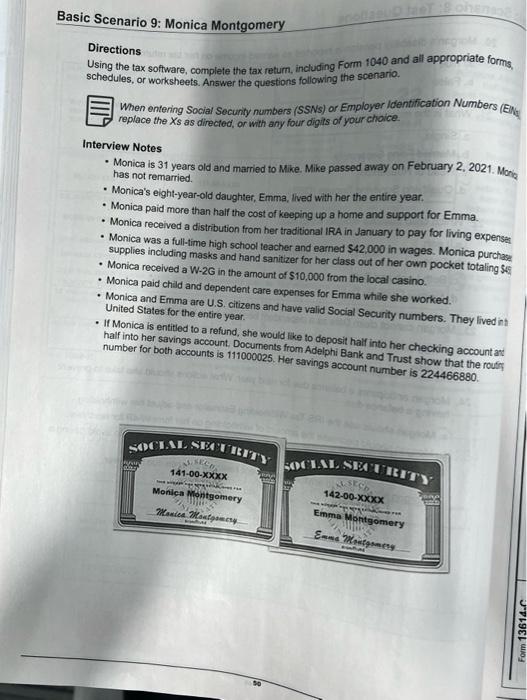

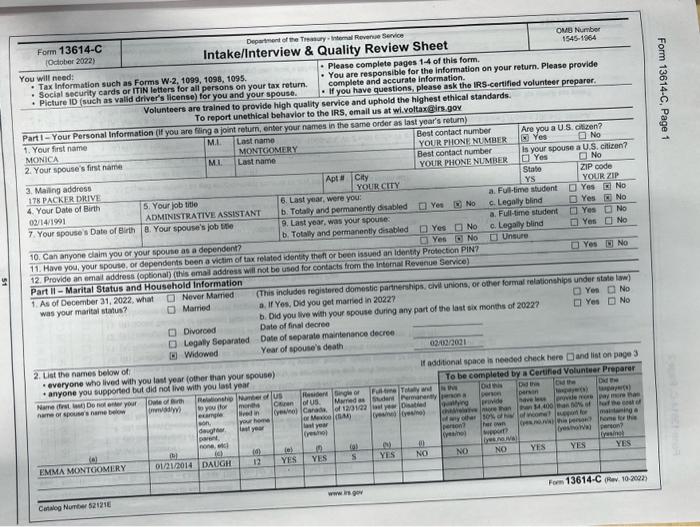

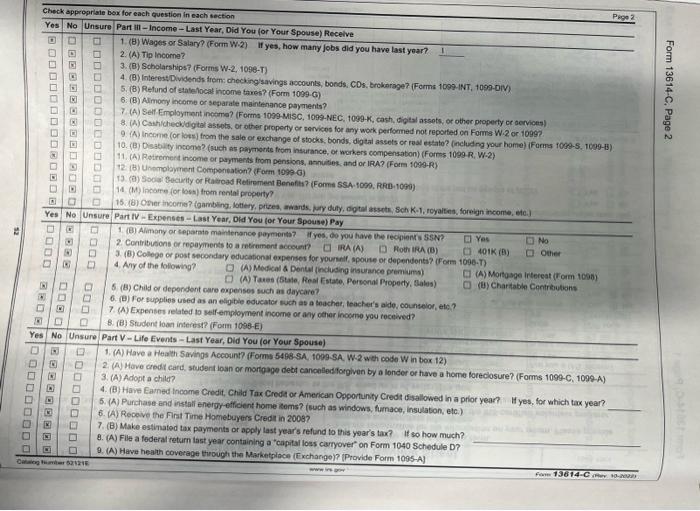

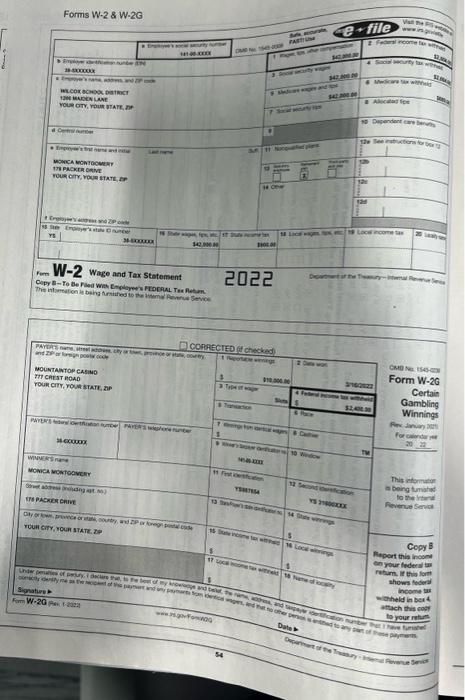

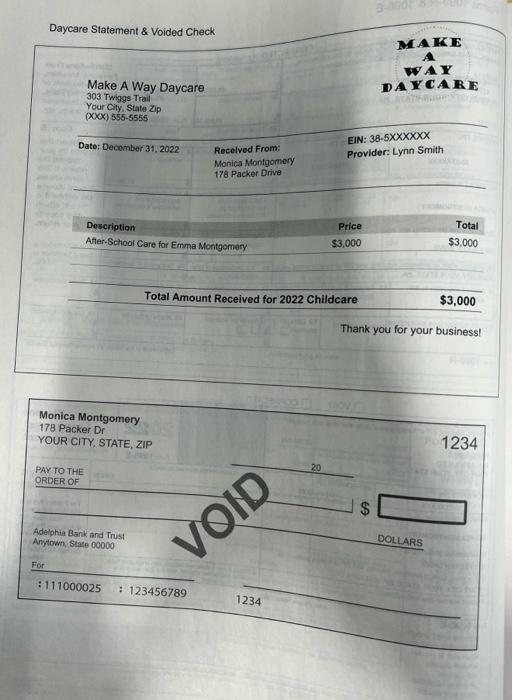

Interview Notes - Monica is 31 years old and married to Mike. Mike passed away on February 2, 2021. Monc has not remarried. - Monica's eight-year-old daughter, Emma, lived with her the entire year. - Monica paid more than half the cost of keeping up a home and support for Emma. - Monica received a distribution from her traditional IRA in January to pay for living expenser - Monica was a full-time high school teacher and earned $42,000 in wages. Monica purchase supplies including masks and hand sanitizer for her class out of her own pocket totaling $ ec - Monica received a W-2G in the amount of $10,000 from the local casino. - Monica paid child and dependent care expenses for Emma while she worked. - Monica and Emma are U.S. citizens and have valid Social Security numbers. They lived int United States for the entire year. - If Monica is entitled to a refund, she would like to deposit haif into her checking account art half into her savings account. Docurnents from Adelphi Bank and Trust show that the roufy number for both accounts is 111000025 . Her savings account number is 224466880 . Widowed If additional space is needed check here and list on page 3 Check appropriale box for each question in each section 1. (B) Wages or Salary? (Form W.2) If yes, how many jobs did you have last year? 2. (A) Tip lncorna? 3. (B) Scholarships? (Forms W-2, 1098-T) 4. (B) InterestDividends frem: checking savings ascounts, bonds, CD5, brokarage? (Forme 1009-1NT, 1099-DIY) 5. (B) Refund of statelocat inicome thnes? (Form 10996 ) 6: (B) Almocy iacome or separate maintenance payments? 7. (A) Self Emplaymant incema? (Forma 1099 MiSC, 1099NE C. 1099K, cash, Cigital assots, or other property or acrices) 8. (A) Cashicheckidigtak asseots, or other property or servicos for any work peifomed not reporfed on Foms W.? or illgg? 11. (A) Rotremert income or payments from pensions, anniities, and or IRA? (Fonm 1099F) 12. (B) Unhmolayment Componeation? (Form 1999 c) 13. () 500as Bectuily or Ftatroad Retirement Benafts? (Fome SSA, 1059, RRD: 10\%0) 14.(M) inpare (or losa) frem rental property? Part IV - Expenses - Last Year, Dld You (or Your Spouse) Pay 4. Avy of the kollowing? (A) Mecical a Dontal (inclusing irisurance premumo) (A) Tanes (5tale, Real Fstace, Personal Propecty, Rales) (A) Mortgoge irtereat (roren 1Cab) 5 (B) Child of deporidont care expenses tuch at daycare? (4) Chariable Contreitutians 6. (b) For supplies used as an eligitie educater such as a loachet, leacher's alde, counseior, eth,? 7. (A) Expenses related to selfemploymant income or any cther incomo you received? B. (B) Student loan infertst? (Fonm 1039-E) Yes No Unsure Pant V - Lafe fivents - Last Year, Did You (or Your Spouse) 1. (A) Have a Health 5 arvings Account? (forms 549S/sA,10993A. W.2 w ch codo. Win box 12) 2. (A) Hove credit card. student ioan or mortoage debt cancelledtorgiven by a londer or have a home toreclosure? (Fomms 1099 -C. 1099-A) 3. (A) Adont a child? 4. (B) Have Earned Income Credit, Child Tax Creda or American Opportunity Credit disallowed in a prior year? H yes, for vahich tax year? 5. (A) Purchase-and instaif energy-efficient home items? (such as windows, furnace, insulaton, etc.) 6. (A) Receive fhe Fint Tirne Homebuytr's Credt in 2009 ? 7. (B) Make-estinatod tax payments or apply last year's refond to this yoar's tax? If so how much?? 9. (A) File a federal return last year containing a "capital loss cieryover" on Form 1040 Schodule DD? 9. (A) Have health coverage though then Marketgiace (Fixcharge)? (Provide Form 1095-A) Catakn himiter bevisie. Forms W.2 \& W.2G Daycare Statement \& Voided Check 30. What amount can Monica claim as an adjustment for the supplies she purchased out of pocket? \& 450 Interview Notes - Monica is 31 years old and married to Mike. Mike passed away on February 2, 2021. Monc has not remarried. - Monica's eight-year-old daughter, Emma, lived with her the entire year. - Monica paid more than half the cost of keeping up a home and support for Emma. - Monica received a distribution from her traditional IRA in January to pay for living expenser - Monica was a full-time high school teacher and earned $42,000 in wages. Monica purchase supplies including masks and hand sanitizer for her class out of her own pocket totaling $ ec - Monica received a W-2G in the amount of $10,000 from the local casino. - Monica paid child and dependent care expenses for Emma while she worked. - Monica and Emma are U.S. citizens and have valid Social Security numbers. They lived int United States for the entire year. - If Monica is entitled to a refund, she would like to deposit haif into her checking account art half into her savings account. Docurnents from Adelphi Bank and Trust show that the roufy number for both accounts is 111000025 . Her savings account number is 224466880 . Widowed If additional space is needed check here and list on page 3 Check appropriale box for each question in each section 1. (B) Wages or Salary? (Form W.2) If yes, how many jobs did you have last year? 2. (A) Tip lncorna? 3. (B) Scholarships? (Forms W-2, 1098-T) 4. (B) InterestDividends frem: checking savings ascounts, bonds, CD5, brokarage? (Forme 1009-1NT, 1099-DIY) 5. (B) Refund of statelocat inicome thnes? (Form 10996 ) 6: (B) Almocy iacome or separate maintenance payments? 7. (A) Self Emplaymant incema? (Forma 1099 MiSC, 1099NE C. 1099K, cash, Cigital assots, or other property or acrices) 8. (A) Cashicheckidigtak asseots, or other property or servicos for any work peifomed not reporfed on Foms W.? or illgg? 11. (A) Rotremert income or payments from pensions, anniities, and or IRA? (Fonm 1099F) 12. (B) Unhmolayment Componeation? (Form 1999 c) 13. () 500as Bectuily or Ftatroad Retirement Benafts? (Fome SSA, 1059, RRD: 10\%0) 14.(M) inpare (or losa) frem rental property? Part IV - Expenses - Last Year, Dld You (or Your Spouse) Pay 4. Avy of the kollowing? (A) Mecical a Dontal (inclusing irisurance premumo) (A) Tanes (5tale, Real Fstace, Personal Propecty, Rales) (A) Mortgoge irtereat (roren 1Cab) 5 (B) Child of deporidont care expenses tuch at daycare? (4) Chariable Contreitutians 6. (b) For supplies used as an eligitie educater such as a loachet, leacher's alde, counseior, eth,? 7. (A) Expenses related to selfemploymant income or any cther incomo you received? B. (B) Student loan infertst? (Fonm 1039-E) Yes No Unsure Pant V - Lafe fivents - Last Year, Did You (or Your Spouse) 1. (A) Have a Health 5 arvings Account? (forms 549S/sA,10993A. W.2 w ch codo. Win box 12) 2. (A) Hove credit card. student ioan or mortoage debt cancelledtorgiven by a londer or have a home toreclosure? (Fomms 1099 -C. 1099-A) 3. (A) Adont a child? 4. (B) Have Earned Income Credit, Child Tax Creda or American Opportunity Credit disallowed in a prior year? H yes, for vahich tax year? 5. (A) Purchase-and instaif energy-efficient home items? (such as windows, furnace, insulaton, etc.) 6. (A) Receive fhe Fint Tirne Homebuytr's Credt in 2009 ? 7. (B) Make-estinatod tax payments or apply last year's refond to this yoar's tax? If so how much?? 9. (A) File a federal return last year containing a "capital loss cieryover" on Form 1040 Schodule DD? 9. (A) Have health coverage though then Marketgiace (Fixcharge)? (Provide Form 1095-A) Catakn himiter bevisie. Forms W.2 \& W.2G Daycare Statement \& Voided Check 30. What amount can Monica claim as an adjustment for the supplies she purchased out of pocket? \& 450