Answered step by step

Verified Expert Solution

Question

1 Approved Answer

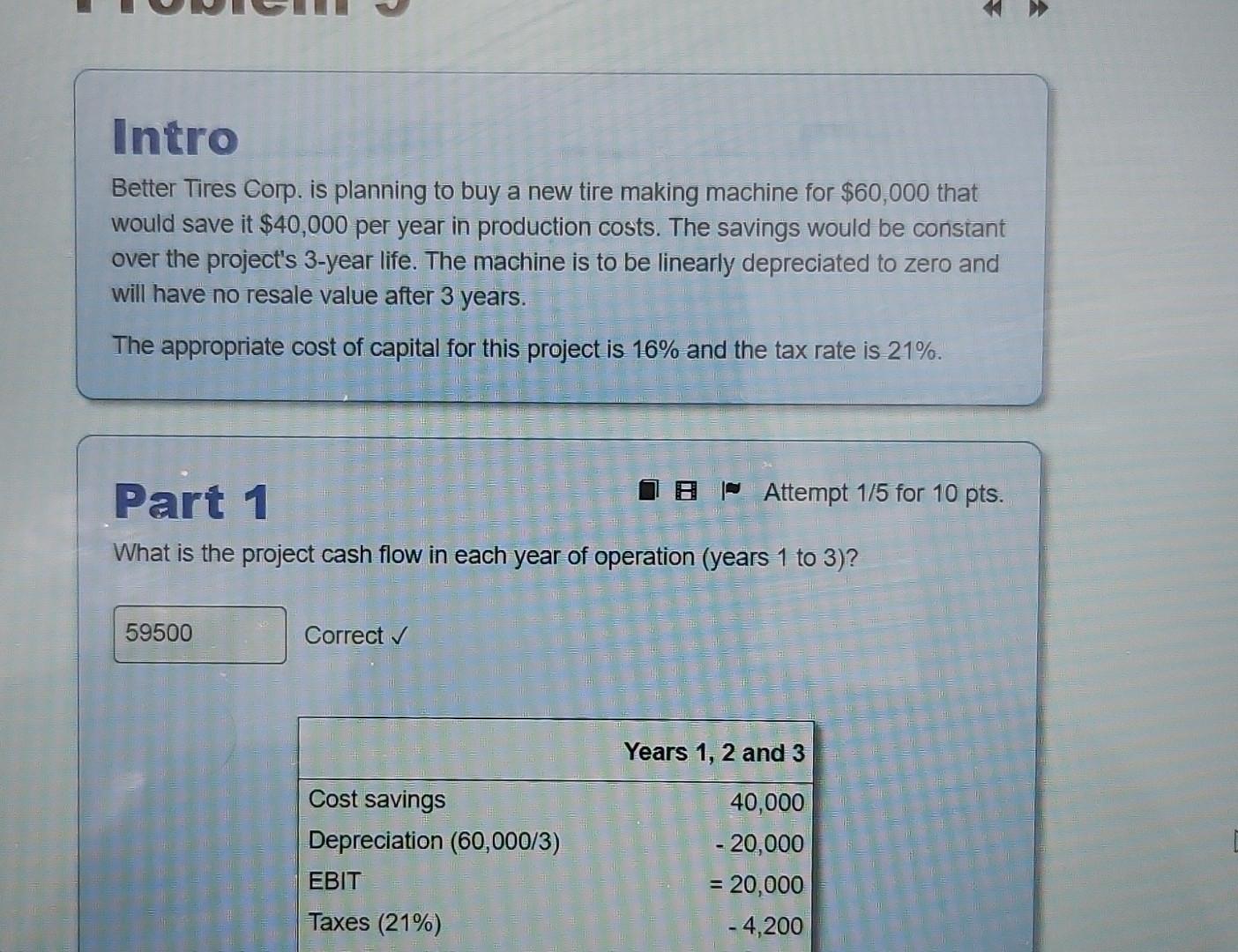

Intro Better Tires Corp. is planning to buy a new tire making machine for ( $ 60,000 ) that would save it ( $ 40,000

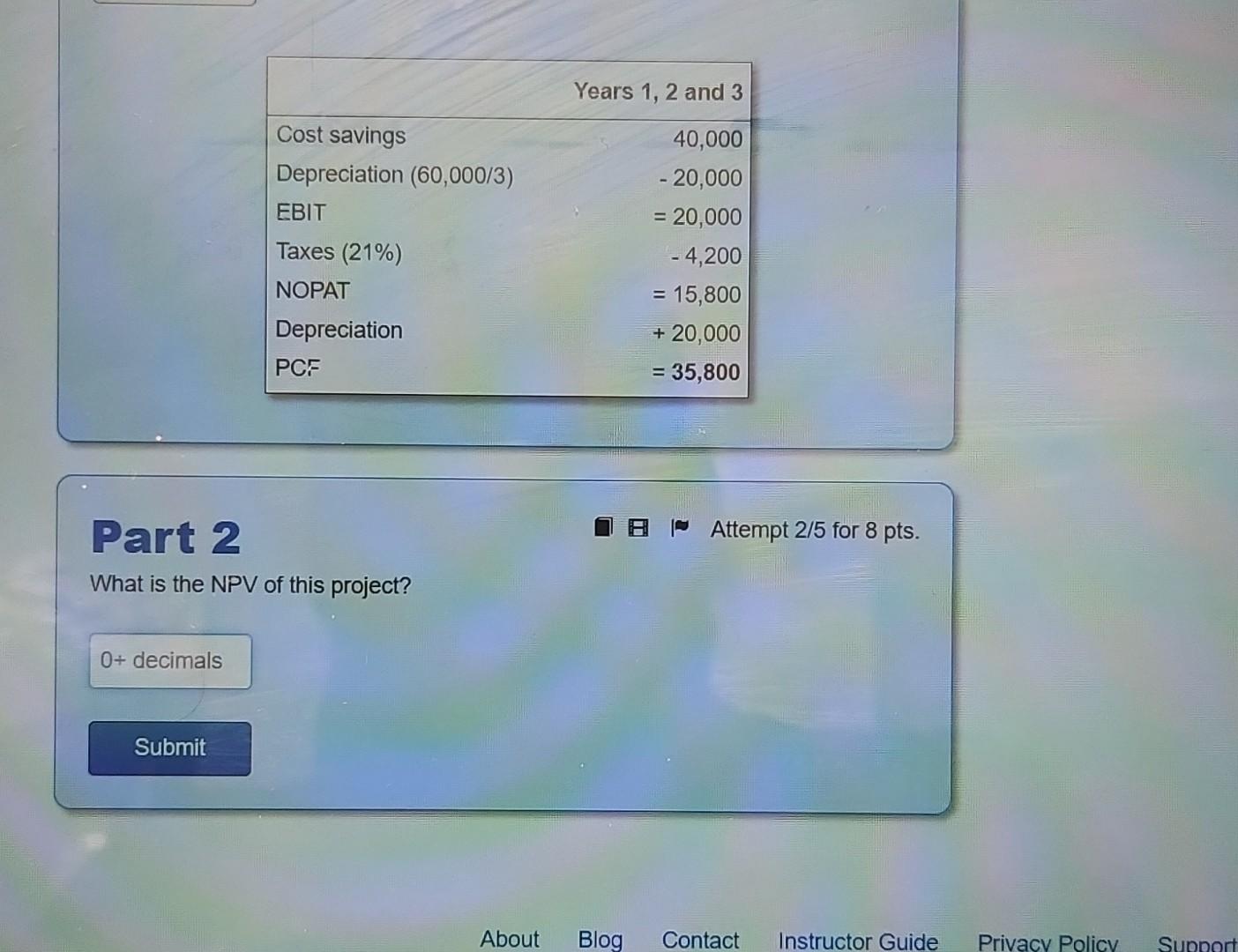

Intro Better Tires Corp. is planning to buy a new tire making machine for \\( \\$ 60,000 \\) that would save it \\( \\$ 40,000 \\) per year in production costs. The savings would be constant over the project's 3-year life. The machine is to be linearly depreciated to zero and will have no resale value after 3 years. The appropriate cost of capital for this project is \16 and the tax rate is \21. Part 1 - \\( \\mathbf{1 0} \\) Attempt \\( 1 / 5 \\) for 10 pts. What is the project cash flow in each year of operation (years 1 to 3 )? Correct \\( \\checkmark \\) \\begin{tabular}{|lr|} \\hline & Years 1,2 and 3 \\\\ \\hline Cost savings & 40,000 \\\\ Depreciation \\( (60,000 / 3) \\) & \\( -20,000 \\) \\\\ EBIT & \\( =20,000 \\) \\\\ Taxes (21\\%) & \\( -4,200 \\) \\\\ NOPAT & \\( =15,800 \\) \\\\ Depreciation & \\( +20,000 \\) \\\\ PCF & \\( =35,800 \\) \\\\ \\hline \\end{tabular} Part 2 Attempt \\( 2 / 5 \\) for 8 pts. What is the NPV of this project? \\( 0+ \\) decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started