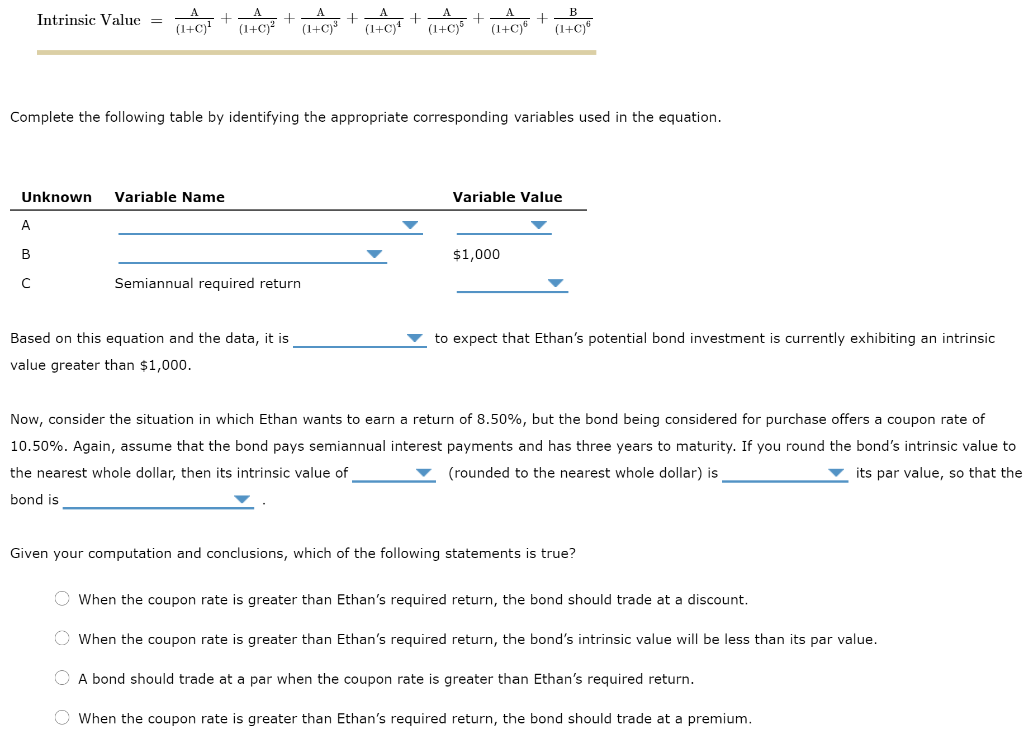

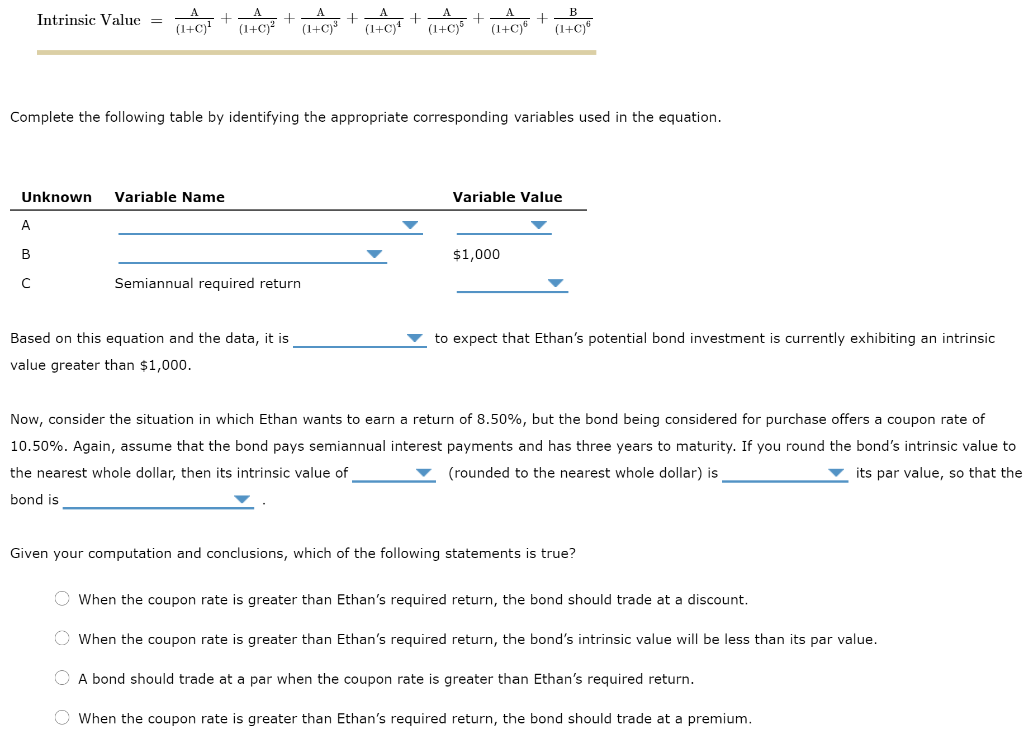

Intrinsic Value = + (1+0) + (1+0) (1+C++ (0 (1+0) (1+C) (1+C) Complete the following table by identifying the appropriate corresponding variables used in the equation. Unknown Variable Name Variable Value A . $1,000 Semiannual required return to expect that Ethan's potential bond investment is currently exhibiting an intrinsic Based on this equation and the data, it is value greater than $1,000. Now, consider the situation in which Ethan wants to earn a return of 8.50%, but the bond being considered for purchase offers a coupon rate of 10.50%. Again, assume that the bond pays semiannual interest payments and has three years to maturity. If you round the bond's intrinsic value to the nearest whole dollar, then its intrinsic value of (rounded to the nearest whole dollar) is its par value, so that the bond is Given your computation and conclusions, which of the following statements is true? When the coupon rate is greater than Ethan's required return, the bond should trade at a discount. When the coupon rate is greater than Ethan's required return, the bond's intrinsic value will be less than its par value. O A bond should trade at a par when the coupon rate is greater than Ethan's required return. When the coupon rate is greater than Ethan's required return, the bond should trade at a premium. Intrinsic Value = + (1+0) + (1+0) (1+C++ (0 (1+0) (1+C) (1+C) Complete the following table by identifying the appropriate corresponding variables used in the equation. Unknown Variable Name Variable Value A . $1,000 Semiannual required return to expect that Ethan's potential bond investment is currently exhibiting an intrinsic Based on this equation and the data, it is value greater than $1,000. Now, consider the situation in which Ethan wants to earn a return of 8.50%, but the bond being considered for purchase offers a coupon rate of 10.50%. Again, assume that the bond pays semiannual interest payments and has three years to maturity. If you round the bond's intrinsic value to the nearest whole dollar, then its intrinsic value of (rounded to the nearest whole dollar) is its par value, so that the bond is Given your computation and conclusions, which of the following statements is true? When the coupon rate is greater than Ethan's required return, the bond should trade at a discount. When the coupon rate is greater than Ethan's required return, the bond's intrinsic value will be less than its par value. O A bond should trade at a par when the coupon rate is greater than Ethan's required return. When the coupon rate is greater than Ethan's required return, the bond should trade at a premium