Question

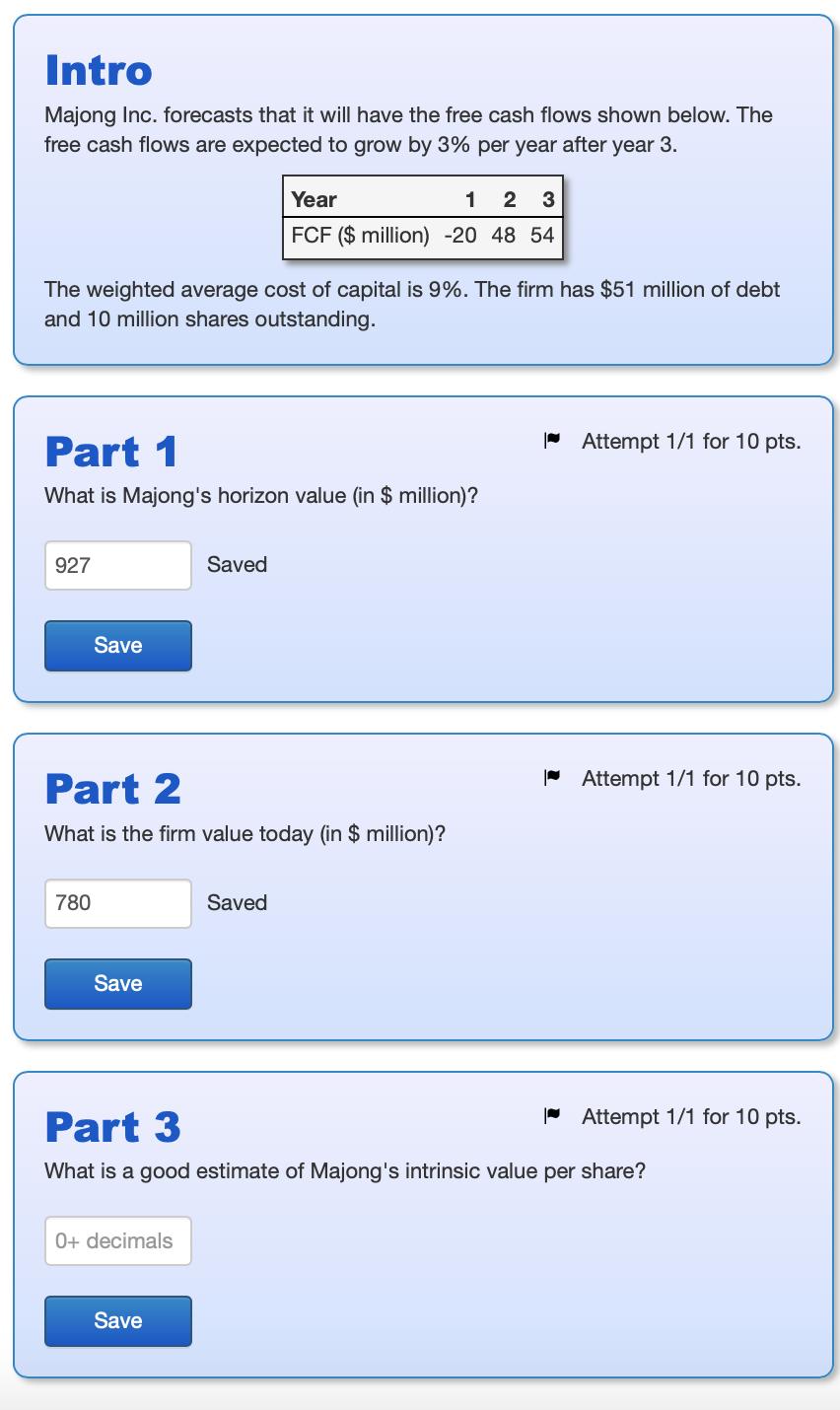

Intro Majong Inc. forecasts that it will have the free cash flows shown below. The free cash flows are expected to grow by 3%

Intro Majong Inc. forecasts that it will have the free cash flows shown below. The free cash flows are expected to grow by 3% per year after year 3. Year 1 2 3 FCF ($ million) -20 48 54 The weighted average cost of capital is 9%. The firm has $51 million of debt and 10 million shares outstanding. Part 1 What is Majong's horizon value (in $ million)? 927 Saved Save Part 2 What is the firm value today (in $ million)? 780 Save Saved Attempt 1/1 for 10 pts. Attempt 1/1 for 10 pts. Attempt 1/1 for 10 pts. Part 3 What is a good estimate of Majong's intrinsic value per share? 0+ decimals Save

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Majong Incs horizon value we need to determine the present value of the growing free ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Differential Equations And Linear Algebra

Authors: C. Edwards, David Penney, David Calvis

4th Edition

013449718X, 978-0134497181

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App