Answered step by step

Verified Expert Solution

Question

1 Approved Answer

intrnational financial managment About Manoa Pic Manoa (UK) Ple, which is based in the UK, is the parent of the enterprise, and manufactures sails for

intrnational financial managment

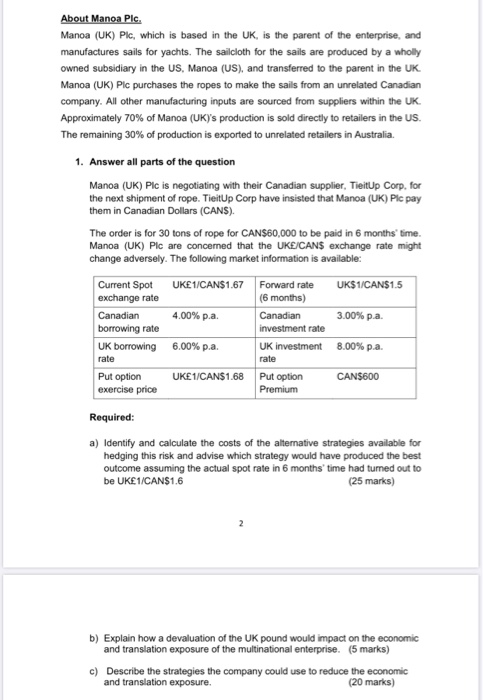

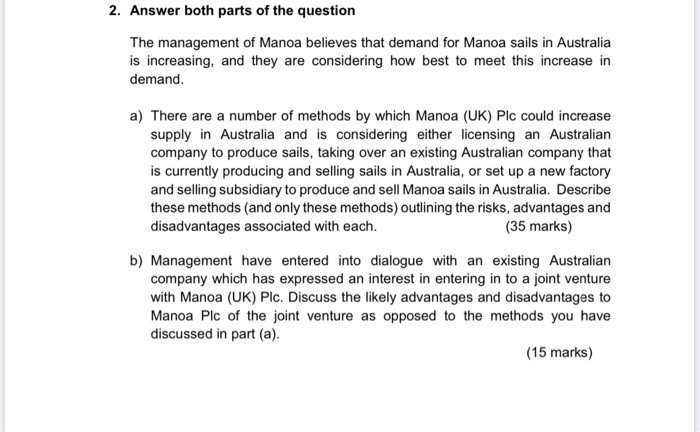

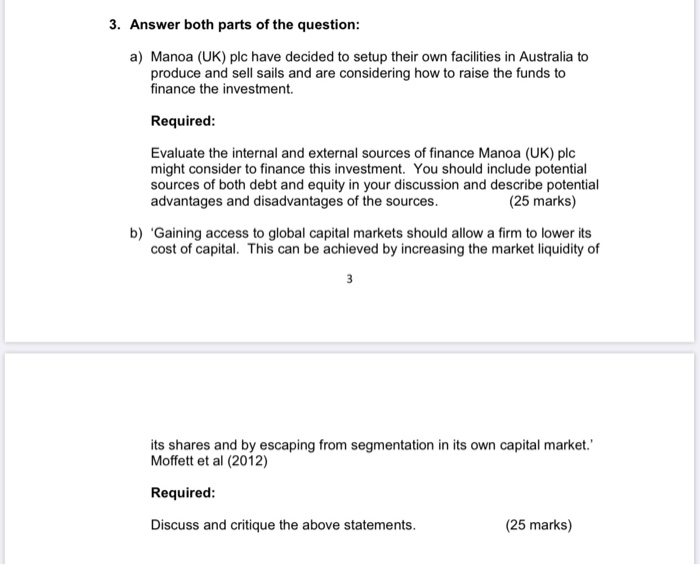

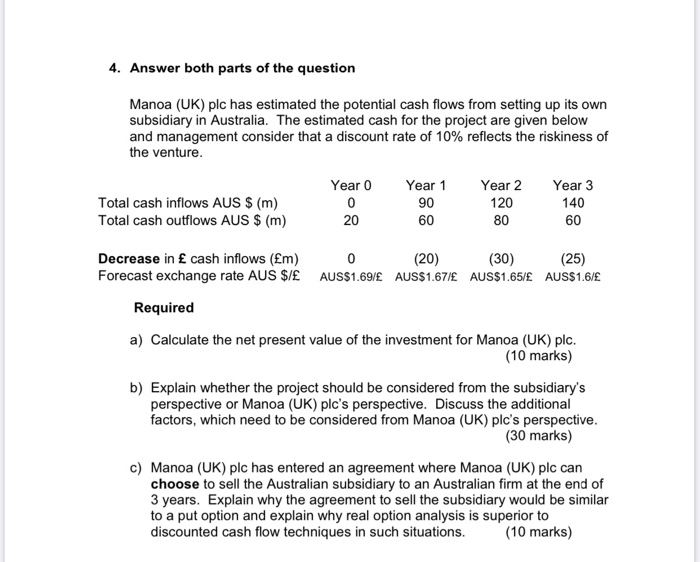

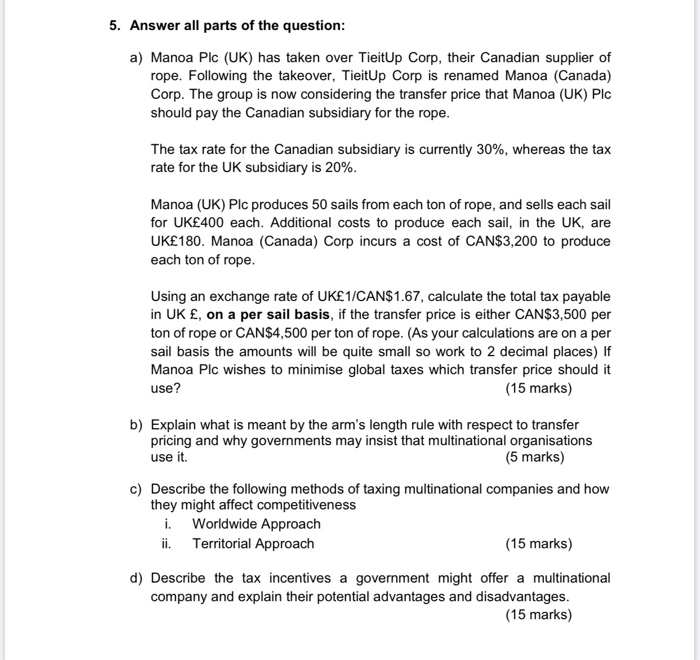

About Manoa Pic Manoa (UK) Ple, which is based in the UK, is the parent of the enterprise, and manufactures sails for yachts. The sailcloth for the sails are produced by a wholly owned subsidiary in the US, Manoa (US), and transferred to the parent in the UK Manoa (UK) Pic purchases the ropes to make the sails from an unrelated Canadian company. All other manufacturing inputs are sourced from suppliers within the UK Approximately 70% of Manoa (UK)'s production is sold directly to retailers in the US The remaining 30% of production is exported to unrelated retailers in Australia, 1. Answer all parts of the question Manoa (UK) Plc is negotiating with their Canadian supplier, TieitUp Corp. for the next shipment of rope. TieitUp Corp have insisted that Manoa (UK) Pic pay them in Canadian Dollars (CANS). The order is for 30 tons of rope for CAN$60,000 to be paid in 6 months' time. Manoa (UK) Pic are concerned that the UKE/CAN$ exchange rate might change adversely. The following market information is available: UK1/CAN$1.67 UK$1/CAN$1.5 4.00% pa. Current Spot exchange rate Canadian borrowing rate UK borrowing rate 3.00% p.a. Forward rate (6 months) Canadian investment rate UK investment rate Put option Premium 6.00% p.a. 8.00% p.a. UKE1/CAN$1.68 Put option exercise price CAN$600 Required: a) Identify and calculate the costs of the alternative strategies available for hedging this risk and advise which strategy would have produced the best outcome assuming the actual spot rate in 6 months' time has turned out to be UKE1/CAN$1.6 (25 marks) b) Explain how a devaluation of the UK pound would impact on the economic and translation exposure of the multinational enterprise. (5 marks) c) Describe the strategies the company could use to reduce the economic and translation exposure. (20 marks) 2. Answer both parts of the question The management of Manoa believes that demand for Manoa sails in Australia is increasing, and they are considering how best to meet this increase in demand. a) There are a number of methods by which Manoa (UK) Plc could increase supply in Australia and is considering either licensing an Australian company to produce sails, taking over an existing Australian company that is currently producing and selling sails in Australia, or set up a new factory and selling subsidiary to produce and sell Manoa sails in Australia. Describe these methods (and only these methods) outlining the risks, advantages and disadvantages associated with each. (35 marks) b) Management have entered into dialogue with an existing Australian company which has expressed an interest in entering in to a joint venture with Manoa (UK) Plc. Discuss the likely advantages and disadvantages to Manoa Plc of the joint venture as opposed to the methods you have discussed in part (a). (15 marks) 3. Answer both parts of the question: a) Manoa (UK) plc have decided to setup their own facilities in Australia to produce and sell sails and are considering how to raise the funds to finance the investment. Required: Evaluate the internal and external sources of finance Manoa (UK) plc might consider to finance this investment. You should include potential sources of both debt and equity in your discussion and describe potential advantages and disadvantages of the sources. (25 marks) b) 'Gaining access to global capital markets should allow a firm to lower its cost of capital. This can be achieved by increasing the market liquidity of its shares and by escaping from segmentation in its own capital market.' Moffett et al (2012) Required: Discuss and critique the above statements. (25 marks) 4. Answer both parts of the question Manoa (UK) plc has estimated the potential cash flows from setting up its own subsidiary in Australia. The estimated cash for the project are given below and management consider that a discount rate of 10% reflects the riskiness of the venture. Year 0 Year 1 Year 2 090120 2060 80 Year 3 140 Total cash inflows AUS $ (m) Total cash outflows AUS $ (m) Decrease in cash inflows (m) Forecast exchange rate AUS $/ 0 (20) (30) (25) AUS$1.69/ AUS$1.67/ AUS$1.65/ AUS$1.6/ Required a) Calculate the net present value of the investment for Manoa (UK) plc. (10 marks) b) Explain whether the project should be considered from the subsidiary's perspective or Manoa (UK) plc's perspective. Discuss the additional factors, which need to be considered from Manoa (UK) plc's perspective. (30 marks) c) Manoa (UK) plc has entered an agreement where Manoa (UK) plc can choose to sell the Australian subsidiary to an Australian firm at the end of 3 years. Explain why the agreement to sell the subsidiary would be similar to a put option and explain why real option analysis is superior to discounted cash flow techniques in such situations. (10 marks) 5. Answer all parts of the question: a) Manoa Plc (UK) has taken over TieitUp Corp, their Canadian supplier of rope. Following the takeover, TieitUp Corp is renamed Manoa (Canada) Corp. The group is now considering the transfer price that Manoa (UK) Plc should pay the Canadian subsidiary for the rope. The tax rate for the Canadian subsidiary is currently 30%, whereas the tax rate for the UK subsidiary is 20%. Manoa (UK) Plc produces 50 sails from each ton of rope, and sells each sail for UK400 each. Additional costs to produce each sail, in the UK, are UK180. Manoa (Canada) Corp incurs a cost of CAN$3,200 to produce each ton of rope. Using an exchange rate of UK1/CAN$1.67, calculate the total tax payable in UK , on a per sail basis, if the transfer price is either CAN$3,500 per ton of rope or CAN$4,500 per ton of rope. (As your calculations are on a per sail basis the amounts will be quite small so work to 2 decimal places) If Manoa Plc wishes to minimise global taxes which transfer price should it use? (15 marks) b) Explain what is meant by the arm's length rule with respect to transfer pricing and why governments may insist that multinational organisations use it. (5 marks) c) Describe the following methods of taxing multinational companies and how they might affect competitiveness i. Worldwide Approach ii. Territorial Approach (15 marks) d) Describe the tax incentives a government might offer a multinational company and explain their potential advantages and disadvantages. (15 marks) About Manoa Pic Manoa (UK) Ple, which is based in the UK, is the parent of the enterprise, and manufactures sails for yachts. The sailcloth for the sails are produced by a wholly owned subsidiary in the US, Manoa (US), and transferred to the parent in the UK Manoa (UK) Pic purchases the ropes to make the sails from an unrelated Canadian company. All other manufacturing inputs are sourced from suppliers within the UK Approximately 70% of Manoa (UK)'s production is sold directly to retailers in the US The remaining 30% of production is exported to unrelated retailers in Australia, 1. Answer all parts of the question Manoa (UK) Plc is negotiating with their Canadian supplier, TieitUp Corp. for the next shipment of rope. TieitUp Corp have insisted that Manoa (UK) Pic pay them in Canadian Dollars (CANS). The order is for 30 tons of rope for CAN$60,000 to be paid in 6 months' time. Manoa (UK) Pic are concerned that the UKE/CAN$ exchange rate might change adversely. The following market information is available: UK1/CAN$1.67 UK$1/CAN$1.5 4.00% pa. Current Spot exchange rate Canadian borrowing rate UK borrowing rate 3.00% p.a. Forward rate (6 months) Canadian investment rate UK investment rate Put option Premium 6.00% p.a. 8.00% p.a. UKE1/CAN$1.68 Put option exercise price CAN$600 Required: a) Identify and calculate the costs of the alternative strategies available for hedging this risk and advise which strategy would have produced the best outcome assuming the actual spot rate in 6 months' time has turned out to be UKE1/CAN$1.6 (25 marks) b) Explain how a devaluation of the UK pound would impact on the economic and translation exposure of the multinational enterprise. (5 marks) c) Describe the strategies the company could use to reduce the economic and translation exposure. (20 marks) 2. Answer both parts of the question The management of Manoa believes that demand for Manoa sails in Australia is increasing, and they are considering how best to meet this increase in demand. a) There are a number of methods by which Manoa (UK) Plc could increase supply in Australia and is considering either licensing an Australian company to produce sails, taking over an existing Australian company that is currently producing and selling sails in Australia, or set up a new factory and selling subsidiary to produce and sell Manoa sails in Australia. Describe these methods (and only these methods) outlining the risks, advantages and disadvantages associated with each. (35 marks) b) Management have entered into dialogue with an existing Australian company which has expressed an interest in entering in to a joint venture with Manoa (UK) Plc. Discuss the likely advantages and disadvantages to Manoa Plc of the joint venture as opposed to the methods you have discussed in part (a). (15 marks) 3. Answer both parts of the question: a) Manoa (UK) plc have decided to setup their own facilities in Australia to produce and sell sails and are considering how to raise the funds to finance the investment. Required: Evaluate the internal and external sources of finance Manoa (UK) plc might consider to finance this investment. You should include potential sources of both debt and equity in your discussion and describe potential advantages and disadvantages of the sources. (25 marks) b) 'Gaining access to global capital markets should allow a firm to lower its cost of capital. This can be achieved by increasing the market liquidity of its shares and by escaping from segmentation in its own capital market.' Moffett et al (2012) Required: Discuss and critique the above statements. (25 marks) 4. Answer both parts of the question Manoa (UK) plc has estimated the potential cash flows from setting up its own subsidiary in Australia. The estimated cash for the project are given below and management consider that a discount rate of 10% reflects the riskiness of the venture. Year 0 Year 1 Year 2 090120 2060 80 Year 3 140 Total cash inflows AUS $ (m) Total cash outflows AUS $ (m) Decrease in cash inflows (m) Forecast exchange rate AUS $/ 0 (20) (30) (25) AUS$1.69/ AUS$1.67/ AUS$1.65/ AUS$1.6/ Required a) Calculate the net present value of the investment for Manoa (UK) plc. (10 marks) b) Explain whether the project should be considered from the subsidiary's perspective or Manoa (UK) plc's perspective. Discuss the additional factors, which need to be considered from Manoa (UK) plc's perspective. (30 marks) c) Manoa (UK) plc has entered an agreement where Manoa (UK) plc can choose to sell the Australian subsidiary to an Australian firm at the end of 3 years. Explain why the agreement to sell the subsidiary would be similar to a put option and explain why real option analysis is superior to discounted cash flow techniques in such situations. (10 marks) 5. Answer all parts of the question: a) Manoa Plc (UK) has taken over TieitUp Corp, their Canadian supplier of rope. Following the takeover, TieitUp Corp is renamed Manoa (Canada) Corp. The group is now considering the transfer price that Manoa (UK) Plc should pay the Canadian subsidiary for the rope. The tax rate for the Canadian subsidiary is currently 30%, whereas the tax rate for the UK subsidiary is 20%. Manoa (UK) Plc produces 50 sails from each ton of rope, and sells each sail for UK400 each. Additional costs to produce each sail, in the UK, are UK180. Manoa (Canada) Corp incurs a cost of CAN$3,200 to produce each ton of rope. Using an exchange rate of UK1/CAN$1.67, calculate the total tax payable in UK , on a per sail basis, if the transfer price is either CAN$3,500 per ton of rope or CAN$4,500 per ton of rope. (As your calculations are on a per sail basis the amounts will be quite small so work to 2 decimal places) If Manoa Plc wishes to minimise global taxes which transfer price should it use? (15 marks) b) Explain what is meant by the arm's length rule with respect to transfer pricing and why governments may insist that multinational organisations use it. (5 marks) c) Describe the following methods of taxing multinational companies and how they might affect competitiveness i. Worldwide Approach ii. Territorial Approach (15 marks) d) Describe the tax incentives a government might offer a multinational company and explain their potential advantages and disadvantages. (15 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started