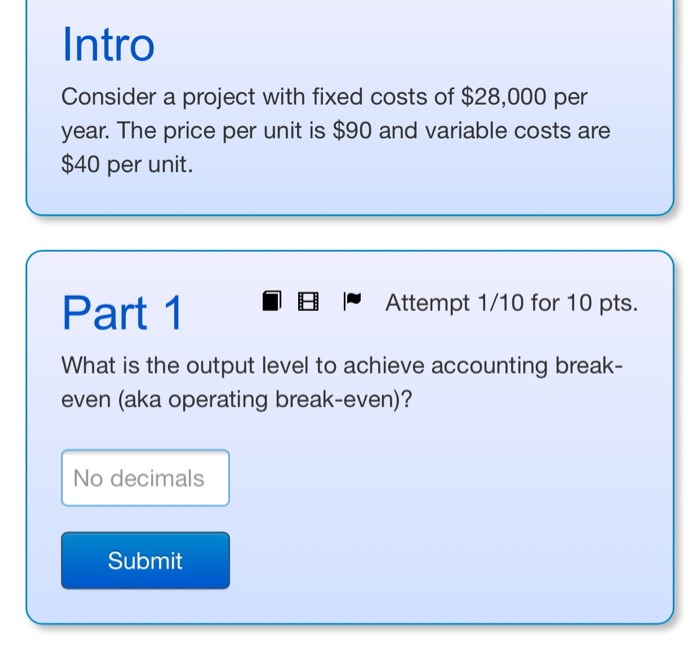

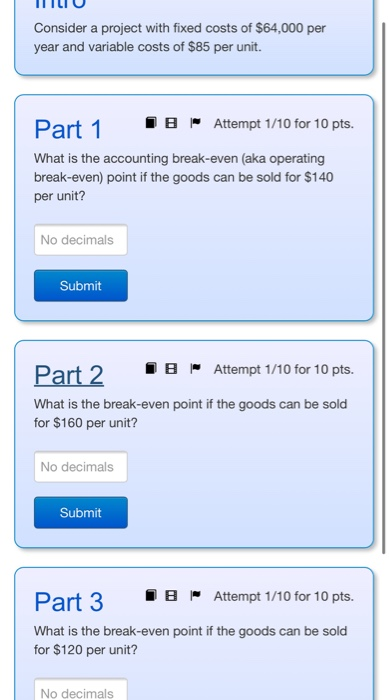

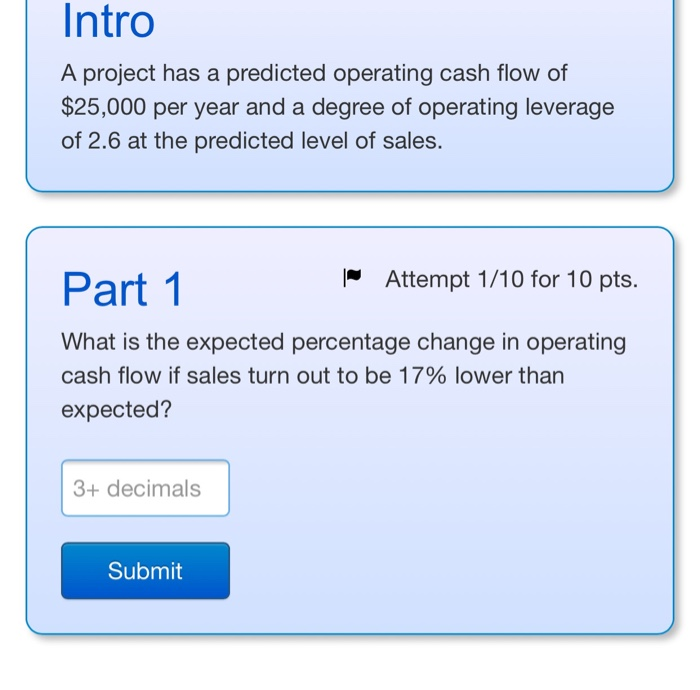

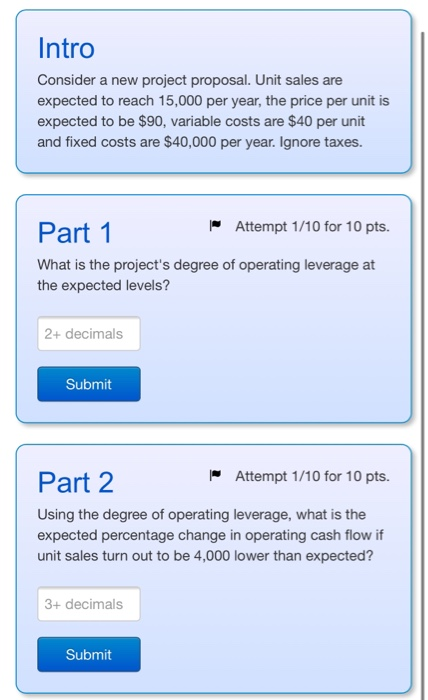

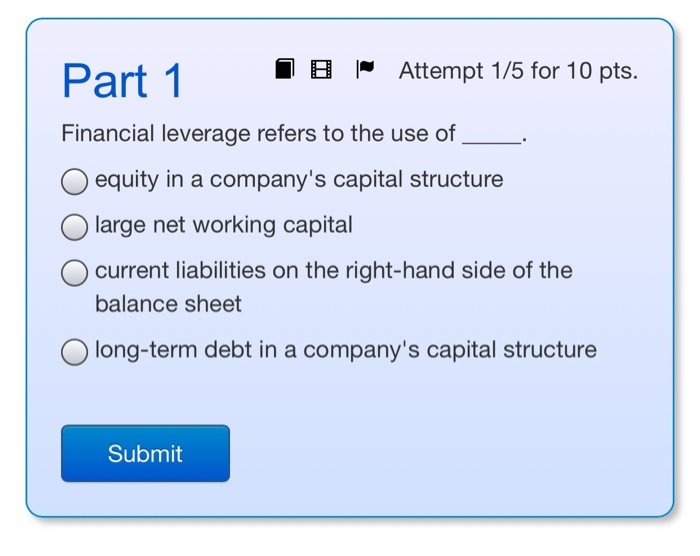

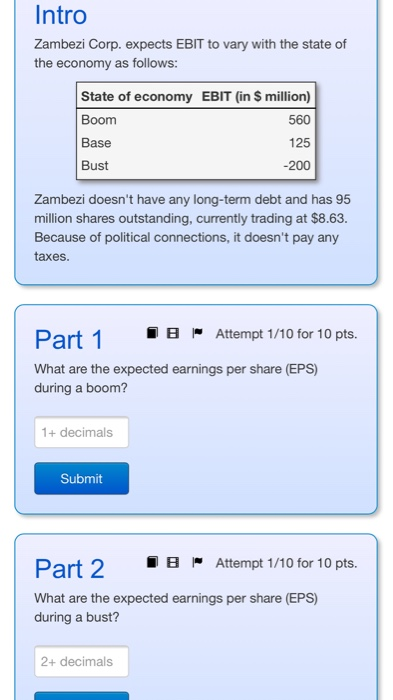

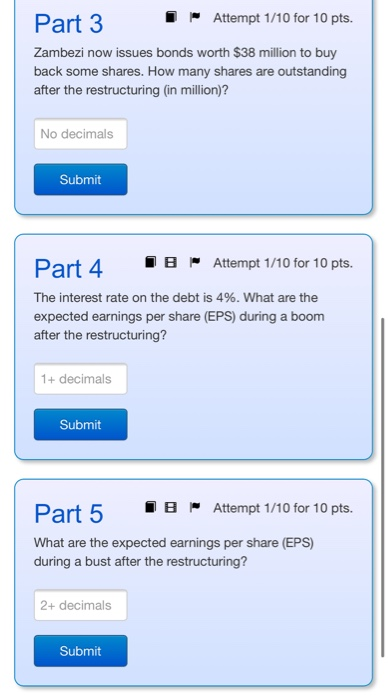

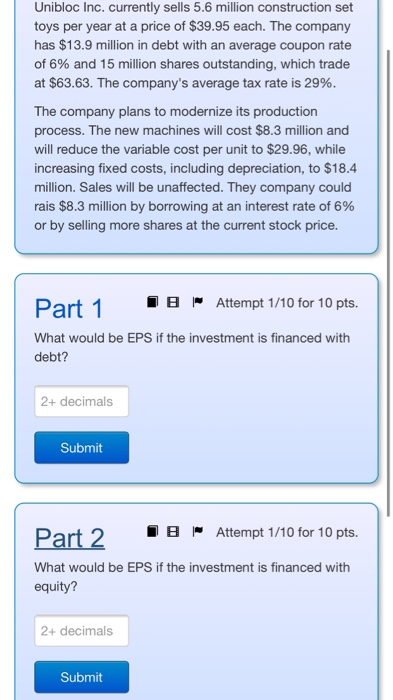

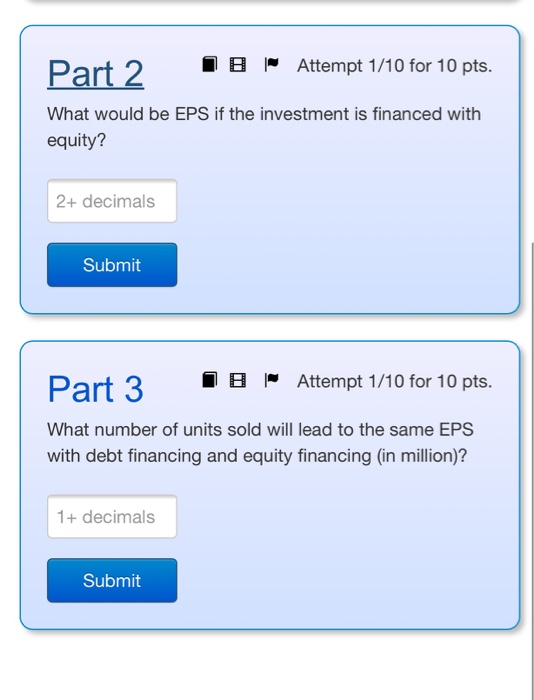

Intro Consider a project with fixed costs of $28,000 per year. The price per unit is $90 and variable costs are $40 per unit. Part 1 1 8 | Attempt 1/10 for 10 pts. What is the output level to achieve accounting break- even (aka operating break-even)? No decimals Submit ITILIU Consider a project with fixed costs of $64,000 per year and variable costs of $85 per unit. Part 1 TB Attempt 1/10 for 10 pts. What is the accounting break-even (aka operating break-even) point if the goods can be sold for $140 per unit? No decimals Submit Part 2 Te Attempt 1/10 for 10 pts. What is the break-even point if the goods can be sold for $160 per unit? No decimals Submit Part 3 B Attempt 1/10 for 10 pts. What is the break-even point if the goods can be sold for $120 per unit? No decimals Intro A project has a predicted operating cash flow of $25,000 per year and a degree of operating leverage of 2.6 at the predicted level of sales. Part 1 | Attempt 1/10 for 10 pts. What is the expected percentage change in operating cash flow if sales turn out to be 17% lower than expected? 3+ decimals Submit Intro Consider a new project proposal. Unit sales are expected to reach 15,000 per year, the price per unit is expected to be $90, variable costs are $40 per unit and fixed costs are $40,000 per year. Ignore taxes. Part 1 Attempt 1/10 for 10 pts. What is the project's degree of operating leverage at the expected levels? 2+ decimals Submit Part 2 Attempt 1/10 for 10 pts. Using the degree of operating leverage, what is the expected percentage change in operating cash flow if unit sales turn out to be 4,000 lower than expected? 3+ decimals Submit 1 B Attempt 1/5 for 10 pts. Financial leverage refers to the use of O equity in a company's capital structure O large net working capital O current liabilities on the right-hand side of the balance sheet long-term debt in a company's capital structure Submit Intro Zambezi Corp. expects EBIT to vary with the state of the economy as follows: State of economy EBIT (in $ million) Boom 560 Base 125 Bust -200 Zambezi doesn't have any long-term debt and has 95 million shares outstanding, currently trading at $8.63. Because of political connections, it doesn't pay any taxes. Part 1 IB Attempt 1/10 for 10 pts. What are the expected earnings per share (EPS) during a boom? 1+ decimals Submit Part 2 IB Attempt 1/10 for 10 pts. What are the expected earnings per share (EPS) during a bust? 2+ decimals Part 3 Attempt 1/10 for 10 pts. Zambezi now issues bonds worth $38 million to buy back some shares. How many shares are outstanding after the restructuring (in million)? No decimals Submit Part 4 IB Attempt 1/10 for 10 pts. The interest rate on the debt is 4%. What are the expected earnings per share (EPS) during a boom after the restructuring? 1+ decimals Submit Part 5 IB Attempt 1/10 for 10 pts. What are the expected earnings per share (EPS) during a bust after the restructuring? 2+ decimals Submit Unibloc Inc. currently sells 5.6 million construction set toys per year at a price of $39.95 each. The company has $13.9 million in debt with an average coupon rate of 6% and 15 million shares outstanding, which trade at $63.63. The company's average tax rate is 29%. The company plans to modernize its production process. The new machines will cost $8.3 million and will reduce the variable cost per unit to $29.96, while increasing fixed costs, including depreciation, to $18.4 million. Sales will be unaffected. They company could rais $8.3 million by borrowing at an interest rate of 6% or by selling more shares at the current stock price. Part 1 TB Attempt 1/10 for 10 pts. What would be EPS if the investment is financed with debt? 2+ decimals Submit Part 2 I8 | Attempt 1/10 for 10 pts. What would be EPS if the investment is financed with equity? 2+ decimals Submit Part 2 TB Attempt 1/10 for 10 pts. What would be EPS if the investment is financed with equity? 2+ decimals Submit Part 3 1B | Attempt 1/10 for 10 pts. What number of units sold will lead to the same EPS with debt financing and equity financing (in million)? 1+ decimals Submit