Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Interview Notes . . Paul and Maggie are married and want to file a joint return. Maggie is a U.S. citizen and has a

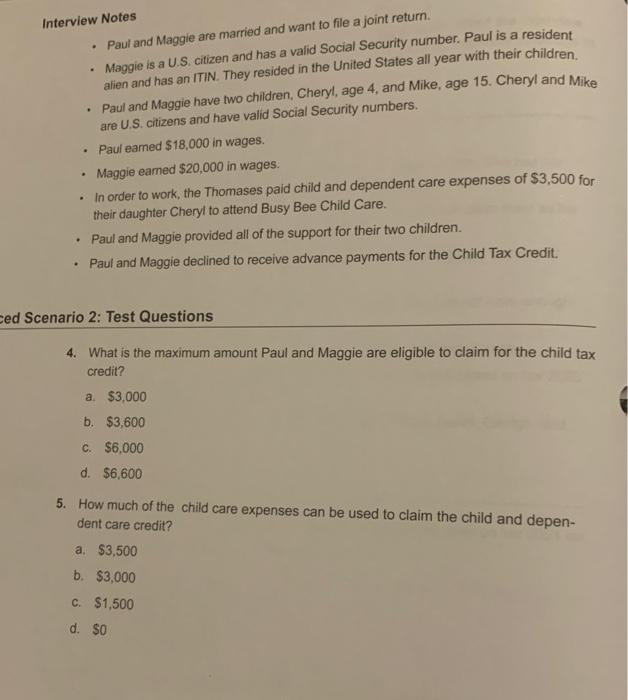

Interview Notes . . Paul and Maggie are married and want to file a joint return. Maggie is a U.S. citizen and has a valid Social Security number. Paul is a resident alien and has an ITIN. They resided in the United States all year with their children. Paul and Maggie have two children, Cheryl, age 4, and Mike, age 15. Cheryl and Mike are U.S. citizens and have valid Social Security numbers. . Paul earned $18,000 in wages. . . Maggie earned $20,000 in wages. In order to work, the Thomases paid child and dependent care expenses of $3,500 for their daughter Cheryl to attend Busy Bee Child Care. Paul and Maggie provided all of the support for their two children. Paul and Maggie declined to receive advance payments for the Child Tax Credit. ced Scenario 2: Test Questions 4. What is the maximum amount Paul and Maggie are eligible to claim for the child tax credit? a. $3,000 b. $3,600 c. $6,000 d. $6,600 5. How much of the child care expenses can be used to claim the child and depen- dent care credit? a. $3,500 b. $3,000 c. $1,500 d. $0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started