Intro to Personal Wealth Management (Scott Keffer)

1) Using the asset and liability information from the base case, develop a balance sheet for Scott Keffer. Assume he has no unpaid bills besides those specifically listed. On a balance sheet, assets are valued at their fair market value and liabilities are listed at their current outstanding balances. What is Scott Keffers net worth?

2) Using the income and expenditure information, complete an income and expenditures statement for Scott. Use the cash flow concept for this financial statement including all money inflows as income and all outflows as expenditures. Did Scott have a cash surplus or a cash deficit? What impact did the cash surplus (deficit) have on his balance sheet?

3) What is the result of including the money received from selling assets (Fidelity Select Computers mutual fund) as income? What is the result of including current savings (reinvested interest, dividends, capital gains distributions as well as contributions to employer-sponsored retirement accounts) as expenditures? What does an income and expenders statement using the cash flow concept where all inflows and outflows are included show compared to a statement where investment inflows and savings are excluded?

4) Based on Scotts financial statements, calculate the following ratios:

a. Savings ratio

b. Liquidity ratio

c. Solvency ratio

d. Debt Service ratio

5) Based on the information in the original case and in Scotts Financial statements, state at least 3 positive and 3 negative aspects of Scotts current financial position.

After reading Chapters 1 and 2, you probably realize that Scotts financial goals are not defined well enough in the original case to serve as the basis for his financial plan and cash budget. Upon further review, Scott has restated his financial goals as follows:

a. Pay off all his credit card balances within the next 2 years.

b. Accumulate $12,000 in liquid assets within the next 3 years for an emergency fund.

c. Buy a house within 5 years. Scott plans on using the inherited funds that are currently invested in the Fidelity Equity-Income II mutual fund for this goal.

d. Save $5,000 for a down payment on a new car within 4 years

e. Continue contributing 7% of his gross salary to his 401(k) plan for retirement.

f. Have enough accumulated in an account to provide his mother $5,000 a year during her retirement years. He expects she will retire in 15 years at age 65 and will live 20 years after retirement. He would like to have all the money accumulated by the time she retires.

g. Establish a regular savings/investment program to accomplish these goals.

6) Using time value calculations, how much would Scott have to save this year to be on track in meeting his goals for:

a. His emergency fund (Remember Scott already has some funds in his money market account, money market mutual fund, and savings account. He does NOT want to consider the money in his checking account or cash on hand for this goal).

b. The down payment for a new car.

c. The fund for his mothers retirement years.

Assume Scott can earn 2% after inflation on taxes on his emergency fund and 3% after inflation and taxes on his car goal. In figuring the savings required for is mothers retirement fund, Scott assumes that he could earn 5% after taxes and inflation on the money once his mother retired. While he is accumulating the money before she retires, he feels he can take more risk and earn 8% after taxes and inflation.

7) Prepare a cash budget using the income and expenditure data from the original case as well as the figures needed to meet his goals (from question 5). In addition, Scott would need to make monthly credit card payments totaling approximately $520 in order to pay off his current credit card debt within the next 2 years. (It is greater than the $448 a month you get when you divide his outstanding credit card debt by 24 because interest would continue to accrue until the debts were paid off.) Assume that Scotts income will be the same as for the upcoming year as it was last year and expect that there will be no sale of assets.

8) Can Scott achieve all of stated goals given his current income and expenditure patterns? If not, what recommendations would you make to help him achieve his goals? Remember he is your client thus you have to come up with positive albeit hard recommendations

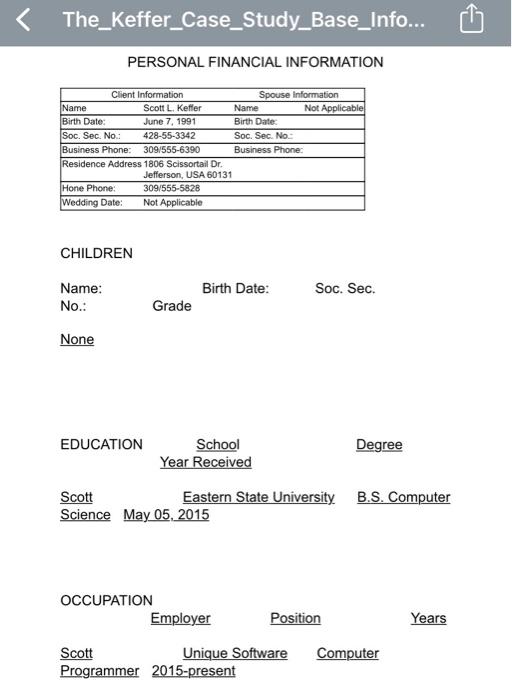

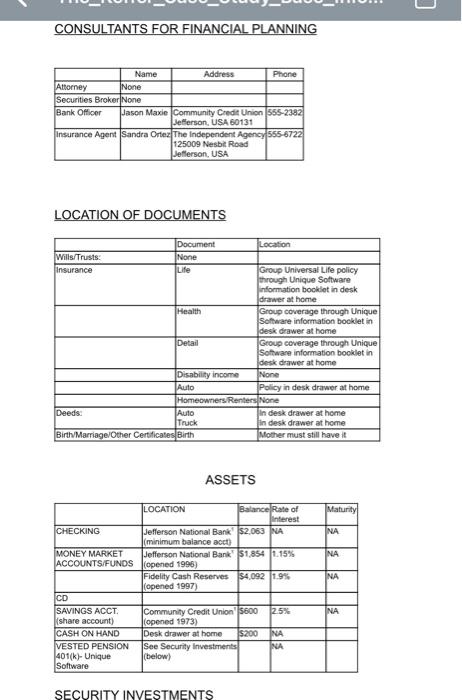

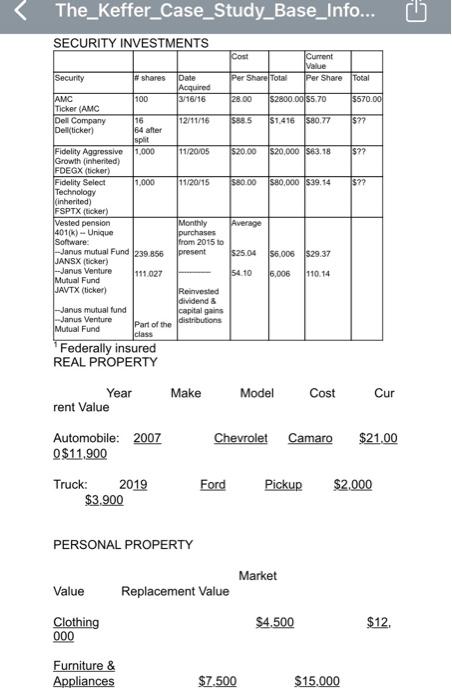

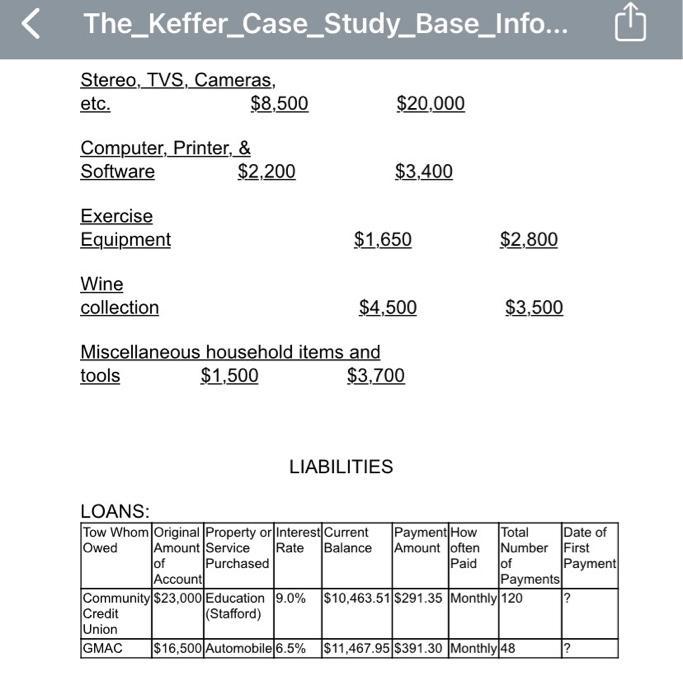

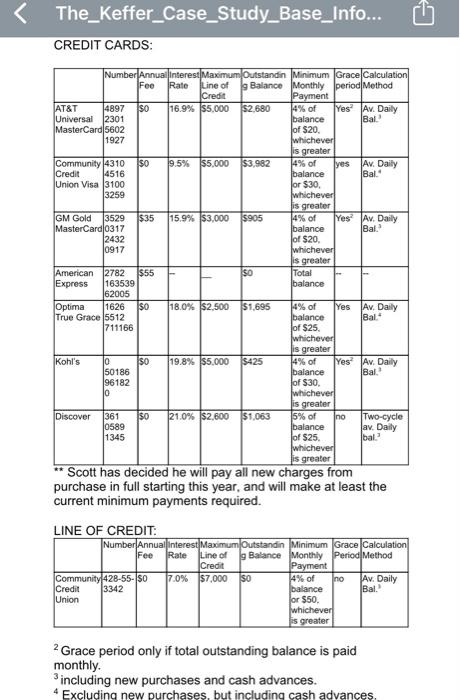

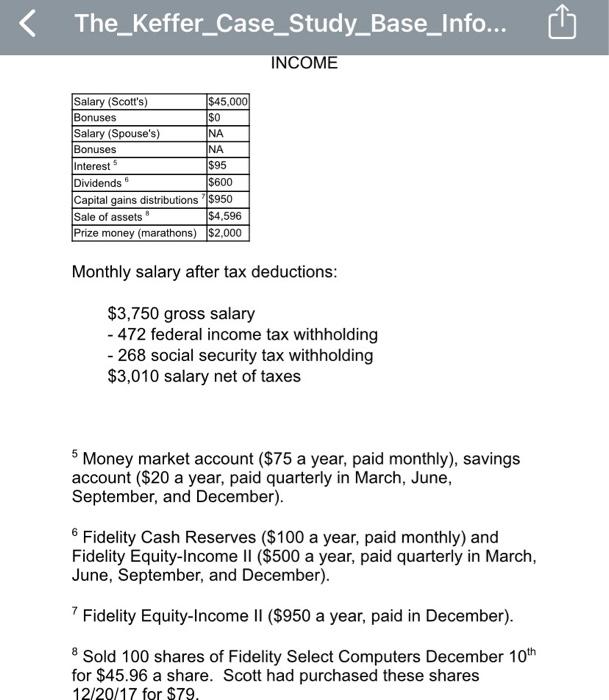

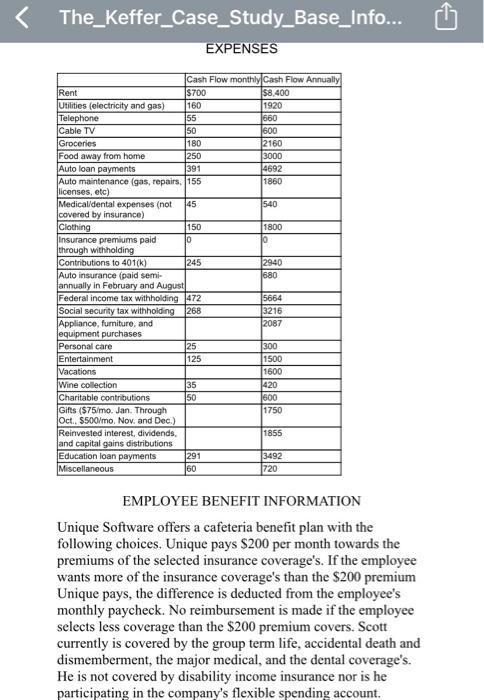

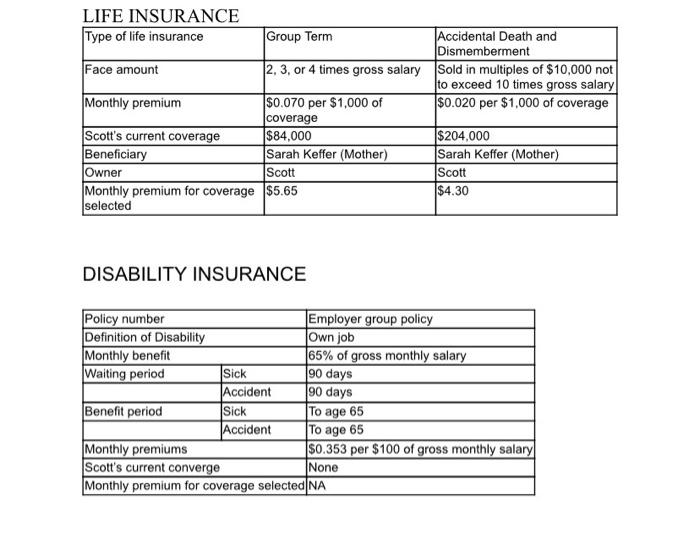

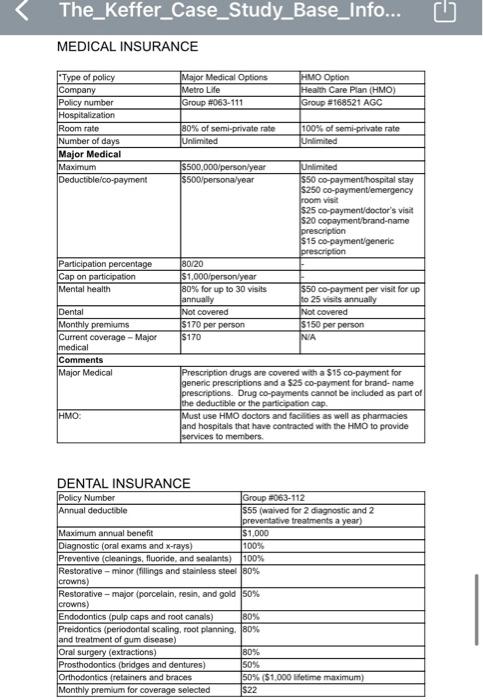

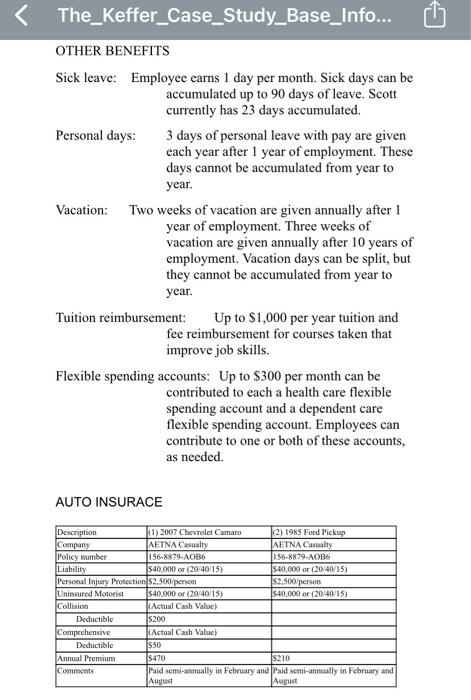

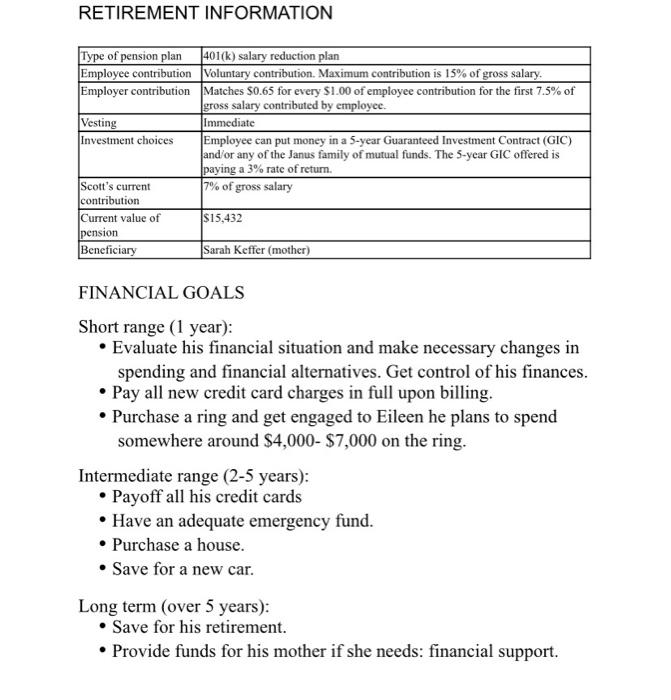

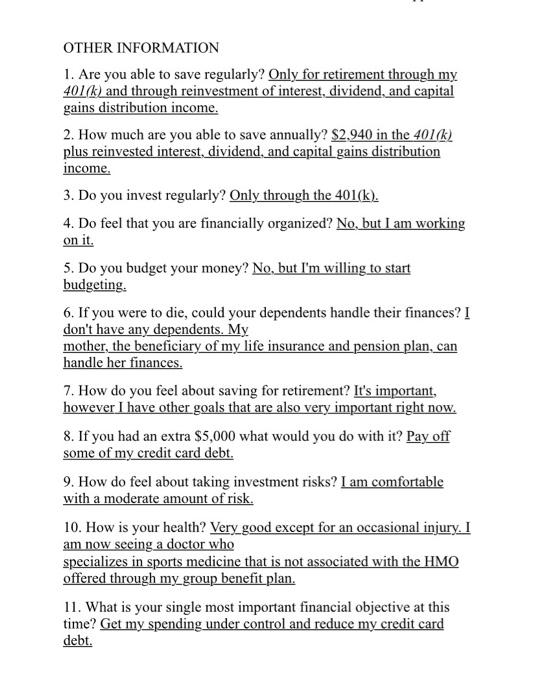

The_Keffer_Case_Study_Base_Info... PERSONAL FINANCIAL INFORMATION Client Information Spouse Information Name Scott L. Keffer Name Not Applicable Birth Date: June 7, 1991 Birth Date: Soc. Sec. No.: 428-55-3342 Soc. Sec. No Business Phone: 309/555-6390 Business Phone: Residence Address 1806 Scissortail Dr. Jefferson, USA 60131 Hone Phone: 309/555-5828 Wedding Date: Not Applicable CHILDREN Birth Date: Soc. Sec. Name: No.: Grade None EDUCATION Degree School Year Received Scott Eastern State University B.S. Computer Science May 05, 2015 OCCUPATION Employer Position Years Computer Scott Unique Software Programmer 2015-present CONSULTANTS FOR FINANCIAL PLANNING None Name Address Phone Attorney Securities Broker None Bank Officer Jason Maxie Community Credit Union 555-2382 Jefferson, USA 60131 insurance Agent Sandra Ortez The Independent Agency 555-6722 125009 Nesbit Road Jefferson, USA LOCATION OF DOCUMENTS Document Location Wills/Trusts: None Insurance Life Group Universal Life policy through Unique Software information booklet in desk drawer at home Health Group coverage through Unique Software information booklet in desk drawer at home Detail Group coverage through Unique Software information booklet in desk drawer at home Disability income None Auto Policy in desk drawer at home Homeowners Renters None Deeds. Auto in desk drawer at home Truck in desk drawer at home Birth Marriage/Other Certificates Birth Mother must still have it ASSETS Maturity NA INA NA LOCATION Balance Rate of interest CHECKING Jefferson National Bank $2,063 NA (minimum balance act) MONEY MARKET Jefferson National Bank $1.854 1.15% ACCOUNTS/FUNDS opened 1996) Fidelity Cash Reserves 34.092 1.9% (opened 1997) CD SAVINGS ACCT. Community Credit Union' 5600 25% share account) (opened 1973) CASH ON HAND Desk drawer at home S200 NA VESTED PENSION See Security Investments NA 401(k)- Unique (below) Software NA SECURITY INVESTMENTS The_Keffer_Case_Study_Base_Info... SECURITY INVESTMENTS Cost Current Value Per Share Total Security #shares Per Share Total Date Acquired 3/16/16 28 00 $2800.00 $5.70 5570.00 12/11/16 SRBS $1.416 580.77 $77 11/20/05 $20.00 $20,000 $83.18 $?? 11/20/15 580.00 $80,000 $39.14 $?? AMC 100 Ticker (AMC Dell Company 16 Delticker) 164 after split Fidelity Aggressive 1.000 Growth inherited) FDEGX (ticker) Fidelity Select 1.000 Technology (inherited) FSPTX (ticker) Vested pension 401(k) - Unique Software: Janus mutual Fund 239 856 JANSX (ticker) -Janus Venture 111.027 Mutual Fund JAVTX (ticker) Average Monthly purchases from 2015 to present 525.04 56.006 $29.37 54.10 6,006 110.14 Reinvested dividend & capital gains Part of the distributions Janus mutual fund |--Janus Venture Mutual Fund class Federally insured REAL PROPERTY Make Model Cost Year rent Value Cur Chevrolet Camaro $21.00 Automobile: 2007 $11.900 Truck: 2019 $3.900 Ford Pickup $2.000 PERSONAL PROPERTY Market Value Replacement Value Clothing 000 $4.500 $12. Furniture & Appliances $7.500 $15.000 The_Keffer_Case_Study_Base_Info... Stereo, TVS, Cameras, etc. $8,500 $20,000 Computer, Printer, & Software $2,200 $3,400 Exercise Equipment $1,650 $2,800 Wine collection $4,500 $3,500 Miscellaneous household items and tools $1,500 $3,700 LIABILITIES LOANS: Tow Whom Original Property or Interest Current Payment How Total Date of Owed Amount Service Rate Balance Amount often Number First of Purchased Paid of Payment Account Payments Community $23,000 Education 9.0% $10,463.51 $291.35 Monthly 120 Credit (Stafford) Union GMAC $16,500 Automobile 6.5% $11,467.95 $391.30 Monthly 48 ? ? The_Keffer_Case_Study_Base_Info... CREDIT CARDS: Number Annual interest Maximum Outstandin Minimum Grace Calculation Fee Rate Line of 9 Balance Monthly period Method Credit Payment AT&T 4897 so 16.9% $5,000 $2,680 4% of YesAv. Daily Universal 12301 balance Bal. MasterCard 5602 of $20. 1927 whichever is greater Community 4310 so 9.5% $5,000 $3,982 4% of yes Av. Daily Credit |4516 balance Bal." Union Visa 3100 for $30 3259 whichever is greater GM Gold 3529 $35 15.9% $3,000 $905 4% of Yes Av. Daily MasterCard 0317 balance Bal. 2432 of $20, 0917 whichever is greater American 2782 $55 ISO Total Express 163539 balance 62005 Optima 1626 $o 18.0% $2.500 $1,695 4% of Yes Av. Daily True Grace 5512 balance Bal." 1711166 of $25 whichever is greater Kohl's lo 19.8% $5,000 $425 4% of Yes? Av. Daily 50186 balance Bal. 96182 of $30, 0 whichever is greater Discover 361 $0 21.0% $2,600 $1.063 5% of Ino Two-cycle 0589 balance Jav Daily 1345 of $25. bal." whichever is greater * Scott has decided he will pay all new charges from purchase in full starting this year, and will make at least the current minimum payments required. 50 Fee LINE OF CREDIT: Number Annual interest Maximum Outstandin Minimum Grace Calculation Rate Line of g Balance Monthly period Method Credit Payment Community428-55-50 7.0% 57.000 SO 14% of no Av. Daily Credit 3342 balance Bal. Union or $50. whichever is greater 2 Grace period only if total outstanding balance is paid monthly 3 including new purchases and cash advances. 4 Excluding new purchases, but including cash advances. The_Keffer_Case_Study_Base_Info... INCOME 5 Salary (Scott's) $45,000 Bonuses $0 Salary (Spouse's) INA Bonuses INA Interest $95 Dividends $600 Capital gains distributions $950 Sale of assets $4,596 Prize money (marathons) $2,000 Monthly salary after tax deductions: $3,750 gross salary - 472 federal income tax withholding - 268 social security tax withholding $3,010 salary net of taxes 5 Money market account ($75 a year, paid monthly), savings account ($20 a year, paid quarterly in March, June, September, and December). 6 Fidelity Cash Reserves ($100 a year, paid monthly) and Fidelity Equity-Income II ($500 a year, paid quarterly in March, June, September, and December). 7 Fidelity Equity-Income II ($950 a year, paid in December). Sold 100 shares of Fidelity Select Computers December 10th for $45.96 a share. Scott had purchased these shares 12/20/17 for $79. 8 The_Keffer_Case_Study_Base_Info... EXPENSES Cash Flow monthly Cash Flow Annually Rent S700 $8.400 Utilities (electricity and gas) 160 1920 Telephone 55 1660 Cable TV 50 600 Groceries 180 2160 Food away from home 250 3000 Auto loan payments 391 4692 Auto maintenance (gas, repairs, 155 1860 licenses, etc) Medical/dental expenses (not 45 540 covered by insurance) Clothing 150 1800 Insurance premiums paid 10 lo through withholding Contributions to 401(k) 245 2940 Auto insurance (paid semi- 680 annually in February and August Federal income tax withholding 472 5664 Social security tax withholding 268 3216 Appliance, furniture, and 2087 equipment purchases Personal care 25 300 Entertainment 125 1500 Vacations 1600 Wine collection 35 420 Charitable contributions 50 1600 Gifts (S75/mo. Jan. Through 1750 Oct. $500/mo. Nov. and Dec.) Reinvested interest, dividends. 1855 and capital gains distributions Education loan payments 291 3492 Miscellaneous 60 720 EMPLOYEE BENEFIT INFORMATION Unique Software offers a cafeteria benefit plan with the following choices. Unique pays $200 per month towards the premiums of the selected insurance coverage's. If the employee wants more of the insurance coverage's than the $200 premium Unique pays, the difference is deducted from the employee's monthly paycheck. No reimbursement is made if the employee selects less coverage than the $200 premium covers. Scott currently is covered by the group term life, accidental death and dismemberment, the major medical, and the dental coverage's. He is not covered by disability income insurance nor is he participating in the company's flexible spending account. LIFE INSURANCE Type of life insurance Group Term Accidental Death and Dismemberment Face amount 2, 3, or 4 times gross salary Sold in multiples of $10,000 not to exceed 10 times gross salary Monthly premium $0.070 per $1,000 of $0.020 per $1,000 of coverage coverage Scott's current coverage $84.000 $204,000 Beneficiary Sarah Keffer (Mother) Sarah Keffer (Mother) Owner Scott Scott Monthly premium for coverage $5.65 $4.30 selected DISABILITY INSURANCE Policy number Employer group policy Definition of Disability Own job Monthly benefit 65% of gross monthly salary Waiting period Sick 90 days Accident 90 days Benefit period Sick To age 65 Accident To age 65 Monthly premiums $0.353 per $100 of gross monthly salary Scott's current converge None Monthly premium for coverage selected NA The_Keffer_Case_Study_Base_Info... MEDICAL INSURANCE Major Medical Options Metro Life Group #063.111 HMO Option Health Care Plan (HMO) Group $168521 AGC "Type of policy Company Policy number Hospitalization Room rate Number of days Major Medical Maximum Deductible co-payment 80% of semi-private rate Unlimited 100% of semi-private rate Unlimited $500,000/person/year 5500/personalyear Unlimited 550 co-payment hospital stay S250 co-paymentlemergency room visit 525 co-payment/doctor's visit S20 copayment brand-name prescription $15 co-payment generic prescription Participation percentage Cap on participation Mental health 80/20 $1,000/person/year 80% for up to 30 visits annually Not covered $170 per person $170 $50 co-payment per visit for up to 25 visits annually Not covered $150 per person NA Dental Monthly premiums Current coverage - Major medical Comments Major Medical Prescription drugs are covered with a $15 co-payment for generic prescriptions and a $25 co-payment for brand-name prescriptions. Drug co-payments cannot be included as part of the deductible or the participation cap Must use HMO doctors and facilities as well as pharmacies and hospitals that have contracted with the HMO to provide services to members HMO. DENTAL INSURANCE Policy Number Group #063-112 Annual deductible |$55 (waived for 2 diagnostic and 2 preventative treatments a year) Maximum annual benefit $1,000 Diagnostic (oral exams and x-rays) 100% Preventive (cleanings, fluoride, and sealants) 100% Restorative-minor (fillings and stainless steel 80% crowns) Restorative - major (porcelain, resin, and gold 50% crowns) Endodontics (pulp caps and root canals) 80% Preidontics (periodontal scaling, root planning. 80% and treatment of gum disease) Oral surgery (extractions) 80% Prosthodontics (bridges and dentures) 50% Orthodontics (retainers and braces 50% ($1.000 fetime maximum) Monthly premium for coverage selected |$22 The_Keffer_Case_Study_Base_Info... OTHER BENEFITS Sick leave: Employee earns 1 day per month. Sick days can be accumulated up to 90 days of leave. Scott currently has 23 days accumulated. Personal days: 3 days of personal leave with pay are given each year after 1 year of employment. These days cannot be accumulated from year to year. Vacation: Two weeks of vacation are given annually after 1 year of employment. Three weeks of vacation are given annually after 10 years of employment. Vacation days can be split, but they cannot be accumulated from year to year. Tuition reimbursement: Up to $1,000 per year tuition and fee reimbursement for courses taken that improve job skills. Flexible spending accounts: Up to $300 per month can be contributed to each a health care flexible spending account and a dependent care flexible spending account. Employees can contribute to one or both of these accounts, as needed. AUTO INSURACE Description (1) 2007 Chevrolet Camaro (2) 1985 Ford Pickup Company AETNA Casualty AETNA Casualty Policy number 156-8879-AOB6 156-8879-AOB Liability 540,000 or (20/40/15) $40,000 or (20440/15) Personal Injury Protection $2.500 person $2.500 person Uninsured Motorist $40,000 or (20/40/15) $40,000 or (20-40/15) Collision Actual Cash Value) Deductible S200 Comprehensive Actual Cash Value) Deductible Isso Annual Premium S470 $210 Comments Paid semi-annually in Februry and Paid semi-annually in February and August August RETIREMENT INFORMATION Type of pension plan 401(k) salary reduction plan Employee contribution Voluntary contribution. Maximum contribution is 15% of gross salary. Employer contribution Matches $0.65 for every S1.00 of employee contribution for the first 7.5% of gross salary contributed by employee. Vesting Immediate Investment choices Employee can put money in a 5-year Guaranteed Investment Contract (GIC) and/or any of the Janus family of mutual funds. The 5-year GIC offered is paying a 3% rate of retum. Scott's current 7% of gross salary contribution Current value of $15,432 pension Beneficiary Sarah Keffer (mother) FINANCIAL GOALS Short range (1 year): Evaluate his financial situation and make necessary changes in spending and financial alternatives. Get control of his finances. Pay all new credit card charges in full upon billing. Purchase a ring and get engaged to Eileen he plans to spend somewhere around $4,000- $7,000 on the ring. Intermediate range (2-5 years): Payoff all his credit cards Have an adequate emergency fund. Purchase a house. Save for a new car. Long term (over 5 years): Save for his retirement. Provide funds for his mother if she needs: financial support. OTHER INFORMATION 1. Are you able to save regularly? Only for retirement through my 401(k) and through reinvestment of interest, dividend, and capital gains distribution income. 2. How much are you able to save annually? $2.940 in the 401(k) plus reinvested interest, dividend, and capital gains distribution income. 3. Do you invest regularly? Only through the 401(k). 4. Do feel that you are financially organized? No, but I am working on it. 5. Do you budget your money? No, but I'm willing to start budgeting. 6. If you were to die, could your dependents handle their finances? I don't have any dependents. My mother, the beneficiary of my life insurance and pension plan, can handle her finances. 7. How do you feel about saving for retirement? It's important, however I have other goals that are also very important right now. 8. If you had an extra $5,000 what would you do with it? Pay off some of my credit card debt. 9. How do feel about taking investment risks? I am comfortable with a moderate amount of risk. 10. How is your health? Very good except for an occasional injury. I am now seeing a doctor who specializes in sports medicine that is not associated with the HMO offered through my group benefit plan. 11. What is your single most important financial objective at this time? Get my spending under control and reduce my credit card debt. The_Keffer_Case_Study_Base_Info... PERSONAL FINANCIAL INFORMATION Client Information Spouse Information Name Scott L. Keffer Name Not Applicable Birth Date: June 7, 1991 Birth Date: Soc. Sec. No.: 428-55-3342 Soc. Sec. No Business Phone: 309/555-6390 Business Phone: Residence Address 1806 Scissortail Dr. Jefferson, USA 60131 Hone Phone: 309/555-5828 Wedding Date: Not Applicable CHILDREN Birth Date: Soc. Sec. Name: No.: Grade None EDUCATION Degree School Year Received Scott Eastern State University B.S. Computer Science May 05, 2015 OCCUPATION Employer Position Years Computer Scott Unique Software Programmer 2015-present CONSULTANTS FOR FINANCIAL PLANNING None Name Address Phone Attorney Securities Broker None Bank Officer Jason Maxie Community Credit Union 555-2382 Jefferson, USA 60131 insurance Agent Sandra Ortez The Independent Agency 555-6722 125009 Nesbit Road Jefferson, USA LOCATION OF DOCUMENTS Document Location Wills/Trusts: None Insurance Life Group Universal Life policy through Unique Software information booklet in desk drawer at home Health Group coverage through Unique Software information booklet in desk drawer at home Detail Group coverage through Unique Software information booklet in desk drawer at home Disability income None Auto Policy in desk drawer at home Homeowners Renters None Deeds. Auto in desk drawer at home Truck in desk drawer at home Birth Marriage/Other Certificates Birth Mother must still have it ASSETS Maturity NA INA NA LOCATION Balance Rate of interest CHECKING Jefferson National Bank $2,063 NA (minimum balance act) MONEY MARKET Jefferson National Bank $1.854 1.15% ACCOUNTS/FUNDS opened 1996) Fidelity Cash Reserves 34.092 1.9% (opened 1997) CD SAVINGS ACCT. Community Credit Union' 5600 25% share account) (opened 1973) CASH ON HAND Desk drawer at home S200 NA VESTED PENSION See Security Investments NA 401(k)- Unique (below) Software NA SECURITY INVESTMENTS The_Keffer_Case_Study_Base_Info... SECURITY INVESTMENTS Cost Current Value Per Share Total Security #shares Per Share Total Date Acquired 3/16/16 28 00 $2800.00 $5.70 5570.00 12/11/16 SRBS $1.416 580.77 $77 11/20/05 $20.00 $20,000 $83.18 $?? 11/20/15 580.00 $80,000 $39.14 $?? AMC 100 Ticker (AMC Dell Company 16 Delticker) 164 after split Fidelity Aggressive 1.000 Growth inherited) FDEGX (ticker) Fidelity Select 1.000 Technology (inherited) FSPTX (ticker) Vested pension 401(k) - Unique Software: Janus mutual Fund 239 856 JANSX (ticker) -Janus Venture 111.027 Mutual Fund JAVTX (ticker) Average Monthly purchases from 2015 to present 525.04 56.006 $29.37 54.10 6,006 110.14 Reinvested dividend & capital gains Part of the distributions Janus mutual fund |--Janus Venture Mutual Fund class Federally insured REAL PROPERTY Make Model Cost Year rent Value Cur Chevrolet Camaro $21.00 Automobile: 2007 $11.900 Truck: 2019 $3.900 Ford Pickup $2.000 PERSONAL PROPERTY Market Value Replacement Value Clothing 000 $4.500 $12. Furniture & Appliances $7.500 $15.000 The_Keffer_Case_Study_Base_Info... Stereo, TVS, Cameras, etc. $8,500 $20,000 Computer, Printer, & Software $2,200 $3,400 Exercise Equipment $1,650 $2,800 Wine collection $4,500 $3,500 Miscellaneous household items and tools $1,500 $3,700 LIABILITIES LOANS: Tow Whom Original Property or Interest Current Payment How Total Date of Owed Amount Service Rate Balance Amount often Number First of Purchased Paid of Payment Account Payments Community $23,000 Education 9.0% $10,463.51 $291.35 Monthly 120 Credit (Stafford) Union GMAC $16,500 Automobile 6.5% $11,467.95 $391.30 Monthly 48 ? ? The_Keffer_Case_Study_Base_Info... CREDIT CARDS: Number Annual interest Maximum Outstandin Minimum Grace Calculation Fee Rate Line of 9 Balance Monthly period Method Credit Payment AT&T 4897 so 16.9% $5,000 $2,680 4% of YesAv. Daily Universal 12301 balance Bal. MasterCard 5602 of $20. 1927 whichever is greater Community 4310 so 9.5% $5,000 $3,982 4% of yes Av. Daily Credit |4516 balance Bal." Union Visa 3100 for $30 3259 whichever is greater GM Gold 3529 $35 15.9% $3,000 $905 4% of Yes Av. Daily MasterCard 0317 balance Bal. 2432 of $20, 0917 whichever is greater American 2782 $55 ISO Total Express 163539 balance 62005 Optima 1626 $o 18.0% $2.500 $1,695 4% of Yes Av. Daily True Grace 5512 balance Bal." 1711166 of $25 whichever is greater Kohl's lo 19.8% $5,000 $425 4% of Yes? Av. Daily 50186 balance Bal. 96182 of $30, 0 whichever is greater Discover 361 $0 21.0% $2,600 $1.063 5% of Ino Two-cycle 0589 balance Jav Daily 1345 of $25. bal." whichever is greater * Scott has decided he will pay all new charges from purchase in full starting this year, and will make at least the current minimum payments required. 50 Fee LINE OF CREDIT: Number Annual interest Maximum Outstandin Minimum Grace Calculation Rate Line of g Balance Monthly period Method Credit Payment Community428-55-50 7.0% 57.000 SO 14% of no Av. Daily Credit 3342 balance Bal. Union or $50. whichever is greater 2 Grace period only if total outstanding balance is paid monthly 3 including new purchases and cash advances. 4 Excluding new purchases, but including cash advances. The_Keffer_Case_Study_Base_Info... INCOME 5 Salary (Scott's) $45,000 Bonuses $0 Salary (Spouse's) INA Bonuses INA Interest $95 Dividends $600 Capital gains distributions $950 Sale of assets $4,596 Prize money (marathons) $2,000 Monthly salary after tax deductions: $3,750 gross salary - 472 federal income tax withholding - 268 social security tax withholding $3,010 salary net of taxes 5 Money market account ($75 a year, paid monthly), savings account ($20 a year, paid quarterly in March, June, September, and December). 6 Fidelity Cash Reserves ($100 a year, paid monthly) and Fidelity Equity-Income II ($500 a year, paid quarterly in March, June, September, and December). 7 Fidelity Equity-Income II ($950 a year, paid in December). Sold 100 shares of Fidelity Select Computers December 10th for $45.96 a share. Scott had purchased these shares 12/20/17 for $79. 8 The_Keffer_Case_Study_Base_Info... EXPENSES Cash Flow monthly Cash Flow Annually Rent S700 $8.400 Utilities (electricity and gas) 160 1920 Telephone 55 1660 Cable TV 50 600 Groceries 180 2160 Food away from home 250 3000 Auto loan payments 391 4692 Auto maintenance (gas, repairs, 155 1860 licenses, etc) Medical/dental expenses (not 45 540 covered by insurance) Clothing 150 1800 Insurance premiums paid 10 lo through withholding Contributions to 401(k) 245 2940 Auto insurance (paid semi- 680 annually in February and August Federal income tax withholding 472 5664 Social security tax withholding 268 3216 Appliance, furniture, and 2087 equipment purchases Personal care 25 300 Entertainment 125 1500 Vacations 1600 Wine collection 35 420 Charitable contributions 50 1600 Gifts (S75/mo. Jan. Through 1750 Oct. $500/mo. Nov. and Dec.) Reinvested interest, dividends. 1855 and capital gains distributions Education loan payments 291 3492 Miscellaneous 60 720 EMPLOYEE BENEFIT INFORMATION Unique Software offers a cafeteria benefit plan with the following choices. Unique pays $200 per month towards the premiums of the selected insurance coverage's. If the employee wants more of the insurance coverage's than the $200 premium Unique pays, the difference is deducted from the employee's monthly paycheck. No reimbursement is made if the employee selects less coverage than the $200 premium covers. Scott currently is covered by the group term life, accidental death and dismemberment, the major medical, and the dental coverage's. He is not covered by disability income insurance nor is he participating in the company's flexible spending account. LIFE INSURANCE Type of life insurance Group Term Accidental Death and Dismemberment Face amount 2, 3, or 4 times gross salary Sold in multiples of $10,000 not to exceed 10 times gross salary Monthly premium $0.070 per $1,000 of $0.020 per $1,000 of coverage coverage Scott's current coverage $84.000 $204,000 Beneficiary Sarah Keffer (Mother) Sarah Keffer (Mother) Owner Scott Scott Monthly premium for coverage $5.65 $4.30 selected DISABILITY INSURANCE Policy number Employer group policy Definition of Disability Own job Monthly benefit 65% of gross monthly salary Waiting period Sick 90 days Accident 90 days Benefit period Sick To age 65 Accident To age 65 Monthly premiums $0.353 per $100 of gross monthly salary Scott's current converge None Monthly premium for coverage selected NA The_Keffer_Case_Study_Base_Info... MEDICAL INSURANCE Major Medical Options Metro Life Group #063.111 HMO Option Health Care Plan (HMO) Group $168521 AGC "Type of policy Company Policy number Hospitalization Room rate Number of days Major Medical Maximum Deductible co-payment 80% of semi-private rate Unlimited 100% of semi-private rate Unlimited $500,000/person/year 5500/personalyear Unlimited 550 co-payment hospital stay S250 co-paymentlemergency room visit 525 co-payment/doctor's visit S20 copayment brand-name prescription $15 co-payment generic prescription Participation percentage Cap on participation Mental health 80/20 $1,000/person/year 80% for up to 30 visits annually Not covered $170 per person $170 $50 co-payment per visit for up to 25 visits annually Not covered $150 per person NA Dental Monthly premiums Current coverage - Major medical Comments Major Medical Prescription drugs are covered with a $15 co-payment for generic prescriptions and a $25 co-payment for brand-name prescriptions. Drug co-payments cannot be included as part of the deductible or the participation cap Must use HMO doctors and facilities as well as pharmacies and hospitals that have contracted with the HMO to provide services to members HMO. DENTAL INSURANCE Policy Number Group #063-112 Annual deductible |$55 (waived for 2 diagnostic and 2 preventative treatments a year) Maximum annual benefit $1,000 Diagnostic (oral exams and x-rays) 100% Preventive (cleanings, fluoride, and sealants) 100% Restorative-minor (fillings and stainless steel 80% crowns) Restorative - major (porcelain, resin, and gold 50% crowns) Endodontics (pulp caps and root canals) 80% Preidontics (periodontal scaling, root planning. 80% and treatment of gum disease) Oral surgery (extractions) 80% Prosthodontics (bridges and dentures) 50% Orthodontics (retainers and braces 50% ($1.000 fetime maximum) Monthly premium for coverage selected |$22 The_Keffer_Case_Study_Base_Info... OTHER BENEFITS Sick leave: Employee earns 1 day per month. Sick days can be accumulated up to 90 days of leave. Scott currently has 23 days accumulated. Personal days: 3 days of personal leave with pay are given each year after 1 year of employment. These days cannot be accumulated from year to year. Vacation: Two weeks of vacation are given annually after 1 year of employment. Three weeks of vacation are given annually after 10 years of employment. Vacation days can be split, but they cannot be accumulated from year to year. Tuition reimbursement: Up to $1,000 per year tuition and fee reimbursement for courses taken that improve job skills. Flexible spending accounts: Up to $300 per month can be contributed to each a health care flexible spending account and a dependent care flexible spending account. Employees can contribute to one or both of these accounts, as needed. AUTO INSURACE Description (1) 2007 Chevrolet Camaro (2) 1985 Ford Pickup Company AETNA Casualty AETNA Casualty Policy number 156-8879-AOB6 156-8879-AOB Liability 540,000 or (20/40/15) $40,000 or (20440/15) Personal Injury Protection $2.500 person $2.500 person Uninsured Motorist $40,000 or (20/40/15) $40,000 or (20-40/15) Collision Actual Cash Value) Deductible S200 Comprehensive Actual Cash Value) Deductible Isso Annual Premium S470 $210 Comments Paid semi-annually in Februry and Paid semi-annually in February and August August RETIREMENT INFORMATION Type of pension plan 401(k) salary reduction plan Employee contribution Voluntary contribution. Maximum contribution is 15% of gross salary. Employer contribution Matches $0.65 for every S1.00 of employee contribution for the first 7.5% of gross salary contributed by employee. Vesting Immediate Investment choices Employee can put money in a 5-year Guaranteed Investment Contract (GIC) and/or any of the Janus family of mutual funds. The 5-year GIC offered is paying a 3% rate of retum. Scott's current 7% of gross salary contribution Current value of $15,432 pension Beneficiary Sarah Keffer (mother) FINANCIAL GOALS Short range (1 year): Evaluate his financial situation and make necessary changes in spending and financial alternatives. Get control of his finances. Pay all new credit card charges in full upon billing. Purchase a ring and get engaged to Eileen he plans to spend somewhere around $4,000- $7,000 on the ring. Intermediate range (2-5 years): Payoff all his credit cards Have an adequate emergency fund. Purchase a house. Save for a new car. Long term (over 5 years): Save for his retirement. Provide funds for his mother if she needs: financial support. OTHER INFORMATION 1. Are you able to save regularly? Only for retirement through my 401(k) and through reinvestment of interest, dividend, and capital gains distribution income. 2. How much are you able to save annually? $2.940 in the 401(k) plus reinvested interest, dividend, and capital gains distribution income. 3. Do you invest regularly? Only through the 401(k). 4. Do feel that you are financially organized? No, but I am working on it. 5. Do you budget your money? No, but I'm willing to start budgeting. 6. If you were to die, could your dependents handle their finances? I don't have any dependents. My mother, the beneficiary of my life insurance and pension plan, can handle her finances. 7. How do you feel about saving for retirement? It's important, however I have other goals that are also very important right now. 8. If you had an extra $5,000 what would you do with it? Pay off some of my credit card debt. 9. How do feel about taking investment risks? I am comfortable with a moderate amount of risk. 10. How is your health? Very good except for an occasional injury. I am now seeing a doctor who specializes in sports medicine that is not associated with the HMO offered through my group benefit plan. 11. What is your single most important financial objective at this time? Get my spending under control and reduce my credit card debt