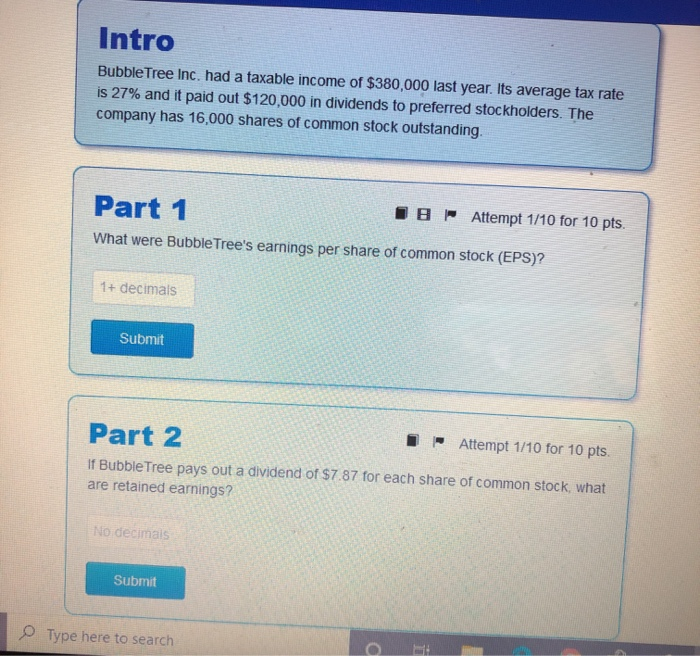

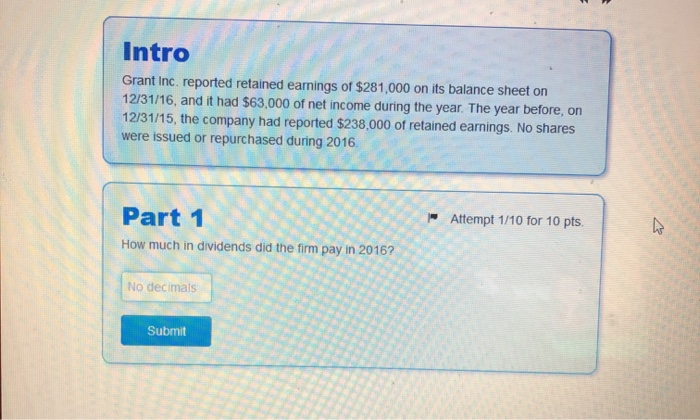

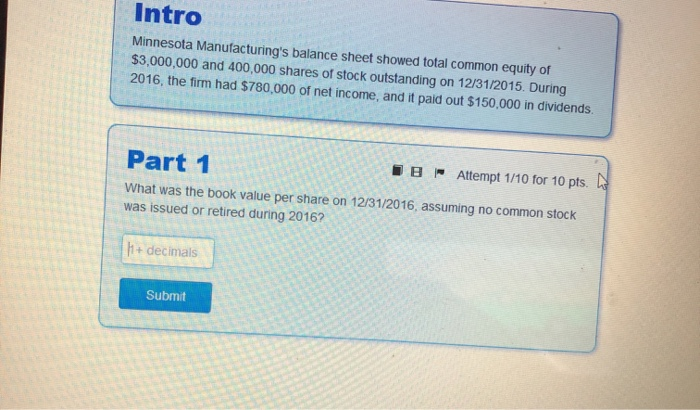

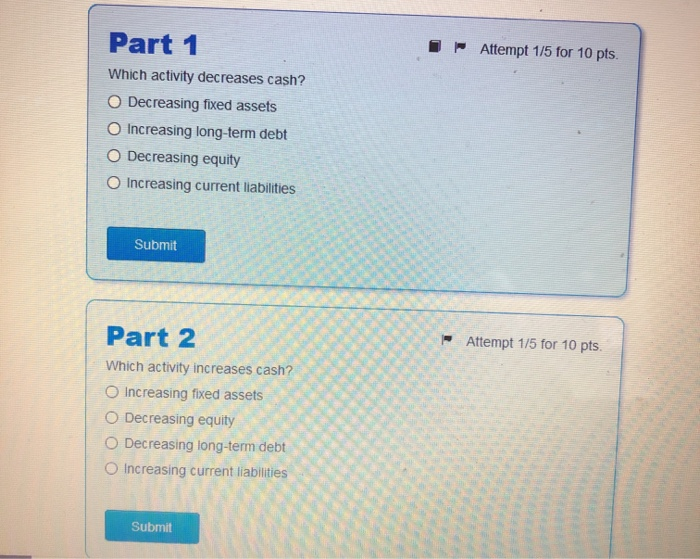

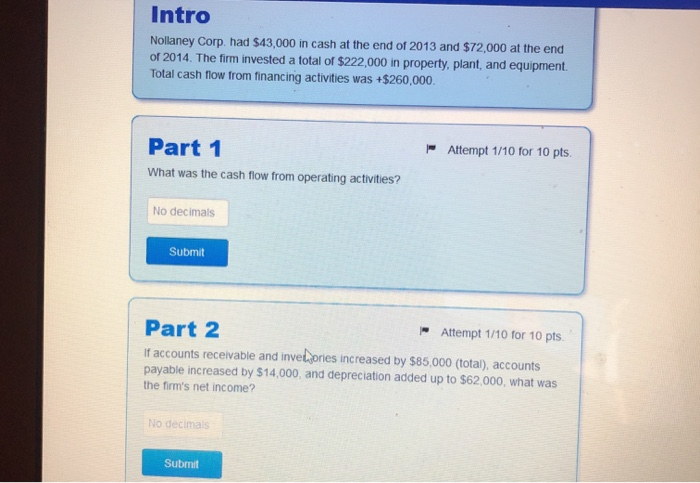

Intro Bubble Tree Inc. had a taxable income of $380,000 last year. Its average tax rate is 27% and it paid out $120,000 in dividends to preferred stockholders. The company has 16,000 shares of common stock outstanding. Part 1 IS Attempt 1/10 for 10 pts. What were Bubble Tree's earnings per share of common stock (EPS)? 1+ decimals Submit Part 2 - Attempt 1/10 for 10 pts. If Bubble Tree pays out a dividend of $7.87 for each share of common stock, what are retained earnings? No decimals Submit Type here to search Intro Grant Inc. reported retained earnings of $281,000 on its balance sheet on 12/31/16, and it had $63,000 of net income during the year. The year before, on 12/31/15, the company had reported $238,000 of retained earnings. No shares were issued or repurchased during 2016, Attempt 1/10 for 10 pts. Part 1 How much in dividends did the firm pay in No decimals Submit Intro Minnesota Manufacturing's balance sheet showed total common equity of $3,000,000 and 400,000 shares of stock outstanding on 12/31/2015. During 2016, the firm had $780,000 of net income, and it paid out $150,000 in dividends, IB Part 1 Attempt 1/10 for 10 pts. What was the book value per share on 12/31/2016, assuming no common stock was issued or retired during 2016? H+ decimals Submit Part- . Attempt 1/5 for 10 pts. Which activity decreases cash? O Decreasing fixed assets O Increasing long-term debt O Decreasing equity O Increasing current liabilities Submit Attempt 175 for 10 pts. Part 2 Which activity increases cash? O Increasing fixed assets Decreasing equity Decreasing long-term debt Increasing current liabilities Submit Intro Nollaney Corp, had $43,000 in cash at the end of 2013 and $72,000 at the end of 2014. The firm invested a total of $222,000 in property, plant, and equipment. Total cash flow from financing activities was +$260,000 | Attempt 1/10 for 10 pts. Part 1 What was the cash flow from operating activities? No decimals Submit Part 2 - Attempt 1/10 for 10 pts. if accounts receivable and invelories increased by $85,000 (total), accounts payable increased by $14,000, and depreciation added up to $62,000, what was the firm's net income? No decimal Submit