Question

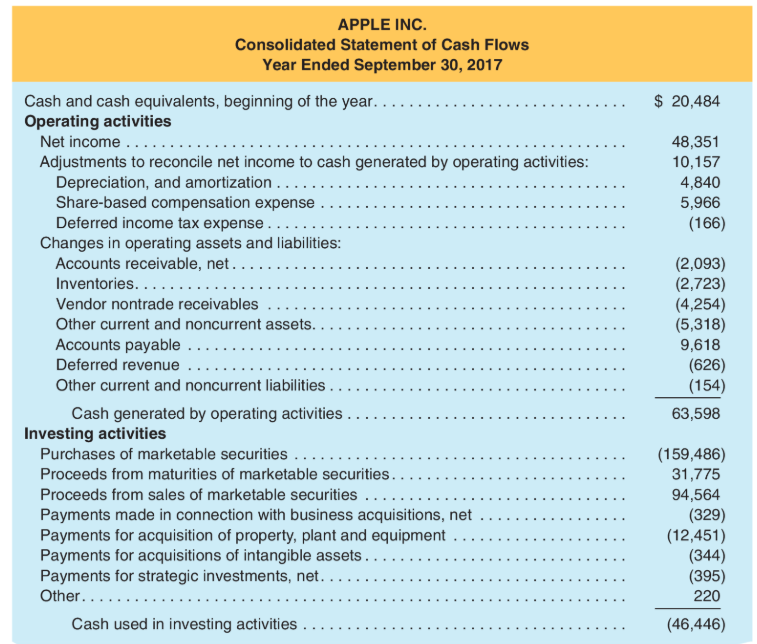

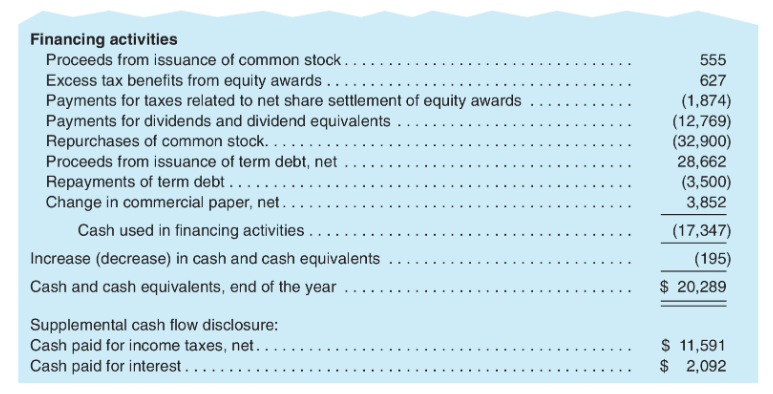

Interpreting Cash Flow Information The 2017 cash ow statement for Apple Inc. is presented below (all $ amounts in millions): REQUIRED a. Did Apples accounts

Interpreting Cash Flow Information

The 2017 cash ow statement for

Apple Inc. is presented below (all $ amounts in millions):

REQUIRED

a. Did Apples accounts receivable go up or down in 2017? Apple reported net sales of $229,234

in its fiscal 2017 income statement. What amount of cash did Apple collect from customers

during the year? (Ignore the Vendor nontrade receivables account, which relates to Apples

suppliers.)

b. Apples cost of goods sold was $141,048 million in 2017. Assuming that accounts payable ap-

plies only to the purchase of inventory, what amount did Apple pay to purchase inventory in

2017?

c. At September 30, 2017, Apple reported a balance of $33.8 billion in property, plant, and

equipment, net of accumulated depreciation, and its footnotes revealed that depreciation ex-

pense on property, plant, and equipment was $8.2 billion for fiscal 2017. What was the balance

in property, plant, and equipment, net of accumulated depreciation at the end of fiscal 2016?

d. Apple lists stock-based compensation as a positive amount$4,840 millionunder cash ow

from operating activities. Why is this amount listed here? Explain how this amount increases

cash ow from operating activities

APPLE INC. Consolidated Statement of Cash Flows Year Ended September 30, 2017 Cash and cash equivalents, beginning of the year. Operating activities Net income...... $20,484 48,351 Adjustments to reconcile net income to cash generated by operating activities: Depreciation, and amortization . ... Share-based compensation expense Deferred income tax expense... Changes in operating assets and liabilities: Accounts receivable, net. 10,157 4,840 5,966 (166) (2,093) (2,723) (4,254) (5,318) Inventories...... Vendor nontrade receivables Other current and noncurrent assets Accounts payable 9,618 Deferred revenue (626) (154) Other current and noncurrent liabilities Cash generated by operating activities Investing activities 63,598 Purchases of marketable securities (159,486) 31,775 Proceeds from maturities of marketable securities.. Proceeds from sales of marketable securities ... 94,564 Payments made in connection with business acquisitions, net Payments for acquisition of property, plant and equipment Payments for acquisitions of intangible assets. . . . Payments for strategic investments, net. Other.... . (329) (12,451) (344) (395) 220 Cash used in investing activities (46,446) Financing activities Proceeds from issuance of common stock . . . Excess tax benefits from equity awards... Payments for taxes related to net share settlement of equity awards Payments for dividends and dividend equivalents Repurchases of common stock. ..... Proceeds from issuance of term debt, net 555 627 (1,874) (12,769) (32,900) 28,662 (3,500) 3,852 Repayments of term debt... . .. Change in commercial paper, net Cash used in financing activities.. (17,347) Increase (decrease) in cash and cash equivalents (195) Cash and cash equivalents, end of the year 20,289 Supplemental cash flow disclosure: Cash paid for income taxes, net . . Cash paid for interest. .. . $11,591 2,092Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started