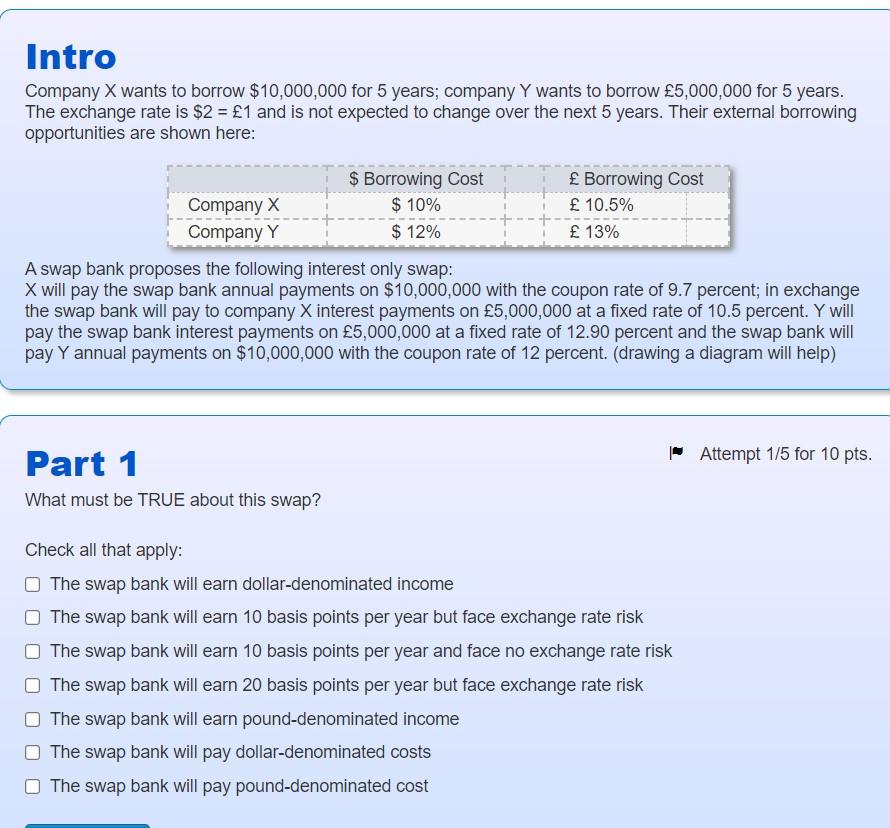

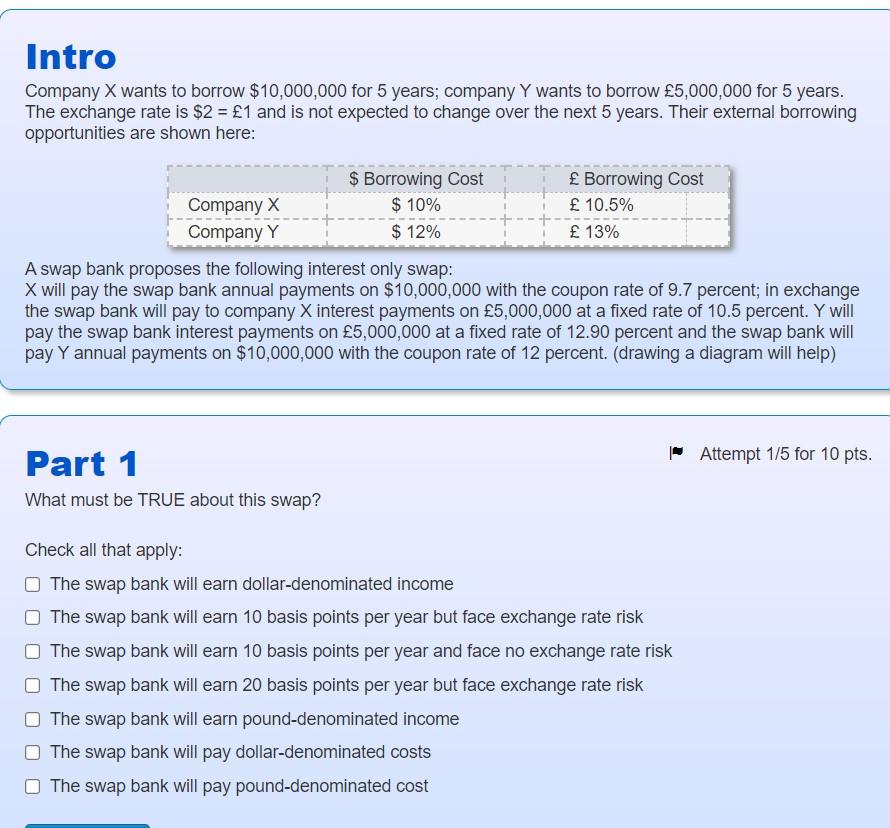

Intro Company X wants to borrow $10,000,000 for 5 years; company Y wants to borrow 5,000,000 for 5 years. The exchange rate is $2 = 1 and is not expected to change over the next 5 years. Their external borrowing opportunities are shown here: $ Borrowing Cost Borrowing Cost Company X $ 10% 10.5% Company Y $ 12% 13% A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of 9.7 percent; in exchange the swap bank will pay to company X interest payments on 5,000,000 at a fixed rate of 10.5 percent. Y will pay the swap bank interest payments on 5,000,000 at a fixed rate of 12.90 percent and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12 percent. (drawing a diagram will help) * Attempt 1/5 for 10 pts. Part 1 What must be TRUE about this swap? Check all that apply: The swap bank will earn dollar-denominated income The swap bank will earn 10 basis points per year but face exchange rate risk The swap bank will earn 10 basis points per year and face no exchange rate risk The swap bank will earn 20 basis points per year but face exchange rate risk The swap bank will earn pound-denominated income The swap bank will pay dollar-denominated costs The swap bank will pay pound-denominated cost Intro Company X wants to borrow $10,000,000 for 5 years; company Y wants to borrow 5,000,000 for 5 years. The exchange rate is $2 = 1 and is not expected to change over the next 5 years. Their external borrowing opportunities are shown here: $ Borrowing Cost Borrowing Cost Company X $ 10% 10.5% Company Y $ 12% 13% A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of 9.7 percent; in exchange the swap bank will pay to company X interest payments on 5,000,000 at a fixed rate of 10.5 percent. Y will pay the swap bank interest payments on 5,000,000 at a fixed rate of 12.90 percent and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12 percent. (drawing a diagram will help) * Attempt 1/5 for 10 pts. Part 1 What must be TRUE about this swap? Check all that apply: The swap bank will earn dollar-denominated income The swap bank will earn 10 basis points per year but face exchange rate risk The swap bank will earn 10 basis points per year and face no exchange rate risk The swap bank will earn 20 basis points per year but face exchange rate risk The swap bank will earn pound-denominated income The swap bank will pay dollar-denominated costs The swap bank will pay pound-denominated cost