Answered step by step

Verified Expert Solution

Question

1 Approved Answer

intro of tax Julie is required to use her own automobile and pay for all her travelling expenses in carrying out her duties of employment.

intro of tax

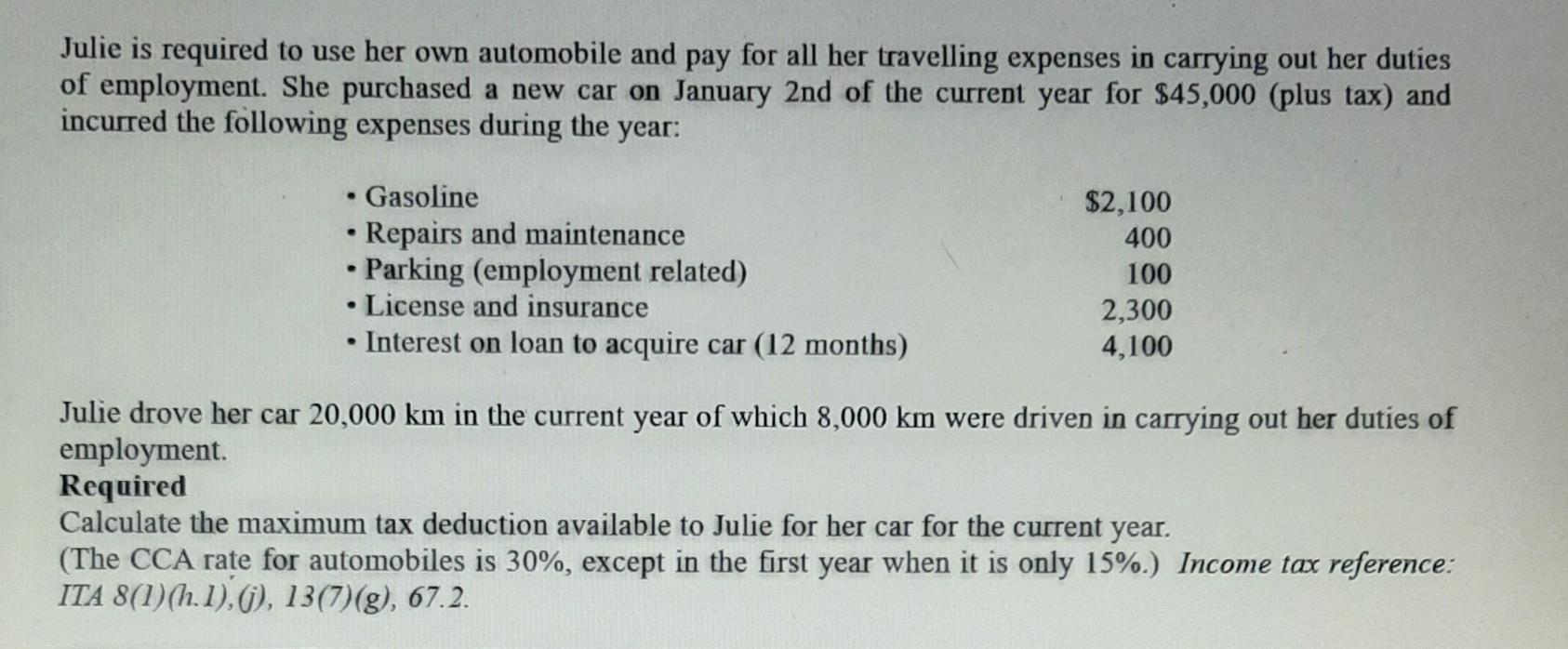

Julie is required to use her own automobile and pay for all her travelling expenses in carrying out her duties of employment. She purchased a new car on January 2nd of the current year for $45,000 (plus tax) and incurred the following expenses during the year: Gasoline Repairs and maintenance Parking (employment related) License and insurance Interest on loan to acquire car (12 months) $2,100 400 100 2,300 4,100 Julie drove her car 20,000 km in the current year of which 8,000 km were driven in carrying out her duties of employment Required Calculate the maximum tax deduction available to Julie for her car for the current year. (The CCA rate for automobiles is 30%, except in the first year when it is only 15%.) Income tax reference: ITA 8(1)(h.1),(), 13(7)(g), 67.2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started