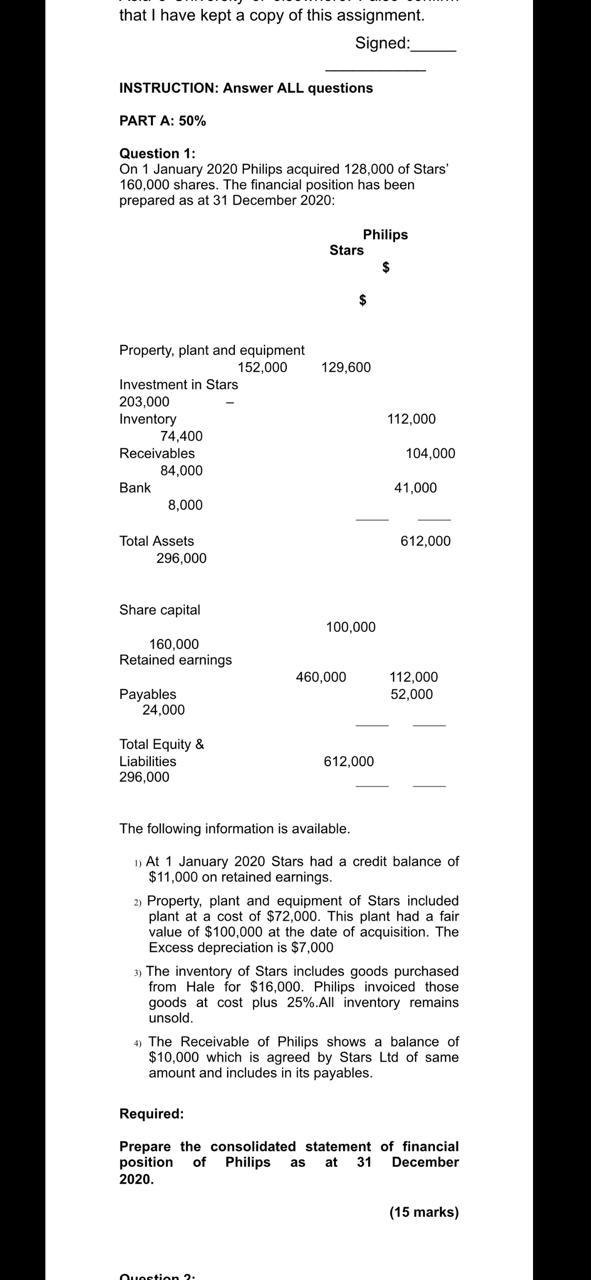

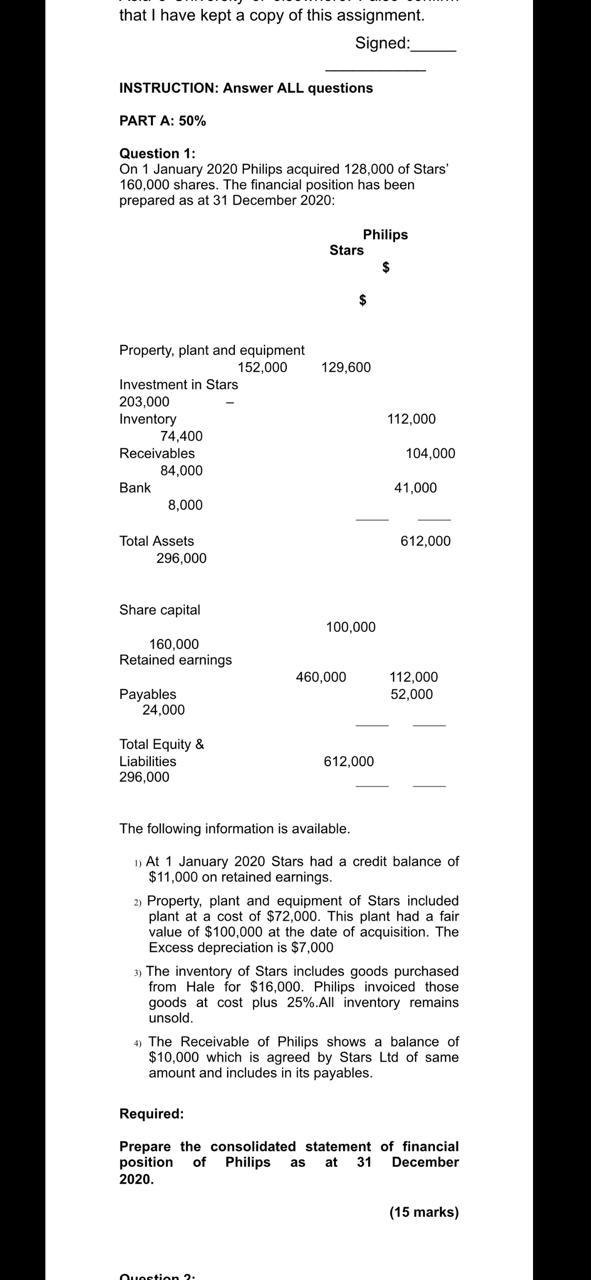

that I have kept a copy of this assignment. Signed: INSTRUCTION: Answer ALL questions PART A: 50% Question 1: On 1 January 2020 Philips acquired 128,000 of Stars' 160,000 shares. The financial position has been prepared as at 31 December 2020: Philips Stars $ $ 129,600 Property, plant and equipment 152,000 Investment in Stars 203,000 Inventory 74,400 Receivables 84,000 Bank 8,000 112,000 104,000 41,000 612,000 Total Assets 296,000 Share capital 100,000 160,000 Retained earnings 460,000 112,000 Payables 24.000 52,000 Total Equity & Liabilities 296,000 612,000 The following information is available. 1) At 1 January 2020 Stars had a credit balance of $11,000 on retained earnings. 2) Property, plant and equipment of Stars included plant at a cost of $72,000. This plant had a fair value of $100.000 at the date of acquisition. The Excess depreciation is $7,000 3) The inventory of Stars includes goods purchased from Hale for $16,000. Philips invoiced those goods at cost plus 25%.All inventory remains unsold. 4) The Receivable of Philips shows a balance of $10,000 which is agreed by Stars Ltd of same amount and includes in its payables. Required: Prepare the consolidated statement of financial position of Philips as at 31 December 2020. (15 marks) Nunction 2 that I have kept a copy of this assignment. Signed: INSTRUCTION: Answer ALL questions PART A: 50% Question 1: On 1 January 2020 Philips acquired 128,000 of Stars' 160,000 shares. The financial position has been prepared as at 31 December 2020: Philips Stars $ $ 129,600 Property, plant and equipment 152,000 Investment in Stars 203,000 Inventory 74,400 Receivables 84,000 Bank 8,000 112,000 104,000 41,000 612,000 Total Assets 296,000 Share capital 100,000 160,000 Retained earnings 460,000 112,000 Payables 24.000 52,000 Total Equity & Liabilities 296,000 612,000 The following information is available. 1) At 1 January 2020 Stars had a credit balance of $11,000 on retained earnings. 2) Property, plant and equipment of Stars included plant at a cost of $72,000. This plant had a fair value of $100.000 at the date of acquisition. The Excess depreciation is $7,000 3) The inventory of Stars includes goods purchased from Hale for $16,000. Philips invoiced those goods at cost plus 25%.All inventory remains unsold. 4) The Receivable of Philips shows a balance of $10,000 which is agreed by Stars Ltd of same amount and includes in its payables. Required: Prepare the consolidated statement of financial position of Philips as at 31 December 2020. (15 marks) Nunction 2