Answered step by step

Verified Expert Solution

Question

1 Approved Answer

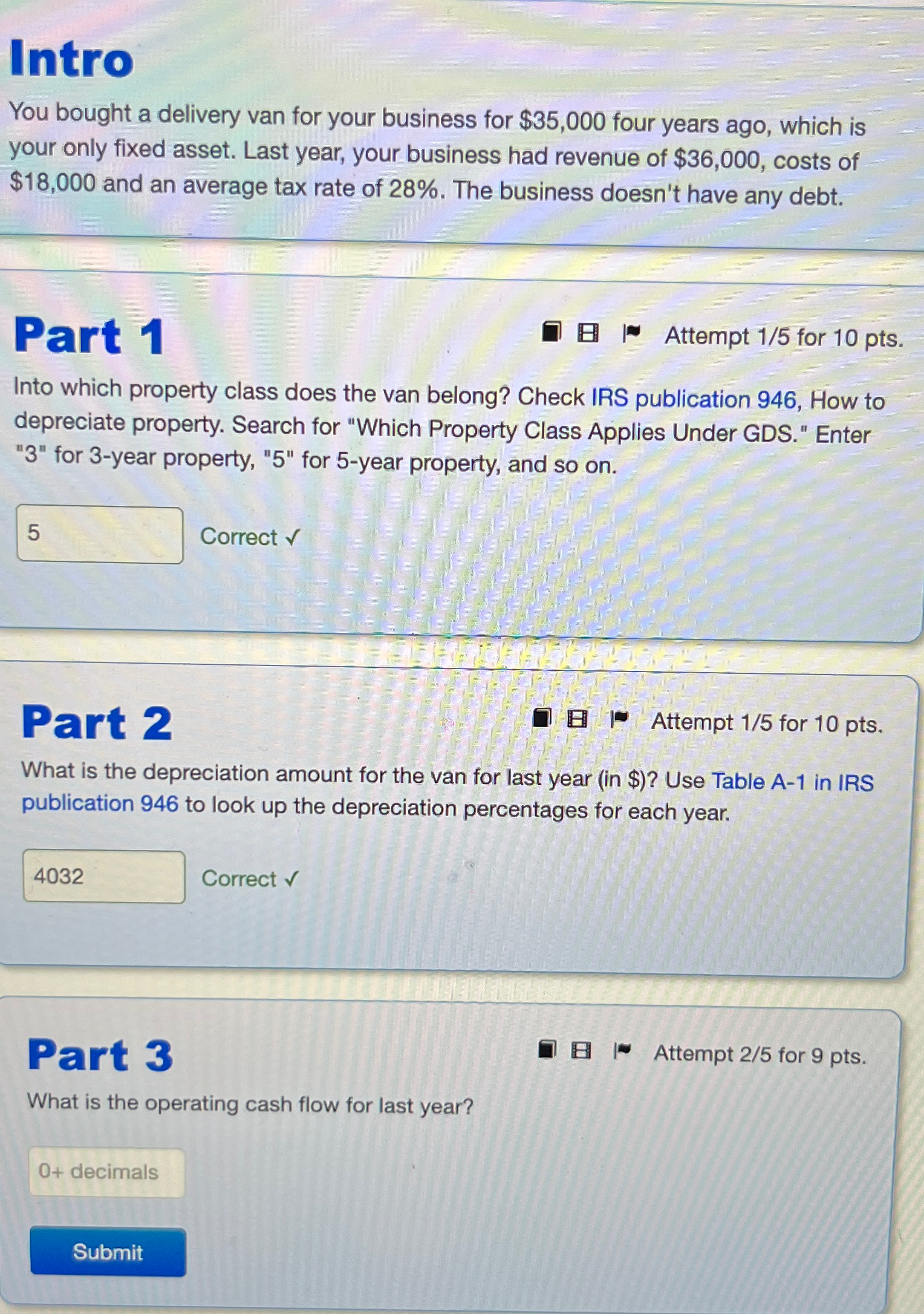

Intro You bought a delivery van for your business for $ 3 5 , 0 0 0 four years ago, which is your only fixed

Intro

You bought a delivery van for your business for $ four years ago, which is your only fixed asset. Last year, your business had revenue of $ costs of $ and an average tax rate of The business doesn't have any debt.

Part

Attempt for pts

Into which property class does the van belong? Check IRS publication How to depreciate property. Search for "Which Property Class Applies Under GDS Enter for year property, for year property, and so on

Correct

Part

Attempt for pts

What is the depreciation amount for the van for last year in $ Use Table A in IRS publication to look up the depreciation percentages for each year.

Correct

Part

Attempt for pts

What is the operating cash flow for last year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started