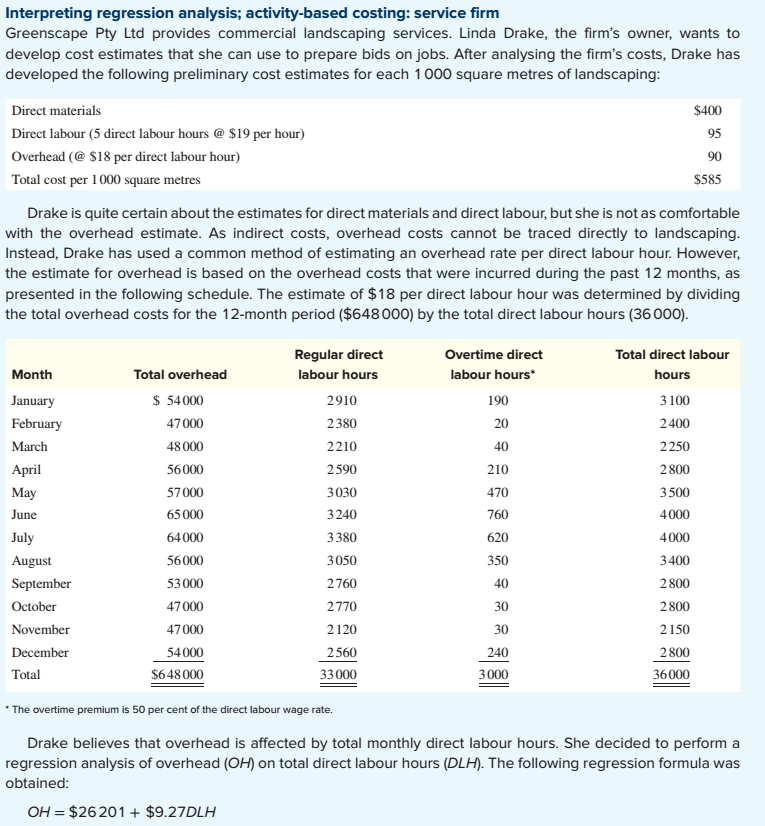

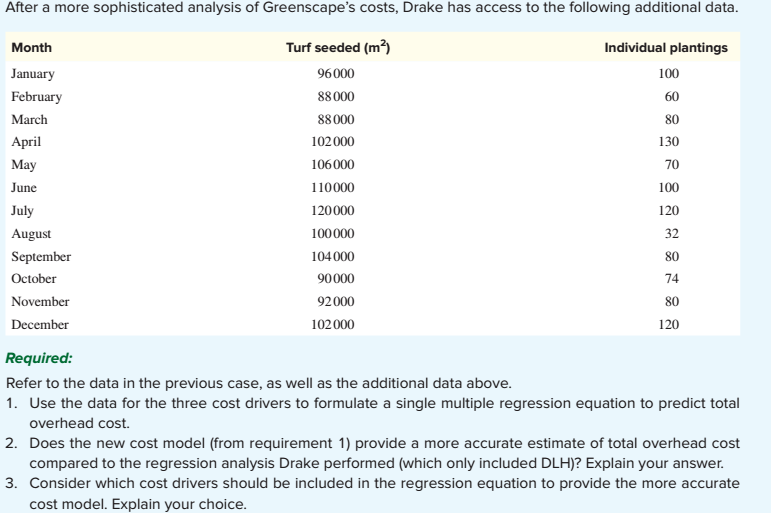

Interpreting regression analysis; activity-based costing: service firm Greenscape Pty Ltd provides commercial landscaping services. Linda Drake, the firm's owner, wants to develop cost estimates that she can use to prepare bids on jobs. After analysing the firm's costs, Drake has developed the following preliminary cost estimates for each 1 000 square metres of landscaping Direct materials Direct labour (5 direct labour hours @ $19 per hour) Overhead (@ $18 per direct labour hour) Total cost per 1000 square metres 95 90 $585 Drake is quite certain about the estimates for direct materials and direct labour, but she is not as comfortable with the overhead estimate. As indirect costs, overhead costs cannot be traced directly to landscaping Instead, Drake has used a common method of estimating an overhead rate per direct labour hour. However, the estimate for overhead is based on the overhead costs that were incurred during the past 12 months, as presented in the following schedule. The estimate of $18 per direct labour hour was determined by dividing the total overhead costs for the 12-month period ($648 000) by the total direct labour hours (36 000) Regular direct labour hours 2910 2380 2210 2590 3030 3240 3380 3050 2760 2770 2120 2560 33000 Overtime direct Total direct labour hours 3 100 2400 2250 2800 3500 4000 4000 3400 2800 2800 2150 2800 36000 Month Total overhead labour hours $ 54000 47000 48000 56000 57000 65000 64000 56000 53000 47000 47000 54000 $648000 190 20 40 210 470 760 620 350 40 30 anuary March April une July August September October December 240 Total 3000 The overtime premium is 50 per cent of the direct labour wage rate. Drake believes that overhead is affected by total monthly direct labour hours. She decided to perform a regression analysis of overhead (OH) on total direct labour hours (DLH). The following regression formula was obtained: OH- $26201$9.27DLH After a more sophisticated analysis of Greenscape's costs, Drake has access to the following additional data Month January February March April May June Turf seeded (m2) 96000 88000 88000 102000 106000 110000 120000 100000 04000 90000 92000 102000 Individual plantings 100 60 80 130 70 100 120 32 80 74 80 120 August September October November December Required: Refer to the data in the previous case, as well as the additional data above 1. Use the data for the three cost drivers to formulate a single multiple regression equation to predict total overhead cost. 2. Does the new cost model (from requirement 1) provide a more accurate estimate of total overhead cost compared to the regression analysis Drake performed (which only included DLH)? Explain your answer. 3. Consider which cost drivers should be included in the regression equation to provide the more accurate cost model. Explain your choice Interpreting regression analysis; activity-based costing: service firm Greenscape Pty Ltd provides commercial landscaping services. Linda Drake, the firm's owner, wants to develop cost estimates that she can use to prepare bids on jobs. After analysing the firm's costs, Drake has developed the following preliminary cost estimates for each 1 000 square metres of landscaping Direct materials Direct labour (5 direct labour hours @ $19 per hour) Overhead (@ $18 per direct labour hour) Total cost per 1000 square metres 95 90 $585 Drake is quite certain about the estimates for direct materials and direct labour, but she is not as comfortable with the overhead estimate. As indirect costs, overhead costs cannot be traced directly to landscaping Instead, Drake has used a common method of estimating an overhead rate per direct labour hour. However, the estimate for overhead is based on the overhead costs that were incurred during the past 12 months, as presented in the following schedule. The estimate of $18 per direct labour hour was determined by dividing the total overhead costs for the 12-month period ($648 000) by the total direct labour hours (36 000) Regular direct labour hours 2910 2380 2210 2590 3030 3240 3380 3050 2760 2770 2120 2560 33000 Overtime direct Total direct labour hours 3 100 2400 2250 2800 3500 4000 4000 3400 2800 2800 2150 2800 36000 Month Total overhead labour hours $ 54000 47000 48000 56000 57000 65000 64000 56000 53000 47000 47000 54000 $648000 190 20 40 210 470 760 620 350 40 30 anuary March April une July August September October December 240 Total 3000 The overtime premium is 50 per cent of the direct labour wage rate. Drake believes that overhead is affected by total monthly direct labour hours. She decided to perform a regression analysis of overhead (OH) on total direct labour hours (DLH). The following regression formula was obtained: OH- $26201$9.27DLH After a more sophisticated analysis of Greenscape's costs, Drake has access to the following additional data Month January February March April May June Turf seeded (m2) 96000 88000 88000 102000 106000 110000 120000 100000 04000 90000 92000 102000 Individual plantings 100 60 80 130 70 100 120 32 80 74 80 120 August September October November December Required: Refer to the data in the previous case, as well as the additional data above 1. Use the data for the three cost drivers to formulate a single multiple regression equation to predict total overhead cost. 2. Does the new cost model (from requirement 1) provide a more accurate estimate of total overhead cost compared to the regression analysis Drake performed (which only included DLH)? Explain your answer. 3. Consider which cost drivers should be included in the regression equation to provide the more accurate cost model. Explain your choice