Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Interpreting and Reporting Property, Plant, and Equipment ( PPE ) Expenditures ( FSET ) General Mills, Inc. ( the Company ) , is a global

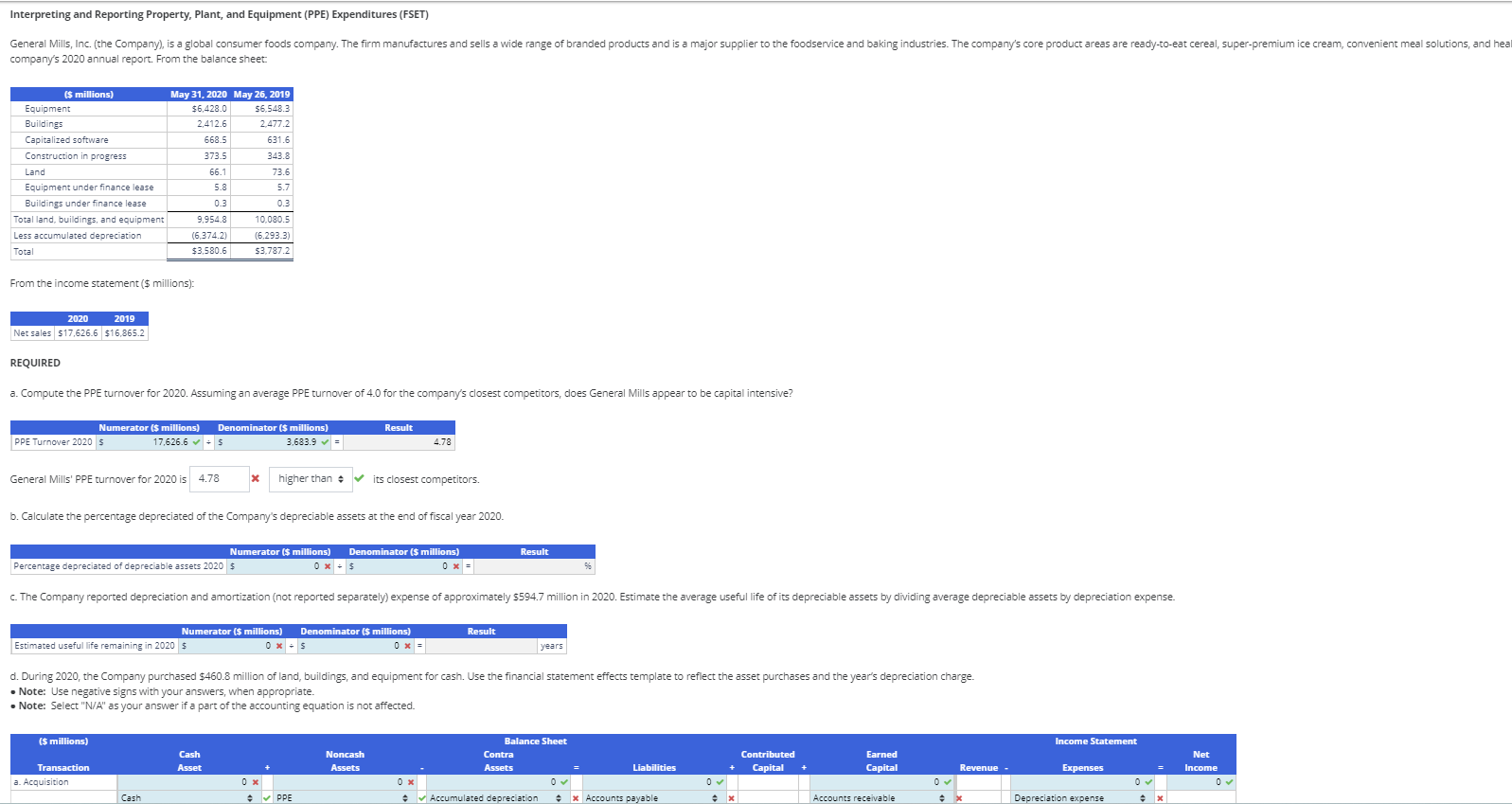

Interpreting and Reporting Property, Plant, and Equipment PPE Expenditures FSET

General Mills, Inc. the Company is a global consumer foods company. The rm manufactures and sells a wide range of branded products and is a major supplier to the foodservice and baking industries. The companys core product areas are readytoeat cereal, superpremium ice cream, convenient meal solutions, and healthy snacking. The following data are taken from the companys annual report. From the balance sheet:

$ millions May May

Equipment $ $

Buildings

Capitalized software

Construction in progress

Land

Equipment under finance lease

Buildings under finance lease

Total land, buildings, and equipment

Less accumulated depreciation

Total $ $

From the income statement $ millions:

Net sales $ $

a Compute the PPE turnover for Assuming an average PPE turnover of for the companys closest competitors, does General Mills appear to be capital intensive?

b Calculate the percentage depreciated of the Company's depreciable assets at the end of scal year

c The Company reported depreciation and amortization not reported separately expense of approximately $ million in Estimate the average useful life of its depreciable assets by dividing average depreciable assets by depreciation expense.

d During the Company purchased $ million of land, buildings, and equipment for cash. Use the nancial statement eects template to reect the asset purchases and the years depreciation charge.

Note: Use negative signs with your answers, when appropriate.

Note: Select NA as your answer if a part of the accounting equation is not affected.Interpreting and Reporting Property, Plant, and Equipment PPE Expenditures FSET

company's annual report. From the balance sheet:

From the income statement $ millions:

REQUIRED

a Compute the PPE turnover for Assuming an average PPE turnover of for the company's closest competitors, does General Mills appear to be capital intensive?

b Calculate the percentage depreciated of the Company's depreciable assets at the end of fiscal year

d During the Company purchased $ million of land, buildings, and equipment for cash. Use the financial statement effects template to reflect the asset purchases and the year's depreciation charge.

Note: Use negative signs with your answers, when appropriate.

Note: Select NA as your answer if a part of the accounting equation is not affected.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started