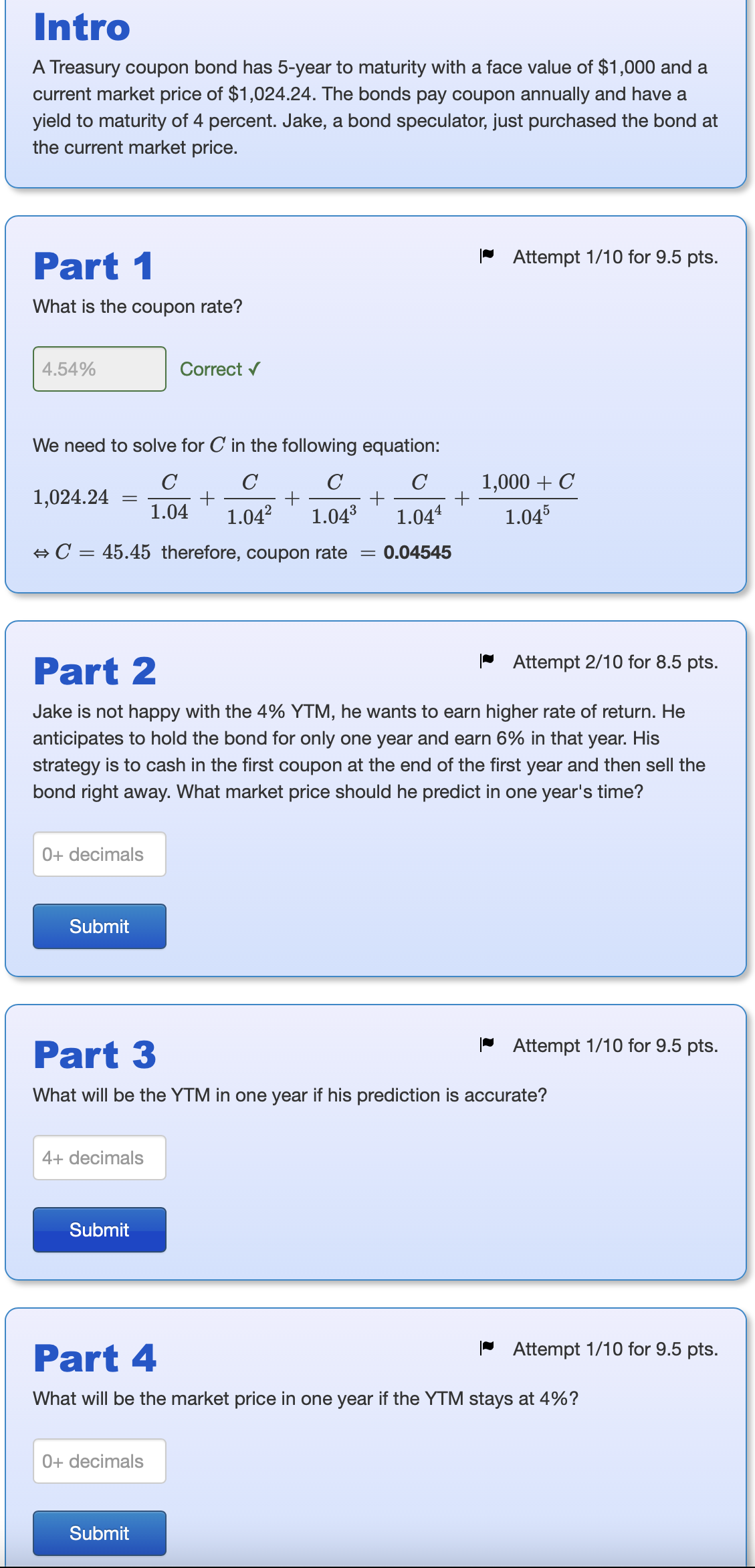

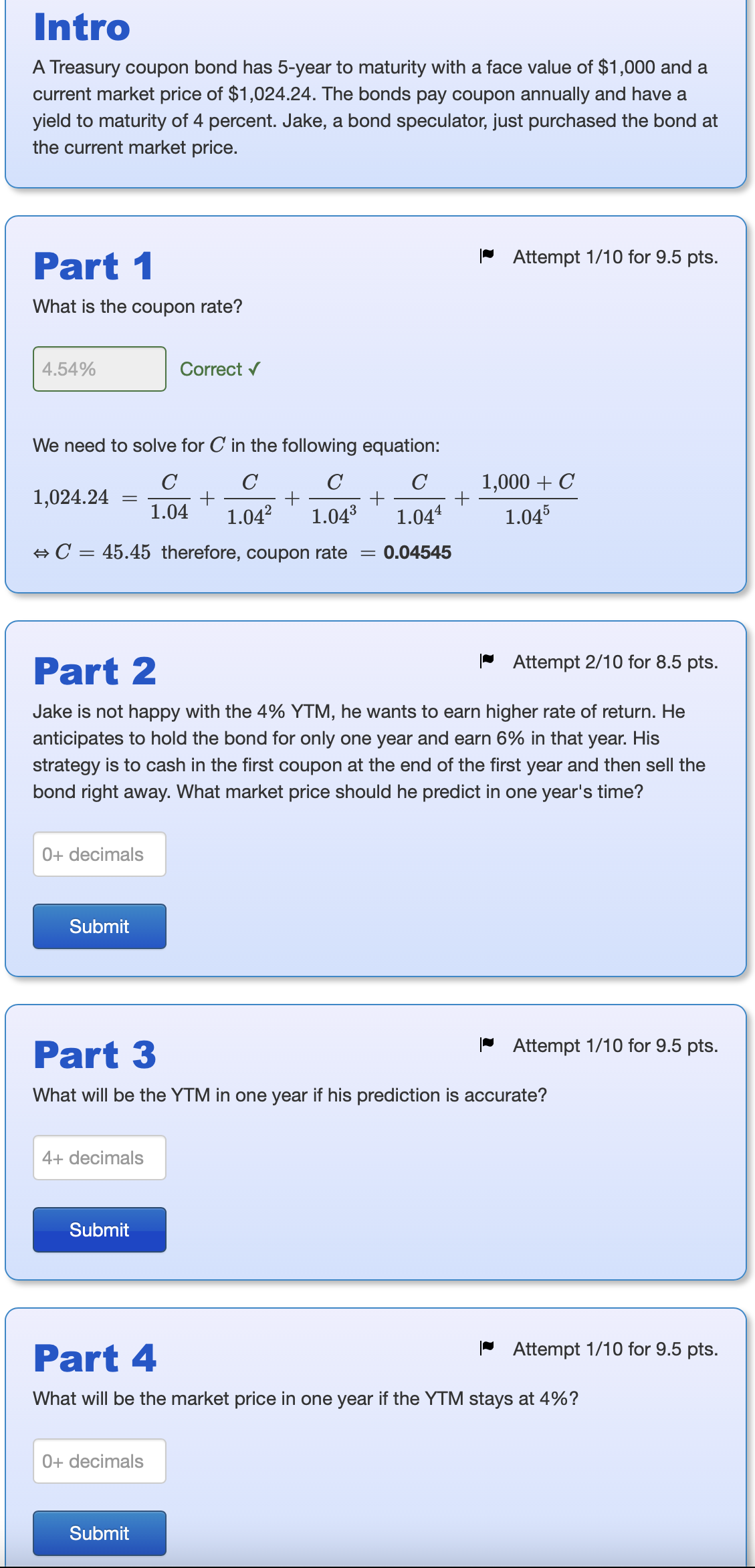

Intro A Treasury coupon bond has 5-year to maturity with a face value of $1,000 and a current market price of $1,024.24. The bonds pay coupon annually and have a yield to maturity of 4 percent. Jake, a bond speculator, just purchased the bond at the current market price. Part 1 | Attempt 1/10 for 9.5 pts. What is the coupon rate? 4.54% Correct We need to solve for C in the following equation: 1,024.24 = C + 1.04 1.042 + + 1,000 + C 1.045 1.043 1.044 AC= 45.45 therefore, coupon rate = 0.04545 Part 2 | Attempt 2/10 for 8.5 pts. Jake is not happy with the 4% YTM, he wants to earn higher rate of return. He anticipates to hold the bond for only one year and earn 6% in that year. His strategy is to cash in the first coupon at the end of the first year and then sell the bond right away. What market price should he predict in one year's time? 0+ decimals Submit Part 3 |- Attempt 1/10 for 9.5 pts. What will be the YTM in one year if his prediction is accurate? 4+ decimals Submit Part 4 | Attempt 1/10 for 9.5 pts. What will be the market price in one year if the YTM stays at 4%? 0+ decimals Submit Intro A Treasury coupon bond has 5-year to maturity with a face value of $1,000 and a current market price of $1,024.24. The bonds pay coupon annually and have a yield to maturity of 4 percent. Jake, a bond speculator, just purchased the bond at the current market price. Part 1 | Attempt 1/10 for 9.5 pts. What is the coupon rate? 4.54% Correct We need to solve for C in the following equation: 1,024.24 = C + 1.04 1.042 + + 1,000 + C 1.045 1.043 1.044 AC= 45.45 therefore, coupon rate = 0.04545 Part 2 | Attempt 2/10 for 8.5 pts. Jake is not happy with the 4% YTM, he wants to earn higher rate of return. He anticipates to hold the bond for only one year and earn 6% in that year. His strategy is to cash in the first coupon at the end of the first year and then sell the bond right away. What market price should he predict in one year's time? 0+ decimals Submit Part 3 |- Attempt 1/10 for 9.5 pts. What will be the YTM in one year if his prediction is accurate? 4+ decimals Submit Part 4 | Attempt 1/10 for 9.5 pts. What will be the market price in one year if the YTM stays at 4%? 0+ decimals Submit