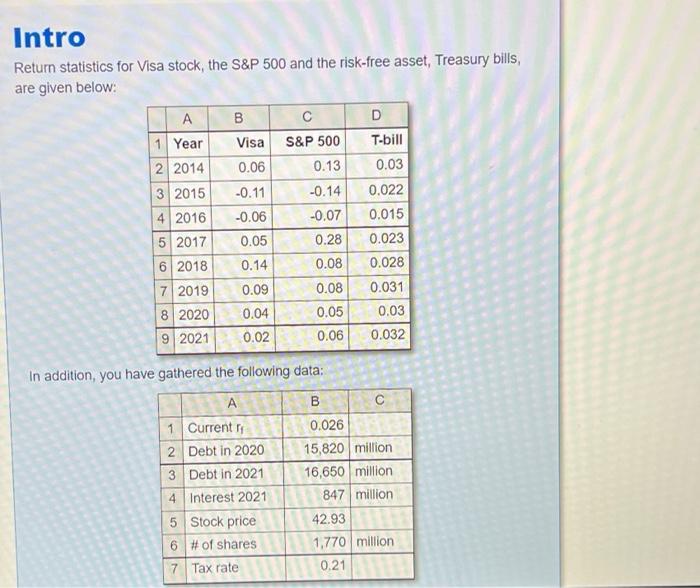

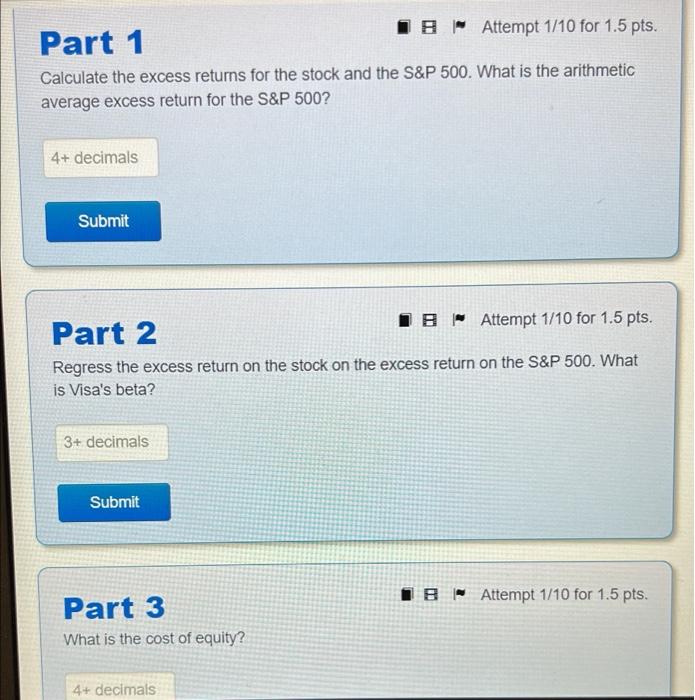

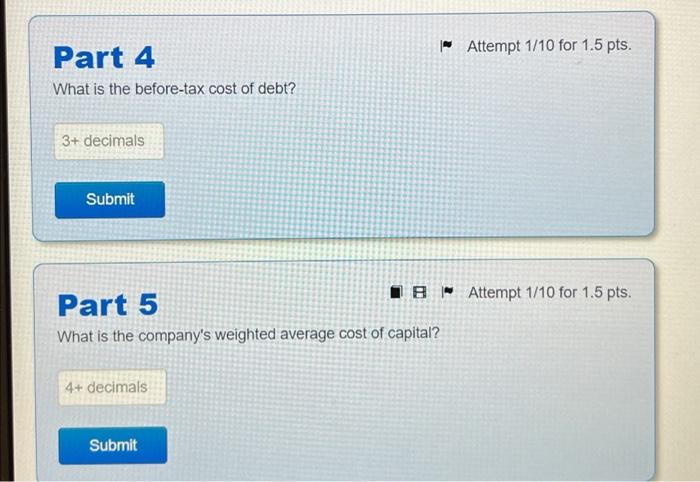

Intro Return statistics for Visa stock, the S&P 500 and the risk-free asset, Treasury bills, are given below: A B D 1 Year Visa S&P 500 T-bill 2 2014 0.06 0.13 0.03 3 2015 -0.11 -0.14 0.022 4 2016 -0.06 -0.07 0.015 5 2017 0.05 0.28 0.023 6 2018 0.14 0.08 0.028 7 2019 0.09 0.08 0.031 8 2020 0.04 0.05 0.03 9 2021 0.02 0.06 0.032 In addition, you have gathered the following data: B A 1 Current 2 Debt in 2020 3 Debt in 2021 4 Interest 2021 5 Stock price 6 # of shares 7 Tax rate 0.026 15,820 million 16,650 million 847 million 42.93 1,770 million 0.21 Part 1 I Attempt 1/10 for 1.5 pts. Calculate the excess returns for the stock and the S&P 500. What is the arithmetic average excess return for the S&P 500? 4+ decimals Submit Part 2 IB Attempt 1/10 for 1.5 pts. Regress the excess return on the stock on the excess return on the S&P 500. What is Visa's beta? 3+ decimals Submit IBAttempt 1/10 for 1.5 pts. Part 3 What is the cost of equity? 4+ decimals - Attempt 1/10 for 1.5 pts. Part 4 What is the before-tax cost of debt? 3+ decimals Submit Part 5 18 Attempt 1/10 for 1.5 pts. What is the company's weighted average cost of capital? 4+ decimals Submit Intro Return statistics for Visa stock, the S&P 500 and the risk-free asset, Treasury bills, are given below: A B D 1 Year Visa S&P 500 T-bill 2 2014 0.06 0.13 0.03 3 2015 -0.11 -0.14 0.022 4 2016 -0.06 -0.07 0.015 5 2017 0.05 0.28 0.023 6 2018 0.14 0.08 0.028 7 2019 0.09 0.08 0.031 8 2020 0.04 0.05 0.03 9 2021 0.02 0.06 0.032 In addition, you have gathered the following data: B A 1 Current 2 Debt in 2020 3 Debt in 2021 4 Interest 2021 5 Stock price 6 # of shares 7 Tax rate 0.026 15,820 million 16,650 million 847 million 42.93 1,770 million 0.21 Part 1 I Attempt 1/10 for 1.5 pts. Calculate the excess returns for the stock and the S&P 500. What is the arithmetic average excess return for the S&P 500? 4+ decimals Submit Part 2 IB Attempt 1/10 for 1.5 pts. Regress the excess return on the stock on the excess return on the S&P 500. What is Visa's beta? 3+ decimals Submit IBAttempt 1/10 for 1.5 pts. Part 3 What is the cost of equity? 4+ decimals - Attempt 1/10 for 1.5 pts. Part 4 What is the before-tax cost of debt? 3+ decimals Submit Part 5 18 Attempt 1/10 for 1.5 pts. What is the company's weighted average cost of capital? 4+ decimals Submit