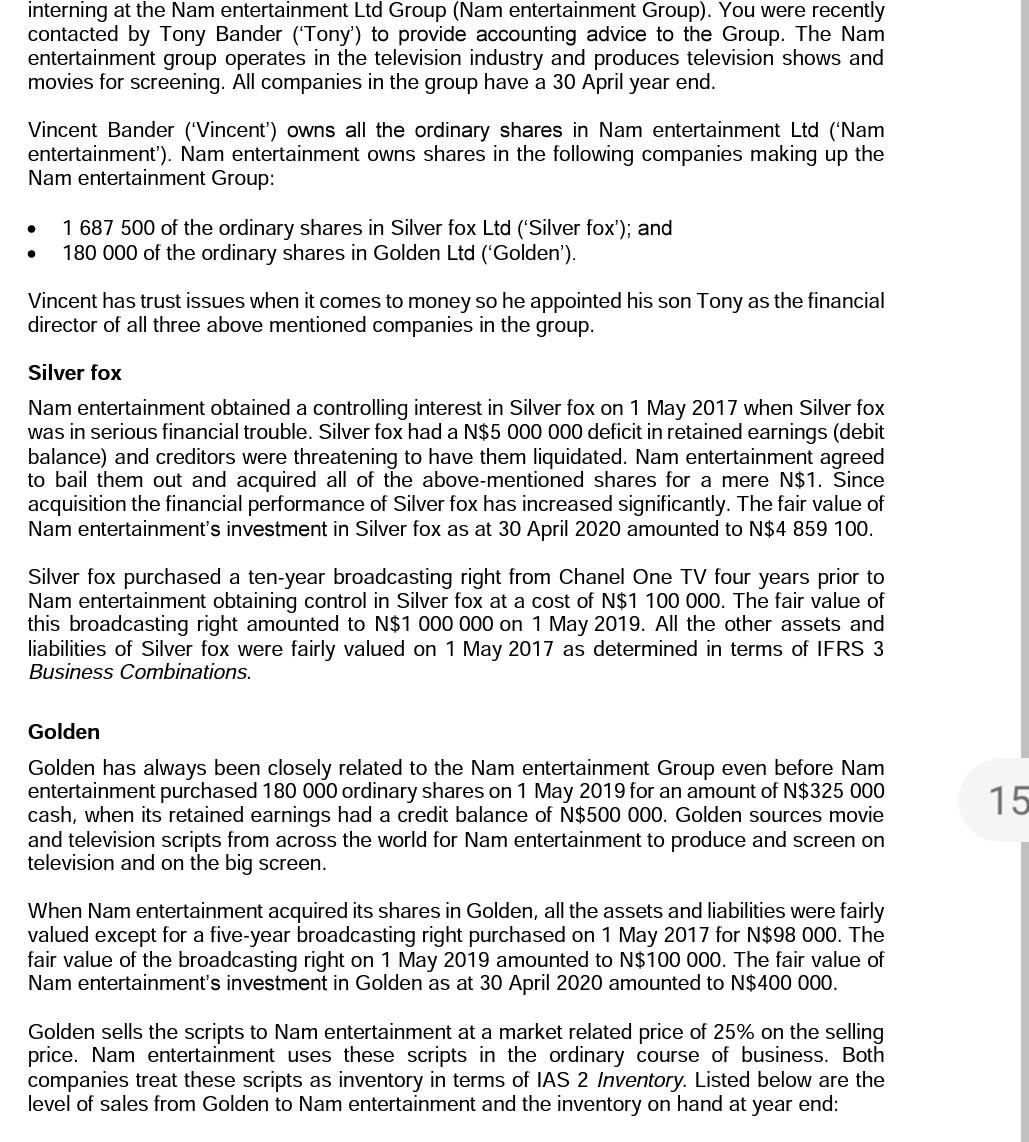

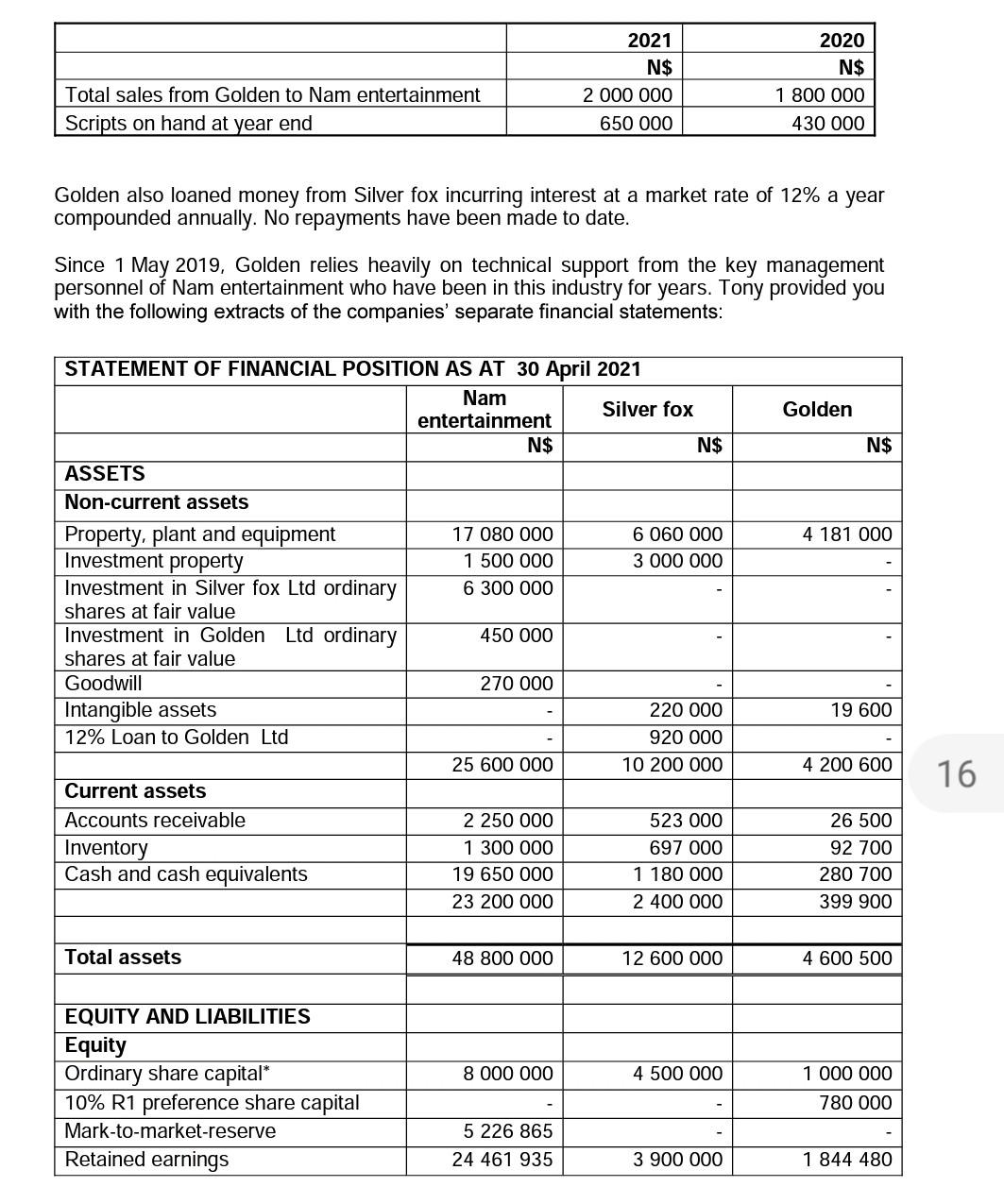

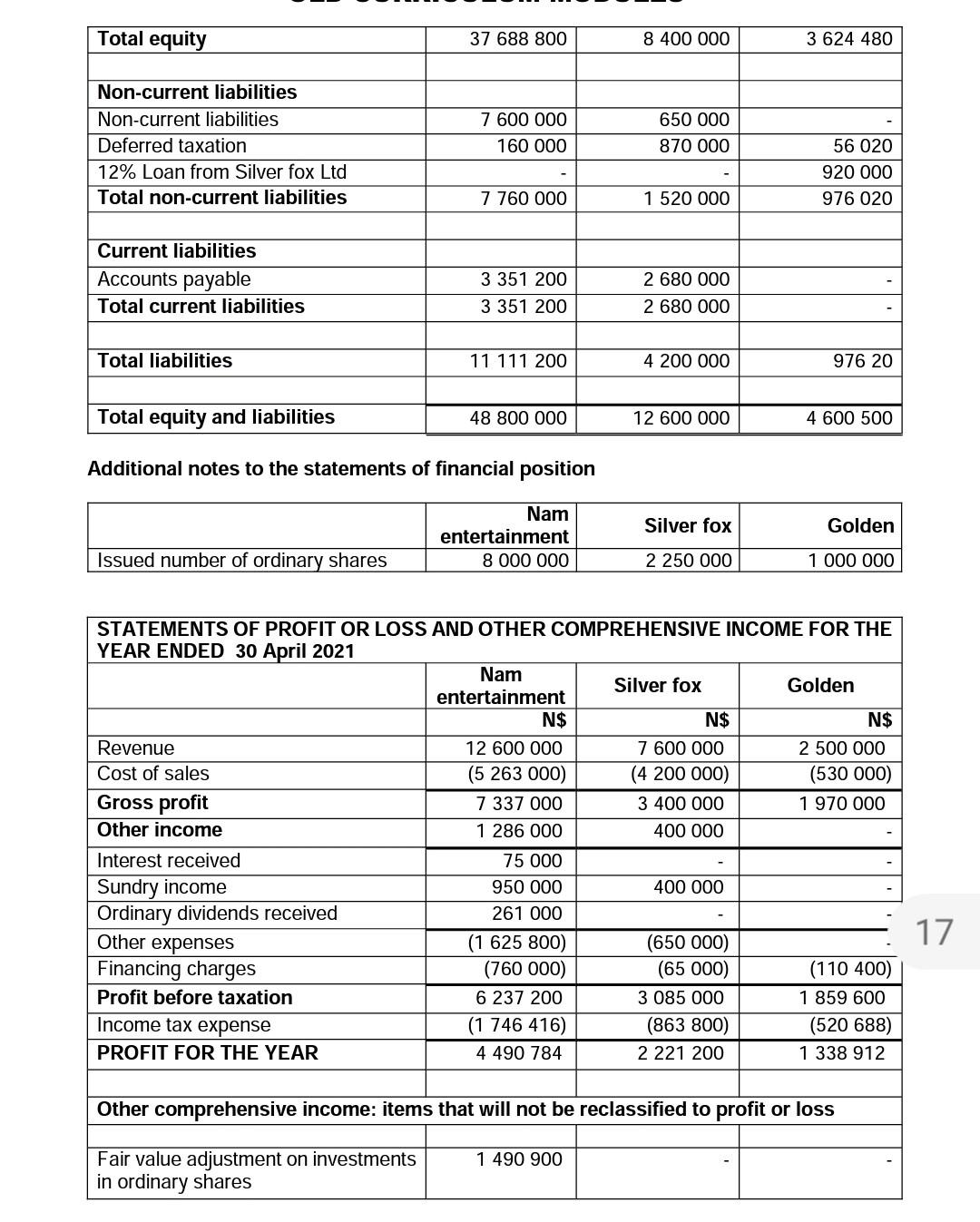

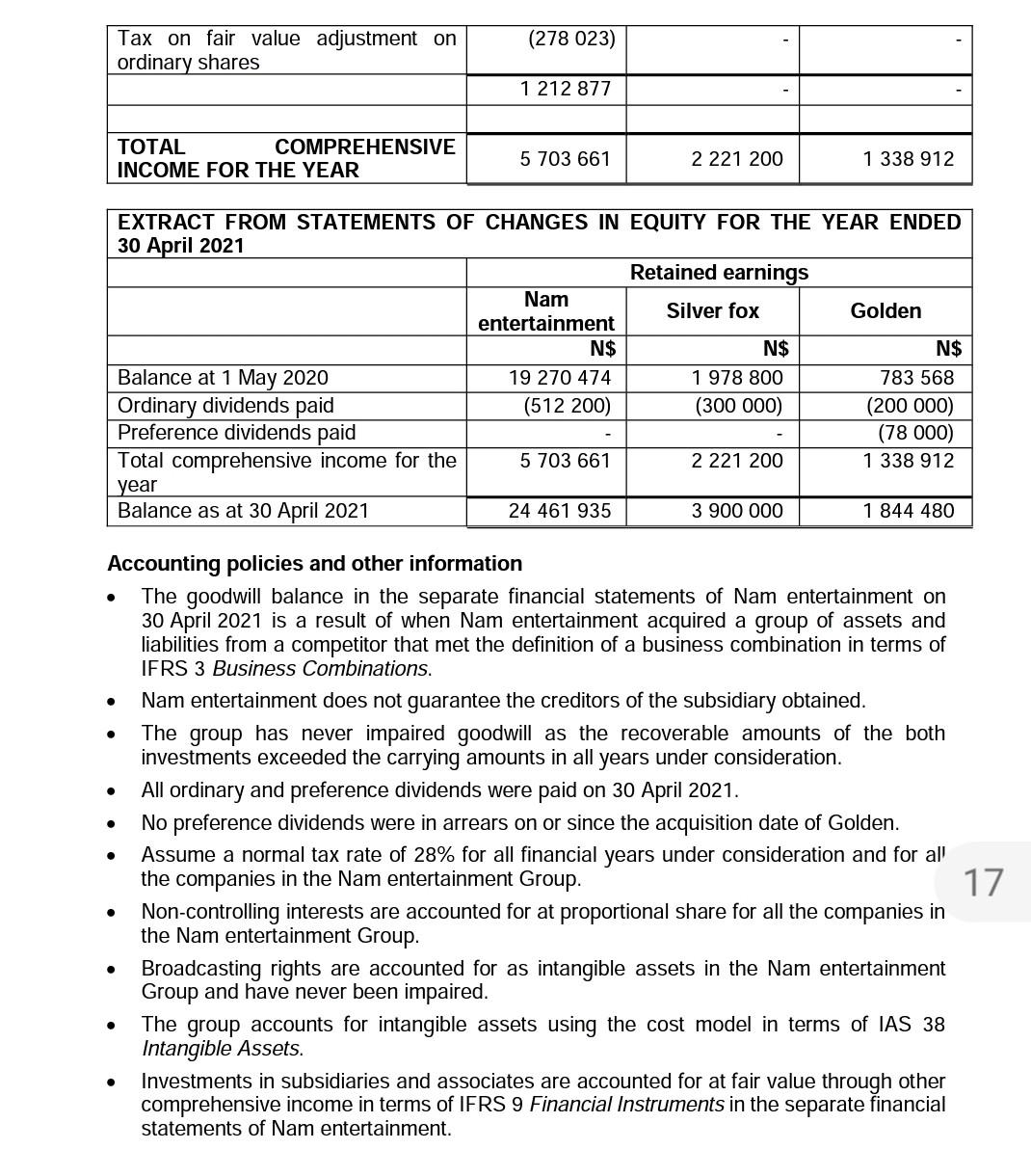

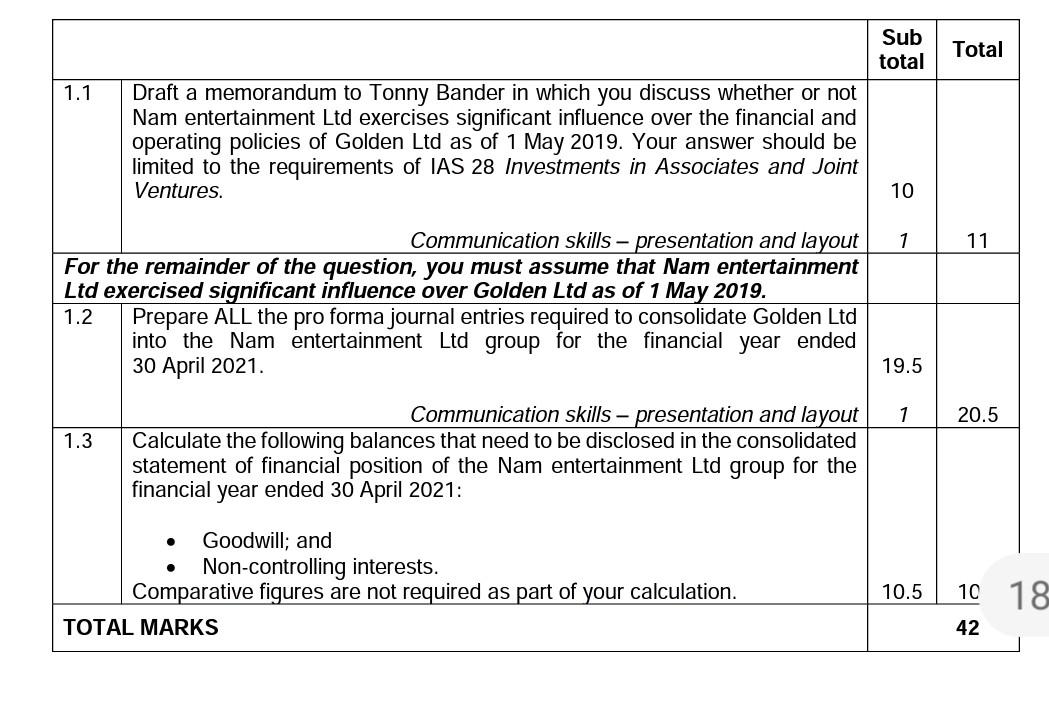

interning at the Nam entertainment Ltd Group (Nam entertainment Group). You were recently contacted by Tony Bander ('Tony') to provide accounting advice to the Group. The Nam entertainment group operates in the television industry and produces television shows and movies for screening. All companies in the group have a 30 April year end. Vincent Bander ('Vincent') owns all the ordinary shares in Nam entertainment Ltd ('Nam entertainment'). Nam entertainment owns shares in the following companies making up the Nam entertainment Group: - 1687500 of the ordinary shares in Silver fox Ltd ('Silver fox'); and - 180000 of the ordinary shares in Golden Ltd ('Golden'). Vincent has trust issues when it comes to money so he appointed his son Tony as the financial director of all three above mentioned companies in the group. Silver fox Nam entertainment obtained a controlling interest in Silver fox on 1 May 2017 when Silver fox was in serious financial trouble. Silver fox had a N$5000000 deficit in retained earnings (debit balance) and creditors were threatening to have them liquidated. Nam entertainment agreed to bail them out and acquired all of the above-mentioned shares for a mere N$1. Since acquisition the financial performance of Silver fox has increased significantly. The fair value of Nam entertainment's investment in Silver fox as at 30 April 2020 amounted to N $4859100. Silver fox purchased a ten-year broadcasting right from Chanel One TV four years prior to Nam entertainment obtaining control in Silver fox at a cost of N$100000. The fair value of this broadcasting right amounted to N$1000000 on 1 May 2019 . All the other assets and liabilities of Silver fox were fairly valued on 1 May 2017 as determined in terms of IFRS 3 Business Combinations. Golden Golden has always been closely related to the Nam entertainment Group even before Nam entertainment purchased 180000 ordinary shares on 1 May 2019 for an amount of N $325000 cash, when its retained earnings had a credit balance of N$500000. Golden sources movie and television scripts from across the world for Nam entertainment to produce and screen on television and on the big screen. When Nam entertainment acquired its shares in Golden, all the assets and liabilities were fairly valued except for a five-year broadcasting right purchased on 1 May 2017 for N$98000. The fair value of the broadcasting right on 1 May 2019 amounted to N$100000. The fair value of Nam entertainment's investment in Golden as at 30 April 2020 amounted to N $400000. Golden sells the scripts to Nam entertainment at a market related price of 25% on the selling price. Nam entertainment uses these scripts in the ordinary course of business. Both companies treat these scripts as inventory in terms of IAS 2 Inventory. Listed below are the level of sales from Golden to Nam entertainment and the inventory on hand at year end: Golden also loaned money from Silver fox incurring interest at a market rate of 12% a year compounded annually. No repayments have been made to date. Since 1 May 2019, Golden relies heavily on technical support from the key management personnel of Nam entertainment who have been in this industry for years. Tony provided you with the following extracts of the companies' separate financial statements: Additional notes to the statements of financial position Accounting policies and other information - The goodwill balance in the separate financial statements of Nam entertainment on 30 April 2021 is a result of when Nam entertainment acquired a group of assets and liabilities from a competitor that met the definition of a business combination in terms of IFRS 3 Business Combinations. - Nam entertainment does not guarantee the creditors of the subsidiary obtained. - The group has never impaired goodwill as the recoverable amounts of the both investments exceeded the carrying amounts in all years under consideration. - All ordinary and preference dividends were paid on 30 April 2021. - No preference dividends were in arrears on or since the acquisition date of Golden. - Assume a normal tax rate of 28% for all financial years under consideration and for all the companies in the Nam entertainment Group. - Non-controlling interests are accounted for at proportional share for all the companies in the Nam entertainment Group. - Broadcasting rights are accounted for as intangible assets in the Nam entertainment Group and have never been impaired. - The group accounts for intangible assets using the cost model in terms of IAS 38 Intangible Assets. - Investments in subsidiaries and associates are accounted for at fair value through other comprehensive income in terms of IFRS 9 Financial Instruments in the separate financial statements of Nam entertainment. interning at the Nam entertainment Ltd Group (Nam entertainment Group). You were recently contacted by Tony Bander ('Tony') to provide accounting advice to the Group. The Nam entertainment group operates in the television industry and produces television shows and movies for screening. All companies in the group have a 30 April year end. Vincent Bander ('Vincent') owns all the ordinary shares in Nam entertainment Ltd ('Nam entertainment'). Nam entertainment owns shares in the following companies making up the Nam entertainment Group: - 1687500 of the ordinary shares in Silver fox Ltd ('Silver fox'); and - 180000 of the ordinary shares in Golden Ltd ('Golden'). Vincent has trust issues when it comes to money so he appointed his son Tony as the financial director of all three above mentioned companies in the group. Silver fox Nam entertainment obtained a controlling interest in Silver fox on 1 May 2017 when Silver fox was in serious financial trouble. Silver fox had a N$5000000 deficit in retained earnings (debit balance) and creditors were threatening to have them liquidated. Nam entertainment agreed to bail them out and acquired all of the above-mentioned shares for a mere N$1. Since acquisition the financial performance of Silver fox has increased significantly. The fair value of Nam entertainment's investment in Silver fox as at 30 April 2020 amounted to N $4859100. Silver fox purchased a ten-year broadcasting right from Chanel One TV four years prior to Nam entertainment obtaining control in Silver fox at a cost of N$100000. The fair value of this broadcasting right amounted to N$1000000 on 1 May 2019 . All the other assets and liabilities of Silver fox were fairly valued on 1 May 2017 as determined in terms of IFRS 3 Business Combinations. Golden Golden has always been closely related to the Nam entertainment Group even before Nam entertainment purchased 180000 ordinary shares on 1 May 2019 for an amount of N $325000 cash, when its retained earnings had a credit balance of N$500000. Golden sources movie and television scripts from across the world for Nam entertainment to produce and screen on television and on the big screen. When Nam entertainment acquired its shares in Golden, all the assets and liabilities were fairly valued except for a five-year broadcasting right purchased on 1 May 2017 for N$98000. The fair value of the broadcasting right on 1 May 2019 amounted to N$100000. The fair value of Nam entertainment's investment in Golden as at 30 April 2020 amounted to N $400000. Golden sells the scripts to Nam entertainment at a market related price of 25% on the selling price. Nam entertainment uses these scripts in the ordinary course of business. Both companies treat these scripts as inventory in terms of IAS 2 Inventory. Listed below are the level of sales from Golden to Nam entertainment and the inventory on hand at year end: Golden also loaned money from Silver fox incurring interest at a market rate of 12% a year compounded annually. No repayments have been made to date. Since 1 May 2019, Golden relies heavily on technical support from the key management personnel of Nam entertainment who have been in this industry for years. Tony provided you with the following extracts of the companies' separate financial statements: Additional notes to the statements of financial position Accounting policies and other information - The goodwill balance in the separate financial statements of Nam entertainment on 30 April 2021 is a result of when Nam entertainment acquired a group of assets and liabilities from a competitor that met the definition of a business combination in terms of IFRS 3 Business Combinations. - Nam entertainment does not guarantee the creditors of the subsidiary obtained. - The group has never impaired goodwill as the recoverable amounts of the both investments exceeded the carrying amounts in all years under consideration. - All ordinary and preference dividends were paid on 30 April 2021. - No preference dividends were in arrears on or since the acquisition date of Golden. - Assume a normal tax rate of 28% for all financial years under consideration and for all the companies in the Nam entertainment Group. - Non-controlling interests are accounted for at proportional share for all the companies in the Nam entertainment Group. - Broadcasting rights are accounted for as intangible assets in the Nam entertainment Group and have never been impaired. - The group accounts for intangible assets using the cost model in terms of IAS 38 Intangible Assets. - Investments in subsidiaries and associates are accounted for at fair value through other comprehensive income in terms of IFRS 9 Financial Instruments in the separate financial statements of Nam entertainment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started