Answered step by step

Verified Expert Solution

Question

1 Approved Answer

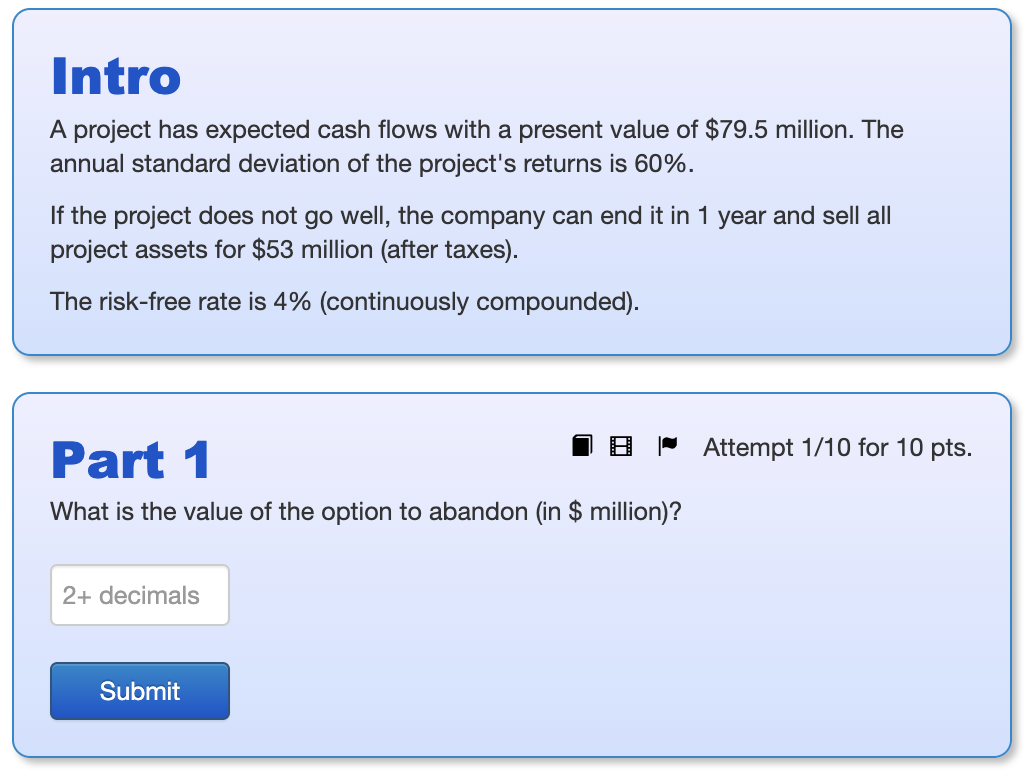

Intro A project has expected cash flows with a present value of $79.5 million. The annual standard deviation of the project's returns is 60%.

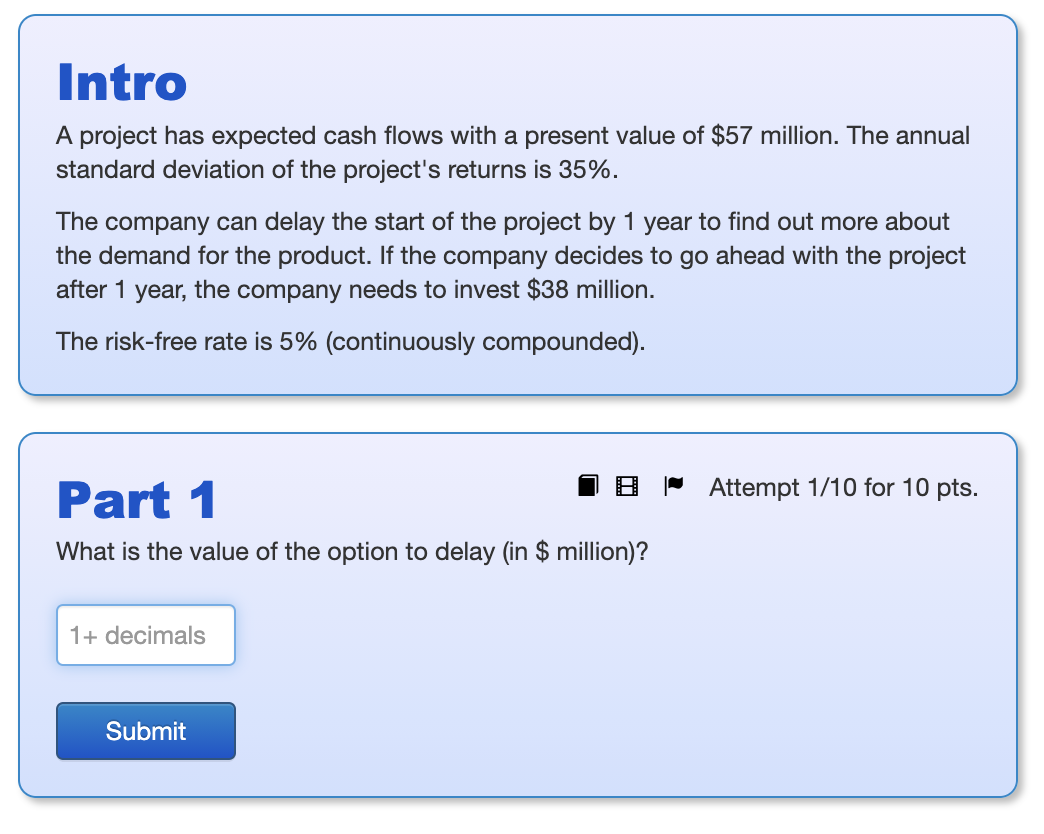

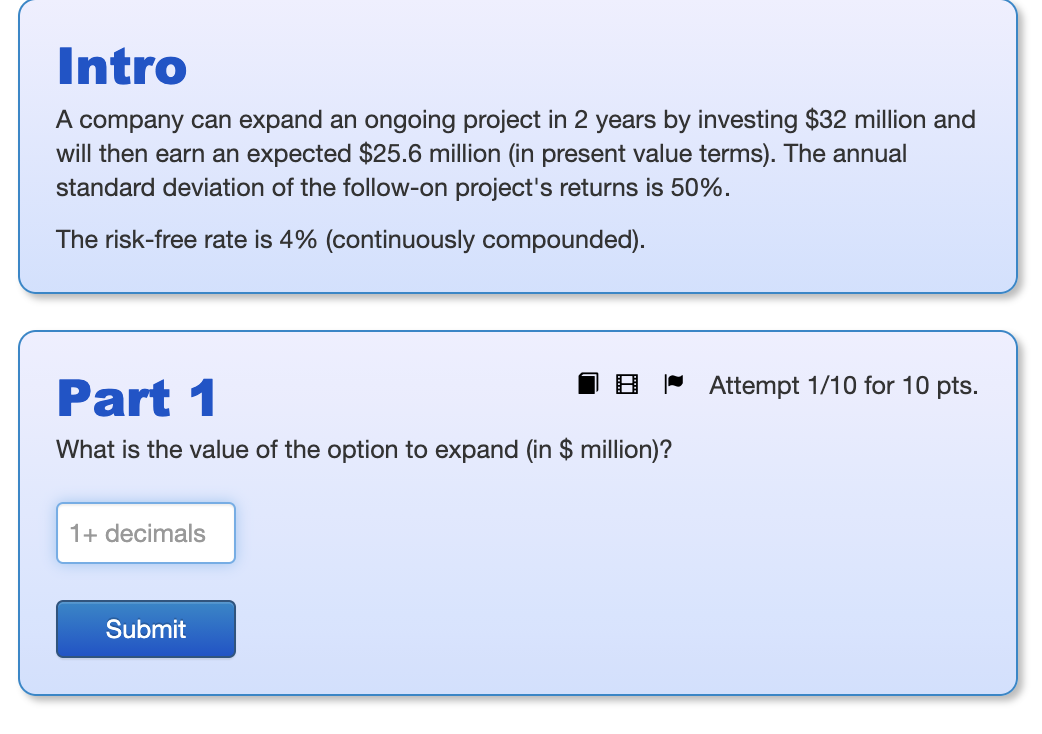

Intro A project has expected cash flows with a present value of $79.5 million. The annual standard deviation of the project's returns is 60%. If the project does not go well, the company can end it in 1 year and sell all project assets for $53 million (after taxes). The risk-free rate is 4% (continuously compounded). Part 1 Attempt 1/10 for 10 pts. What is the value of the option to abandon (in $ million)? 2+ decimals Submit Intro A project has expected cash flows with a present value of $57 million. The annual standard deviation of the project's returns is 35%. The company can delay the start of the project by 1 year to find out more about the demand for the product. If the company decides to go ahead with the project after 1 year, the company needs to invest $38 million. The risk-free rate is 5% (continuously compounded). Part 1 What is the value of the option to delay (in $ million)? Attempt 1/10 for 10 pts. 1+ decimals Submit Intro A company can expand an ongoing project in 2 years by investing $32 million and will then earn an expected $25.6 million (in present value terms). The annual standard deviation of the follow-on project's returns is 50%. The risk-free rate is 4% (continuously compounded). Part 1 What is the value of the option to expand (in $ million)? 1+ decimals Submit Attempt 1/10 for 10 pts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started