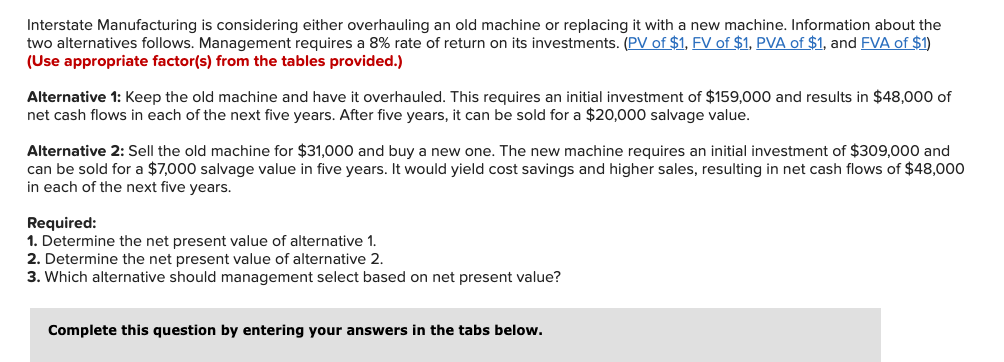

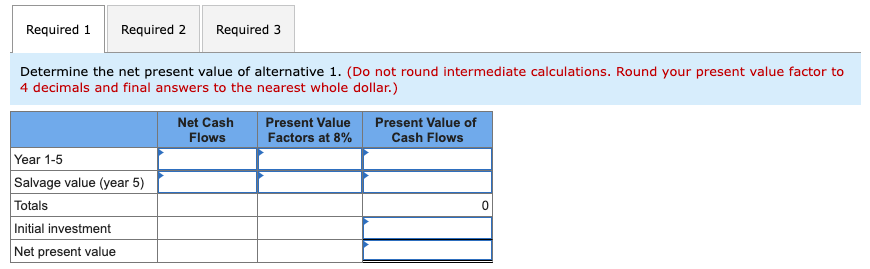

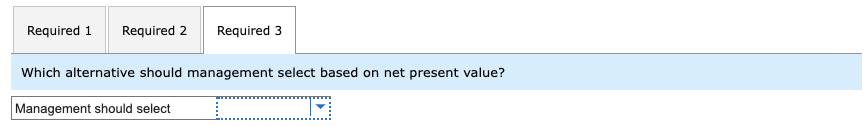

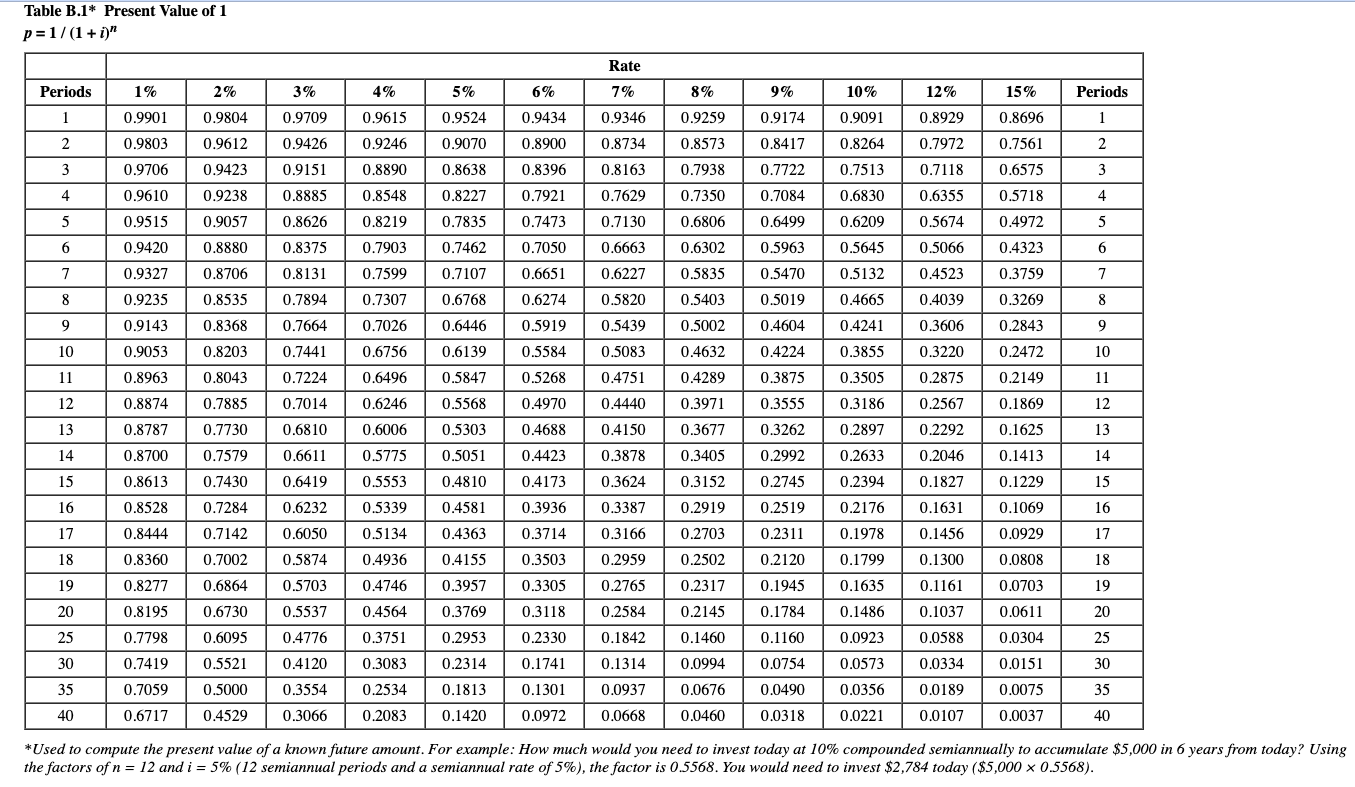

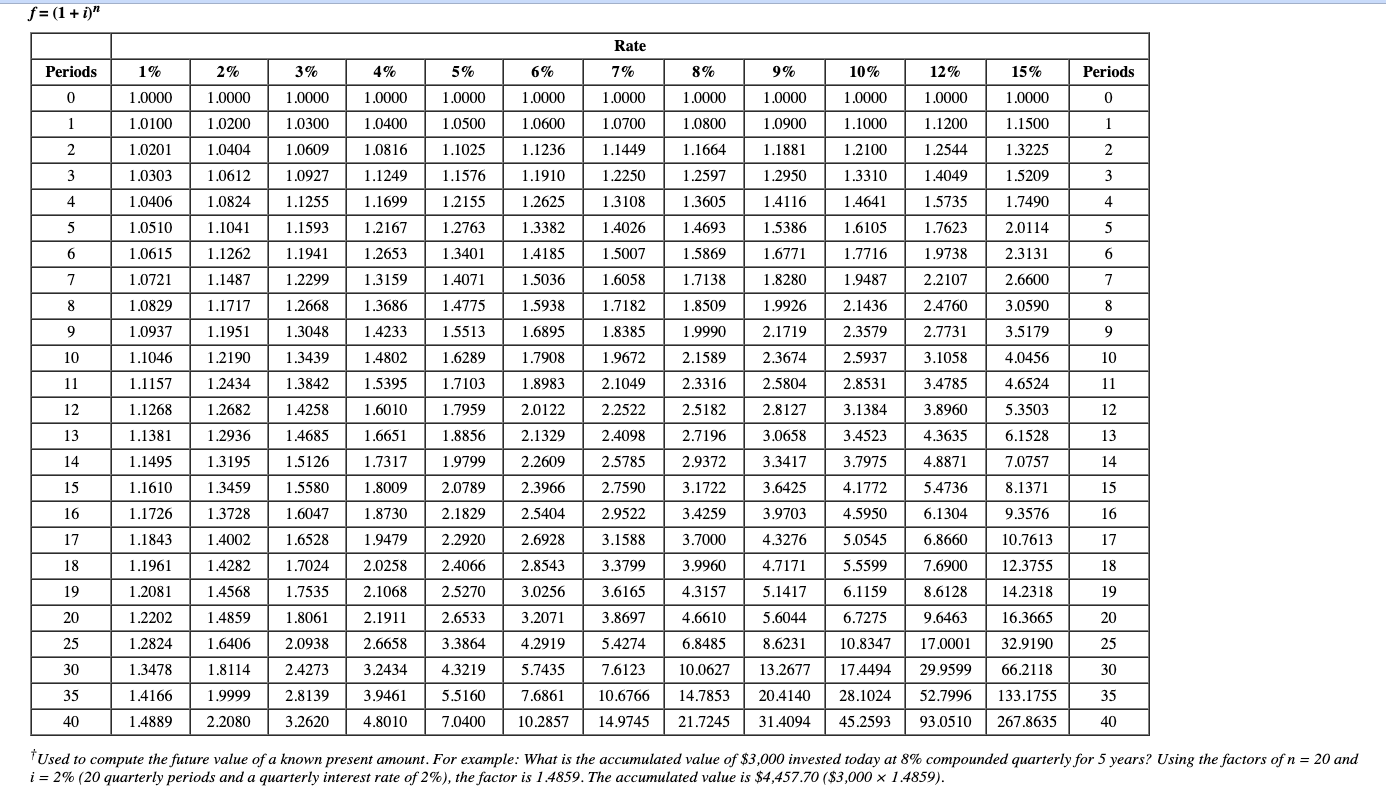

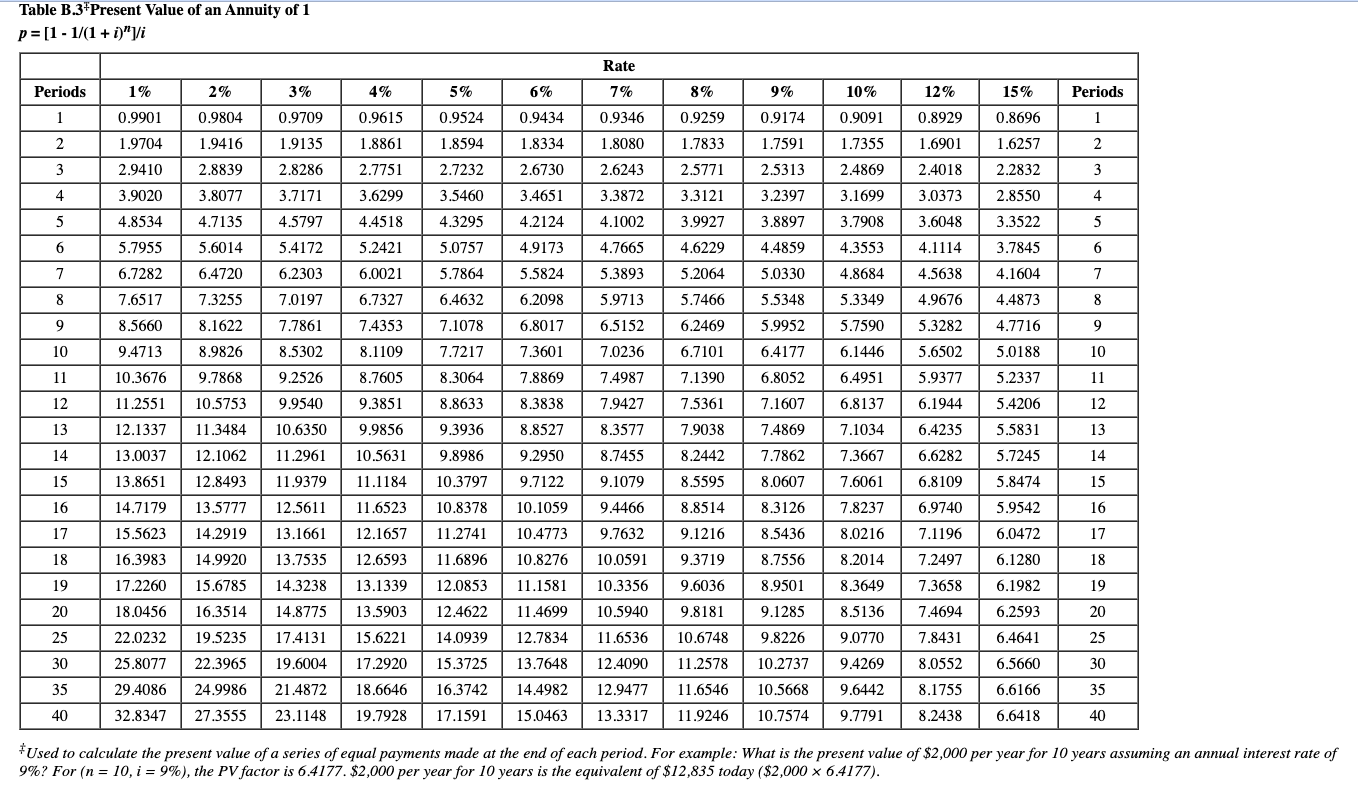

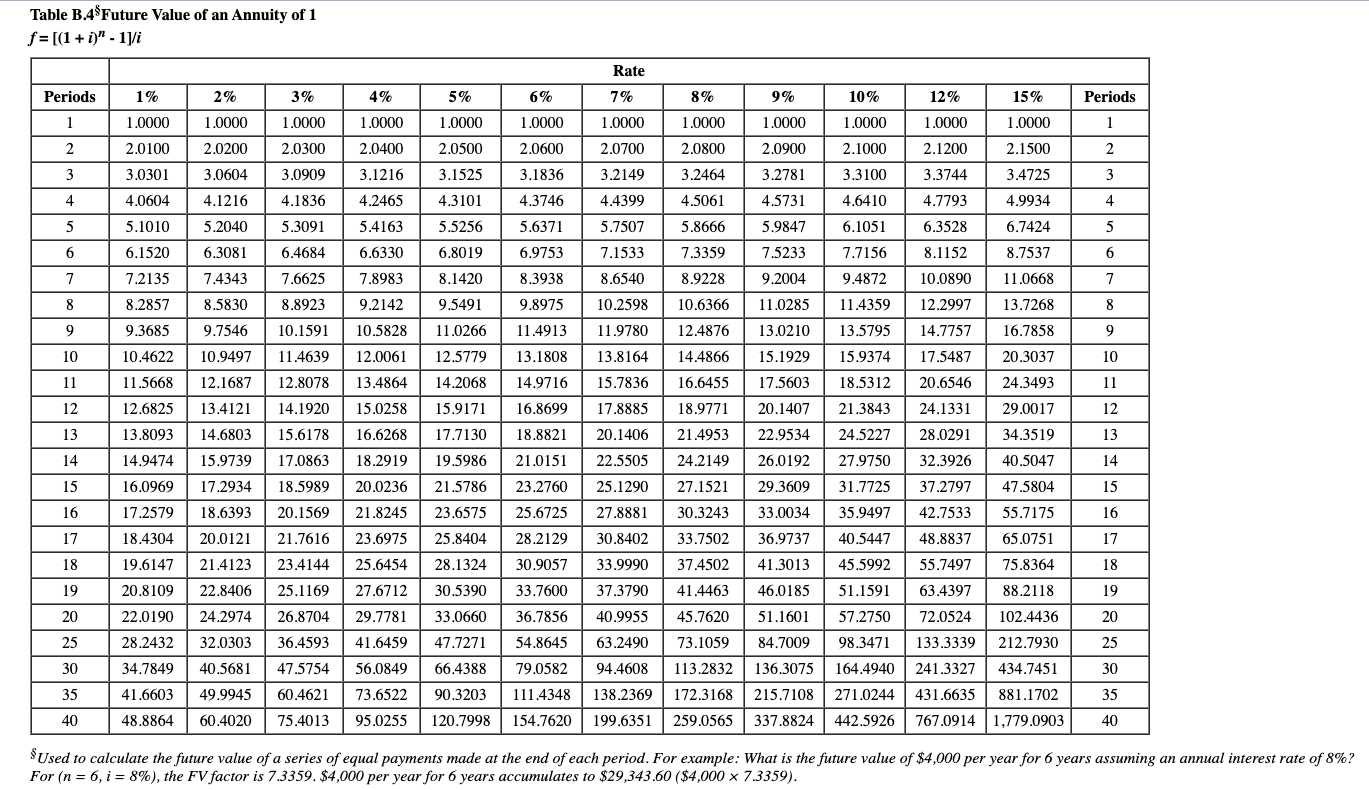

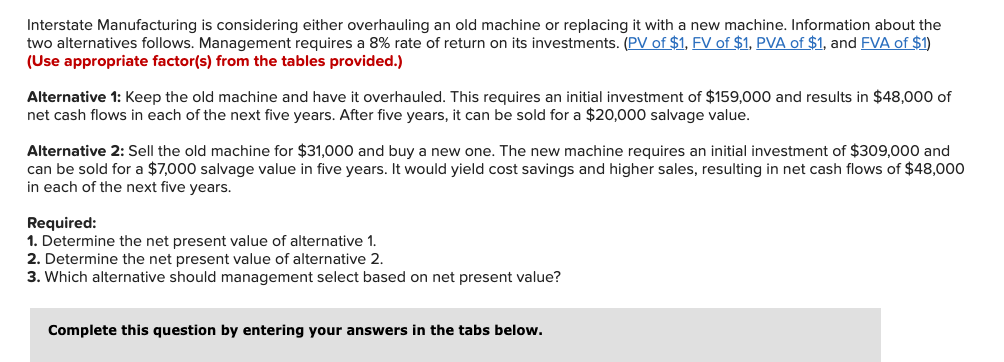

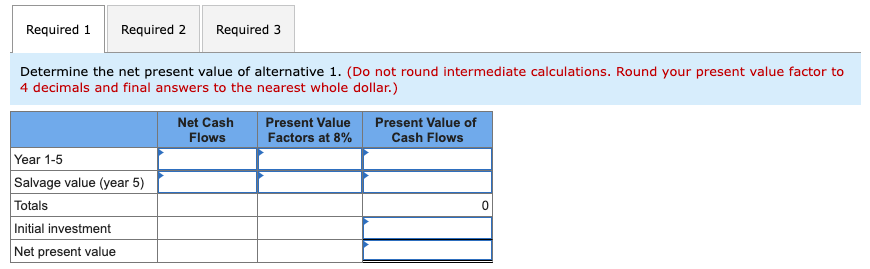

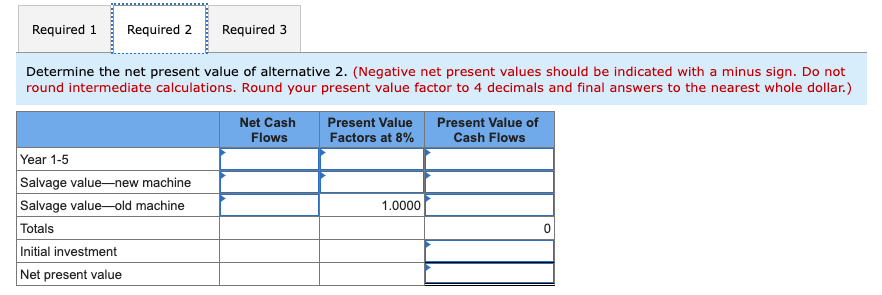

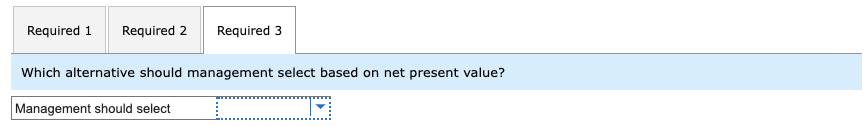

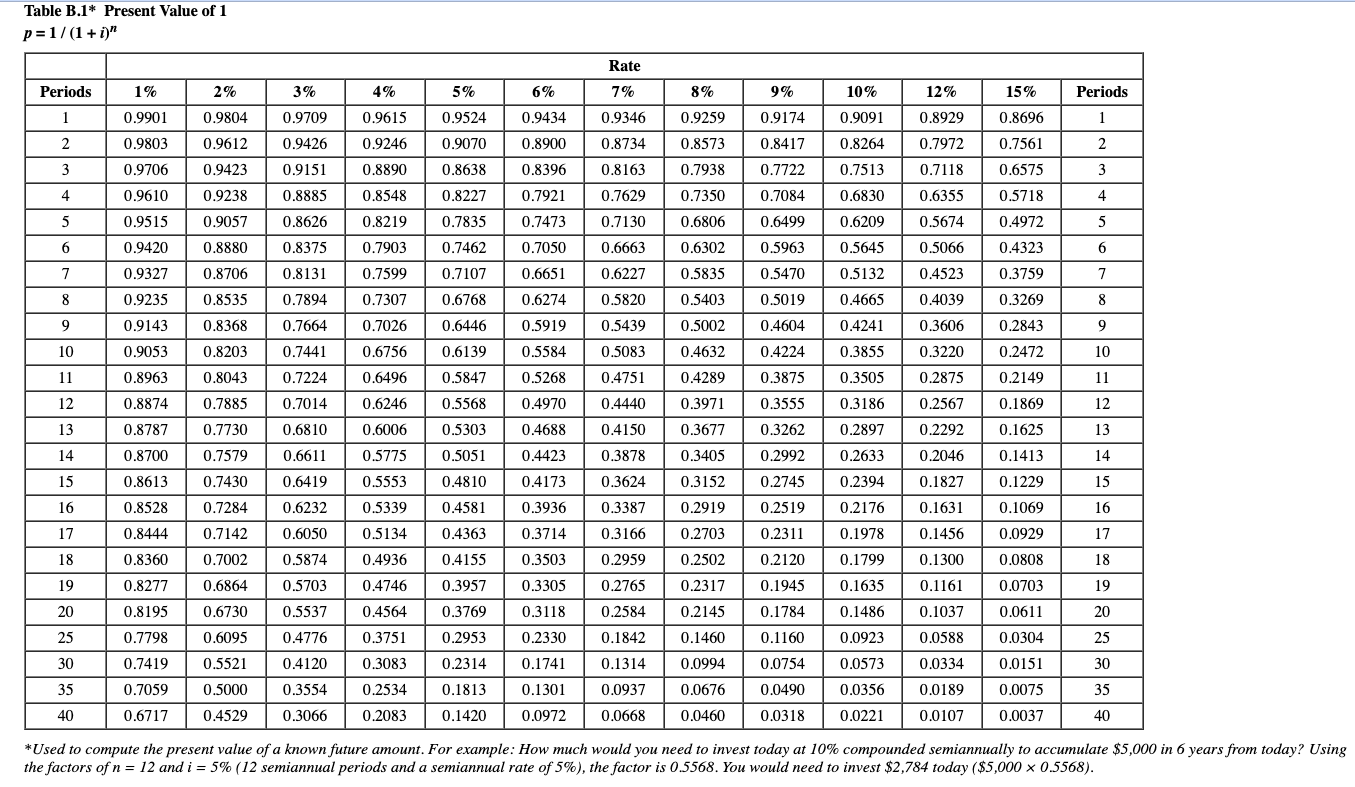

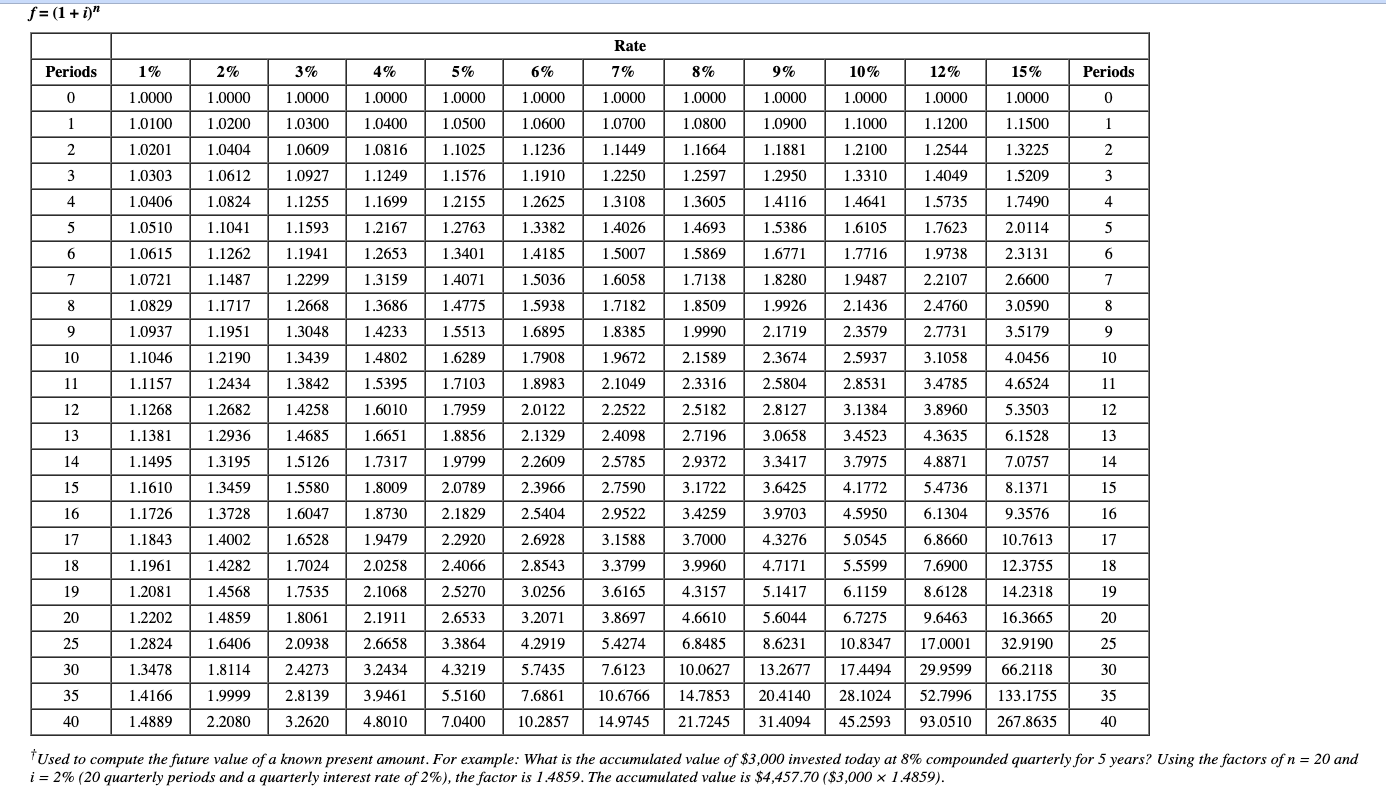

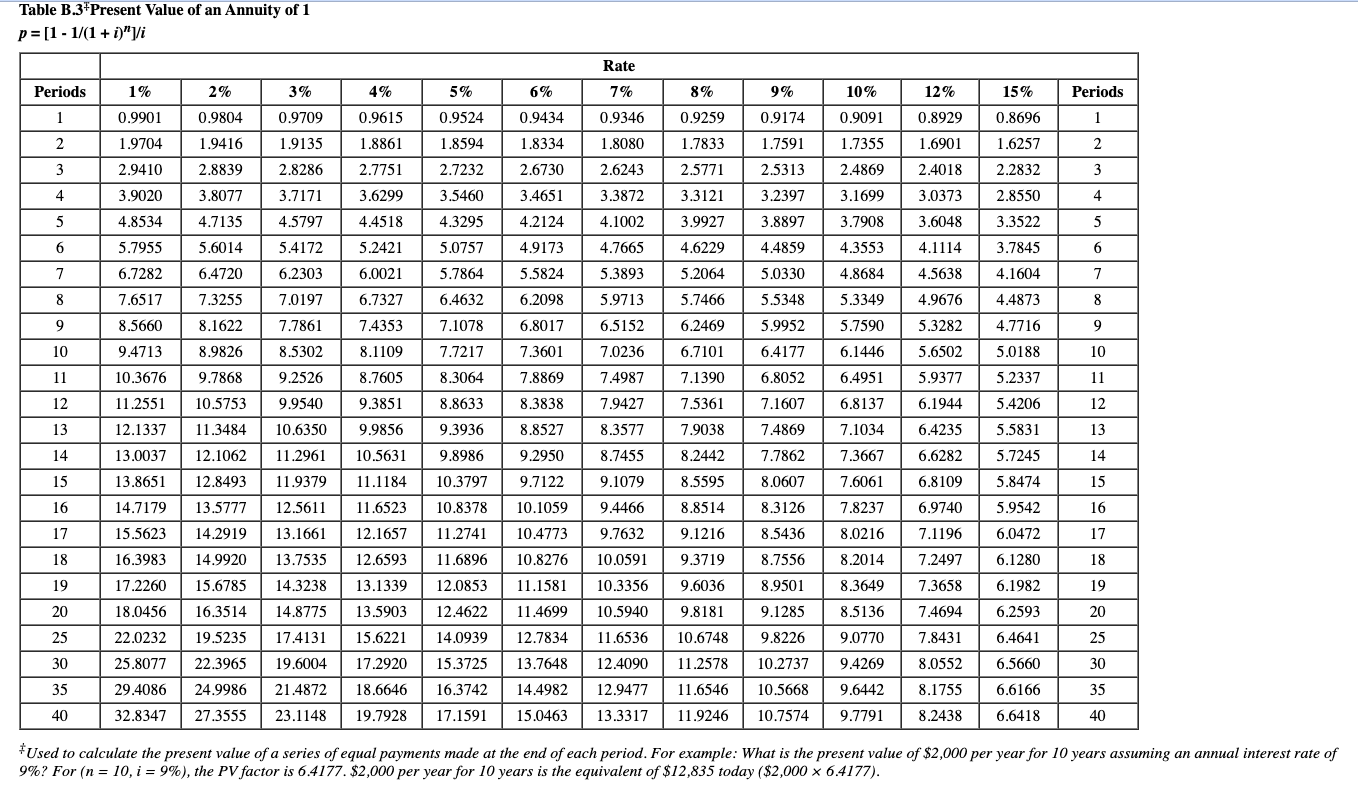

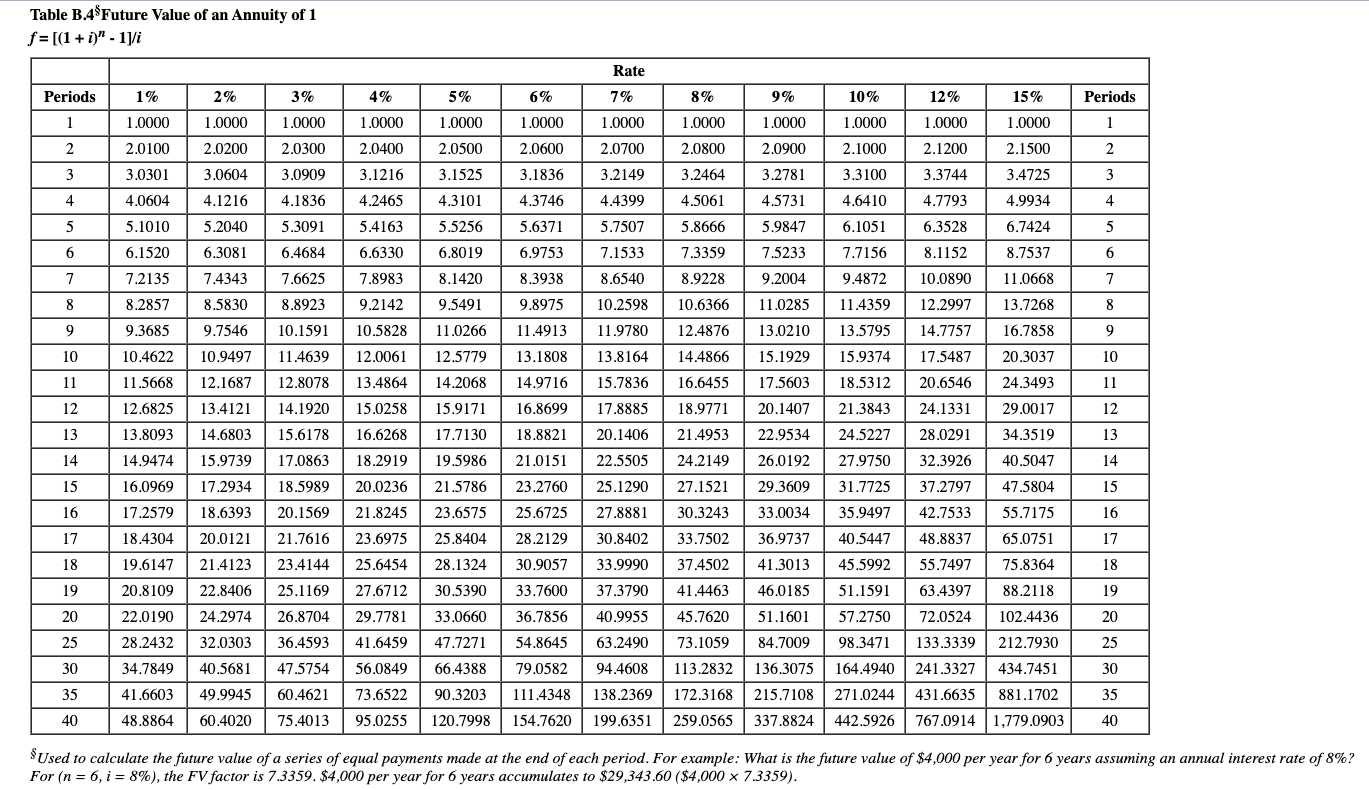

Interstate Manufacturing is considering either overhauling an old machine or replacing it with a new machine. Information about the two alternatives follows. Management requires a 8% rate of return on its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Alternative 1: Keep the old machine and have it overhauled. This requires an initial investment of $159,000 and results in $48,000 of net cash flows in each of the next five years. After five years, it can be sold for a $20,000 salvage value. Alternative 2: Sell the old machine for $31,000 and buy a new one. The new machine requires an initial investment of $309,000 and can be sold for a $7,000 salvage value in five years. It would yield cost savings and higher sales, resulting in net cash flows of $48,000 in each of the next five years. Required: 1. Determine the net present value of alternative 1. 2. Determine the net present value of alternative 2. 3. Which alternative should management select based on net present value? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine the net present value of alternative 1. (Do not round intermediate calculations. Round your present value factor to 4 decimals and final answers to the nearest whole dollar.) Net Cash Flows Present Value Factors at 8% Present Value of Cash Flows Year 1-5 Salvage value (year 5) Totals Initial investment Net present value 0 Required 1 Required 2 Required 3 Determine the net present value of alternative 2. (Negative net present values should be indicated with a minus sign. Do not round intermediate calculations. Round your present value factor to 4 decimals and final answers to the nearest whole dollar.) Net Cash Flows Present Value Factors at 8% Present Value of Cash Flows 1.0000 Year 1-5 Salvage value-new machine Salvage value-old machine Totals Initial investment Net present value 0 Required 1 Required 2 Required 3 Which alternative should management select based on net present value? Management should select CM Table B.1* Present Value of 1 p=1/(1+ ip" Rate Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 15% Periods 1 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.8929 1 | | | 0.8696 0.7561 2 0.9803 0.9612 0.9426 0.9246 0.9070 0.8900 0.8734 0.8573 0.8417 . 0.8264 2 0.7972 0.7118 3 0.9706 0.9423 0.9151 0.8890 0.8638 0.8396 0.8163 0.7938 0.7722 0.7513 0.6575 3 4 0.9610 0.9238 0.8885 0.8548 0.8227 0.7921 0.7629 0.7350 0.7084 0.6830 0.6355 0.5718 4 5 0.9515 0.9057 0.8626 0.8219 0.7835 0.7473 0.7130 0.6806 0.6499 0.6209 0.5674 0.4972 5 6 0.9420 0.8880 0.8375 0.7903 0.7462 0.7050 0.6663 0.6302 0.5963 0.5645 0.4323 6 0.5066 0.4523 7 0.8706 0.7599 0.7107 0.6651 0.6227 0.5835 0.5470 0.5132 0.3759 0.9327 0.9235 7 0.8131 0.7894 8 0.8535 0.7307 0.6768 0.6274 0.5820 0.5403 0.5019 0.4665 0.4039 0.3269 8 9 0.9143 0.8368 0.7664 0.7026 0.6446 0.5919 0.5439 0.5002 0.4604 0.4241 0.3606 0.2843 9 10 0.9053 0.8203 0.7441 0.6756 0.6139 0.5584 0.5083 0.4224 0.3855 0.3220 0.2472 10 0.4632 0.4289 11 0.8963 0.8043 0.7224 0.6496 0.5847 0.5268 0.4751 0.3875 0.3505 0.2875 0.2149 11 12 0.8874 0.7885 0.7014 0.6246 0.5568 0.4440 0.3971 0.3555 0.3186 0.2567 0.1869 12 0.4970 0.4688 13 0.8787 0.7730 0.6810 0.6006 0.5303 0.4150 0.3677 0.3262 0.2897 0.2292 0.1625 13 14 0.8700 0.7579 0.5775 0.5051 0.4423 0.3878 0.3405 0.2992 0.2046 0.1413 14 0.6611 0.6419 0.2633 0.2394 15 0.8613 0.7430 0.5553 0.4810 0.4173 0.3624 0.3152 0.2745 0.1229 15 16 0.8528 0.6232 0.5339 0.3936 0.3387 0.2919 0.2519 0.2176 0.1069 16 0.4581 0.4363 17 0.7284 0.7142 0.7002 0.8444 0.1827 0.1631 0.1456 0.1300 0.6050 0.5134 0.3714 0.3166 0.2703 0.2311 0.1978 0.0929 17 18 0.8360 0.5874 0.4936 0.4155 0.3503 0.2959 0.2120 0.1799 0.0808 18 0.2502 0.2317 19 0.8277 0.6864 0.5703 0.4746 0.3957 0.3305 0.2765 0.1945 0.1635 0.1161 0.0703 19 20 0.6730 0.5537 0.4564 0.2584 0.2145 0.1784 20 0.8195 0.7798 0.3769 0.2953 0.3118 0.2330 0.1486 0.0923 0.1037 0.0588 0.0611 0.0304 25 0.6095 0.4776 0.3751 0.1842 0.1460 0.1160 25 30 0.7419 0.5521 0.4120 0.3083 0.2314 0.1741 0.1314 0.0994 0.0754 0.0573 0.0334 0.0151 30 35 0.5000 0.3554 0.2534 0.1301 0.0937 0.0676 0.0490 0.0356 0.0189 35 0.7059 0.6717 0.1813 0.1420 0.0075 0.0037 40 0.4529 0.3066 0.2083 0.0972 0.0668 0.0460 0.0318 0.0221 0.0107 40 *Used to compute the present value of a known future amount. For example: How much would you need to invest today at 10% compounded semiannually to accumulate $5,000 in 6 years from today? Using the factors of n = 12 and i = 5% (12 semiannual periods and a semiannual rate of 5%), the factor is 0.5568. You would need to invest $2,784 today ($5,000 x 0.5568). f=(1+ :* Rate Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 15% Periods 0 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 0 1.0000 1.1200 1 1.0100 1.0200 1.0300 1.0400 1.0500 1,0600 1.0700 1.0800 1.0900 1 1.1000 1.2100 2 1.1500 1.3225 1.0201 1.0404 1.0609 1.0816 1.1025 |||||||| 1.1236 1.1449 1.1664 1.1881 1.2544 2 3 1.0303 1.1249 1.1576 1.1910 1.2250 1.2950 1.3310 1.4049 1.5209 1.0612 1.0824 3 1.0927 1.1255 | | | | | | 1.2597 1.3605 4 1.0406 1.1699 1.2155 1.2625 1.3108 1.4116 1.4641 1.5735 1.7490 4 5 1.1041 1.1593 1.2167 1.2763 1.3382 1.4026 1.4693 1.5386 1.6105 1.7623 2.0114 5 1.0510 1.0615 6 1.1941 1.2653 1.3401 1.4185 1.5007 1.5869 1.6771 1.7716 1.9738 2.3131 6 . 7 1.0721 1.1262 1.1487 1.1717 1.2299 1.3159 1.4071 1.8280 1.9487 2.2107 7 1.5036 1.5938 1.6058 1.7182 1.7138 1.8509 2.6600 3.0590 8 1.0829 1.2668 1.3686 1.4775 1.9926 2.1436 2.4760 8 9 1.0937 1.1951 1.3048 1.4233 1.5513 1.6895 1.8385 2.1719 2.3579 2.7731 3.5179 9 1.9990 2.1589 10 1.1046 1.2190 1.3439 1.4802 1.6289 1.7908 1.9672 3.1058 4.0456 10 1.1157 1.2434 1.3842 1.5395 1.7103 1.8983 2.1049 2.3316 2.3674 2.5804 2.8127 3.4785 11 12 11 2.5937 2.8531 3.1384 3.4523 4.6524 5.3503 1.1268 1.2682 1.4258 1.6010 1.7959 2.0122 2.2522 2.5182 3.8960 12 13 1.1381 1.2936 1.4685 1.6651 2.1329 2.4098 2.7196 3.0658 4.3635 13 14 1.3195 1.5126 1.7317 1.8856 1.9799 2.0789 2.2609 2.5785 2.9372 3.3417 3.7975 4.8871 6.1528 7.0757 8.1371 14 1.1495 1.1610 1.1726 T" 15 1.3459 1.5580 1.8009 2.3966 2.7590 3.6425 TT 4.1772 5.4736 3.1722 3.4259 15 16 1.3728 1.6047 1.8730 2.1829 2.5404 4.5950 6.1304 16 17 1.1843 1.4002 1.6528 1.9479 2.6928 3.7000 2.9522 3.1588 3.3799 2.2920 2.4066 5.0545 3.9703 4.3276 4.7171 17 6.8660 7.6900 9.3576 10.7613 12.3755 14.2318 18 1.1961 1.4282 1.7024 2.0258 2.8543 3.9960 18 5.5599 6.1159 19 1.2081 1.4568 1.7535 2.1068 2.5270 3.0256 3.6165 4.3157 5.1417 8.6128 19 20 1.2202 || 1.4859 1.8061 2.1911 2.6533 3.2071 3.8697 4.6610 5.6044 9.6463 16.3665 20 25 1.6406 2.6658 3.3864 4.2919 5.4274 1.2824 1.3478 25 6.8485 10.0627 6.7275 10.8347 17.4494 8.6231 13.2677 2.0938 2.4273 2.8139 17.0001 29.9599 32.9190 66.2118 30 * 1.8114 3.2434 4.3219 5.7435 7.6123 30 35 1.4166 1.9999 || 3.9461 5.5160 7.6861 10.6766 20.4140 52.7996 133.1755 35 "T" 14.7853 21.7245 28.1024 45.2593 40 1.4889 2.2080 3.2620 4.8010 7.0400 10.2857 14.9745 31.4094 93.0510 267.8635 40 Used to compute the future value of a known present amount. For example: What is the accumulated value of $3,000 invested today at 8% compounded quarterly for 5 years? Using the factors of n = 20 and i = 2% (20 quarterly periods and a quarterly interest rate of 2%), the factor is 1.4859. The accumulated value is $4,457.70 ($3,000 x 1.4859). Table B.3*Present Value of an Annuity of 1 p= [1- 1/( 1+ 1)"]i Rate Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 15% Periods 1 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.8929 0.8696 1 0.9901 1.9704 1.9135 TT 1.8594 1.8334 1.8080 1.7833 1.7355 1.6901 ]]* 1.6257 2 3 2 1.9416 2.8839 1.8861 2.7751 1.7591 2.5313 TIT ||** 2.9410 2.8286 TTTT 2.7232 2.6243 2.5771 2.4869 2.4018 2.2832 3 2.6730 3.4651 4 3.9020 3.8077 3.6299 3.5460 3.3872 3.3121 3.2397 3.1699 3.0373 2.8550 4 3.7171 4.5797 5 ... 4.4518 4.3295 4.2124 4.1002 3.9927 3.8897 3.7908 | 3.6048 3.3522 5 4.8534 5.7955 4.7135 5.6014 6 5.2421 4.9173 4.6229 4.4859 4.3553 3.7845 6 5.4172 6.2303 5.0757 5.7864 4.7665 5.3893 4.1114 4.5638 7 6.7282 6.4720 6.0021 5.5824 5.2064 5.0330 4.8684 4.1604 7 8 7.6517 7.3255 7.0197 6.7327 6.4632 6.2098 5.9713 5.7466 5.5348 5.3349 4.9676 4.4873 8 | ola 9 8.5660 8.1622 7.1078 6.8017 6.5152 6.2469 5.9952 5.7590 5.3282 4.7716 9 7.7861 8.5302 7.4353 8.1109 10 9.4713 8.9826 7.3601 7.0236 6.7101 6.4177 6.1446 5.6502 5.0188 10 7.7217 8.3064 11 10.3676 9.2526 8.7605 7.8869 7.4987 6.8052 6.4951 5.9377 5.2337 11 9.7868 10.5753 7.1390 7.5361 12 9.9540 9.3851 8.8633 8.3838 7.9427 7.1607 6.8137 5.4206 12 6.1944 6.4235 13 11.3484 10.6350 9.9856 9.3936 8.8527 8.3577 7.9038 7.4869 7.1034 5.5831 13 14 12.1062 9.8986 8.7455 8.2442 7.7862 6.6282 5.7245 11.2961 11.9379 14 9.2950 9.7122 7.3667 7.6061 15 12.8493 10.3797 9.1079 8.5595 8.0607 6.8109 11.2551 12.1337 13.0037 13.8651 14.7179 15.5623 16.3983 17.2260 5.8474 15 16 10.5631 11.1184 11.6523 12.1657 12.6593 13.5777 10.8378 10.1059 8.8514 8.3126 7.8237 5.9542 12.5611 13.1661 16 9.4466 9.7632 6.9740 7.1196 17 14.2919 11.2741 10.4773 9.1216 8.5436 8.0216 6.0472 17 18 14.9920 13.7535 11.6896 10.8276 10.0591 9.3719 8.7556 8.2014 7.2497 6.1280 18 19 15.6785 14.3238 13.1339 12.0853 11.1581 10.3356 9.6036 8.9501 8.3649 7.3658 6.1982 19 20 18.0456 16.3514 14.8775 13.5903 11.4699 10.5940 9.8181 8.5136 6.2593 9.1285 9.8226 7.4694 7.8431 20 25 25 22.0232 12.4622 14.0939 15.3725 15.6221 12.7834 11.6536 10.6748 9.0770 19.5235 22.3965 6.4641 17.4131 19.6004 30 13.7648 12.4090 11.2578 10.2737 9.4269 8.0552 6.5660 30 25.8077 29.4086 17.2920 18.6646 35 24.9986 14.4982 11.6546 9.6442 8.1755 6.6166 35 21.4872 23.1148 16.3742 17.1591 12.9477 13.3317 10.5668 10.7574 40 32.8347 27.3555 19.7928 15.0463 11.9246 9.7791 8.2438 6.6418 40 *Used to calculate the present value of a series of equal payments made at the end of each period. For example: What is the present value of $2,000 per year for 10 years assuming an annual interest rate of 9%? For (n = 10, i = 9%), the PV factor is 6.4177. $2,000 per year for 10 years is the equivalent of $12,835 today ($2,000 x 64177). Table B.4$Future Value of an Annuity of 1 f=[(1 + i)" - 13/1 Rate Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 15% Periods 1 1 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 2 2.0100 2.0200 2.0300 2.0400 2.0500 2.0600 2.0700 2.0800 2.0900 2.1000 2.1200 2.1500 -am 2 3 3.0301 3.0604 3.0909 TT 3.1525 3.1836 3.2149 3.2464 3.2781 3.3100 3.3744 3.1216 4.2465 3.4725 4 4.0604 4.1216 4.1836 4.3746 4.4399 4.5061 4.5731 4.6410 4.7793 4.9934 4 4.3101 5.5256 5 5.1010 5.2040 5.4163 5.6371 5.7507 5.8666 5.9847 6.1051 6.3528 6.7424 5 5.3091 6.4684 6 6.1520 6.3081 6.6330 6.9753 TT 7.1533 7.3359 7.5233 7.7156 8.1152 8.7537 6.8019 8.1420 6 7 7.2135 7.6625 8.3938 8.6540 8.9228 a 9.4872 10.0890 7 7.4343 8.5830 9.2004 11.0285 8 8.2857 7.8983 9.2142 10.5828 8.8923 9.5491 9.8975 10.2598 10.6366 11.0668 13.7268 16.7858 11.4359 13.5795 8 12.2997 14.7757 9 9.3685 9.7546 10.1591 11.0266 11.4913 11.9780 12.4876 13.0210 9 10 10.4622 10.9497 11.4639 12.0061 12.5779 13.1808 14.4866 15.1929 15.9374 20.3037 10 13.8164 15.7836 11 11.5668 12.1687 12.8078 14.9716 16.6455 17.5603 24.3493 13.4864 15.0258 11 17.5487 20.6546 24.1331 14.2068 15.9171 18.5312 21.3843 12 12.6825 13.4121 14.1920 16.8699 17.8885 20.1407 29.0017 12 13 14.6803 15.6178 16.6268 17.7130 18.8821 20.1406 22.9534 28.0291 34.3519 13 13.8093 14.9474 18.9771 21.4953 24.2149 27.1521 24.5227 27.9750 14 15.9739 17.0863 18.2919 22.5505 26.0192 32.3926 40.5047 14 21.0151 23.2760 15 16.0969 17.2934 18.5989 19.5986 21.5786 23.6575 20.0236 25.1290 29.3609 47.5804 15 31.7725 35.9497 | al 16 17.2579 18.6393 20.1569 21.8245 27.8881 33.0034 37.2797 42.7533 48.8837 55.7175 16 17 18.4304 20.0121 25.8404 25.6725 28.2129 30.9057 30.8402 30.3243 33.7502 37.4502 40.5447 65.0751 23.6975 25.6454 17 21.7616 23.4144 25.1169 36.9737 41.3013 18 19.6147 21.4123 28.1324 33.9990 55.7497 75.8364 18 45.5992 51.1591 19 20.8109 22.8406 30.5390 37.3790 46.0185 63.4397 88.2118 19 33.7600 36.7856 41.4463 45.7620 20 24.2974 27.6712 29.7781 41.6459 26.8704 40.9955 72.0524 22.0190 28.2432 20 33.0660 47.7271 51.1601 84.7009 25 36.4593 32.0303 40.5681 25 57.2750 98.3471 164.4940 73.1059 113.2832 30 102.4436 212.7930 434.7451 34.7849 54.8645 79.0582 111.4348 47.5754 63.2490 94.4608 138.2369 56.0849 136.3075 133.3339 241.3327 431.6635 30 35 41.6603 66.4388 90.3203 120.7998 49.9945 60.4621 73.6522 271.0244 35 172.3168 259.0565 215.7108 337.8824 881.1702 1,779.0903 40 48.8864 60.4020 75.4013 95.0255 154.7620 199.6351 442.5926 767.0914 40 $Used to calculate the future value of a series of equal payments made at the end of each period. For example: What is the future value of $4,000 per year for 6 years assuming an annual interest rate of 8%? For (n = 6,i = 8%), the FV factor is 7.3359. $4,000 per year for 6 years accumulates to $29,343.60 ($4,000 x 7.3359)